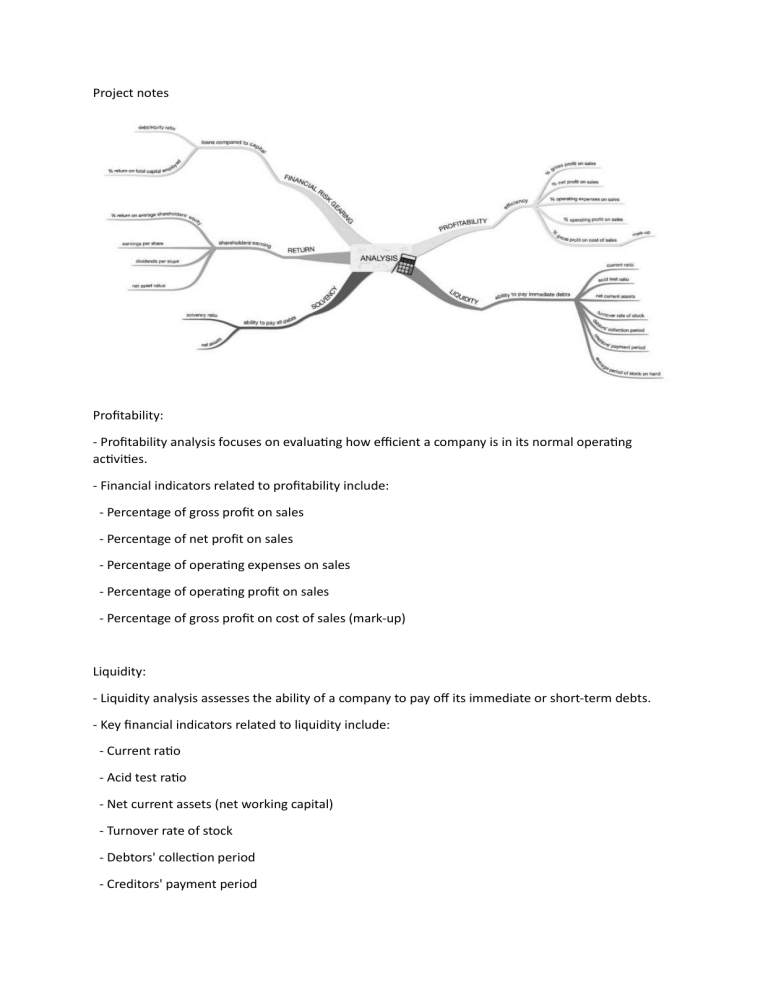

Project notes Profitability: - Profitability analysis focuses on evaluating how efficient a company is in its normal operating activities. - Financial indicators related to profitability include: - Percentage of gross profit on sales - Percentage of net profit on sales - Percentage of operating expenses on sales - Percentage of operating profit on sales - Percentage of gross profit on cost of sales (mark-up) Liquidity: - Liquidity analysis assesses the ability of a company to pay off its immediate or short-term debts. - Key financial indicators related to liquidity include: - Current ratio - Acid test ratio - Net current assets (net working capital) - Turnover rate of stock - Debtors' collection period - Creditors' payment period - Average period of stock on hand Solvency: - Solvency analysis examines the ability of a company to pay off all its debts. - Financial indicators related to solvency include: - Solvency ratio - Net assets Return: - Return analysis focuses on determining whether shareholders are earning a fair return on their investment. - Financial indicators related to return include: - Percentage return on average shareholders' equity - Earnings per share - Dividends per share - Net asset value Financial Risk: - Financial risk analysis evaluates the extent to which a company is financed by loans or borrowed money compared to its own capital. - Key financial indicators related to financial risk include: - Debt/equity ratio - Percentage return on total capital employed - Gearing ratio Auditors report Comments on an audit report: 1. The Need for Financial Statements: - Financial statements are of interest to various groups, including: - Owners of the business (shareholders) who want to assess the overall health of the business. - Potential owners who may consider investing money in the business. - Management of the business (board of directors) who use the report for planning, maintaining good practices, and improving weaknesses. - Banks that have lent money to the business, as they are interested in the availability of assets to cover their loans. - Employees of the business and trade unions who are interested in profitability and negotiating wage increases. - Tax authorities such as SARS, as they need to assess the company's profit or loss and the associated tax payments. 2. Function of the Independent Auditor: - The auditor's role is to provide assurance to shareholders by signing an Auditor's Report, indicating that the financial statements are reliable. - The auditor's responsibility is not to check every transaction or detect fraud but to give an opinion on the true and fair representation of the company's operations for a specific financial year. - If the auditor becomes aware of fraud, they have a duty to report it to the shareholders. - Auditors are held to high ethical standards and can face disciplinary proceedings for negligence. 3. Quality of Auditors: - External auditors should be registered professionals with bodies such as the South African Institute of Chartered Accountants (SAICA) and the Independent Regulatory Board for Auditors (IRBA). - Engaging registered auditors offers advantages such as adherence to professional ethics, assurance of high-quality work, maintenance of professional standards, and the ability to take disciplinary action for negligence. 4. Importance of the Auditor's Role for Shareholders: - Shareholders rely on the auditor's opinion since they are not involved in the day-to-day operations of the business. - Auditors can be held liable for producing a misleading report and may face consequences such as legal action or loss of future contracts for substandard work. 5. The Independent Auditor and the Audit Report: - The independent auditor is appointed by shareholders at the annual general meeting and charges fees based on the expected hours spent on the audit. - The auditor's opinion is based on an assessment of whether the financial statements are prepared in accordance with GAAP, the Companies Act, and provide a fair representation of the company's activity. 6. Role of Internal Auditors: - Internal auditors, who are employees of the company, play a crucial role in testing internal controls and detecting fraud or mistakes. - Their responsibilities include checking various aspects of the business, such as debtors, wages, and computer entries. - External auditors consider the work carried out by internal auditors during their audit process. Audit Reports: - Auditors issue reports to express their opinion on their findings, addressing them to the shareholders. - Reports can be qualified, indicating irregularities that auditors disclose to shareholders, unqualified with minor irregularities, or withheld/disclaimed, recommending further investigations before issuing a report. Internal Audit Reports: Internal audit reports are prepared by internal auditors to present audit findings, express opinions, and provide recommendations for improvement. These