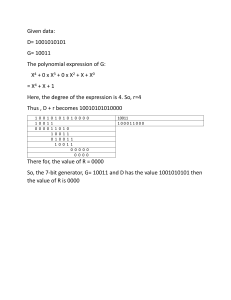

The 26th AsRES Annual Conference 2022 4-7 August 2022, Tokyo - Hybrid Wet Market – Convenience or Health Hazard? Ervi Liusman (School of Hotel & Tourism Management, The Chinese University of Hong Kong) K.W. Chau (Ronald Coase Centre for Property Rights Research, HKUrban Lab, The University of Hong Kong) Y.L. Wong (Ronald Coase Centre for Property Rights Research, HKUrban Lab, The University of Hong Kong) Wet market has both positive & negative externalities Positive Externalities Negative Externalities Convenience Health & Hygiene problem Image source: Wikipedia Image source: Sassy Group Media Limited Noise pollution 2 Literature review HOUSING EXTERNALITIES HEALTH HAZARD OF WET MARKET Air pollution (Ricker and Henning, 1967; Nourse, 1967) Pathogen dissemination due to live poultry market (Gao et al. 2016)) Railway operation (Chau and Ng, 1998; Bowes and Ihlanfeldt, 2001; Jayanta et al., 2015; Diao et al., 2016) Traffic and highway development (Hughes Jr and Sirmans, 1992; Ossokina and Verweij, 2015; Levkovich et al., 2016) Urban renewal programs (Yau et al., 2008; Chau and Wong, 2015; Rossi-Hansberg et al., 2010; Zheng et al., 2020; Chareyron et al, 2022) Heritage conservation (Koster and Rouwendal, 2017; Kee and Chau, 2020) Exposure to wet market poultry and influenza A H7N9 infection (Chen et al., 2013; Fournié and Pfeiffer, 2013) Effect of wet market on early transmission of COVID-19 (Mizumoto et al., 2020) Pathogen on wet markets cutting board (Lo et l., 2019) Enhancement of hygienic practice of wet markets (Rao et al., 2021) Industrial land use (Burnell, 1985) Commercial development (Kholdy et al., 2014; Pope and Pope, 2015; Yang et al., 2016; Kurniven and Wiley, 2019) 3 Objectives ▷ Examine combined effect of positive and negative externalities on nearby housing prices ▷ Examine how the above effect changes over time and across different wet markets 4 Hypotheses H1 Despite the preference of using fresh food in cooking, frozen food has gained wider acceptance in Asian countries, particularly among younger generations. This trend makes proximity to wet markets less desirable over time. Besides, Hong Kong people becomes increasingly concern about health and hygiene environment after SARS in 2003. This will reinforce the diminishing positive externality of wet market over time. The net positive externality of wet markets diminishes over time. H2 Larger wet markets offer more variety of foods. The shoppers can have more choices and can complete all shopping goals in one single trip. This implies the scale effect in its positive externalities. Larger wet markets have stronger net positive external effect on nearby housing prices than smaller wet markets do. H3 Privately owned properties are more efficiently managed. The private owners have more incentive to increase the attractiveness of the wet market since it will increase their rent and value. The profit maximizing motive of private wet market will also enhance the penetrating power to its positive externality to nearby residents. The net positive external effect of privately-owned wet markets is stronger than that of the publicly-owned wet markets. H4 Older wet markets are less attractive due to physical deterioration of the building. An old and depleted wet market creates a negative visual environment in its neighbourhood. The strength of the net positive external effects of older wet markets in weaker than those newer ones. 5 Empirical test procedures First Collect 2nd hand housing price transaction data in the vicinity of 9 wet markets over the period 1991-2020 (30 years) Second Estimate hedonic price models for the 9 markets over 5-yearsub-periods Third Estimate relative strength of the net positive externalities in each market sub-period model (SNE) Last Test the hypotheses by regressing the SNE on time (end year of each sub-period) and the characteristics of the wet markets. 