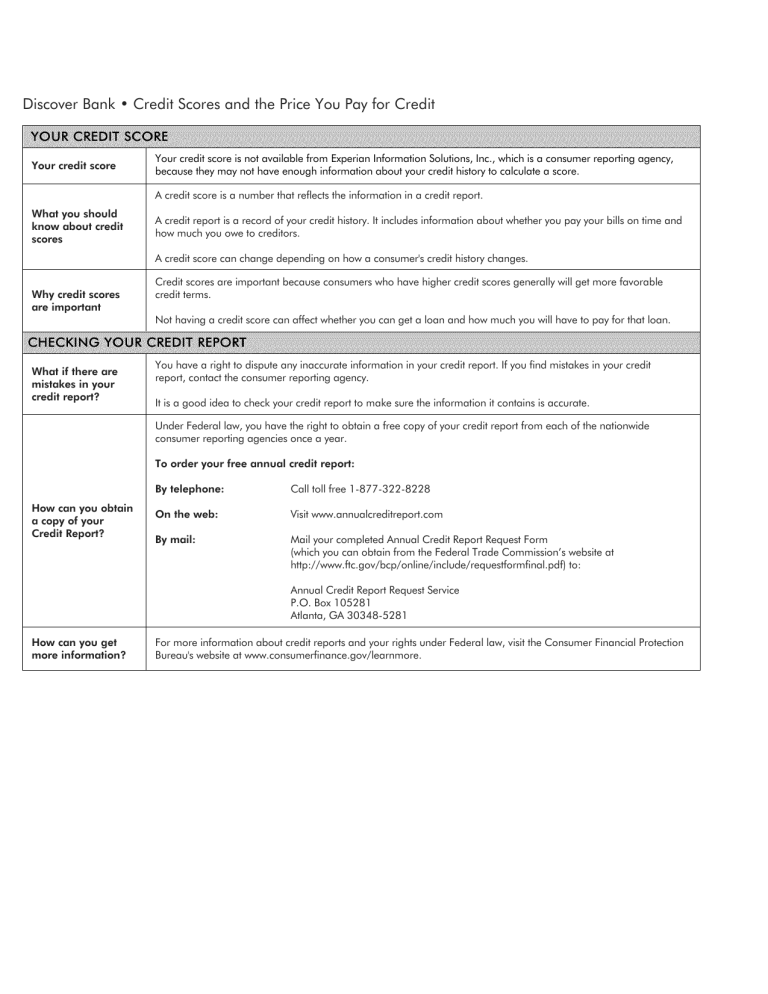

Discover Bank • Credit Scores and the Price You Pay for Credit Your credit score Your credit score is not available from Experian Information Solutions, Inc., which is a consumer reporting agency, because they may not have enough information about your credit history to calculate a score. A credit score is a number that reflects the information in a credit report. What you should know about credit scores A credit report is a record of your credit history. It includes information about whether you pay your bills on time and how much you owe to creditors. A credit score can change depending on how a consumer's credit history changes. Why credit scores are important What if there are mistakes in your credit report? Credit scores are important because consumers who have higher credit scores generally will get more favorable credit terms. Not having a credit score can affect whether you can get a loan and how much you will have to pay for that loan. You have a right to dispute any inaccurate information in your credit report. If you find mistakes in your credit report, contact the consumer reporting agency. It is a good idea to check your credit report to make sure the information it contains is accurate. Under Federal law, you have the right to obtain a free copy of your credit report from each of the nationwide consumer reporting agencies once a year. To order your free annual credit report: How can you obtain a copy of your Credit Report? By telephone: Call toll free 1-877-322-8228 On the web: Visit www.annualcreditreport.com By mail: Mail your completed Annual Credit Report Request Form (which you can obtain from the Federal Trade Commission’s website at http://www.ftc.gov/bcp/online/include/requestformfinal.pdf) to: Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 How can you get more information? For more information about credit reports and your rights under Federal law, visit the Consumer Financial Protection Bureau's website at www.consumerfinance.gov/learnmore. PRICING SCHEDULE Interest Rates and Interest Charges Annual Percentage Rate (APR) for Purchases 0.00% APR for Balance Transfers Offer #1 Intro APR until the last day of your billing period ending during 02/2024. After the intro APR expires, your APR will be the market based on the Prime Rate. 25.24%. This APR will vary with 10.99% intro APR for 6 months from date of first transfer, for transfers that post to your account by 11/10/2023.†† After the intro APR expires, your APR will be 25.24%. This APR will vary with the market based on the Prime Rate. APR for Cash Advances 29.99% This APR will vary with the market based on the Prime Rate. Penalty APR and When It Applies None Paying Interest Your due date is at least 25 days after the close of each billing period (at least 23 days for billing periods that begin in February). We will not charge you any interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers as of the later of the transaction date or the first day of the billing period in which the transaction posted to your Account. Minimum Interest Charge If you are charged interest, the charge will be no less than $0.50. For Credit Card Tips from the Consumer Financial Protection Bureau To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore Fees Set-up and Maintenance Fees • Annual Fee None Transaction Fees • Balance Transfer Offer #1 • Either $10 or 5% of the amount of each cash advance, whichever is greater. Cash Advance Intro fee of 3% of the amount of each transfer for transfers that post to your account by 11/10/2023 with the 10.99% intro APR balance transfer offer described above. After that, 5% of the amount of each transfer. Penalty Fees • Late Payment None the first time you pay late. After that, up to $41. • Returned Payment Up to $41 How We Will Calculate Your Balance: We use a method called "daily balance (including current transactions )." See your Cardmember Agreement for more details. Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your Cardmember Agreement. †† See the terms of the applicable balance transfer offer for details. CONTINUED ON REVERSE SIDE Additional Interest Rate Information Rate Plan¹ Annual Percentage Rate Daily Periodic Rate Expiration Date² Purchases V=PRIME+16.74% 25.24% 0.06915% Cash Advances V=PRIME+21.74% 29.99% 0.08216% 0.00% 0.00000% 02/2024 10.99% 0.03011% 6 months4 Intro Purchase Rate Intro BT Offer 1 ¹ V=Variable rate. Variable rates are as of July 31, 2023, and will vary with the market based on the Prime Rate. ² Expiration dates are the last day of the billing period ending during the month indicated. 4 From date of first transfer, for transfers under this offer that post to your account by 11/10/2023.