reports are typically addressed to senior management, the audit committee, or the board of directors. Interim reports are made during the course of the audit and can be delivered in writing or orally. They serve various purposes, including: - Notifying management of significant findings that require immediate attention, such as serious control weaknesses or suspicions of fraud. - Updating management on the progress of a lengthy audit. - Informing management about significant changes in the scope of the audit. Management of Internal Audit Resources: The Chief Audit Executive (CAE) is responsible for effectively managing internal audit resources. This includes ensuring that: - Internal auditors possess appropriate skills for their roles. - There are a sufficient number of internal auditors. - Internal auditors are assigned to activities that align with their skills. External Auditing: Independent Auditor (External Auditor): All public companies are required to appoint a registered independent external auditor. The independent auditor provides an objective opinion on the accuracy and reliability of the company's financial statements. Independent Auditor's Report: The independent auditors prepare a formal report called the independent auditor's report, in which they express their opinion on the accuracy and reliability of the company's financial statements. There are three categories of independent auditor's reports: 1. Unqualified Audit Report (Clean Report): An unqualified audit report is issued when the external auditor finds the financial statements to be free from discrepancies and that they provide a true and fair view of the financial reporting framework used. The report states that the financial statements are prepared in accordance with International Financial Reporting Standards (IFRS) and the requirements of the Companies Act in South Africa. 2. Qualified Audit Report: A qualified audit report is issued when the external auditor encounters one or two situations that do not comply with the prescribed accounting standards (IFRS/GAAP). However, the rest of the financial statements are fairly presented. The report acknowledges the exceptions or discrepancies in the financial statements. 3. Adverse Audit Report: An adverse audit report is issued when the external auditor determines that the financial statements of the company being audited are materially misleading and do not conform to the prescribed accounting standards (IFRS/GAAP). The report states that the financial statements do not fairly present the company's financial position and results of operations. Some tricky questions: The accountant may have rounded the figures in the financial statements to the closest million rand for several reasons: 1. Simplification: Rounding the figures to the nearest million reduces the level of detail in the financial statements, making them easier to understand and interpret for users who may not require precise figures. 2. Materiality: The accountant may have determined that the rounding adjustments do not have a significant impact on the overall financial position or results of the company. Therefore, rounding to the nearest million is considered appropriate and does not compromise the accuracy or relevance of the financial statements. 3. Presentation purposes: Rounding to the nearest million can enhance the readability and presentation of the financial statements. It eliminates the need for excessively long numbers and decimal places, making the statements more concise and user-friendly. 4. Industry practice or regulatory requirements: Rounding to the nearest million may be a common practice in the industry or mandated by regulatory bodies. It ensures consistency in financial reporting across companies and facilitates comparability among financial statements. Remgro is a South African investment holding company that operates by acquiring strategic stakes in other companies. Through its investments, Remgro becomes a shareholder in these companies and is entitled to receive dividends. When Remgro purchases shares in other companies, it becomes a part-owner and shareholder of those companies. As a shareholder, Remgro is entitled to a portion of the profits generated by these companies, which are distributed to shareholders in the form of dividends. Dividends are typically declared by the board of directors of each company based on their financial performance and the decision to distribute profits to shareholders. As a shareholder, Remgro receives dividends from the companies in which it holds shares, based on its ownership percentage in those companies. Remgro's ability to own shares and receive dividends is facilitated through its investment strategy and the ownership structure of the companies it invests in. By acquiring strategic stakes in various companies, Remgro diversifies its portfolio and participates in the financial success of those companies through dividend income. Financial Statements: Financial statements are