6 Hedonic price model specification EQUATION 1: ( )= _ + _ + + + _ + _ + ∗ + LOG(PRICE) Natural logarithm of housing transaction price U_AGE Age of the housing unit at the time of transaction FL Floor level of the housing unit U_SIZE Gross floor area of housing unit DIST Linear distance between wet market and housing unit SUBPERIOD 5-year sub-period time dummy TIME Time dummy ∗ + + 7 Estimate SNE from the hedonic price model EQUATION 2: = + + _ + _ + + + EQUATION 3: = + + _ + _ + + + SNE Relative strength of net externality SUBPERIOD 5-year sub-period dummy M_SIZE Gross floor area of wet market M_AGE Average age of wet market CFC Cooked food centre dummy OWNERSHIP Wet market ownership dummy AC Air conditioning system dummy STOREY Number of storeys of wet market + 8 Changes in property value due external effects Pure positive externalities Coefficient of the distance from the Wet Market <0 Distance from the wet market 9 Changes in property value due external effects Pure negative externalities Coefficient of the distance from the Wet Market >0 Distance from the wet market 10 Changes in property value due external effects Positive externalities > negative externalities Positive externality weakened as distance increase. Combined +ve and –ve externalities Distance from the wet market At the turning point (minimum): positive externality diminishes to zero 11 Changes in property value due external effects Relative strength of positive externalities weaker positive externality Relatively weaker positive externality Distance from the wet market Turning point closer to the wet market 12 Changes in property value due external effects Negative externalities > positive externalities Negative externality weakened as distance increase. Distance from the wet market At the turning point (Maximum): negative externality diminishes to zero Combined +ve and –ve externalities Changes in property value due external effects Relative strength of negative externalities Distance from the wet market Turning point further away from the wet market Relatively stronger negative externality Stronger negative externality Measured of combined externalities Distance of turning point as measure of the relative strength of net positive / negative externality (SNE) Net positive externality Distance from of turning point of the Minimum from the wet market SNE > 0 Net negative externality Distance from of turning point of the Maximum from the wet market SNE < 0 Decrease (increase) in the relative strength of net positive (negative) externality Larger (smaller) value of SNE => stronger relative net positive (negative) externality 15 Data of 9 wet markets in Hong Kong Name District Region Ownership Year No. of Opened storeys Distance to MTR (in m) 230 Remarks 1 Total area (in m2) 1,000 Mei Foo Sun Chun Market Pei Ho Street Market Sheung Wan Market Smithfield Market Sham Shui Po KLN Private 1982 Sham Shui Po KLN FEHD 1995 3 9,975 170 With CFC C&W HKI FEHD 1989 2 5,460 300 With CFC C&W HKI FEHD 1996 3 6,150 71 Tai Po Shatin Kowloon City NT NT KLN FEHD FEHD FEHD 2004 1985 1984 3 1 1 12,000 4,200 1,100 450 180 1,000 With AC and CFC With CFC With CFC Tai Po Hui Market Tai Wai Market To Kwan Wan Market Wanchai Market Yan Oi Market Wanchai Tuen Mun HKI NT FEHD FEHD 2008 1981 1 1 4,800 1,580 300 1,500 With AC With AC With AC Image source: Adapted from Google Map 16 Summary statistics Variables First stage regression PRICE U_AGE U_SIZE FL DIST Second stage regression SNE M_SIZE U_AGE STOREY N Mean Minimum Maximum Std. Dev 47,147 47,147 46,794 47,147 47,147 2.99 20.91 661.63 12.94 356.68 .02 1.0 173.0 1.0 17.0 26.49 53.0 3138.0 62.0 899.0 2.17 12.02 221.99 9.39 220.87 35 35 35 35 -137.24 4123.57 24.16 1.43 -696.53 1000.0 0.50 1.0 704.0 12000.0 42.5 3.0 441.93 3552.24 11.01 0.74 17 Results: First stage regression