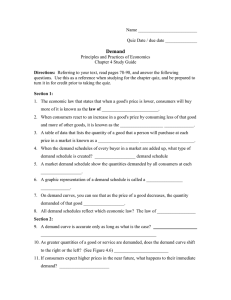

1|Page AS Chapter 2: The price system and the micro economy Market: It is the exchange of goods/services or the factors of production (resources). The exchange of goods/services is called the product market while the exchange of production is called the factor market. Free market The market for a good/service is said to be a free market if its price and quantity traded is determined by the free interaction of the forces of market demand and supply. In a free market the government has no role in determining the prices and quantities of the goods/services. The free market forces are market demand and market supply which are also referred to as the invisible hands. Demand It is the quantity of any good/commodity that the buyers are able and willing to buy at various prices over a period of time, ceteris paribus. Example: When the price of good x is $10 per unit, its quantity bought by the consumers is 50 units per week. So, demand for good x is 50 units per week. Demand for a good arises only when the consumers have the ability and willingness to pay for the good. A consumer’s want to have something without the ability and willingness to pay for it is not demand; it is a mere wish or desire. A consumer’s wish/desire to have something becomes his demand if he has the ability and willingness to pay for it. So, an effective demand is a consumer’s desire to have something that is supported by his ability and willingness to pay for it. Table: Demand Schedule Price of Good X Quantity demanded ($ per unit) (Units per week) 10 2 9 3 8 4 7 5 6 6 5 7 4 8 2|Page Fig : Demand curve Individual and market demand: Individual demand is the quantity of a good bought/demanded by an individual buyer at various prices over a period of time. Example: If at the price of $10 per unit, the market demand for good x is 50 units/ week and the quantity demanded by buyer A is 20% of the total market demand then, individual demand for good x is 10 units/ week. Market demand Market demand is the sum of the quantities of a good demanded by all the individual buyers of the good at various prices over a period of time. It is derived by horizontally adding up or aggregating the individual demand. Price of good x ($ per unit) 10 9 8 7 6 5 Table: Individual and market demand schedule Quantity Demanded (units per week) Buyer A Buyer B Buyer C Market Demand 1 2 3 6 2 3 4 9 3 4 5 12 4 5 6 15 5 6 7 18 6 7 8 21 Fig: Individual demand curve 3|Page In the above diagram, DD is an individual demand curve. It is negatively sloped (sloping downward from left to right). This shows that there exists an inverse relationship between the price of a good and its quantity demanded by an individual buyer. That is, when the price of a good rises, its quantity demanded by an individual buyer decreases and vice versa. Fig: Derivation of market demand curve Factors affecting demand: Determinants of demand 4|Page Price of the given good Taste of the consumers Prices of related goods (substitutes and complements) Income of consumers Number of buyers/ users of the good Expectation of price and income change Seasonal change Government policy Culture and tradition Advertisement Price of the given good [dx= f (Px)] All other factors being unchanged, when the price of a good rises, its quantity demanded decreases and vice versa. Fig: the demand curve 5|Page Total Expenditure (TE) = Price x Qty. demanded Example, when price=OP, Quantity demanded=OQ So, TE =OP x OQ =OPaQ If P=8 and Qd=12 then, TE = 8 X12=96 Non-price factors/ determinants of demand Taste of consumers/fashion Demand for a good rises if it is in fashion or preferred by the consumers while its demand decreases if it goes out of fashion. Income of consumers To analyse the effect of change in consumer’s income on the demand for the good, we classify the goods as superior or normal goods and inferior goods. In case of superior or normal goods, as consumers’ income increases, their demand increases and vice versa. Fig: Demand for superior/normal goods In case of inferior goods, an increase in consumers’ income reduces their demand and vice versa. Fig: Demand for inferior goods 6|Page Prices of related goods [dx= f(py)] To analyse the effect of change in price of related goods on the demand for a good, we classify the goods as substitutes and complements. In case of substitutes, an increase in the price of one good raises the demand for another good and vice versa. For example, an increase in price of Pepsi raises the demand for coke and vice versa Fig: Alternative demand 7|Page In case of complements, an increase in price of one good reduces the demand for another good and vice versa. For example, an increase in price of petrol reduces the demand for motorbikes and vice versa. Fig: Joint demand Number of buyers/ users of the good An increase in the number of buyers or users of the good increases the demand for the good and vice versa. For example, an increase in the number of students studying A Level economics will increase the demand for economics text book and vice versa. Expectation of price and income change If the consumers expect the price of a good to rise in the near future its demand will increase as the consumers will rush to buy the good and hold in stock before the price rises. While if the consumers expect the price of the good to fall in the near future, its demand will decrease as the consumer will postpone their purchase and wait for the price to fall. Similarly, expectation of income change also affects the demand for the goods. If an economy is experiencing economic growth, consumers can expect a rise in employment and income. This will increase the consumer confidence and hence they will consume more. On the other hand, if the economy is experiencing recession, there will be an atmosphere of pessimism as employment and income is expected to fall. Thus, there will be lack of consumer confidence and the demand for goods decreases. 8|Page Seasonal change Demand for the goods changes with the change in season/weather. For example, demand for cold drinks increases in the summer season while their demand decreases in the winter season. Culture and tradition Demand for the goods is also affected by the culture and tradition followed by the people. For example, demand for fruits, flowers, sweets, dairy products etc. increases during the festive season. Government policy Demand for a good is also affected by government policy. For example, government policy of increase in direct taxes (income tax) reduces the disposable income of the consumers which in turn, reduces the demand for the good. On the other hand, cut in income tax raises the demand for the good. Advertisement An effective advertisement provides information to the consumers about the good and attracts the consumers towards the good. This increases the demand for the good. ‘Change in quantity demanded’ and ‘change in demand’: movement along and shift in demand curve Change in quantity demanded is caused by a change in the price of the good itself, all other factors remaining unchanged. Change in quantity demanded cause a movement along the demand curve. An increase in the price of the good reduces the quantity demanded and causes a leftward movement along the demand curve. This is technically referred to as “contraction of demand”. On the other hand, a fall in the price of good increases its quantity demanded and causes a rightward movement along the demand curve. This is referred to as an “expansion of demand”. Fig: Change in quantity demanded: movement along the demand curve 9|Page Change in demand is caused by the change in one or all the non-price determinants of demand, price of the good being unchanged. Change in demand causes a