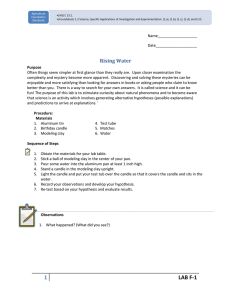

Day Trade Like a Millionnaire Copyright © 2021 by MK Financial, LLC Author - Maurice Kenny All rights reserved. Printed in the United States of America. No part of this book May be used or reproduced in any manner whatsoever without written permission except in the case of brief quotations em- bodied in critical articles or reviews. For information contact : https://www.MauriceKenny.com Book and Cover design by Designer ISBN: 123456789 First Edition: Feb 2021 CONTENTS PREFACE ......................................................................................................... 1 CHAPTER 1 – ICE BREAKER CHALLENGE............................................................ 5 CHAPTER 2 – WHY THE TOP TRADERS WHEN & WHO ARE THEY .................... 12 CHAPTER 3 – UNCOVERING THE HEDGE FUND STRATEGY .............................. 31 CHAPTER 4 – HOW TO DAY TRADE USING SUPPLY & DEMAND ...................... 38 CHAPTER 5 – STOCKS TO TRADE & TECHNICAL INDICATORS TO USE .............. 51 CHAPTER 6 – HOW TO DRAW SUPPLY & DEMAND ZONES ............................. 71 CHAPTER 7 – HOW TO READ PRICE ACTION & ENTRY CRITERIA ..................... 83 CHAPTER 8 – HOW TO USE PRICE ACTION TO ENTER A TRADE....................... 97 CHAPTER 9 – STOP LOSS 101, HOW TO STOP LOSING ALL YOUR MONEY ..... 109 CHAPTER 10 – WHERE TO PLACE YOUR STOP LOSS ...................................... 121 CHAPTER 11 – WHAT YOU KNOW NOW ...................................................... 127 ABOUT THE AUTHOR ................................................................................... 129 Preface If you’re reading this, I want you to know upfront that this is not your normal book. Yes, I will teach you how to day trade like a millionaire & how to successfully make consistent money in the stock market, but I will not do it how most books will. I will not tell you some boring story of how the stock market was created. Also, I will not tell you a random useless story about how when I was a little kid, I just loved finance & things, and it just clicked at a young age. I may be wrong, but if you are still reading this book, know that this book is for you as a person who wants to learn the details behind how to day trade and not the details around it. So, the format of this book will continue similar to that. You will receive as much value as I can provide to you. The best way to utilize this book is to read it step by step to learn a new concept and then put the book down so you can try to implement it in the real stock market. If you have any questions or want to join one BOOK TITLE of my coaching programs to help you more hands-on, then you can find me on my website www.mauricekenny.com I am here to help you get away from the statistic, which is the fact that 90% of traders fail. I will introduce you to how the top 10% of the traders in the world trade. In order for that to happen, there are going to be a lot of details and information. There are going to be many examples. There's going to be a lot of everything step by step. If you’re more of a person that learns from watching then, as an example, I have selected a few free lessons that you can watch from my course which you can watch “HERE”. To move on, from a very high-level perspective, there are four key agenda points. From an agenda point number one perspective, the first thing we'll be covering is hedge fund trading strategy & an intro to options. Whether you are a new trader, intermediate trader, or an advanced trader who’s trying to pick up some new tricks, this should help you from an introduction perspective. This will explain what the hedge fund managers and hedge fund companies do. More importantly, it will explain why you should care. Also, it will answer your question of how this relates to the top 10% of traders. Number two, from an agenda perspective, we'll be talking about how to actually predict stock movement with the supply 2 AUTHOR NAME and demand zone trading strategy. This is the main core trading strategy that we'll be talking about throughout this book, and there will be a lot of chart analysis sprinkled throughout it as well. I promise you, it will be one of the simplest things you've ever finally looked at when it comes to trading. None of the crazy fancy indicators or anything you may be thinking of. Because my philosophy is that I would much rather make things simple. If you like simple & predictable, then you are going to like this book. The third point is how to day trade like a sniper. This comes down to your entries, and it comes down to your exits. This is where we will talk more about when to enter and when to exit day trades for flawless profitable executions. From a detailed perspective, that means we will answer the question of what price action is and what it tells you. You need to know the story the chart tells you so you can know what to do next. No more saying to yourself, “I think I should just enter now, and when I do, the stock will go to the moon.” No, we're going to talk specifics. When to enter, when to exit, what is the chart telling you, and what do I do now because X candlestick looks like this. And, number four, we will finally talk about how to lose money the correct way with a simple way to use stop losses. No, 3 BOOK TITLE that doesn't mean I'm going to tell you, "Hey, put your stop loss here and risk 5-10%. No, we're going to talk about specifics. We're going to talk about why you're putting your stop loss here. Do you put a physical one, or do you have a mental one? What exactly is the difference between the two? As in, does it relate to the supply and demand zone where the top 10% of traders put their stop losses in the first place? Should you do the same or not, and best case of all, we'll be doing test scenarios to practice trading and practice losing money in real time. I will walk through chart analysis through this book, but if you download thinkorswim, the desktop version for your PC, that will significantly help you. From a strategy perspective, the supply and demand trading strategy is risk management first and trading second. So, that's it for the agenda. Now, let's go ahead and go to the next part. 4 AUTHOR NAME Chapter 1 Ice Breaker Challenge Before we get into the massive amount of detail behind how to day trade like a millionaire, let me give you 1 free gift. If you learn more from watching and listening, then you can check out a free video I put together by clicking “HERE”. This is a video from my course, which this book is 100% based on. The catch is that the course is five-hours’ worth of video content, which is a lot more than I could jam-pack into this book. So, for more examples, you can also purchase the course by clicking “HERE” to learn more. So let’s get started. Let me do a bit of an ice breaker for you so you can know a bit more about who I am. For you, as the reader, this is more of an ice breaker challenge because it’s not 5 BOOK TITLE only for you to pick my brain but also for you to try to answer these questions yourself. After each ice breaker question, you should take a pause and answer it for yourself. Like I said before, I won’t bore you with useless details because I know you’re here to learn about trading rather than about me, but the reason why this is important is that you need to know why I am teaching you in the first place. It is not to earn a quick buck from you buying a cheap book. It’s more than that, so in order to kick things off, essentially, there will be five ice breaker questions. For number one, it's your "why." Why do I day trade? For me, life pushed me into day trading as my main source of income, and I didn’t have much of a choice. I started out in corporate America, and I did pretty well in IT. I rose my way up to becoming an IT director in a large fortune 500 company by my mid-twenties. One way to say it is I was technically living the “American dream," per se. The catch was that there was a problem. The problem was, I kept getting laid off. I kept getting laid off year after year, after year, after year. So, yes, I'm only 27 at this point of me writing this book, but it just kept happening no matter what I did. I would bend over backwards and do everything necessary. I would not work 40 hours but, instead, I would work 60 hours. I gave every company everything I had to give. I got to the point 6 AUTHOR NAME where I was the regional IT director, and still, the same thing happened. No matter what, I just got laid off. For you all who are reading this, I am not saying this to make you feel sorry for me. I am just letting you know my backstory. What ended up happening is that I finally got laid off to the point that I said, "I can't continue living like this. I have to put my life, family's life, wife, and everybody’s lives in my own hands. I can't put my life in another man's hands. My life is my life. So I became a full-time day trader making all of my income as my main source of income at the time from day trading because I didn't have a choice. I needed to be a provider. In order to become a provider, I had to be self-sustainable. So, because of that, I didn't have a choice but to day trade. I had to figure this out. I had to do what I needed to do. I had to win. So, this my "why," to answer number one ice breaker. Number two, my six-month financial goal. Now, this is definitely a question that you should try to answer for yourself because if you're going to be successful, you will need to define what success looks like for you. For my financial goal, it has changed recently because money-wise, you can call me "comfortable," to say the least, since I have made a lot of money trading already. So, in that aspect, I am fine, but my aspirations have changed. From a six-month perspective, now I'm trying to continue my day trading coaching program, creating courses, writing books, and everything else so 7 BOOK TITLE I can help create another 100 six-figure income-generating day traders. That is my financial goal. It's not me personally, but it's one of the reasons you're reading this in the first place because you want to make six figures from day trading, you want to make some kind of passive income, or you want to make X amount of money so you can live the dream life you want. I'm trying to help create 100 people to reach those goals of going from zero to hero and meet their financial goals. That's my number two. Number three is defining what my win-ratio percentage today from day trading is. My win-ratio percentage day trading is about 80% currently, and it has been that way for a while. So, that means the best-case scenario, if I day trade five times in a week, I only take one big trade a day. I win four days of the five. I'll have a loss on, say hypothetically, Friday. But Monday through Thursday, I'm winning. So, out of 4 