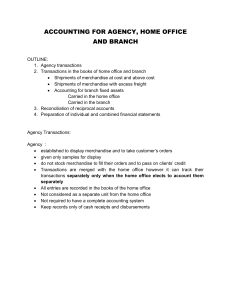

ACCOUNTING FOR BRANCH AND AGENCY TRANSACTIONS As a means of achieving marketing objectives, selling units in form of agency or a branch may be established. SIMILARITIES - DIFFERENCES - - - SALES AGENCY vehicle for enlarging sales volume. carries samples but not stocks. Take orders & send to HO for approval of Credit (HO ships directly to customers) A/R is maintained at the HO Working fund is provided & replenished Under imprest system. No other cash is Handled. Does not keep complete set of books nor Uses double entry accounting system. Record of sales to customers & list of Cash payments supported by vouchers. - BRANCH vehicle for enlarging sales volume carries stocks of MDSE from HO & outsider makes usual warranties with respect to quality makes collections of A/R Functions as an independent business unit but subject to control by the HO Agency an organization that merely takes orders for goods, carries no stock other than samples, and that operates under the direct supervision of the home office. ACCOUNTING FOR AGENCY OPERATIONS • The entries made by the home office depend on whether sales agency net income is determined separately or not separately SEPARATELY NOT SEPARATELY - general ledger accounts to be maintained SALES – AGENCY RENT EXPENSE – AGENCY COST OF SALES – SALES AGENCY (Perpetual) SHIPMENTS TO SALES AGENCY (Periodic) - The purpose is to evaluate an agency’s performance. - No separate GL accounts. The transactions are recorded in the HO’s own revenue and expense accounts. ILLUSTRATION: Myra Trader, Inc. established a sales agency in Cebu. The revenues and expenses of the home office are recorded separately from those of the sales agency. The following transactions occur for Manila Trader, Inc.: 1.) 2.) 3.) 4.) 5.) 6.) A working fund of P20,000 is established. Shipped merchandise to Cebu agency for use as samples, P4,000. Fill sales orders from Cebu Agency, P180,000. Replenishment of working fund of the agency, P16,000. Close revenue and expense accounts of the agency. Close Cebu Agency income to Income Summary account. Prepare entries in the home office books. ACCOUNTING FOR BRANCH OPERATIONS Branch an organization that sells goods out of a stock that it maintains and that possesses the authority to engage in transactions as an independent unit. • HO & branch maintain separate accounting systems. • Outside party transactions are recorded in the usual manner, while Inter company transactions in their respective accounting systems. • All accounts are combined for external reporting in recognition of “sinle economic enterprise” • Elimination entries required for consolidated FS preparation. • RECIPROCAL ACCOUNTS o Home Office Current takes the customary capital/equity account in the branch books (credit balance) o Branch Current/Investment in Branch represents investment of home office in the branch (debit balance) o Shipments to branch represents merchandise shipped to the branch (credit balance); shown as a deduction in computing cost of sales of the home office. o Shipments from home office merchandise received by the branch from the home office (debit balance); shown as addition in computing cost of sales of the branch. PROFORMA JOURNAL ENTRIES TRANSACTIONS HOME OFFICE 1.) Establishment of Branch. Investment in Branch 2.) Recognition of branch income. XX Cash XX Office Equipment XX Investment in Branch 4.) Merchandise shipments to branch at cost with freight. 5.) Merchandise shipments to branch with profit. 6.) The home office purchased office equipment for its branch. Branch keeps records of its plant assets. Cash XX 7.) The home office purchased office equipment for its branch. Home office keeps records of branch plant assets. XX Allow. For overvaluation XX XX Home Office Office Equipment XX XX XX Home Office XX No entry Office Equipment - Branch XX Office Equipment - Branch XX XX Investment in Branch Investment in Branch expenses Home Office XX XX Cash XX Cash 10.) apportionment of expenses XX Home Office XX Investment in branch 9.) Expenses incurred by the branch but paid by the home office. XX Shipments from Home Office XX Shipments to branch Cash 8.) The branch purchased plant assets that are recorded on the books of the home office. XX Freight In XX Cash XX Shipments from Home Office XX XX Investment in Branch XX Home Office XX Shipments to branch Investment in Branch XX Shipments from Home Office XX XX Investment in Branch Office Equipment Home Office XX Shipments to branch XX Income Summary XX Investment in Branch Cash Home Office XX Branch Income 3.) Merchandise shipments to branch at cost. BRANCH Expenses XX XX XX Home Office XX Expenses XX Home Office XX XX XX PREPARATION OF COMBINED FINANCIAL STATEMENTS • Elimination of reciprocal accounts elimination entries do not appear in HO nor branch books. It appears only in consolidated working paper to facilitate the preparation of combined F/S/ o Home office XX Investment in Branch XX (note: amount is the balance before recognizing the branch income) o Shipment to branch Shipment from home office (if billed at cost) XX XX o o o o Shipment to branch XX Allowance for overvaluation of branch inventory XX Shipment from home office (if there is mark up) XX Allowance for overvaluation of branch inventory XX Merchandise Inventory, beg. (to eliminate mark up on Inventory beg.) XX Merchandise Inventory, end (I/S) Merchandise Inventory, end (B/S) (to present