Variables DIST*SUBPERIOD1995 DIST2*SUBPERIOD1995 DIST*SUBPERIOD2000 DIST2*SUBPERIOD2000 DIST*SUBPERIOD2005 DIST2*SUBPERIOD2005 DIST*SUBPERIOD2010 DIST2*SUBPERIOD2010 DIST*SUBPERIOD2015 DIST2*SUBPERIOD2015 DIST*SUBPERIOD2020 DIST2*SUBPERIOD2020 AGE effect Floor effect Size effect Time fixed effect R2 Adjusted R2 Observations Mei Foo Sun Chuen -0.0007*** (0.0000) 1.72E-06*** (0.0000) -0.008*** (0.0000) 2.01E-06*** (0.0000) -0.0009*** (0.0001) 1.98E-06*** (0.0000) -0.0003*** (0.0000) 8.66E-07*** (0.0000) -0.0006*** (0.0001) 1.51E-06*** (0.0000) -0.0011*** (0.0002) 2.47E-06*** (0.0000) Yes Yes Yes Yes 0.9125 0.9119 19,950 Pei Ho Street -0.0001 (0.0002) 1.36E-07 (0.0000) 0.0002 (0.0002) -3.90E-07 (0.0000) -0.0006*** (0.0001) 9.72E-07*** (0.0000) 0.0004 (0.0002) -1.32E-07 (0.0000) 4.80E-05 (0.0003) 9.11E-08 (0.0000) Yes Yes Yes Yes 0.8740 0.8677 2357 Sheung Wan -0.0006*** (0.0002) 1.38E-07 (0.0000) 0.0004* (0.0002) -1.33E-06*** (0.0000) 0.0015*** (0.0003) -3.33E-06*** (0.0000) 0.0012*** (0.0002) -2.91E-06*** (0.0000) 0.0009*** (0.0003) -1.94E-06*** (0.0000) 0.0016*** (0.0004) -2.85E-06*** (0.0000) Yes Yes Yes Yes 0.9301 0.9285 5825 Smithfield Tai Po Hui 6.92E-05 (0.0001) -2.88E-08 (0.0000) 0.0003 (0.0002) -1.13E-07 (0.0000) 0.0003** (0.0001) -7.38E-08 (0.0000) 1.51E-05 (0.0002) -1.88E-08 (0.0000) -0.0002 (0.0003) -6.49E-08 (0.0000) Yes Yes Yes Yes 0.9432 0.9415 3682 -0.0016*** (0.0003) 1.17E-06*** (0.0000) 0.0029*** (0.0002) -2.74E-06*** (0.0000) 0.0031*** (0.0002) -2.83E-06*** (0.0000) 0.0033*** (0.0003) -2.99E-06*** (0.000) Yes Yes Yes Yes 0.8827 0.8808 4751 Tai Wai -0.0014*** (0.0004) 1.81E-06*** (0.0000) -0.0027*** (0.0002) 3.07E-06*** (0.0000) -0.0025*** (0.0002) 2.79E-06*** (0.0000) -0.0016*** (0.0002) 1.81E-06*** (0.0000) -0.0006** (0.0002) 4.94E-07* (0.0000) -0.0012*** (0.0003) 1.21E-06*** (0.0000) Yes Yes Yes Yes 0.9156 0.9117 3095 To Kwa Wan 7.15E-05 (0.0006) 3.16E-06*** (0.0000) 0.0068*** (0.0008) -6.16E-06*** (0.0000) 0.0114*** (0.0003) -1.23E-05*** (0.0000) 0.0056*** (0.0003) -4.75E-06*** (0.0000) 0.0029*** (0.0003) -2.87E-06*** (0.0000) 0.0026*** (0.0003) -2.91E-06*** (0.0000) Yes Yes Yes Yes 0.9455 0.9445 7161 Wan Chai 0.0001 (0.0000) -2.24E-08 (0.0000) 0.0009*** (0.0000) -6.94E-07*** (0.0000) 0.0011*** (0.0000) -1.02E-06*** (0.0000) 0.0008*** (0.0000) -7.50E-07*** (0.0000) 0.0008*** (0.0000) -7.23E-07*** (0.0000) 0.0003** (0.0001) -1.70E-07 (0.0000) Yes Yes Yes Yes 0.9226 0.9214 9069 Yan Oi 8.40E-05 (0.0000) -2.56E-07*** (0.0000) 0.0002*** (0.0000) -3.33E-07*** (0.0000) 0.0004*** (0.0000) -2.51E-07*** (0.0000) 0.0005*** (0.0000) -3.73E-07*** (0.0000) 0.0004*** (0.0000) -3.07E-07*** (0.0000) 0.0004*** (0.0000) -3.17E-07*** (0.0000) Yes Yes Yes Yes 0.9412 0.9408 18,298 18 Results: Second stage regression Variables SUBPERIOD M_SIZE M_AGE CFC OWNERSHIP AC STOREY Constant R2 Adjusted R2 Observations I -19.1203** (8.76211) 0.1190*** (0.0183) 13.4271* (7.1020) -637.8942*** (99.1177) 827.1769*** (128.8405) -718.1073*** (105.1743) 37969.71** (17408.27) 0.8001 0.7573 35 II -27.7571** (11.9219) 0.1925** (0.0714) 22.0639** (10.7667) -410.2210* (235.4370) 902.0232*** (146.4790) -613.2872*** (143.8379) -363.4620 (341.1689) 55167.88 (23710.77) 0.8082 0.7584 35 19 Conclusions ▷ The combined effect of positive and negative externalities on nearby housing prices varies among different wet markets. ▷ Our study confirms the relative strength of positive externalities diminishes over time. ▷ Larger wet markets and privately-operated wet markets impose stronger positive externalities to the surrounding housing prices. However, AC system and cooked food centre weaken positive externalities. ▷ Older wet markets exert stronger positive external effects, while number of storeys has no effect on relative strength of net externality. 20 THANK YOU! For enquiries, please contact: K.W. Chau (hrrbckw@hku.hk) / Ervi Liusman (ervi@cuhk.edu.hk) 21