shift in the demand curve. An increase in demand causes the rightward shift while a decrease in demand causes a leftward shift in the demand curve. For example, price of economics textbook being unchanged, if there is an increase in the number of students studying economics; demand for economics textbook will increase. This will cause the demand curve to shift rightward. Fig: Change in demand: shift in demand curve 10 | P a g e Law of demand The law of demand states that all other things being unchanged; there exist an inverse relationship between the price of good and its quantity demanded. That is when the price of a good rises, its quantity demanded decreases and vice versa. Fig: the demand curve 11 | P a g e Exceptions of law of demand Giffen Goods Giffen Goods is a concept that was introduced by Sir Robert Giffen. These goods are goods that are inferior in comparison to luxury goods. However, the unique characteristic of Giffen goods is that as its price increases, the demand also increases. And this feature is what makes it an exception to the law of demand. Veblen Goods Veblen Goods is a concept that is named after the economist Thorstein Veblen, who introduced the theory of “conspicuous consumption“. According to Veblen, there are certain goods that become more valuable as their price increases. If a product is expensive, then its value and utility are perceived to be more, and hence the demand for that product increases. And this happens mostly with precious metals and stones such as gold and diamonds and luxury cars such as Rolls-Royce. As the price of these goods increases, their demand also increases because these products then become a status symbol. The expectation of Price Change There are times when the price of a product increases and market conditions are such that the product may get more expensive. In such cases, consumers may buy more of these products before the price increases any further. Consequently, when the price drops or may be expected to drop further, consumers might postpone the purchase to avail the benefits of a lower price. There are also times when consumers may buy and store commodities due to a fear of shortage. Therefore, even if the price of a product increases, its associated demand may also increase as the product may be taken off the shelf or it might cease to exist in the market. Necessary Goods and Services Another exception to the law of demand is necessary or basic goods. People will continue to buy necessities such as medicines or basic staples such as sugar or salt even if the price increases. The prices of these products do not affect their associated demand. 12 | P a g e Change in Income Sometimes the demand for a product may change according to the change in income. If a household’s income increases, they may purchase more products irrespective of the increase in their price, thereby increasing the demand for the product. Similarly, they might postpone buying a product even if its price reduces if their income has reduced. Hence, change in a consumer’s income pattern may also be an exception to the law of demand. Reasons for an inverse relationship between the price of a good and its quantity demanded Income effect: Consumer’s money income being unchanged when there is an increase in the price of a good, real income (purchasing power) of the consumer decreases. That is, the consumer can buy lower quantity of the good using the given money income when the price of the good rises. Hence the quantity demanded of a good falls when its price rises and vice versa. Let, M= $100 Px= $10/ unit So, $100/$10= 10 units Now, M1=$100 Px1=$20/ unit So, M1/Px1= $100/$20= 5 units Substitution effect: When the price of a good rises, it becomes relatively expensive. So the consumers substitute the expensive good with the cheaper ones. Hence, the quantity demanded of a good falls when its price rises and vice versa. For example when the price of Pepsi increases its quantity demanded decreases because the consumers switch to coke which is now relatively cheaper. It is always the case that the consumers substitute towards the cheaper products. Law of diminishing marginal utility: According to this law, as the quantity of a good consumed by a consumer increases, the utility (satisfaction) derived from the successive units (marginal utility) decreases. So, a rational consumer will not consume the successive units of the good at the same price. He will consume the successive units of the good only if the price decreases. Hence, the quantity consumed/demanded of a good increases only when its price decreases. 13 | P a g e Table: Marginal utility derived from a good and the price paid by a consumer Quantity of good x Marginal utility Price paid / value assigned consumed ( utils/units) by consumers (in $) 1 8 40 2 6 30 3 4 20 4 2 10 Types of demand Direct demand Demand for the finished products that directly satisfy the human wants is called direct demand. Indirect or derived demand Demand for factors of production / resources such as land, labour, capital etc. is called derived demand as they are demanded for the production of finished goods or services. Alternative demand Demand for substitutes is called alternative demand. Joint demand Demand for two or more goods to satisfy a single want is called joint demand. For example, demand for pen, ink and paper to write something. Composite demand Demand for a single good to satisfy multiple wants is called composite demand. For example, demand for electricity for cooking, heating, lighting, cleaning etc. 14 | P a g e Supply Supply is the quantity of a good/ commodity that the sellers are able and willing to offer for sale at various prices over a period of time, ceteris paribus. Example: When the price of good x is $10 per unit, the sellers are able and willing to sell 50 units per week. So, supply of good x is 50 units per week. Individual and market supply Individual supply is the quantity of a good that an individual seller of the good is able and willing to sell at various prices over a period of time, ceteris paribus. Example: If at the price of good X is $10 per unit, the market supply of good x is 100 units/ week and the quantity supplied by seller A is 20% of the total market supply then, quantity of good x supplied by seller A is 20 units/ week. Market supply Market supply is the sum of the quantities of a good supplied by all the individual sellers of the good at various prices over a period of time. It is derived by horizontally adding up or aggregating the individual supply. Price of good x ($ per unit) 2 4 6 8 10 12 Table: Individual and market supply schedule Quantity Supplied (units per week) Seller A Seller B Seller C 1 2 3 2 3 4 3 4 5 4 5 6 5 6 7 6 7 8 Fig: Individual supply curve Market Supply 6 9 12 15 18 21 15 | P a g e Fig: Derivation of market supply curve Factors affecting / determinants of supply Price of the given good Prices of resources Prices of related goods Technology Government policy (taxes and subsidies) Expectation of price change Number of sellers Price of the given good [Sx = f(Px)] All other things being unchanged, an increase in the price of the given good raises the quantity supplied of the good and vice versa. 