inventory end at its cost) XX XX Inter branch receivables and payables PROBLEM 1 MCG, Inc. of Quezon City, a distributor of computer equipment, establishes a branch sales office in Cebu City. Both the home office and the branch uses the periodic inventory system. Branch fixed assets are recorded on the home office books. Transactions during 2012, the first year of branch operations, are summarized below: Cash a. Cash is sent to Cebu branch, P20,000 IIB Cash b. H/O Merchandise is shipped to the branch at cost, P200,000. IIB STB c. SFHO H/O Store equipment is purchased by the branch and carried in the home office books, P10,000. Equipment IIB d. Credit sales: Home office, P900,000; branch, P240,000 e. Collection of accounts receivable: f. Operating expensed paid: g. Cash remittance by Cebu branch to home office, P100,000 h. Operating expenses charged by home office to branch, P12,000 AR Sales H/O Cash AR Sales Home office, P1,000,000; branch, P220,000 home office, P152,000; branch, P60,000 Requirement: 1.) Prepare journal entries for the home office and the branch. 2.) Closing entries in the home office and branch books. 3.) Determine the combined amount for sales, cost of sales, operating expenses, and net income. PROBLEM 2 The same data in problem 1 except that the home office bills merchandise shipments to the branch at 30% above cost. 1.) Prepare journal entries for the home office and the branch. 2.) Closing entries in the home office and branch books. 3.) Determine the combined amount for sales, cost of sales, operating expenses, and net income. RECONCILIATION OF RECIPROCAL ACCOUNTS TRANSACTIONS Debits in the branch account without corresponding credits in the home office account. (shipment of merchandise in transit) example. The home Office shipped merchandise to the branch in the amount of P20,000. The shipment has not yet reached the branch as of December 31. 2.) Credits in the branch account without corresponding debits in the home office account. (branch receivable collected by the home office) example. On December 28, an accounts receivable of the branch was collected by the home office from a branch customer. 3.) Debits in the home office account without corresponding credits in the branch account. (cash remittance of the branch to home office in transit) example. On December 29, the branch purchased office equipment for P8,000. Assets used by the branch are carried in the home office records. 4.) Credits in the home office account without corresponding debits in the branch account. (correction of account for the understatement of net income for the preceding period) example. On December 28, the branch collected for the home office an accounts receivable amounting to P6,000 from a home office customer. 5.) Bookkeeping or mechanical errors on either set of books. HOME OFFICE BRANCH Shipments from Home Office Home Office Home Office Accounts Receivable Office Equipment - branch XX Investment in branch XX Investment in Branch Accounts Receivable XX XX XX XX XX XX example. A debit of P1,450 in the Investment in branch account was erroneously recorded by the branch in the home office account as P1,540. (representing apportionment of expeses) Home Office Expenses 90 90 PROBLEM 3 A reconciliation of the Investment in Branch account in the home office of Makati company and the home office account carried on the branch books showed the following discrepancies at December 31, 2012: a. Collection of branch accounts receivable by the home office, P16,000. The branch was not notified. Cash H/O IIB AR SFHO IIB b. Shipment in transit to branch on December 31, 2012, P64,000. STB H/O c. Acquisition of furniture by the branch, P24,000. The fixed asset accounts is to be maintained on the home office books. H/O The home office had not been notified of such acquisition. F&F Cash IIB H/O d. Return of excess merchandise by the branch but not received yet by the home office, P30,000. STB Cash H/O IIB SFHO e. Cash remittance by the branch on December 31, 2012 was in transit, P10,000. IIB Cash f. The balance of the home office account in the books of the branch on December 31, 2012 is P880,000 Compute the Unadjusted and adjusted balance of Investment in Branch account. PROBLEM 4 On December 31, 2012, the Investment in branch account on the home office’s books has a balance of P170,000. In analyzing the inter-company transactions recorded in each of these accounts for December, you discover the following discrepancies: a. A, P20,000 branch remittance to the home office initiated on December 27, 2012 was recorded on the home office books Cash H/O on January 4, 2013. IIB Cash b. A home office merchandise shipment to the branch on December 29, 2012 was recorded by the branch on January 5, IIB SFHO 2013. The cost of this merchandise is P40,000. STB H/O c. The home office incurred P24,000 of advertising expenses and allocated P10,000 of this amount to the branch on OPEX OPEX December 15, 2012. The branch has not recorded this transaction. IIB H/O d. A branch customer erroneously remitted P6,000 to the home office.Cash The home office recorded this cash collection on December 23, 2012. Meanwhile, back at the branch, no entry has been made yet. e. Merchandise costing P86,000 was sent to the branch by the home office on December 10, 2012. The billing was at cost, but the branch recorded the transaction at P68,000. Determine the unadjusted and adjusted balance of the home office account.