formal documents that provide an overview of a company's financial performance and position. They typically include the income statement, balance sheet, cash flow statement, and statement of changes in equity. Financial statements are prepared according to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) and are primarily focused on presenting financial information to stakeholders. While financial statements remain a crucial component of corporate reporting, the adoption of integrated reporting reflects a broader recognition that financial performance alone is insufficient for assessing a company's overall value and sustainability. Integrated reports offer a more holistic and forward-looking perspective, aligning with the growing emphasis on sustainability, ESG factors, and long-term value creation in today's business landscape. Integrated Reports: Integrated reports, on the other hand, go beyond the scope of financial statements. They provide a comprehensive view of a company's value creation process, taking into account not only financial aspects but also environmental, social, and governance (ESG) factors. Integrated reports aim to provide a holistic understanding of a company's performance, strategy, and its impact on various stakeholders, including shareholders, employees, customers, communities, and the environment. Reasons for Publishing Integrated Reports: 1. Stakeholder Engagement: Integrated reports recognize that stakeholders are interested in more than just financial performance. By including ESG information, integrated reports address the broader concerns and interests of stakeholders, fostering better engagement and transparency. 2. Long-Term Value Creation: Integrated reports emphasize the long-term value creation strategy of a company. They provide insights into how a company manages risks and opportunities related to sustainability, governance, and societal impact. This information is valuable for investors and stakeholders who are increasingly focused on sustainable and responsible business practices. 3. Enhanced Decision Making: Integrated reports provide a more complete and balanced view of a company's performance. By considering financial and non-financial factors, decision-makers can make more informed judgments about a company's prospects, risks, and opportunities. 4. Regulatory Requirements and Best Practices: Some jurisdictions have introduced mandatory or encouraged the publication of integrated reports as part of corporate reporting requirements. International frameworks like the International Integrated Reporting Framework provide guidelines for producing integrated reports, encouraging their adoption as a best practice. 5. Reputation and Trust: Publishing integrated reports demonstrates a company's commitment to transparency, accountability, and responsible business practices. It can enhance a company's reputation and build trust with stakeholders, including investors, customers, employees, and regulatory bodies. https://www.remgro.com/about-remgro/directorate/ To answer the question of whether Remgro should finance further investments by taking out additional loans or by issuing shares, you can follow these steps: 1. Understand the concept: Start by understanding the implications and benefits of each financing option. Loans involve borrowing money from lenders and paying interest on the borrowed amount, while issuing shares involves selling a portion of the company's ownership to investors in exchange for capital. 2. Evaluate financial situation: Assess Remgro's current financial position, including its existing debt levels, cash flow, profitability, and capital structure. Consider factors such as the company's ability to service additional debt, its creditworthiness, and the impact on its financial ratios. 3. Consider cost of financing: Compare the cost of loans (interest rate) with the return on total capital employed. If the return on capital employed (ROCE) is higher than the interest rate on loans, it suggests that the company is generating higher returns on its investments than the cost of borrowing. 4. Assess risk and flexibility: Evaluate the risks associated with taking on additional debt or issuing shares. Consider factors such as repayment obligations, financial leverage, potential dilution of ownership, and the company's ability to meet its financial obligations in different market conditions. 5. Analyze long-term implications: Consider the long-term impact of each financing option on the company's capital structure, ownership control, and future financing flexibility. Assess how each option aligns with Remgro's strategic objectives and growth plans. 6. Make a recommendation: Based on the evaluation of the above factors, provide a recommendation on whether Remgro should finance further investments by taking out additional loans or by issuing shares. Justify your recommendation by highlighting the financial implications, risk considerations, and alignment with the company's goals. .