weeks or 20 plus days, you can imagine how big my wins outweigh my losses. Which I'll walk through, of course, in much more detail in the future chapters. To hit on one point again, you did read that right. Yes, I am a day trader, but I only make one trade a day. The reasoning behind it is to take a win and then shut the computer off to keep my profits. Plus, if you only make one trade in a day, you can imagine how picky I am on the trade I enter, which helps me keep a high winning percentage. Number four, my day trading strategy. This is, again, a very 8 AUTHOR NAME valuable question that you should answer for yourself. If you think about it and you don’t technically have a go-to strategy, then that is the first problem as to why you’re not making money. In the stock market game, you should not be a jack of all trades. You just need to be a master of one strategy so you can make money. Think about it. You’re trying to maximize how much money you make, not maximize how much fun you have. Pick one strategy and do it so much that it becomes second nature. Do not stretch yourself thin. As far as my strategy goes, like I mentioned before, it is based on the supply and demand strategy. This is the core concept that I will be walking through in later chapters with visuals and actual charts. Number five is strengths and weaknesses. It will be useful for you to understand your biggest weakness to know what to work on, and define your biggest strength when it comes to day trading. For one, just be very honest with you. For me, I would say my strength is that I follow my process to the exact letter. I dot every I and cross every T. I day trade exactly according to the plan and don't do anything outside of it to make sure I keep that 80% win ratio. Now, my weakness, being honest with you, is that I follow my plan to the exact letter. Now, what does that mean? That means that, in my plan, I only day trade one ticker, which is SPY 9 BOOK TITLE / S&P 500. That means there are big moves on there that I am missing. You know what, though? There is nothing wrong with that. The way I like to think about it is there are hedge funds, people, and millions being made on each ticker, so technically, all you need is one to get rich anyway. Don’t do what everyone else does. Otherwise, you will get the same results everyone does. Most traders fail, so do you really want to trade like everyone else? You may be asking yourself, “Well, what if Tesla has some big news? Will you make an exception?” Nope, I won’t, and I won’t trade it. Maybe I could have made thousands and thousands of dollars on that. Well, I'm not trading it. It's out of my plan and criteria. You may be asking, “Well, what if you can 10x your money, so what about penny stocks?” Penny stocks can be great if you know how to trade that market cap since it's not unheard of for one to start shooting up 1,000%. The catch is you won't know hypothetically until it's too late. So I may see it shooting up from 100% to 200% to 300% to 400%, all the way to 1000%. Am I jumping in? No, I'm not because I don’t want to chase stocks, and instead, I want the chart to prove to me it’s worth taking the trade now. My weakness is that I'm almost too good at following my own plan, but the strength outweighs the weakness, so I am happy with that. 10 AUTHOR NAME So, now it's your turn. If you haven’t already, I want you, on the notes section of your phone, to try to answer these questions. 1. What is your why? 2. What’s your financial goal? 3. What’s your win ratio? 4. What’s your day trading strategy currently? 5. What are your strengths and weaknesses when it comes to day trading? 11 BOOK TITLE Chapter 2 Why The Top Traders Win & Who Are They? First things first, we should define why you should care about how hedge funds trade. If you notice the top of the chapter, I technically answered the question for you of who they are. The top traders are not everyday people trading from home. They are the hedge funds because big money moves the market. We will talk about this extensively before getting into a lot of the chart analysis because the why will help you be patient and understand why we're waiting for our setups to come to us. For step number one, we need to talk about why you should care about the hedge fund strategy period before we start talking about what is the hedge fund strategy along with how it relates to the supply and demand strategy as a whole. There are four 12 AUTHOR NAME pieces here. Number one, I buy only when the hedge fund tells me to buy. That's one of the reasons the hedge fund strategy as a whole is vital. The hedge fund strategy is essentially a replication of the strategy that I will be showing you. So, whenever the big guys are buying, I'm buying, too, which leads into the number two piece—I only sell when the hedge funds tell me to sell. And that doesn't physically mean that they're on the phone with me saying, "Hey, Maurice, I'm with hedge fund ABC, or my name is Warren Buffett, I'm telling you, Maurice, sell your 100 shares of SPY right now." No, it's basically reading the chart from a price action perspective and understanding that the market is telling me I need to sell now. There is no magic formula necessarily to it. It's just recognizing what the charts are telling you at that point in time and on that specific day. Based on all the data, whether it be price, volume, or just purely how the supply and demand strategy works as a whole. Number three, I only enter a trade after confirmation that the market and I have agreed on the next move. To do that, like I said, I'm not on the phone with Warren Buffett (one of the best traders and investors in the entire world), and I am not going off of my gut assumption or intuition. It is all based on my day trading strategy. The supply and demand day trading strategy. If the chart is telling me that, hypothetically, at $324, this is where the chart will start reversing, then I need confirmation 13 BOOK TITLE that, indeed, it's reversing. That confirmation could be, for example, a green candle to form coming up, then another candle to form in that same direction. Or, if you’re big on using indicators, that confirmation could come from using that. It could be an indicator which maybe some of you are familiar with, such as the RSI. The RSI is basically showing you if something's overbought or oversold. So, if something's overbought, then maybe you're just buying the option put so you make money on the stock going down. Whatever it is, you have been trading, most likely, based on confirmations before. What I am telling you is that I'm basing all of my confirmations that we'll be going over very soon on what the hedge funds trade. So, that way, I am almost nearly entirely 100% sure that, when I'm buying, the price is skyrocketing up in my favor. For number four, the last piece here is that I must trade like a hedge fund by only caring about money for all of that to happen. What businesses care about is getting a good deal price. They care about money, not trading like an everyday day trader and only caring about indicators. Most people care about finding the next best indicator or the next person to follow that will tell them when to buy, sell, or when to do everything. No, that’s not how you should be thinking. You're thinking like an everyday day trader. You're not thinking about the people that are moving the market. The people moving the market are 14 AUTHOR NAME the people we're going to talk about very soon. They're called hedge funds. They're called banks. They're called businesses, and businesses only care about money. They care about getting a good deal. So, the whole logic of buy low & sell high from a high-level perspective does work in that aspect. Technically, the reason it doesn't work fully is that it's so broad that it does not answer the question of what's low and what's high. Where am I buying it? My strategy based around the supply and demand trading strategy shows you exactly where those lows are intraday so you can know when to buy precisely. Then, on top of that, where are those highs intraday, so you make that big profit. Doing so, I average results of $2,000 in profit to $5,000 in profit on a daily basis with my current win ratio. So, no, I am not making billions like the hedge funds, but again, that is because I mirror exactly what they are doing strategy-wise to get a good return with much less risk. So in order to buy low and sell high, yes, it sounds like a pie in the sky idea, but it's not. You just have to know what it means as it relates to your trading strategy. I can't wait to tell you all about it. Now, if these hedge funds are so important, who exactly are these top day traders? Who exactly are these top funds that are moving the market? Two examples of hedge funds are Berkshire Hathaway, which is run by Warren Buffett. He's one of the leading investors, but he's more of a long-term type. That's just 15 BOOK TITLE one example of a hedge fund (technically, it’s a holding company). Another more specific example is Bridgewater associates. Bridgewater associates is much more your traditional hedge fund. Basically, they're the ones that take money from X person, they invest it, and they're moving the entire market as a whole. They're your competition. When you're day trading, if you buy 200 shares, then maybe they're buying 2 million shares. Whatever it is, they're the ones that are competing against you. So, when you're losing, then they're the ones winning. When you're winning, they're also the ones winning alongside you. They know what they're doing, and they have that liquidity. They have all that money in the system to make things move. Think about it: if Microsoft is such a big company and you are buying shares, even if you buy a few hundred, you’re not moving the price up $10. Or, from a numbers’ perspective, you are buying 100 shares that are $100 each will not move the entire US market as a whole either. But these big guys are doing that! Bridgewater associates move the market because of all the money they have. During the movie The Big Short, which I recommend you checking out, there was an example of the power a hedge fund can have on the overall market in the 2008 financial crisis. Or on the other side of things, people don’t realize that the banks are involved in this as well when it comes to investment services. Most people are familiar with JP Morgan. JP Morgan doesn't just hold your money. They invest the money as well. 16 AUTHOR NAME Depending on their size, most banks typically have some investment service or investment department within their company. So, these are the two people that are also in the market with you. Again, this is the reason it is so important to know because you are trading alongside Joe and Jill that live next to you outside, but there are people that