16 | P a g e Fig: the supply curve Non- price determinants of supply Prices of resources An increase in the prices of resources (FOP) increases the costs of production and reduces the supply of the goods and vice versa. Prices of related goods In case the goods are in joint supply, an increase in the price of one good raises the supply of another good and vice versa. For example, an increase in price of goose meat increases the supply of feathers and vice versa. Technology An improvement in the state of technology increases the supply of the good as the improved technology enables the firms to produce higher quantity of the goods at lower costs. Government policy An imposition of indirect taxes on the production of goods increases the costs of production and reduces the supply of the goods and vice versa. On the other hand, if the government provides subsidies to the producers, the costs of producing the goods decreases and hence supply increases. Expectation of price change If the sellers expect the prices of the goods to rise in the near future supply will decrease as the sellers will hold the goods in stock to sell them at higher prices in the future. On the other hand, if the sellers expect the prices to fall in the near future, supply will increase as the consumers will rush to sell the goods at the current prices. Number of sellers [Sx=f(Ns)] If the number or sellers of the good increases, supply of the goods will increase and vice versa. 17 | P a g e Change in quantity supplied and change in supply: Movement along and shift in supply curve ‘Change in quantity supplied’ is caused by the change in the price of the good itself, all other factors/determinants remaining unchanged. An increase in the price of a good raises its quantity supplied and causes a rightward movement along the supply curve. This is technically referred to as ‘expansion of supply’. While a fall in the price of the good reduces its quantity supplied and causes a leftward movement along the supply curve. This is technically referred to as ‘contraction of supply’. Fig: Change in quantity supplied ‘Change in supply’ is caused by the change in the non-price determinants of supply, price of the good being unchanged. For example, price of the good being unchanged, if the number of sellers of the good increases, its supply will increase. Change in supply causes a shift in supply curve. An increase in supply causes a rightward shift while a decrease in supply causes a leftward shift in the supply curve. Fig: Change in supply 18 | P a g e The law of supply The law of supply states that, all other factors being unchanged there exists a direct relationship between the price of a good and its quantity supplied. That is, when the price of a good rises, its quantity supplied increases and vice versa. Fig: the supply curve In the above figure, When price is OP quantity supplied is OQ. So, Total Revenue (TR) = Price x quantity sold = OP x OQ = OPa Q Reasons for a direct relationship between the price of a good and its quantity supplied Law of diminishing returns Diminishing return, also called law of diminishing returns or principle of diminishing marginal productivity is and economic law stating that if one input in the production of a commodity is increased while all other inputs are held fixed, a point will eventually reached at which additions of the input yield progressively smaller, or diminishing, increases in output. In the classic example of the law, a farmer who owns a given acre of land will find that a certain number of labourers will yield the maximum output per worker. If he hires more workers, the combination of land and labour would be less efficient because the proportional increase in the overall output would be less than the expansion of the labour force. The output per worker would therefore fall. This rule holds in any process of production unless the technique of production also changes. 19 | P a g e Incentive of higher profit If the product cost is given, a higher price means greater profits and thus an incentive to increase the quantity supplied. Hence, price and quantity supplied are directly related. Putting demand and supply altogether: Market in equilibrium and disequilibrium Equilibrium is a situation of balance where at least under present circumstances there is no tendency for change to occur. The market for a product reaches a state of equilibrium when the market demand for the product becomes equal to the market supply and the demand curve intersects the supply curve. The price established at the state of market equilibrium is called the equilibrium price (market clearing price) and the quantity traded (demanded and supplied) is called the equilibrium quantity. Table: Equilibrium in a free market Price of PCs($) 2000 1800 1600 1400 1200 1000 800 Quantity demanded of PCs per day 1000 2000 3000 4000 5000 6000 7000 Quantity supplied of PCs per day 7000 6000 5000 4000 3000 2000 1000 20 | P a g e Fig: Equilibrium in a free market Change in market equilibrium The market equilibrium changes if there is any change in the market forces of demand and supply of a good. For example, supply of the good being unchanged if the demand for the good increases, then the excess demand will cause the equilibrium price to rise. Fig: Effect of increase in demand on equilibrium price 21 | P a g e Fig: Effect of fall in demand on equilibrium price Fig: Effect of change in demand on equilibrium price Fig: Effect of increase in supply on equilibrium price 22 | P a g e Fig: Effect of decrease in price on equilibrium price Fig: Effect of change in supply on equilibrium price 23 | P a g e Fig: Effect of change in demand and supply on market equilibrium Note: If the market demand and market supply of the good falls by the same proportion, the equilibrium price will remain unchanged while the equilibrium quantity decreases. Fig: Effect of change in demand and supply on market equilibrium Note: If the supply of the good decreases by an equal proportion as an increase in demand then the equilibrium quantity will remain unchanged while the equilibrium price increases. 24 | P a g e Fig: Effect of change in demand and supply on market equilibrium Note: If the demand for a good increases by a higher proportion than an increase in supply then the excess demand will cause the equilibrium price as well as the equilibrium quantity to rise. Typical demand function/ Linear demand curve equation A typical demand function is given by: Qd = a – bP Where, Qd =Quantity demanded a = autonomous demand or the quantity demanded if the price were zero (demand independent of price) b = change in quantity demanded resulting from a change in price or the inverse of slope of the 𝛥𝑄𝑑 demand curve ( 𝛥𝑝 ). The value of b is always negative because of an inverse relationship between the price of a good and its quantity demanded. P= price of the good. For example, let us take the demand for pizza in a small town in a single day. The demand function for pizza can be expressed as: 25 | P a g e Qd = 600 – 50P In the above demand function the value of ‘a’ variable is 600.This is the autonomous demand as it represents the number of pizzas demanded irrespective of the price. That is, even if the price is zero, 600 pizzas would be demanded in the town. This value of ‘a’ variable will change if there is any change in the factors affecting demand for pizza. For instance, if the income of consumers rises, demand for pizza will increase and the value of ‘a’ variable will increase. This will cause the demand curve to shift rightward. While a fall in the value of ‘a’ variable will cause the demand curve to shift to the left. The value of ‘b’ variable in the demand function is 50 which is the inverse of slope of the demand curve. It says that if the price of pizza changes (rises or falls) by $1, its quantity demanded will change (fall or rise) by 50 units. A change in the value of b variable will cause the slope/steepness of the demand curve to change. In the above demand function, when the price is zero, 600 pizzas are demanded. This gives us the x-intercept, the point where the demand curve meets the x- axis. It can also be called the Q-intercept for demand because quantity demanded is always measured along the x-axis. So for demand