do this professionally. So, to trade like a millionaire, what better way to win and be part of the top 10% than to do what the top 10% are doing? But the only way you could do what the top 10% are doing is to know who the top 10% are. Hence, it is good to know now that the hedge funds are your friends but also your enemy. So, if you can literally mirror them and know exactly what they do, when and why, and understand their mentality and interpret their psychology behind all of it, then you can understand enough about them so that you can copy, mimic, imitate them. Use whatever word you want to use to make you feel better, but you could make top 10% money, being the small fish in a big pond. As one last example, this works because while they're making $10 million, you can make $200,000. Maybe that’s not as much money as you want to make but, for most people, that's well up there. Some of the world's top people make cash flow of about $200,000 to $300,000 a year. As a result, if you make $200,000 for yourself at home in your underwear, hypothetically, wouldn’t 17 BOOK TITLE you take the opportunity? Or would you rather go into the office, listening to a boss, and not being able to take a lunch break because things are so busy? Now, let's talk about the flow of the market as a whole. In other words, how shares flow throughout the market. The flow of the market takes up about six different segments. The most interesting part about all of this is that me and you, the Joe's and Jill's that are learning about the stock market like this, are only a part of number six, which is the market. We are a part of the market, but we're not “the market” as a whole. Let me explain step by step. Here are the steps. 1. Company – Sells Shares 2. Bank – Facilitates Deal 3. Hedge Fund – Buys Shares 4. Hedge Fund – Wants To Sell Shares 5. Broker – Receives an Order On The Exchange 6. The Market – Everyone Gets The Opportunity to buy So starting with number one, let's use company A as an example here. Company A has shares. They want to sell some shares. The reason why is because this is an IPO (initial public offering). So, it's a brand new company that wants to join the NASDAQ or join the S&P 500, and as a result, everyone must have access to buy their available shares. 18 AUTHOR NAME After that, Company A will begin step number two because, since they are a brand new company, they need to get this access into the market through a bank, so a hedge fund can buy their shares. That means, for part number two, they have to approach a bank such as, for example, JP Morgan. They facilitate a deal for this to happen. This, of course, is not seen by everyday people, and instead, is all behind the scenes. This does not have anything to do with me or you or anyone else who’s a regular person. They're facilitating this deal to say, "Hey, we have some shares for $10, and this is what we think we value our company at. We want to put this into the market. We're looking for someone to buy it for $10 because that’s what we value our company as." The bank just has to accept that they will facilitate this deal so it can happen. So, then, number three is where the hedge fund comes into place. Like mentioned before, the bank is in the middle and essentially brings this to the hedge fund for a potential deal. This is where the hedge can, as an example, say, "Yes, we'll buy 3 million shares of Company A, for $10 since you said it's valued at $10." Then, there comes the most interesting part that most people are not familiar with. The hedge funds can continue to buy as many shares as they want at that $10 evaluation, but again, there may be news articles about it, but everyday people can’t buy yet. 19 BOOK TITLE What happens next is the value continues to go up because it's hedge funds versus hedge funds only at that point in time. The next thing you know is that, two months later, Company A’s share value has increased. The market says Company A was $10 a share, but with the recent interest, it has gone up to $30 a share. The catch is that everyday people like me and you are not given the opportunity to buy thousands of these shares since it’s early on. Remember, this is only step three of six, and we, the people, don’t technically come in until step number six, so technically, we have missed out on a lot of value. Then, step four, and you can probably guess what happens next since the value has gone up. The hedge fund says, "Hey, we want to sell these shares here. Seems like it tripled in value up to $30, so now we're looking to sell in about two weeks or so." This is where number five comes in, where the broker, who’s basically the middleman, says, "Hey, we received an order on the exchange for the price of these shares at $30." At this point, the everyday Joe’s in the market can start buying, but what they don’t realize is those early investors are ready to cash out. They just need to put their sell orders on the market exchange so the everyday Joe’s can buy at the high rates to cash them out along with whoever else. That's where you and I come in as number six to say, "Okay, now we have the opportunity to buy X shares of an IPO at $30." Unfortunately, by this point, typically, what happens more often 20 AUTHOR NAME than not is the price drastically drops. If you're familiar with any kind of IPOs, you buy an IPO, and for early investors, it rockets up, but for everyone else, by the time it gets to step six, it plummets down for the most part. Some go up, but most of them, by the time you can buy, go down in value. Since we’re within number six, as the market, we have no idea what we just saw. On the outside, it seemed like it tripled in value, but when we bought, it dipped. We thought maybe it'd go up 30%, and we could just get a little meat off the bone, but again since it was overbought from a RSI perspective, it started reversing back. Some people keep holding and holding until it gets back to $10 in the hopes of it coming back up like a rocket, but by then, they have lost a lot of money by using the strategy of hope rather than an actual day trading strategy. That's typically the overall flow of the market, and that’s why it is important for you to understand the mentality of the hedge funds since they make the price move up or down. All the big guys with all the money that drive the market think the same 1, 2, 3, 4, & 5 steps, but it's up to you to interpret so you can profit by the time you jump in on number six. Another example is when there's an earnings report from a big company that's coming out. It makes you think that, if Microsoft has good earnings, you should blindly buy. However, most of the time, by the time you jump in at the market bell, that 21 BOOK TITLE is already priced in from the pre-market. This happens very often, but think about it—if it were that easy, why wouldn’t everyone just trade based on the news someone else told them? It’s never that easy. So the question is, do you buy in the pre-market? If you get in, can you ride the price up? Or do you short the market after because, more than likely, it was going to go down anyway since the hedge funds are cashing out by then little by little? You must start thinking about steps one through five in order to trade like a millionaire in the top 10%. Think differently and understand this flow of the market, and you can win unlike everyone else. In this game, it’s good to think differently than everyone else. More often than not, that’s the right mindset to have if you want to have a different result than all the other failing traders. Next, let's talk about specifics when it comes to hedge funds versus retail traders. A really quick differentiating factor between the two is that the hedge funds are the businesses driving the market, and the retail traders are you and me. Now, here are three kinds of statistics that would help you understand how the markets have been changing and shifting from 2019 to 2021. In 2019, there were a lot fewer retail traders. So, if you want, you can call it pre-Coronavirus. Pre-Coronavirus, the entire market made up about 10% of retail traders and 90% of the institutional investors, the hedge funds, banks, and big guys. So if you look back at the charts, things were a lot smoother or, 22 AUTHOR NAME quoting the institutional investors, “The waters weren't as muddy.” The reason why they say that is because they played hedge fund versus hedge fund much more often. That resulted in the moves being much more predictable and smoother. The moves were not as volatile because of that certainty factor. In 2020, the Coronavirus happened. A lot of people, unfortunately, got hit because of that, whether it be actually getting the virus or, like most companies, having to work remotely. Many small businesses went either out of business or had to make a massive shift. There was an entire economic shift in every country in the world, and as a result, the retail traders jumped from 10% to 25%. You can imagine how muddy the water was—if you want to call it like that in the words of JP Morgan specifically. That turned out to mean that the market made up about 75% for the institutional investors, which is significantly down from before. Keep in mind the numbers on the other side are in the billions, so this is a massive shift. So, this is important to know. From 2019 to 2020, because of the increase in retail investors, the moves became substantially larger. Retail traders like me and you are not trading like hedge fund traders. Hedge Funds are buying low and selling high based on supply and demand strategies—which we're going to go over to pretty soon in this book—used to fully control where the price is going since they were the main players in the market. The retail traders buy based on emotion, based on guts, or based on just 23 BOOK TITLE hoping that it will go up because they need to make mortgage next month. They need to pay their mortgage, they need to pay their rent, they need to pay for their car, they need to pay for their wife or husband to go on a trip, or whatever the reason. Hedge funds want the same things, but they play with house money while retail traders play with their money. People turned to the market because of the Coronavirus because they didn’t have any money, and they needed to make money to make their family happy and buy the things they needed to survive. All of that mixed up, and moves began shooting down rapidly, extremely fast because, if it didn’t go how someone wanted it, then people sold very quickly. People were losing money left and right. So you can imagine how the market shifts, turns, and swings differently just because more people are involved. That's why it's important to know how to hedge funds trade, because whether they take up 90% of the market in 2019 or a bit lower in 2020, you, as a retail trader, need to adapt your strategy based on the volatility. Their trading strategies stay the same, but you'd have to be more cautious. Even after 2021 post Coronavirus, you need to pay attention to how many more investors are in the market. That’s why what's called the VIX indicator is important because it’s technically what people look at. VIX indicator is known as the fear index. That typically is going to be up much higher during a crisis and can give you a better idea to know to think that, “Hey, something's going on in 24 AUTHOR NAME the world or the US or whatever country you're in because the VIX is going up.” If you want to check out that ticker, it is in the US exchanges; so, you can check out where it is on any brokerage that you are using. Just remember that the higher it is, it means that the volatility is extremely high. So that matters for both hedge funds and the retail traders like me and you. Both players matter. In 2021 basically, the statistic has been changing more as well. The retail traders have already dropped to about 20%. The reason is that a lot of them are losing. A lot of them are losing their money, they are losing their shirt, they're losing all the money they've ever had in their account, blowing it up because they don’t know how to trade and instead want to make a quick buck. They are not investing like the institutional traders, and that 20% is more than likely going to drop down to 18% to 15%. Within the upcoming years, I'm willing to bet that percentage will continue to decrease because, guaranteed, when you're looking for a quick buck, you lose. Those people do not want to understand the system. They want it easy. So, yes, the supply and demand strategy is easy to understand, but it's hard to implement because patience becomes a factor over what you typically usually invest. That's why institutional investors win because they're thinking about the bigger picture in the longer term. Retail traders are thinking short term, and they can only see the little 25 BOOK TITLE picture. Now, again, look at these three different stats here. The retail traders have gone from 10% to 25% to 20%, and more than likely, 2022 will be between 15% and 18%. What does that mean? It means that, as long as you can survive in this market, making X amount of money now, then you can easily survive the years to come. The fewer retail traders means the markets are not going to be as volatile, and the market will become easier to trade. Less competition is better. So, the more you know how to trade supply and demand as a strategy overall to mirror the investors being the hedge funds, the easier it's going to be for you to kill it. Now, going off of what I mentioned, more investors equals more losers. This is specifically for the everyday people called retail investors. One of the reasons the everyday retail trader loses is that they trade against the market. They don't trade with the market. Trading with the market is like trading the supply and demand strategy. Remember, this is important because you need to imitate what they are doing because they're the ones that move the market. If they put all of their eggs into one basket, then you need to put at least one of your own eggs in the basket so you can follow along with them. There's nothing wrong with being the small fish in a big pond as long as you're imitating what the big fish is doing in that pond. So number one is undeniably one of the most important points you have to understand. Don't trade against the 26 AUTHOR NAME market. Trade with the market. Number two reason retail traders lose, many of these day traders, unfortunately, buy based on gut, which I've talked about a few times here. This is more of a psychological type thing that can affect you. But you can't buy based on gut alone. You have to buy based on your confirmation. You have to buy based on your strategy that you've tested over and over again. Not based on thinking, “I believe it's going to $3, so this could be easy money.” Or thinking, “If it starts going up, then I'll buy it because it's going to be a breakout.” You have to know that this does not work. Otherwise, you run the risk of blowing up your account and losing all of your money—which is not uncommon. Now, I used to do it when I first started. So how I got out of buying based on my gut? For one, figuring out what strategy works for me. Two, it's going into thinkorswim and actually practicing on the on-demand software. Essentially, I would try to practice days with fake money to just buy and sell in order to be profitable. The catch is, I only did one single strategy and did it for multiple days in a row. You can literally do an entire month in one day as a result of being able to choose what day you want to trade at a faster pace. Doing so gives you the ability to ask yourself valuable questions and give yourself more screen time to think the following thought. How does my stuff actually work with what indicators? How many days out of one month can I win? How large are my losses, and what is causing those losses? 27 BOOK TITLE What do I need to tweak so that it can become profitable? What was I wrong about that I need to admit so I can get better? You have to be real with yourself and not go based on your gut. Go based on your strategy and see how good it is and how does it work in the current market. That's number two. Number three, you can't afford to lose trades. Most of these investors start losing because they can't afford what they're losing. If you have $10,000 in your bank account, and if you lost all of it day trading, that’s a problem because you still need to make your payments for everything you have in life. If you don't have $10,000, figure out what's your magic number. If your magic number is $5,000, trade with $5,000. If it’s $500, then trade with that. I've met someone, and their magic number was $10. She ended up trading with $10. Will it be hard to trade up from there? Yes, it will be hard. Is it possible? Yeah, it is. You know why? It’s because trading based on number two that I mentioned. If you're practicing your trades, you can find out how to buy something for $10 and make it into $15. Then, keep doing that strategy so it can go from $15 to $30. The concept is the same when money gets larger because if you can triple your $10 investment, then you can triple your 10,000 investment as long as the trading strategy stays the same and you only have one strategy. Now, if you’re thinking, “Okay, I now understand my methodology, and everything is going smoothly with my $10 28 AUTHOR NAME investment, so I think I'm ready. I'm not buying based on gut feeling, and I'm trading with the market. I can afford to potentially lose what I have in.” That means you can move to number four, which is having a plan before you enter every trade. If you have no planned entry, exit, or stop loss or have defined the amount of money you’re willing to lose, then you’re not ready to enter a trade. Until then, you don't play with money you can’t afford to lose. Also, you sure as heck don't enter a trade without a planned spot to exit in the best-case scenario and worst-case scenario. Put a stop loss on any trades unless it's planned beforehand. You have to know what to do. If you don't have a plan, you plan to fail. Let me say that again. If you don't have a plan, you plan, by default, to fail. So make sure that's set up. Number five, the more investors are in the market, equals more losers in the market. Many of them don't have a mentor or expert to teach them, unlike the institutional investors. Institutional investors have trading floors full of people to ask advice from. They've had people that worked there for ten to fifty years, who have seen everything. They've been trading for so long. They've seen almost everything more often than not, and they're just there to help a new upcoming employee that's doing some trading. Just to learn from someone and sit with someone like that would drastically speed up your learning habits. Not having a mentor will, by default, cause the market to become 29 BOOK TITLE your mentor. So, in order for you to learn, you will lose money from all your mistakes. As a result, that's something you need. That’s why I am writing this book because I am someone who can help you have one leg up against your competition. That’s why I coach people on how to day trade to make $1000 a week minimum through my program by them visiting my website www.MauriceKenny.com That way, you can learn as much as possible with very detailed hands-on examples. Since I've learned from institutional investors, you have a leg up against your neighbor down the street. That way, when they place a buy order, and they lose money, that means you can make that money on their loss to buy it at the lower price and sell it for more. The more you know, the more you can get better than your competition. This is a zerosum game. You win based on however many people lose, and you win based on what you know against your competition. So, avoid all five of these mistakes and continue to be one of the top 10% traders, or make them and be among the 90% of losers. 30 AUTHOR NAME Chapter 3 Uncovering The Hedge Fund Strategy Next, we will be walking through how exactly a Hedge Fund operates. We talked a little bit about the retail traders, but now we're going to talk about the big guys' actual strategy. First, how operations go within the company. Second, the overall strategy itself. Yes, from an operations perspective, I understand that you are not going to be running the hedge fund operations, but understanding how they operate can help you mirror what they do so you can be profitable when they are too. This is 100% necessary to understand before trading. If you don't understand something like this and you’re not profitable, this is one reason you're not ahead currently. Now, starting with number one, the first thing that matters 31 BOOK TITLE when it comes to the hedge fund strategy is understanding what they really care about. Just like every other business, what they care about is revenue coming in. In other words—money. You can't do a business without money. So, number one, they have to receive client money from me or you if we were their clients. The way it works is you can go up to a hedge fund and say, “I have $2 million that I want to give you as an exchange for something else. In return, I want you to promise me you'll make X percent back on my money.” As a result, they will give you hypothetically 5% back on top of your $2 million with you doing very little to no work. That's their guarantee to you. What they get out of that are fees, commissions, etc., on top of it all. So, the hedge fund managers typically make a lot of money based on these deals alone. But that's the typical kind of way they get revenue. Then, the second piece here, and the