function, Q-intercept for demand is 600. Let us now assume that the price of pizza is $10. At this price, the quantity demanded is: Qd =600 – 50(10) = 100 So, at the price of $10, only 100 units of pizza are demanded. According to the law of demand, a fall in price should increase the quantity demanded of pizza. To test this let us assume that the price of pizza falls to $8 then, Qd = 600 – 50(8) = 200 Thus we see that when the price of pizza falls to $8, quantity demanded of pizza increases from 100 units to 200 units. For every $1 fall in price, 50 additional units of pizza are demanded/ sold. This means that the price coefficient of 50 determines the responsiveness of consumers to the change in price. At lower prices, more pizzas are demanded. For example, at $4 quantity demanded is: Qd =600 – 50(4) = 400 Note: 26 | P a g e The ‘a’ variable in the demand function is the autonomous demand or the quantity demanded when the price is zero. It changes with the change in the determinants of demand. Meanwhile, the variable ‘b’ demonstrates the law of demand, which says that there is an inverse relationship between the price of a good and its quantity demanded by consumers. According to the above demand function, as the price of pizza falls from $10 to $0, the quantity demanded of pizza rises from 100units to 600 units. So, it is possible to construct both a demand schedule and demand curve from this demand function. Table: Linear demand schedule for pizza (a = 600) Price of pizza (p)/ $ 10 9 8 7 6 5 4 3 2 1 0 Quantity demanded per day(Qd) 100 150 200 250 300 350 400 450 500 550 600 Fig: Linear demand curve for pizza (a=600) Exercise 1: Using the demand schedule given below, answer the following questions: 27 | P a g e Price of PCs($) 2000 1800 1600 1400 1200 1000 800 Quantity demanded of PCs per week 1000 2000 3000 4000 5000 6000 7000 1. How many PCs per week are people willing and able to buy if the price is $1100? 2. What price will persuade people to buy 1350 PCs per week? Soln-1: Finding ‘a’ variable Taking the price range $1800 to $1600 b= ∆𝑄𝑑 ∆𝑝 = 1000 200 =5 Qd= a – bp 2000= a – 5(1800) a=11000 So, at price of $1100, the quantity of PCs that the people are able and willing to buy per week is, Qd = 11000 – 5 (1100) Qd= 5500 Typical supply function/ linear supply curve equation 28 | P a g e A typical supply function is given by Qs= C + dP Where, QS= Quantity supplied C = autonomous supply or quantity supplied when price is zero d= change in quantity supplied caused by the change in the price of the good or inverse of the ∆𝑄𝑠 slope of supply curve ( ∆𝑃 ). The value of d is always positive because of a direct relationship between the price of a good and its quantity supplied. P = price of the good In the above supply function, ‘c’ represents the non-price factors affecting supply and indicates the quantity supplied when price is zero. Any change in the non-price determinants of supply will cause the ‘c’ variable to change and the supply curve will shift rightward or leftward. For example, if the number of firms in the market/ industry increases, then the autonomous level of supply will increase and the supply curve will shift rightward. The corresponding value of Q s will increase by the same amount as ‘c’ variable at each price along the supply curve. The ‘d’ variable is an inverse of the slope of the supply curve or it is the responsiveness of producers to the change in the price of the good. Any change in the value of d variable will cause the slope/ steepness of the supply curve to change. For example, if the value of‘d’ variable is 5, then an increase in the price of good by $1 will cause the quantity supplied to increase by 5 units. Returning to the market for pizza, let us assume that the supply function of pizza is given by: Qs = - 200 + 150P According to the above supply function, if the price were zero, -200 pizzas would be supplied. In other words, no producers would be able and willing to sell pizzas at a price of zero. To determine the price at which, producers would begin producing and selling pizzas or to find the P-intercept/ y-intercept, we set the quantity to zero and solve for P, 0 = -200 + 150P 200=150P P= 1.33 29 | P a g e At a price of $1.33, producers begin to consider selling pizzas. This is where the supply curve begins. At any price greater than $1.33, there is a direct relationship between the quantity supplied and price. For example, if the price of pizza rises to $3 then, Qs = -200 + 150(3) =250 If the price rises to $5 then, QS = -200 + 150(5) = 550 Now, if the price falls to $4 then, QS = -200 + 150(4) = 400 Using the above supply function, it is possible to construct the supply schedule and the supply curve. Table: Linear supply schedule for pizza, c = -200 Price of pizza Quantity supplied (in $) per day 10 1300 9 1150 8 1000 7 850 6 700 5 550 4 400 3 250 2 100 1 -50 0 -200 Fig: Linear supply curve, c= -200 30 | P a g e Exercise: Using the supply schedule given below, answer the following questions: Price of PC($) Quantity of PCs supplied per week 800 1000 1000 2000 1200 3000 1400 4000 1600 5000 1800 6000 2000 7000 1. How many PCs per week are companies planning to supply if the price is $1100? 2. What price would persuade companies to supply 1350 PCs? Soln 1: d= ∆𝑄𝑠 ∆𝑃 =5 Qs= C + dp 2000 = C +5(1000) C = -3000 So, qty. of PCs that the companies are planning to supply is, Qs= -3000 + 5(1100) =2500 Soln. 2: 1350 = -3000 + 5(P) P = 870 31 | P a g e Equation of market equilibrium The equation of market equilibrium is given by: Qd = Qs In the example of market for pizza, Qd = 600 – 50P Qs = -200 + 150P To find the equilibrium price, solve for P 600 – 50P = -200 +150P 200P= 800 P =4 To find the equilibrium quantity, plug in the value of P in the demand or supply function Qd = 600-50P =600- 50(4) =400 Qs = -200 + 150(4) =400 So the equilibrium price is $4 and the equilibrium quantity is 400 units. 32 | P a g e Elasticity of demand It is the responsiveness of consumers to the change in the factors affecting demand like price of the good, income of consumers, change in prices of related goods etc. It measures to what extent the demand for the goods changes when there is any change in these factors. Types of elasticity of demand Price elasticity of demand(PED) Income elasticity of demand(YED) Cross elasticity of demand(XED) Price elasticity of demand (PED) It is the measure of change in the quantity demanded of a good caused by any percentage change in the price of the good, ceteris paribus. Mathematically, PED = = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑑𝑒𝑚𝑎𝑛𝑑𝑒𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑖𝑡𝑦 𝑑𝑒𝑚𝑎𝑛𝑑𝑒𝑑 ÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑑𝑒𝑚𝑎𝑛𝑑𝑒𝑑) 𝑥 100 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑝𝑟𝑖𝑐𝑒)𝑥 100 = 𝜟𝑸𝒅 𝜟𝑷 ÷ 𝑷 𝑸𝒅 = 𝜟𝑸𝒅 𝑸𝒅 x 𝑷 𝜟𝑷 = 𝜟𝑸𝒅 𝜟𝑷 x 𝑷 𝑸 Example: 1 Px Qdx 10(P1) 50(Q1) 20(P2) 40(Q2) Soln: 33 | P a g e % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑑𝑒𝑚𝑎𝑛𝑑𝑒𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 PED = = − 𝟐𝟎% 𝟏𝟎𝟎% = - 0.2 = 0.2˂ 1 Or, PED = = 𝜟𝑸𝒅 𝜟𝑷 −𝟏𝟎 𝟏𝟎 x x 𝑷 𝑸 𝟏𝟎 𝟓𝟎 = - 0.2 = 0.2 ˂ 1 Note: The value of PED is always negative because of an inverse relationship between the price of a good and its quantity demanded but by rule we ignore the negative sign. Example: 2 Px 20(P1) 25(P2) PED= Qdx 50(Q1) 20(Q2) −𝟔𝟎% 𝟐𝟓% = - 2.4 = 2.4 ˃1 Interpretation: Since the value of PED is greater than 1, demand for good x is elastic. This means that quantity demanded changes by a greater percentage than the percentage change in the price of the good. In the given information, quantity demanded has fallen by 60% in response to 25% rise in the price of the good. 34 | P a g e Types of price elasticity of demand Perfectly elastic