blue one is the cash flow—that’s the king for them. So, what they do is using that money as liquidity. And, as a result, they can now trade 24/7, not with their own money from their pocket, not those commissions, not those fees, not any of that, not their salary, their 401k—they use the client's money to trade. So, let's say they make 2% in one day on that $2 million somehow. That's great, but it doesn't matter. They need liquidity as much as possible. They're going to sell so many shares so that they can get X money back and be able to give them a return and buy shares. So, they can always have 32 AUTHOR NAME money coming in and coming out. They care about cash flow. They need the client's money to trade as much as they want, or as little as they want, and by anytime they want to move the needle to move the market. If you look at the image here, actually, that's them moving the market in a sample chart. You can just say, hypothetically, the blue is them buying 2 million shares each. Two million shares going up and then a yellow candle that's them saying, "Well, okay, we made some money, let's go ahead and sell some." That push back is a different hedge fund selling against them to say, "Well, we need to sell this now." And that's where those reverse candles start coming down in the yellow. But that's the whole premise behind that they need their money from clients as liquidity to be able to move the market when they want, how they want, and however much they want to within legal grounds, of course. The third piece is an essential piece where you need to start to pay attention much more; while the first two are behind the scenes and it's great to understand them, they are not the most 33 BOOK TITLE important. The third thing and the fourth thing, or the most important, because in the yellow here, that’s where the market maker comes in, they have market makers in their companies that set the target price. And I'll say that again, they have market makers, individual people, that set the target price. So, if the current price is, say, $200, and the market maker says, "Hey, we have enough liquidity to push this price up to $205," that's our target price. Then, they're going to use the second bullet point that liquidity as their manipulation. They're manipulating the price to push itself up to that $205, their target. And, that way, they're actually selling high, and they're just going to sell it off. So, they bought low and sold high there, technically. There's much more to it. But that's the general idea. And, then, the last piece here is hedging. So, that's essentially kind of wrapped into what I already talked about. But hedging is buying and selling to reach the target. So, they're manipulating that market to push it up. Basically, they could have 10,000 shares constantly buying to push it up each minute on each candle. But whenever they get to the top of their target of whatever that price is, they're hedging against it. They may be selling half of their shares, but they're still selling. They're selling at a profit. So they're hedging against themselves. They're hedging against the other hedge funds at this point. As far as this kind of flow goes, this is hedge fund versus hedge fund. It's not even a hedge fund versus you or me. They're just fighting the other hedge funds to 34 AUTHOR NAME get as much liquidity as possible. They know where they're because they see it in the system, which we'll go over very soon in this course. But it's really hedge fund versus hedge fund because they move the entire market. Now, let's walk through an example. There are five pieces here, just like before, but we're going to walk through an actual kind of example of how a hedge fund would be trading. So, number one, as we mentioned before, the most important piece to all this is the market maker. So, first, the market maker chooses a cheap price target below its current price. So, hypothetically, if there's a price currently at $200, they could say, “We have a target price to buy low, not at $200, but $195. Once it gets to that, we'll shoot it off.” But we'll get to that very soon. So, they have current prices of stocks at $200 in a price target at $195. So, number two, they simply just draw a zone down there. Draw a little rectangle, or draw a circle, whatever it is, in that target zone of $195. And the great thing about this is that they're traders on the trading floor; they can see this. This is the goal we're trying to get to sell enough shares to push it down. Now, number three is, like I mentioned, they're selling shares, they're selling stocks, they're selling options to push the price to this zone. It's hard to do it because, when they're selling, they're moving the entire market. But that's hedge fund A. Hedge fund B is buying to push the price up. That's why you see this constant friction between candles going down, candles going up, 35 BOOK TITLE candles going down twice, candles going up points to different hedge funds having two different strategies as a very basic sample explanation. And, number four, that manipulated zone that was already just arbitrarily picked, whether it be arbitrary or specifically picked by the market maker based on how much money they're trying to hit. It's hit as the lowest price that they're looking for. So, that's great; they hit their zone, they hit their price target, they hit exactly where they want to go. Then, to move to number five, they hit the low. Now, they just buy many new shares at the lowest price there, and the stock skyrockets up. That's where you see those big moves happening. No matter what the company is, especially the large-cap companies. If you see it pushing down, coming up a little bit, pushing down, coming up a little more, pushing down, hitting this weird area where you feel like there's nothing there, but out of nowhere, it shoots up an entire severe crazy amount, that means that was a zone. You just weren't aware of it. And you didn't have an understanding of where the market maker chose this price. But when they choose the price, it's very apparent. And I'll show you, like I mentioned, how apparent it is. Once you see it, you can't unsee it. All you see is zones. All you see is money at that point in time. But we'll get to that. This is an example of how hedge funds trade. In the next lesson, we'll be talking about how 36 AUTHOR NAME exactly the retail guys trade. 37 BOOK TITLE Chapter 4 How To Day Trade Using Supply & Demand Now, the next piece is the supply and demand trading strategy. We've finally made it to this. To start out, I want to give you a very good introduction of just really reading out the definition of supply and demand. Reading out, supply and demand is the equilibrium between price and the volume of shares traded. Any imbalance is profitable. Any imbalance is where the profit lies. That's where you're going to be trading it. Now, the supply zone, from a very basic perspective, you'll see down the line actual examples of it being drawn. But the supply zones are typically a red rectangle that's going to be at the top. This actually signifies a high number of shares and a high price. And, basically, this is the buyers and sellers saying that this 38 AUTHOR NAME price, currently, hypothetically $200, is not worth more than the price as it is now. So, let’s say a market went from $200 down to $190 and then slowly back up to $200. At that $200, there is friction because of the big spike downward originally, so as a result, when it gets near again, it will reverse drastically. That zone where this happens is called a supply zone. Again this means that, at $200, the markets agree this is the highest it's gone at this moment intraday. And currently, it's not worth any more than $200 because the buyers and sellers have agreed on that. As a result, this is a supply zone. It’s almost the same thing on the flip side, but it’s called a demand zone. This is typically a green rectangle if we draw this out. Now, this is almost like defying the opposite. It is signifying that there's a low amount of shares at a low price. So, in other words, it's not worth less than, say, $190. Supply zones capture the top of the line, while demand zones capture the bottom of the line. And it's a real quick reference. This is not just simple support and resistance levels. It can be seen like that, but you'll see very soon why it's not. As one little quick example, if you've charted just support and demand lines indicators on your chart, you can easily put 30, 40, 50, sometimes 80 support and resistance lines. When it comes to supply and demand zones, typically, when it comes to the ones I'm talking about, which are called major zones, there's maybe four, maybe two max, sometimes at the most six. But, other than that, there 39 BOOK TITLE aren’t many, especially at one time within probably a four-hour window. So, if you want to think about supply and demand zones, they're very simple to understand, but they're an advanced version of support and resistance. And we'll talk about that very soon. Since you have a better understanding of what supply and demand is, let's talk about the retail strategy as a whole and how it relates to the supply and demand strategy. The supply and demand strategy mirrors the exact hedge fund strategy that we talked about, just a lot simpler. So number one, first, we identify the market makers' price target. And that could be whatever, be it $200, $210, $200.01, or $205. We typically can spot that exact price target to the tee within a 10% margin. You can technically predict where the market maker has priced the set because of the supply and demand strategy. Number two, let’s say you guessed the price correctly. So let's go ahead and just draw the respective zone. That's basically you drawing that hypothetical red or green rectangle. So the red being the supply zone, and the green being the demand zone, just respectively on the chart. And, again, if this isn't making much sense now, trust me, we're going to go through many examples. Technically, fifteen examples of how to draw supply and demand zones on different charts, how they work, how they don't work, 40 AUTHOR NAME when to draw them certain sizes, when not to draw them certain sizes, the colors, and every possible detail. So that's coming up pretty soon. Number three, after you've drawn it, you basically just wait for the zone to be hit. The market makers are doing all the work—they're buying to push it up, selling just to get some liquidity trying to figure out, “Okay, well, we're beating this hedge fund.” Now the hedge funds may be thinking that there's a big amount of stop-loss orders below at a lower price, so they will intentionally push the price down and then push it back up there. The hedge funds are doing all the work. They're doing everything. All you have to do is: 1. Find