demand (PED=Ꝏ) Demand for a good is said to be perfectly elastic if a small proportionate change in its price causes the quantity demanded to change infinitely or immeasurably. That is a small proportionate fall in price causes the quantity demanded to increase infinitely while a small proportionate rise in price causes the quantity demanded to fall to zero. Example: Px Qdx 10 0 9 Ꝏ Here, Ꝏ PED= 𝟏𝟎 % =Ꝏ Fig: Perfectly elastic demand Note: If the demand for a good is perfectly elastic, any percentage change in the quantity demanded causes the total revenue or total expenditure to change by equal proportion. Perfectly inelastic demand / fixed demand/ zero elasticity (PED=0) 35 | P a g e Demand for a good is said to be perfectly elastic or fixed if any proportionate change in the price doesn’t have any effect on the quantity demanded. That is, quantity demanded of the good remains fixed or unchanged even if its price changes by a very high proportion. Example: Px Qdx 10 50 5 50 Here, PED= 𝟎 𝟐𝟓 =0 Fig: Perfectly inelastic demand Note: If the demand for a good is perfectly inelastic, any percentage change in price causes the total revenue or total expenditure to change by equal proportion. Unitary elastic demand (PED=1) Demand for a good is said to be unitary elastic if any proportionate change in its prices causes the quantity demanded to change by equal proportion. For example, a 10% increase in the price of the good causes the quantity demanded to fall by 10% and vice versa. Example: Px Qdx 10 100 15 50 Here, PED = 𝟓𝟎 𝟓𝟎 =1 36 | P a g e Fig: Unitary elastic demand (PED =1) Relatively elastic or elastic demand (PED ˃1) Demand for a good is said to be relatively elastic or elastic if any proportionate change in its price causes the quantity demanded to change by a relatively greater proportion. For example, demand for a good is elastic if a 10% rise in its price causes the quantity demanded to fall by more than 10%. Example: Px Qdx 10 100 12 50 Here, PED = 50% 20% =2.5 ˃1 Fig: Relatively elastic demand (PED˃1) 37 | P a g e Relatively inelastic or inelastic demand (PED ˂1) Demand for a good is said to be relatively inelastic or inelastic if any proportionate change in its price causes the quantity demanded to change by a relatively smaller proportion. For example, demand for a good is inelastic if a 10% rise in its price causes the quantity demanded to fall by less than 10%. Example: Px Qdx 10 100 20 50 50% Here, PED = 100% =0.5˂1 Fig: Relatively inelastic demand (PED˂1) Exercise: Calculate and interpret the value of PED from the given information Px Qdx 10 100 8 150 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑑𝑒𝑚𝑎𝑛𝑑𝑒𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 PED= 50% = 20% =2.5˃1 Interpretation: Since the coefficient of PED is greater than 1, demand for good x is elastic. In the given information quantity demanded increases by 50% in response to 20% fall in price. 38 | P a g e Exercise 2: Calculate and interpret the value of PED from the given information Px Qdx 10 100 20 80 PED = Fig: Types of PED and the demand curves Worked example: Using the following diagram, D1 represents the demand for cigarettes, D2 represents the demand for movie tickets and D3 represents the demand for ice-cream. Find out which good has the most elastic and which good has the most inelastic demand. 39 | P a g e Soln; PED for cigarettes=0.21 PED for movie tickets= 1.14 PED for ice cream=3 Demand for cigarettes is most inelastic (least elastic) while demand for ice cream is most elastic. Factors affecting price elasticity of demand Number of substitutes of a good Demand for a good with large number of substitutes is elastic while the demand for a good with few or no substitutes is inelastic. Nature of the good Demand for the goods of basic necessity such as staple food, fuel, salt etc. and habit forming goods such as cigarettes, tobacco, alcohol etc. is inelastic while the demand for luxuries and comforts is elastic. Proportion of consumer’s income spent on the good Demand for a good will is elastic if the consumers have to spend a good while demand will be inelastic if the consumers have to spend only a small proportion of their income on the good. Postponement of consumption Demand for a good will is inelastic if the consumption of the good cannot be postponed. For example, demand for food, medicine etc. is inelastic as their consumption cannot be postponed. While demand will be elastic if the consumption of the good can be postponed. Number of uses of a good Demand for a good with large number of uses is elastic while demand for a good with a single use is inelastic. Time Elasticity of demand for a good is also affected by the time gap between the changes in the price of the good. If the price of good rises and remain high for a long time then, demand will be elastic. This is because given a long time; the consumers can find and switch to the substitutes. While demand will be inelastic if the price of a good rises and fall back to the original within a short period of time. 40 | P a g e Measuring PED using total outlay (Total Expenditure) method Total outlay or total expenditure is the total amount of money spent by the consumers on the good at different prices. Mathematically, Total outlay or total expenditure = price x quantity demanded This method measures the PED by comparing the price of the good with the total expenditure made by the consumers on the good. This method measures the following three types of PED: PED equal to unity / Unitary elastic demand (PED=1) According to the total outlay method, PED is equal to unity if any change in the price of the good doesn’t have any effect on the total expenditure. That is, total expenditure doesn’t change with the change in the price of the good. Example: Price of Quantity Total expenditure good x demanded (P x Q) 3 4 12 4 3 12 Here, PED= 𝟏 𝜟𝑸𝒅 𝜟𝑷 =𝟏 x x 𝑷 𝑸 𝟑 𝟒 = 0.75 = 1 Fig: PED equal to unity 41 | P a g e Note: If the value of total expenditure is the same at all the prices of the good, then the demand curve is said to be a rectangular hyperbola. This means that the areas of the rectangles below the demand curve will be the same. Fig: Rectangular hyperbola demand curve In the above diagram, When P= $4, Qd= 3 units So, TR= $4 x 3 =$12(OP1aQ1) When price falls to $3 per unit, quantity demanded increases to 4 units. So, TR =$3 x 4 = $12(OPbQ) PED greater than unity / elastic demand (PED˃1) PED is greater than unity if a fall in the price of the good raises the total expenditure and vice versa. Example: Price of good x 10 8 Here, PED = 𝜟𝑸𝒅 𝜟𝑷 x 𝑷 𝑸 𝟓 =𝟐 x 𝟏𝟎 𝟓 Quantity demanded 5 10 = 5 ˃1 Total expenditure (P x Q) 50 80 42 | P a g e Fig: PED greater than unity/ elastic demand PED less than unity / inelastic demand (PED˂1) PED is less than unity if a fall in the price of the good reduces the total expenditure and vice versa. Example: Price of good x Quantity demanded 5 7 10 5 Here, PED = 𝜟𝑸𝒅 𝜟𝑷 x 𝑷 𝑸 = 𝟐 𝟓 x 𝟏𝟎 𝟓 Total expenditure (P x Q) 50 35 = 0.8 ˂ 1 Fig: PED less than unity/ inelastic demand 43 | P a g e Linear demand curve and the coefficient of PED Price of good x Quantity demanded 1 10 2 3 9 8 4 7 5 6 6 5 7 4 8 9 3 2 10 1 44 | P a g e Business relevance of PED: usefulness of PED in business decision making An understanding of the concept of PED helps us to understand the likely price volatility following any change in the supply of the goods. This is important for commodity producers who may suffer big price movements from time to time. For example, demand for a good being unchanged, if its supply decreases its price will rise; but the extent to which the price rises depends on the price elasticity of demand. Rise in price following a fall in supply will be higher in case of inelastic