out if $200 is the price target, 2. Draw a little rectangle that looks nice and colored, 3. Wait for it to come back and retest. That's it. That's literally it, just waiting for it to come back to retest it. The reason why it's different from support and resistance levels is that, as you know, if you draw support and resistance, it doesn't always get hit. Sometimes, there's a margin between it. That margin between it is the supply and demand that you're not aware of basically; the more precise you can get, the easier it is to win on these trades. But, again, sometimes you're waiting for maybe five minutes at minimum for the zone that you've drawn to be retargeted and re-hit, or maybe you're waiting for three hours. And the zone gets hit. And there's a beautiful huge push 41 BOOK TITLE back, and you say, “Well, I waited three hours for a huge trade.” You don't have to physically wait for it. All you do is just set an alarm, wait for the alarm to turn off on your phone, walk back to your computer, put on the trade, $3000, $5000, $8000, and call it a day. That's what I do. People make trading way too hard. It's not as hard as you think it is. It's figuring out where's this price target, draw the respective zone, wait for it to hit, and earn $3000. It's basically where you're saying to buy on that reversal and just make the profit. Simple as that. Now, let's go ahead and walk through an example of what I said. See this physically and understand how exactly the flow happens for us as retail traders. So let's just say, hypothetically, at number one, a zone is identified at 9 AM CST at $100 flat. Number two, the price moves above $100 and fluctuates between $100.01 and $102 throughout the day. And, now, think about this as an FYI: if I go back to one, the $90 of the market has been open. I'm in Texas CST, so I'm typically used to the market opening at 8:30 AM. But this is at 9:00 AM. Sometimes, I wake up at nine; sometimes, I wake up at 9:30 AM. I don't have to trade that morning kind of power hour volatility. You can if you want it, but I don't want to. For one, I want to sleep a little longer if I'm just really frank with you. And I know many you don't necessarily want to just stare at charts eight hours a day. And this is why I wanted this strategy here. 42 AUTHOR NAME You don't have to trade for a 40-hour workweek. You can trade twenty. You can trade five. Some weeks, I trade for about five hours. Honestly, depending on the week, I may trade for about an hour, just because I come back to the computer when my alarm goes off. And that trade, I'm in and out within twenty minutes. And if I do that three times, maybe four times out of the week, that's my $15,000 profit, as an example. And I'm done after just trading less than an hour for an entire week. And I have all this free time to myself. So, this strategy works 100%. But the strategy only works if you make it work. So, back to this example, number one says zone was identified at 9 AM as $100. Number two, the price fluctuates between $100.01 and $102; you're just watching, then on number three, you start doing a little bit. A little bit, meaning that you simply wait for it to come back to $100 for the retest. Number four, you let the retest happen and wait for confirmation that it's actually reversing whatever that confirmation will be for you. We'll talk about that very soon, and, later in this course, on what exactly confirmation means. But you don't just enter the trade because it hits your only $100 zone. Maybe you entered at 100 points something else. You don't just go and buy just because it touched it. You need confirmation. You need price action to tell you something, which is why number five is that you enter the trade based on price action and exit at your defined target. This goes back to one reason why many day traders, swing traders, and 43 BOOK TITLE long term investors lose. They just trade based on gut. They just trade based on intuition. They just trade based on a friend or a family telling them that they should enter this trade. But if something goes against you, you have no defined target of when you're entering and when you're exiting. And when you're stepping out, you're going to lose. You need a price target. And specifically, what tells you that is price action. You need to understand the story behind the candles and what they're telling you at that moment on the one-minute time frame chart. We'll go over how exactly to understand what the story is and read the candles' language. It's not just the candle forms, whether it’s green or red, or it’s formed. The candle’s intricacies in itself, from the candle itself, its size, its length, and wick size, whether it be at the top or the bottom, signify a lot of where the movement is going next. Just seeing a long wick at the top and a small body below it can signify easily that that's just the company's getting liquidity. So it can reverse back in the opposite way. That's why the wick is so long. There are not many buyers in X amount, and the X wick up above that. They're just getting liquidity. That's why I didn't stay there, hypothetically. That's why those long wicks are there. They don't plan on buying that. They're just pushing it up, getting what they need to get, and getting out quickly. There are not enough buyers there. The thicker the candle, the more buyers there are. The smaller the candle body is, the fewer buyers there 44 AUTHOR NAME are. See the following image. The same can be said for the wick because the majority of the buyers/sellers are in the body of the candle. You can think of the candle wick as the hedge funds trying to align on the price together before it comes back to form the candle's body. The candles mean something extremely important. Now, again, this is just a simple example. The best-case scenario is that, when identified at 9 AM, you waited for the retest to happen at four. Let's say that the retest happened at maybe 10 AM. And from 09:00 to 10:00, you didn't do anything but wait. The retest happened at 10:00, you entered the trade at 10:00, and you're out of the trade at maybe 10:10, or 10:20, depending on how slow it is from a volume perspective, but you're done. You've technically traded for about ten minutes, and the hour was just you waiting on a computer on Facebook, Twitter, Instagram, Tick Tock, whatever it is, watching a video. Sometimes, I go back to bed and 45 BOOK TITLE go to sleep until the alarm pops up. Maybe I had a long day the day before that. Just being honest with you—you don't have to make trading so hard. It's really, really simple. It's just that you're a part of the 90%. Right now, that overcomplicates it. Now, I'm trying to help fix that for you. Now, you may be wondering, this sounds almost too good to be true, while I'm trying to tell you that it's not. The catch— because there's a catch with everything since you think it's way too good to be true to trade just ten minutes a day—is that the only way this works is that your trader psychology has to be on point. You have to trust the process. You can't just day trade first and think risk management second. That's how trading works. It's risk management first, and then actual trading, second. That's how trading works, not the other way around. Your psychology and risk management are the most important part. So, that waiting is the most difficult part. Because you're thinking the entire time you’re missing out on a trade, or “Oh, if I had taken this trade in the morning, I would have made bank already.” You may think it’s easy, but it's pretty hard just to be patient. Some people are so picky about wanting to jump into a trade just to chase it on its way up, catch a big winner, catch a big runner, use scanners, and use all the tools you need. You don't need all of that. So, the only way it works is to trust the process. And I'll show you why you should trust it and how you should trust it. And not only that; after you finish this course, you will 46 AUTHOR NAME 100% trust this process because it works. And not only just because I'm saying so. That doesn't mean anything, right? You're going to trust this process because, by the time I'm done with you, after more than sixty examples of trades that we're going to be walking through, you will be confident in the process. I’ll go through explaining, and you’ll get your homework done down the line on how a lot of these things work. You’ll document where's your entry, your exit, the supply and demand zones period, the major and minor ones, where exactly is your stop loss. Then, you’ll figure out why did this happen? Asking the "why" questions will separate you from being a part of the 10% instead of being a part of the 90%. Number one, the only way this works is if you’re picky about when you trade. So, yes, you only traded for about ten minutes in the previous example and waited for an hour, all while being in the room watching TV. But that's because you have to be picky about when you trade. You only trade when the trade comes to you. You don't trade otherwise. And, on that same extension for number two, if you're doing all that, you have to give the trade wiggle room. Just because you've bought at an X price, and it doesn't immediately go your direction, even if you've waited for that hour, you need to give the trade wiggle room. That's the whole point of the supply and demand zones in the first place. It may start going 100% in your direction, which typically it does. And I'll show you examples of 47 BOOK TITLE things that could have broken it down to easy, medium, and hard trades. So those days where it's extremely easy, you buy, and it just runs based on the supply and demand zone. But there are other days when you buy, it pushes back a little bit, and you might be negative $50. But negative $50 freaks some people out; or, maybe, you're negative $200, and then you sell it. Since you didn't give it that wiggle room I told you about, you may sell too early. Like you’ll go ahead and sell, then, as soon as you sell, it just rockets off in the other direction, and you would have been not negative $200 but plus $1,000. And that's because you didn't give it wiggle room, you didn't trust your process. This is the only way it works 100%. Now, number three, you have to know how much you're willing to lose. We've talked about this before, but I wanted to bring it up again because this is the most important piece that we could talk about now. You have to know how much you are willing to lose, how much you are willing to put in each trade, and what's your magic number. Are you okay to trade with $1,000? Are you okay to trade with $5,000? Are you okay to trade with just $10? Whatever it is, define that number. Put that, if not a little more, into your account, and trade with it. But I will tell you this, especially if you haven't tried it at all. Here's one thing I'll guarantee you, you're going to lose—100%! You're going to lose a trade. Maybe two, three, five, or even ten! But I'll tell you what, it doesn't matter. You know, no one wins 100% of the time. 48 AUTHOR NAME That's the beautiful thing about trading. You can lose five times, but there are 20 days you can trade. So, you lose five, but you win 15; it doesn't matter. You had a whole bad week last five, but you won the next three weeks. That's pretty great as long as you've cut your losses pretty quickly, right? So it means nothing. So, with number three, know how much you're willing to lose so you can win off of that. And, number four, only trade after confirmations. We're going to go specific over confirmations because, before entering any trade, I only enter based on X confirmations, and I have a couple that I go to. But, whether you take my strategy or another person's strategy, or you modify a little bit of it so that it works for you, you need confirmations. You can't enter just because you feel like it. You can't enter just because of one confirmation, either. You need multiple. So, if anything, I need to change the sentence to only trade after multiple confirmations. That's the truth of the matter. Now, let's move on number five. Number five is to let the stock prove to you it's worth trading right now at this point. You only enter the trade again, as this is an exception based on number four when the trade comes to you. So it's a supply and demand strategy. There's a lot of waiting, and just hoping it comes back to it. And, if it doesn't come back to your zone, you don't trade. If it comes back, you trade. You'll be waiting five minutes for your phone to go off with an alarm. Honestly, you could be 49 BOOK TITLE waiting. Worst-case scenario, I don't wait more than three hours. But worst-case scenario, I think, one time, I've waited the entire day until the very end of the day, the end of the power hour. So right before from two to three o'clock. For one to maybe two o'clock or so, or whatever the time zone I was at the time, but you wait for it. And here's why I'd rather "wait and win" than "rush and lose," and you'll have the same mindset because the trade will work, but you have to let the chart, the stock, the ticker itself prove to you that it's worth trading and it's worth, you put your hard-earned money into so you can win. You don't rush things. Otherwise, you lose. We all know that. Don't rush anything, whether it's training or in life, career, anything. Be patient, and you will win. That's a guarantee here. 50 AUTHOR NAME Chapter 5 Stocks To Trade & Technical Indicators To Use Now, this is one of my favorite slides because it typically always freaks people out a little bit. This is where I'm going to start covering what stocks to trade and how to make trading ten times easier—an arbitrary number of ten times, but it's true: whether it is two, three, five, or ten times, it doesn't matter. But this is how you make trading a lot easier. Here's number one, for me and for a lot of the big guys that trade in the first place, especially independently, I didn't realize until I just started doing it by accident. Only trade one ticker. All I trade is SPY. That's it. Nothing more, nothing less. I don't trade Tesla even though everyone talks about it, their mom, on Facebook, Twitter, and Instagram. Even 51 BOOK TITLE in the news nowadays, everyone's talking about Tesla. Don't get me wrong, Elon Musk is a great guy. I really love his invention and love everything about the guy, extremely genius. One of the best people that's been alive in a long time because he's making such big moves in the market, for his company, for humanity, and for the stock market as well. But that doesn't mean I'm trading him. The same thing for Apple. Apple's a large conglomerate. They do so many things well, do a few things unwell, but you can't argue that they're one of the leaders and a lot of a few things that they actually do right and they do what they do. But just because, hypothetically, it is supposed to be all green candles upward, that doesn't mean I invest them. Small examples, NIO, smaller company. People say it has big potential. That doesn't mean I'm buying it. I'm not buying the hype. I don't care. Maybe it's good. Maybe it's bad. I have no interest at all. And here's why. Why should I trade multiple tickers if all I need is one to get rich? Ask yourself this question. Just please answer this to yourself. Let's say you can trade SPY, and you can make $1,000 today, make $0 tomorrow and make $2,000 the next day. Is that okay? Or do you feel like, "Well, I'd prefer to trade SPY one day, get $1000 then trade Tesla on Wednesday and then get $2000 and then the next day trade Apple and then get $500 and then go to NIO, continuing so on and so forth?” Now, here, you may be saying, "Well, I'm fine with that. It's 52 AUTHOR NAME increasing my odds." Here's the problem with that. Now, you're bouncing from chart to chart to chart. That’s how I traded in the past. I don't use scanners. I've been using a scanner for a long time. I don't go to the scans on thinkorswim, click high percent gainer and find the high percent gainers, or find the next person with earnings. I don't trade based on earnings. I don't trade on high percent gainers. I don't trade based on what the next company is doing when it comes to a new product. If Apple has a new product, cool, that's great. I don't care. Why should I? I want my screen to be static, and the only thing changing to be the candlesticks because those tell me the story of what's going on. There are millions of dollars being flown through each one of these tickers here. You're telling me you just can't make money on one, how cocky and how greedy are you? To think that you need to trade every single ticker just because so? Trade just one. Companies are making millions and billions of dollars on just trading one single ticker, but you want to trade everything? If they have teams of people to trade multiple stocks, why should you trade all of them? Put it even simpler, this can be a factor why you’re not profitable as a trader. Before, I used to trade much more than 80 tickers. To be honest with you, I used to think, “Well, I can't trade any ticker to become a consistently profitable trader. Let me trade five.” This is how I got the mindset: I chose five, that didn't work. 53 BOOK TITLE I did five for a whole month, it just didn't work. I kept popping chart to chart to chart, it didn't work. Okay, move to four, that was a little better. Then, I moved to the three, then to two, then to one. I trade only SPY now. Do you know what that did? Increased my win ratio because I kept seeing the same movement. Like any other chart here, SPY moves as they have their own personality, and they move similarly every day. After a while, you start seeing a pattern. No matter what pattern you may see, there are different ones that constantly happen over and over again. That's why I trade one ticker. I don't want the complexities. I don't care. I'm not in the stock market game just to have fun. I'd rather be happy and bored trading slowly than poor and having fun by trading hundreds of tickers. Now, pick which one you want to do. Now, let's break down what exactly is an option contract because the strategy that I mostly do, which is the supply and demand strategy that we're learning here, is built around the option contracts. So, here’s what an option contract is. That is an agreement between a buyer and a seller that gives the buyer the right and, specifically, the right to buy or sell a particular asset at a later date at an agreed-upon price. So, the reason why the right is underlined is that you can, hypothetically, buy 100 contracts for $10,000 or one contract for, say, $200. But you don't have to necessarily sell that entire contract as a whole and buy those 54 AUTHOR NAME contracts outright. So, let me go more in detail on that. Basically, what a contract is, is the right for you to buy that one contract. But that is an agreement for 100 shares. So, if one share is worth, say, hypothetically, $300, and you're buying one contract at X price, you're agreeing that you're going to buy hypothetically 100 shares at this X price. So, what some people try to do is that if they're betting on the price going up, they have their price that's going to be lower, so they can hypothetically lock in how much that stock price is going to be before it rises. Once they have that price, if the difference is $500 or $5,000, they usually sell it right away or hold it depending on the strategy. That's the definition from an option contract perspective. And breaking it down just a little more. If you look at the second piece, there's the math formula behind it. So it's just three core pieces. You don't have to necessarily know this, but it's a good thing to understand. So you can track things in a spreadsheet to know exactly how the calculation happens on how much you're buying one contract for. So, the price is this, let's say the option costs $1.20 per contract. That doesn't necessarily mean you're buying one option that’s only $1.20. That's what people misunderstand here. So one option contract costs $1.20 times one contract, which is 100. Remember, like we mentioned earlier, one contract is 100 shares. So, right 55 BOOK TITLE now, it's $1.20 times 100. The last piece here is the number of purchased contracts. So, that could be one if you're buying that one contract, or it could be fifty if you're buying fifty contracts, whatever the number is. If it's 100 contracts, at about $1.15, that's about $11,000 to $12,000 worth of an option price. So when you go into thinkorswim or Robinhood, if you're buying 100 options, as far as the contracts go, you can use this math equation that would equal about $12,000. Or you can just let the system do it. And depending on which one you're using, it should show out that this is how much it is before you buy. And this is that math equation beforehand. So if you want to calculate what works for you, how many contracts you could typically buy at this rate of, say, $1.20, you can play with these numbers and put in 20 times 100 times 2 or 120 times 100 times 30. Simply play with the calculator until you get the calculation and formula. But you can see how high these numbers can go just from that alone. So it's a little bit different. The third piece here is the option contracts’ variations. There are three types, and they are: ITM, ATM, OTM. Breaking all those down, it's basically, In The Money, At The Money, and Out The Money. First, we’ll start with ITM or In The money. We'll break it down, walking through six examples of what this looks like. But when we show you on thinkorswim, these are the prices that are going to be highlighted in purple. These are