demand than elastic demand. Fig: Price volatility following a fall in supply An understanding of the concept of PED helps us to understand how the firm’s total revenue (TR) changes if there is any change in the price of the given good. Fig: Effect of change in price on firm’s total revenue 45 | P a g e Information on the PED can be used by a business as part of a policy of price discrimination (also known as ‘yield management’). This is where a business decides to charge different prices for the same product to different segments of the market e.g. peak and off peak rail travel or prices charged by many of our domestic and international airlines. An understanding of the concept of PED helps us to understand the effect of imposition of indirect taxes on the government’s tax revenue. For example, imposition of indirect taxes generates tax revenue for the government but the amount of tax revenue received by the government depends on the price elasticity of demand. Fig: Effect of imposition of indirect taxes on government’s tax revenue Tax revenue received by imposing indirect taxes on the good that has inelastic demand (Di) = 15 x 90 =1350(P4abP2) Tax revenue received by imposing indirect taxes on the good that has elastic demand (De) =15x80=1200(P3cdP1) Thus, a government receives higher tax revenue by imposing indirect taxes on the good that has inelastic demand than the good that has elastic demand. 46 | P a g e Income elasticity of demand (YED) It is the measure of change in demand for a good caused by any change in the income of consumers. In other words, it is the measure of responsiveness of demand for a good to any change in the income of consumers. Mathematically, YED = = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑑𝑒𝑚𝑎𝑛𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑖𝑛𝑐𝑜𝑚𝑒 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑑𝑒𝑚𝑎𝑛𝑑 ÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑑𝑒𝑚𝑎𝑛𝑑) 𝑥 100 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑖𝑛𝑐𝑜𝑚𝑒÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑖𝑛𝑐𝑜𝑚𝑒)𝑥 100 = 𝜟𝑸 𝜟𝒀 ÷ 𝒀 𝑸 = 𝜟𝑸 𝑸 x 𝒀 𝜟𝒀 = 𝜟𝑸 𝜟𝒀 x 𝒀 𝑸 Example: Income (in ‘000) $20 $25 Demand for good x 50 60 YED = 𝜟𝑸 𝜟𝒀 x 𝒀 𝑸 = 𝟏𝟎 𝟓 x 𝟐𝟎 𝟓𝟎 Demand for good Z 50 80 = 0.8 ˃ 0 Interpretation: Since the value of YED is greater than 0, good x has positive YED. That is, an increase in consumer’s income causes the demand for the good x to rise and vice versa. So, good x is a superior normal good. 47 | P a g e Types of YED Positive YED (YED˃0) Negative YED (YED˂0) Zero YED (YED=0) Positive YED YED is positive if an increase in consumer’s income raises the demand for the good and vice versa. YED is positive in case of superior or normal goods. Example: Income (in ‘000) $20 $10 YED= = 𝜟𝑸 𝜟𝒀 −𝟐𝟎 −𝟏𝟎 Demand for good x 50 30 x x 𝒀 𝑸 𝟐𝟎 𝟓𝟎 =0.8 ˃ 0 Fig: Positive YED 48 | P a g e Negative YED YED is negative if an increase in consumer’s income reduces the demand for the good and vice versa. YED is negative in case of inferior goods. Example: Income (in ‘000) $20 $10 YED= = 𝜟𝑸 𝜟𝒀 𝟐𝟎 −𝟏𝟎 x x Demand for good x 50 70 𝒀 𝑸 𝟐𝟎 𝟓𝟎 = - 1.25 ˂ 0 Fig: Negative YED Zero YED YED is zero if any change in consumer’s income does not affect the demand for the good. YED may be zero in case of the goods of basic necessity such as rice, salt etc. Example: Income Demand for (in ‘000) good x $20 50 $10 50 YED=0 49 | P a g e Fig: Zero YED Note: Higher the value of YED, higher will be the responsiveness of demand to the change in consumer’s income. Worked example: Income (in thousand) 20 30 Demand for good x 50 40 YED for good x = −𝟏𝟎 𝟏𝟎 x 𝟐𝟎 𝟓𝟎 = - 0.4 YED for good y= −𝟑𝟎 𝟏𝟎 x 𝟐𝟎 𝟓𝟎 = - 1.2 Demand for good y 50 20 Interpretation: Since the coefficient of YED for good y is greater than the coefficient of YED for good x (regardless of positive or negative signs) good Y is more responsive to the change in consumers’ income than good Y. Exercise: Calculate and interpret the value of YED from the following information. Income($) Demand for good X $200 70 $150 90 50 | P a g e Business relevance of YED: Usefulness of YED in making business decision The concept of YED is of significant use in making business decisions. YED may be positive or negative depending on the types of goods. YED is positive in case of superior or normal goods. This means that the demand for superior or normal goods increases when there is an increase in consumer’s income and vice versa. So, the firms should increase the production of normal goods during the period of normal economic growth. This is because during the period of normal economic growth employment and income increases causing the demand for superior/normal goods to increase. On the other hand, the firms should reduce the production of normal goods during the period of recession. This is because during recession employment and income decreases causing the demand for normal goods to fall. YED is negative in case of inferior goods. This means that the demand for inferior goods falls during the period of normal economic growth while their demand increases during the period of recession. So, the firms should reduce the production of inferior goods during the period of economic growth and increase their production during the period of recession. Cross elasticity of demand (XED) XED is the measure of change in demand for a good caused by any change in the price of its related goods (substitutes or complements). In other words, it is the measure of responsiveness of demand for a good to the change in the prices of its related goods. Mathematically, XEDXY = = = = = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑑𝑒𝑚𝑎𝑛𝑑 𝑓𝑜𝑟 𝑔𝑜𝑜𝑑 𝑥 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑔𝑜𝑜𝑑 𝑦 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑑𝑒𝑚𝑎𝑛𝑑 𝑓𝑜𝑟 𝑔𝑜𝑜𝑑 𝑥 ÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑑𝑒𝑚𝑎𝑛𝑑 𝑓𝑜𝑟 𝑔𝑜𝑜𝑑 𝑥) 𝑥 100 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑔𝑜𝑜𝑑 𝑦÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑔𝑜𝑜𝑑 𝑦)𝑥 100 𝜟𝑸𝒙 𝑸𝒙 𝜟𝑸𝒙 𝑸𝒙 𝜟𝑸𝒙 𝜟𝑷𝒚 𝜟𝑷𝒚 𝑷𝒚 𝑷𝒚 x 𝜟𝑷𝒚 𝑷𝒚 x 𝑸𝒙 ÷ Example: Price of good y $20 $10 Demand for good x 50 70 51 | P a g e XEDXY = = 𝜟𝑸𝒙 𝜟𝑷𝒚 𝟐𝟎 −𝟏𝟎 x 𝑷𝒚 𝑸𝒙 𝟐𝟎 𝟓𝟎 x = - 0.8˂ 0 Interpretation: Since the XEDxy is negative, good x and y are complements. Types of XED: Positive XED (XED ˃ 0) Negative XED (XED ˂ 0) Zero XED (XED = 0) Positive XED (XED ˃ 0) XED between two goods is positive if an increase in the price of one good raises the demand for another good and vice versa. XED is positive in case of substitutes like Pepsi and coke, tea and coffee, bus travel and rail travel etc. Example: Price of good y $20 $10 XEDxy = = 𝜟𝑸𝒅𝒙 𝜟𝑷𝒚 −𝟐𝟎 −𝟏𝟎 x x Demand for good x 50 30 𝑷𝒚 𝑸𝒙 𝟐𝟎 𝟓𝟎 = 0.8 ˃ 0 Fig: Positive XED 52 | P a g e Negative XED (XED˂0) XED between two good is negative if an increase in the price of one good reduces the demand for another good and vice versa. XED is negative in case of complements like car and petrol, steel and motor bike etc. Example: Price of good y $20 $10 Demand for good x 50 60 XEDxy = - 0.4 ˂ 0 Fig: Negative XED Zero XED (XED=0) XED between the two goods is zero if the change in price of one good doesn’t affect the demand for another good. XED is zero in case of unrelated goods like Pepsi and pen. Example: Price of good y $20 $10 XED XY = 0 Demand for good x 50 50 53 | P a g e Fig: Zero XED Note: Higher value of XED shows higher degree of relationship between the goods. That is, higher the value of XED, more closely the goods is related to each other. Example: Price of good X $10 $15 Demand for good Y 50 60 Demand for good Z 50 100 XEDYX = 0.4 XEDZX = 2.0 Interpretation: Since XEDZX ˃ XEDYX, goods X and Z are more closely related than goods X and Y. Business relevance of XED: Usefulness of XED in business decision making The concept of XED is of significant use in making business decisions. XED may be positive or negative depending on the types of relationship between the goods. XED is positive in case of substitutes like Pepsi and coke. That is, a fall in price of Pepsi reduces the demand for coke and vice versa. In such a situation, the firms are highly concerned with the pricing strategy of the rival firms. If a rival firm cuts the price of its product, a firm must respond by cutting the price of its own product. If a firm fails to respond to the cut in price by the rival firm, its total revenue and profit will fall as the consumers will switch to the rival product which has now become relatively cheaper. For example, if Pepsi cuts its price, coke must respond by cutting its price to prevent the fall in its revenue and profit. 54 | P a g e In case of complements,the firms are concerned with selling a wide range of complements rather than selling just a single product. An understanding of the concept of XED helps the firms to identify the relationship between the goods and formulate such a pricing strategy that increases the firm’s total revenue and profit. For example, if the firms offer discount prices on movie tickets then, the sale of movie tickets will increase and at the same time the revenue received from parking charges and the sale of snacks will increase. This will increase the firm’s total revenue and profit. Exercise: Calculate and interpret the value of XED between the goods from the given information. Price of good X Demand for good y 20 50 25 30 XEDYX = −20 5 20 50 x =-1. 6 ˂ 0 Interpretation: Since the value of XEDYX is negative, good x and y are complements. That is, demand for good Y has decreased in response to an increase in price of good x. Price elasticity of supply (PES) It is the measure of responsiveness of quantity supplied of a good to any % change in the price of the good. Mathematically, PES = = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑠𝑢𝑝𝑝𝑙𝑖𝑒𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑖𝑡𝑦 𝑠𝑢𝑝𝑝𝑙𝑖𝑒𝑑÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑠𝑢𝑝𝑝𝑙𝑖𝑒𝑑) 𝑥 100 (𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒÷𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑝𝑟𝑖𝑐𝑒)𝑥 100 = 𝜟𝑸𝒔 𝑸𝒔 = 𝜟𝑸𝒔 𝑸𝑺 = ÷ 𝜟𝑸𝒔 𝜟𝑷 𝜟𝑷 𝑷 x x 𝑷 𝜟𝑷 𝑷 𝑸𝒔 55 | P a g e Example: 1 Px QSx 10(P1) 50(Q1) 20(P2) 60(Q2) Soln: PES = = % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑞𝑢𝑎𝑛𝑡𝑖𝑡𝑦 𝑠𝑢𝑝𝑝𝑙𝑖𝑒𝑑 % 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑝𝑟𝑖𝑐𝑒 20% 100% = 0.2˂1 𝜟𝑸𝒔 𝜟𝑷 Or, PES = 𝟏𝟎 𝟏𝟎 = x x 𝑷 𝑸𝒔 𝟏𝟎 𝟓𝟎 = 0.2 ˂ 1 Note: The value of PES is always positive because of a direct relationship between the price of a good and its quantity supplied. Example: 2 Px Qsx 20(P1) 50(Q1) 25(P2) 80(Q2) PES= = 𝟑𝟎 𝟓 𝜟𝑸𝒔 𝜟𝑷 x x 𝑷 𝑸𝒔 𝟐𝟎 𝟓𝟎 =2.4 ˃1 Interpretation: Since the value of PES is greater than 1, supply of good X is elastic. That is, any % change in price causes the quantity supplied to change by a relatively higher %. In the given information quantity supplied of 56 | P a g e good X increases by 60% in response to 25% increase in price. So, supply of good X is elastic (or 1% increase in price causes the quantity supplied to increase by 2.4%). Types of price elasticity of supply Perfectly elastic supply (PES=Ꝏ) Supply of a good is said to be perfectly elastic if a small percentage change in its price causes the quantity supplied to change infinitely or immeasurably. That is, a small proportionate rise in price causes the quantity supplied to increase infinitely while a small proportionate fall in price causes the quantity supplied to fall to zero. Example: Px QSx 10 0 11 Ꝏ Here, PES = Ꝏ Fig: Perfectly elastic supply When P=11 and Qs=10 TR1=110 Now, Qs = 20 TR2 =220 Note: If the supply of a good is perfectly elastic any % change in quantity supplied will cause the firm’s total revenue to change by equal %. 57 | P a g e Perfectly inelastic supply / fixed supply / zero elasticity (PES=0) Supply of a good is said to be perfectly inelastic or fixed if any proportionate change in the price doesn’t have any effect on the quantity supplied. That is, quantity supplied of the good remains fixed or unchanged even if its price changes by a very high proportion. Example: Px QSx 10 50 5 50 Here, PES = 0 Fig: Perfectly inelastic supply When P =10, let Qs= 50 TR1 = P x Q = 500 When ‘p’ increases to 15, TR2=15 x 50 =750 Note: If supply of a good is perfectly inelastic, any % change in the price of the good will cause the firm’s TR revenue to change by equal %. Unitary elastic supply (PES=1) Supply of a good is said to be unitary elastic if any proportionate change in its prices causes the quantity supplied to change by equal proportion. For example, a 10% increase in the price of the good causes the quantity supplied to rise by 10% and vice versa. Example: Px Qsx 10 100 15 150 58 | P a g e 50% Here, PES = 50% =1 Fig: Unitary elastic supply (PES =1) Relatively elastic or elastic supply (PES ˃1) Supply of a good is said to be relatively elastic or elastic if any proportionate change in its price causes the quantity supplied to change by a relatively greater proportion. For example, supply of a good is elastic if a 10% rise in its price causes the quantity supplied to rise by more than 10%. Example: Px QSx 10 100 12 150 50% Here, PES = 20% =2.5 ˃ 1 Fig: Relatively elastic supply (PES˃1) 59 | P a g e Relatively inelastic or inelastic supply (PES ˂1) Supply of a good is said to be relatively inelastic or inelastic if any proportionate change in its price causes the quantity supplied to change by a relatively smaller proportion. For example, supply of a good is inelastic if a 10% rise in its price causes the quantity supplied to rise by less than 10%. Example: Px QSx 10 100 20 120 20% Here, PES = 100% =0.2 ˂ 1 Fig: Relatively inelastic supply (PES˂1) Exercise 1: Calculate and interpret the value of PES from the given information and draw a supply curve to illustrate the type of PES. Px 10 15 QSx 100 120 20% = 50% PES= 0.4< 1 60 | P a g e Interpretation: Since the coefficient of PES is less than 1, supply of good x is inelastic. This means that quantity supplied changes by a relatively smaller % in response to any % change in price. In the given information, quantity supplied increases by only 20% in response to 50% increase in price. Exercise 2: Calculate and interpret the value of PES from the given information and draw a supply curve to illustrate the type of PES. Px 10 6 QSx 100 80 Difference between elastic, inelastic and fixed supply Factors affecting price elasticity of supply Firm’s ability to store the goods Supply of the goods is elastic if the firms can store the goods for a long time and vice versa. For example the supply of manufactured goods is elastic as they are durable in nature and hence can be stored for a long time. When their prices fall, the firms hold them in stock and wait for the prices to rise. On the other hand, supply of the goods that are perishable in nature is inelastic as they can’t be stored for a long time. For example, supply of agricultural products, dairy products, meat, fish etc. is inelastic as they are perishable in nature and cannot be stored for a long time. 61 | P a g e Firm’s ability to increase production/ availability of spare capacity Supply of the goods is elastic if the firms can easily increase the production of goods in response to an increase in prices. Firm’s ability to increase production depends on the spare/excess capacity available with the firms. If the firms have spare/excess capacity, they can easily increase production in response to increased prices of the goods. On the other hand supply is inelastic if the firm’s don’t have spare capacity and hence cannot increase production in response to the increased prices. Factor mobility Supply is elastic if the factors of production (labor and capital) are mobile and move freely between uses. In such a case, if the price of good x increases, the firms can switch the resources from the production of good y to the production of good x and increase its production in response to the increased price. On the other hand, supply is inelastic if the factors of production are immobile. Time Supply is elastic if the price of a good rises and remains high for a long time. This is because given a long time; the firms can manage to increase their productive capacity and increase the production of goods in response to their increased prices. On the other hand, supply is inelastic if the price of a good rises and falls back to the original within a short period of time. Business relevance of PES: Usefulness of PES in making business decisions An understanding of the concept of PES helps to understand the price volatility following the change in the demand for the good and how the firms can respond to the change in the price. For example, supply of the good being unchanged an increase in demand for the good causes its price to rise. The extent to which the firms can respond to this increased price depends on the price elasticity of supply. Fig: Price volatility following an increase in demand for the good 62 | P a g e The above diagram shows that if supply of a good is elastic, an increase in its price will lead to a higher proportionate increase in supply. So, the firms try to make the supply more elastic so that they can respond to the increased demand for the good. To make the supply of the goods elastic, the firms have to consider the following: Invest in spare capacity which can be used if demand rises. Paying workers overtime to increase production Using agencies to hire more workers at busy times. To outsource production to other firms who can meet supply Improve efficiency and time management techniques to increase supply. Consumer and producer surplus Consumer surplus is the benefit consumers receive when they pay a price below what they are willing to pay. In other words, it is the difference between the maximum amount the consumers are willing to pay and the actual amount they pay for the given quantity of a good. Consumer surplus = Maximum willingness to pay – actual amount paid / market price 63 | P a g e The concept of consumer surplus can be explained using the following example: Table: Demand and supply schedule: Good X Price/ $ 25 20 15 10 5 Quantity demanded(Qd) / millions 5 15 20 25 30 Quantity supplied(Qs) /millions 30 25 20 15 5 In the above schedule, the equilibrium price is $15 at which 20 million units of good x are sold. However, there are many consumers who are willing to pay more than the market price. For example, at price of $25, consumers demand 5 million units of good x. These consumers will get an extra benefit of $10 at each unit of good x consumed because the market price of good x is $15 per unit. In this case, consumer surplus = price the consumers are willing to pay – actual market price = $25- $15= $10 The following table shows the calculation of consumer surplus: Price /$ Quantity Market price/ $ Specific (Demand demanded (Qd) / consumer price) millions surplus (Demand pricemarket price) 25 5 15 10 20 15 15 5 15 20 15 0 Fig: Consumer surplus 64 | P a g e In the above diagram, Consumer’s willingness to pay for OQ quantity of good x= OMEQ Actual amount paid = OPEQ So, CS = OMEQ – OPEQ = PME Numerically, CS = area of triangle PME =0.5 X (15 x 20) =150 Any change in the price of the good causes the consumer surplus to change. An increase in price reduces the consumer surplus while a fall in price increases the consumer surplus. In the above diagram, as the price rises from $15 to $ 20, consumer surplus falls to P1ME1 (75) while if the price falls to $10, consumer surplus increases to 250. 65 | P a g e Producer surplus It is the benefit that accrues to the producers in the competitive markets. Producer surplus is the benefit producers receive when they receive a price above the one at which they were willing to supply the good. In other words, it is the difference between the actual market price and the minimum price at which the producers are willing to sell the product. Mathematically, Producer surplus = Actual market price – minimum acceptable price As seen in the demand and supply schedule, even at the lowest price some producers are willing to produce the product. It might be because they are very efficient. For example, at a price of $5, they would produce 5 million units of the product. However, for every unit produced, they would receive $15 as it is the price prevailing in the market. Therefore, they enjoy a producer surplus of $10($15- $5) per unit. The following table shows the calculation of producer surplus Table: Calculating producer surplus Price /$(supply price) 15 10 5 Quantity supplied(Qs) / millions 20 15 5 Market price/ $ 15 15 15 Fig: Producer Surplus Producer surplus (market pricesupply price) 0 5 10 66 | P a g e Consumer surplus + producer surplus = community surplus In this example, community surplus is $300 million. It is shown in the following diagram: Fig: community surplus 67 | P a g e Function / role of price in a market economy In a market economy price acts as an allocative, rationing and signaling mechanism. As an allocative mechanism, the function of price is to guide the allocation of resources between alternative uses. In a market economy, the private enterprises are guided by profit motive. They allocate the scarce resources to produce those goods that yield the maximum profit. The amount of profit generated form the production of any product depends on the market price of the product. All other things being unchanged, higher the price of the product, higher will be the profit and vice versa. As a rationing mechanism the function of price is to restrict/ reduce quantity demanded of some goods by some consumers. Price may act as a rationing mechanism with or without the government intervention in the market. For example, if the firms have limited production capacity, they may restrict the quantity demanded of their products by keeping their prices high. At higher prices the quantity demanded of the goods by some consumers is reduced and thus rationing occurs. This is the reason why the producers of luxurious cars, designer clothes, exclusive furniture etc. keep the prices of their products high. The governments may also use the price to ration the quantity demanded of some goods by the consumers. For example, government imposes indirect taxes on demerit goods like cigarettes, tobacco, alcohol etc. to restrict the quantity demanded of these products. Imposition of indirect taxes raises the price of these products and their quantity consumed is reduced. Thus rationing occurs. Government may also use minimum pricing (price floor) to reduce the quantity demanded of some goods. The effective minimum price is set above the equilibrium price. This setting of minimum price reduces the quantity demanded, although the quantity supplied of the good increases. Fig: Effect of minimum price 68 | P a g e As a signaling mechanism, the function of price is to provide signals / information to consumers and producers to adjust consumption and production with the change in market conditions. For example, supply of a good being unchanged if its demand increases, the excess demand will put pressure on the price to rise. This rise in price provides signals to consumers to reduce consumption and to the producers to increase production. Fig: role of price as a signaling mechanism Fig: Role of price as a signaling mechanism in the resource market xxxxxxxxxxxxxx