the ones that are, for 56 AUTHOR NAME the most part, the closest to the price because they're in the money. They're the closest to ATM or At The Money's exact price of what it's worth. The last one, OTM or Out The Money, is things that are very far out there. They're not anywhere near what the current price is. So hence it's out of the money. An example for in the money is if something has a strike price and the strike price is more than the stock’s price. Let’s say the stock’s price is $376. Any number above that, say, $377, $378 etc., is In The Money. The At The Money is the same price that it started at. So if it started at $370, the ATM would be $370. Last, Out The Money would be anything below that. So, instead of $370, which is at the money, any number below that, say, $369, $368, etc., is Out The Money. There are two options that you should be aware of. CALL and PUT. An option CALL is you betting that the stock is going to go up. So, if the stock’s price goes up, which are the green candles as an example, then, if you did an option call, you're making money here. On the flip side of things, if you do an option PUT, you are basically betting against the market, saying the markets will go down. So, if you hypothetically bought at the top, bet that the market was going to go down, then you're making money because you're on the right side, saying the stock will go downward. On 57 BOOK TITLE the other hand, if you have bought so and it doesn't work your way and goes up, you're losing money. If you buy a call and it goes down, you're losing money. So you have to make sure you have those differences kind of defined. CALLs are when it goes up, PUTs when it goes down. And in a nutshell, from a very basic perspective, that's an option contract. This is a very interesting slide because this goes against the other one, against the grain of what most people do. So the question here is, do you rather trade with any indicator, or do you just trade on a naked chart? What's better, a naked chart or having a few indicators on your screen to help you out? Like the RSI, or if you see on the image below, the MACD, and vwap. And then, I'd make indicators. There are probably thousands and thousands of indicators. I could probably make a whole other course on its own self just on indicators alone and which ones are the best and how Fibonacci works and different things like that. But here's the difference. How do hedge funds use technical analysis? The answer is, they technically don't. 58 AUTHOR NAME The above image is the chart of how I used to technically trade when I was losing. I had like eight plus indicators on the screen at any point in time. And those were my "confirmations." My confirmations weren't that good. Because there were so many, I could only make a trade maybe once a week, make some money, but it was just horrible. It was the worst way to trade. And I just hated every minute of it. So I had to start picking things. I had to say, "Okay, well, they're all technically saying the same thing. When you really think about it, so why do I need all of them?" A perfect example is if you look at Apr 9th from the initial image at the very bottom: the stoch RSI is saying is it's overbought. The basic way the RSI works is that once this turns green up here, it's overbought. So, it needs to start reversing downward. So, if I go up on the screen here, see how this it's overbought. And if they're reversing downward. So I made sense. "Okay, so that means anytime that happens on the RSI, I can just 59 BOOK TITLE buy a put option, which is betting the markets will go down and then make money off of it. Cool." That makes sense. But here came the problem. The RSI indicator told me what the problem was. If you can tell this red line above it, here is the top of the line for the vwap. So the way vwap works, as far as the top of the line, is that it should get relatively close and then bounce back downward. So, if that's the case, aren't they technically saying the same thing? Well, yeah, that's true. And there are numerous examples that I could continue on. But, at the end of the day, they all say the same thing. And, usually, you don't really recognize this happening until it's too late. That's why these are called lagging indicators. And what the hedge funds use and what I use, and what I will teach you is the supply and demand trading strategy. In this course, here are real-time indicators. All you need is price and volume. They'll tell you every single thing you ever need. You can completely take off all these indicators and trade on basically a naked chart, just candlesticks and volume. The candlesticks tell you the price, and the volume tells you how big the candles are going to be generally, including the wicks. That's it. Now, the question you have to ask yourself is, what indicators are you using right now and why? One way I like to try to push people a little bit is if you are using the RSI and many people are very familiar with the RSI. Then, if you take it off, can 60 AUTHOR NAME you maybe just do a circle on the chart where it is overbought? Where's the top? Where's the bottom? If you do that, then, you'll realize that "Hmm, if I just read the chart, it's telling me what the RSI would say anyway. So I don't technically need it." And after a while, depending on what you're looking at, they all kind of do the same thing. The only things that are different are price and volume. And this is why real-time indicators matter. You only need price and volume. The hedge funds are the ones that are pushing all the volume in the first place. So they care about the volume because they need to know how much the other hedge funds are putting in and if there are more buyers or sellers. So we need to pay attention to this. When the hedge funds, their competition, need to know that, you need to know that, too. What’s the price? Well, they have the market maker set the price. So they need to know if it's going to get to $270, for example. If the market makers set the $272.5 price before a reversal, they need another price. They know how much you're buying it for their business. All I care about is money. That's it. So you need to care only about what the real-time indicators show you, which is price and volume, because the hedge funds show you that. And that's it. Nothing more, nothing less. You can completely change your game just from doing that alone. And it'll force you to look at the candle. Ask the candle. What are you doing? Where are you moving? Why are you moving like that? 61 BOOK TITLE When you ask those questions, "Okay, it's moving up, the candlesticks are moving up." You may look at the chart here at the top. Well, why did it basically have a wick at the bottom and a wick at the top? But there's a middle candle here, basically, what does it say? Well, when you think about it, it's right before downward reverse. So maybe it's saying that there's a balance between the buyers and sellers, and there's a reversal downward, then this wick is a little bit longer. And this candlestick’s a bit thicker in the first place. That means there were a lot of sellers here, kind of a stepping stone. But there is this wick going downward. Hence saying that there's pressure, there are sellers coming down. So the wicks tell you that there is movement. It's basically an arrow pointing downwards, saying exactly where it's going to go. As far as this stock here concerns, which is SPY, the same thing continues until it bottoms out here. And, if you want to look at the RSI from the initial image, it’s the same thing, but look at the candlesticks at the top of the chart itself. I mean look how long the candlesticks are. If you look on the side, some of them move about $1.50 downward. That's a huge move, just purely red. So, of course, it's oversold, and it's going to reverse. Of course, it tells you exactly what you need to know. It's just that you're not paying attention to what the charts are telling you. Read the chart, read the story, understand the language, and you won't need indicators at all. 62 AUTHOR NAME Now, wrapping up hedge funds as far as strategy concerns, you need to understand how important is level two and time and sales. Now, when it comes to level two, you should understand that level two is down here at the bottom, level two is the blue. The reason why level two matters is that the hedge funds need to understand what their competition is doing. And in relation to you saying what's your competition is doing, which is the hedge funds. Now let's walk through exactly how level two works. And, in the next lesson, we'll talk about time and sales. Now, level two basically is broken up between the exchange here, the bid, and the bid size. Now the bid here is the price. And this is an option put; the price that's going for this option put at the moment is $1.16 an option. And it should be at the money if I remember correctly. For this next exchange, it’s $1,15. So some people are trying to get cheaper and cheaper rates. So, more often than not, these guys aren't going to get bought out. But these will 63 BOOK TITLE because this is the current price of the market, give or take. Hence, if we scroll up, the little gray box is the current price. The current price is $1.17. And now here's what's definitely interesting, that's where we are from a pricing perspective, but almost from a volume perspective, because again, price and volume are the most important aspects here. Most important components, most important indicators. Here, it's showing 59. This 59 does not mean option contracts, only 59 option contracts; you have to add a zero to this. Surprisingly, it's 590 option contracts that are being bought. This is thousands and thousands of hundreds of thousands of dollars altogether for this being put together. So some people in this exchange are buying 590 contracts at $1.16. Some are buying 500. Some people here are literally buying thousands of contracts, which shows on level two, so you can imagine how big of a flow this is. And this is visible for everybody. This is all basically saying, "Hey, this is how my competition is doing. If we're only buying 30, maybe there are enough people to push the price up." Or, on the flip side of things, when it comes to the ask, which is the people selling, you need to know well how many people are selling, because here's the catch when it comes to level two. And when it comes to buying and selling, overall. Just because you're buying, it doesn't mean you'll get filled. Like Apple, these people are at $1.14, if they're trying to 64 AUTHOR NAME buy at $1.14. If there's no $1.14 over here, they're not going to be able to sell it for that price if it got a sell for a little higher, which is great for them. But on the flip side of things, let's say the one down here, they're trying to sell for $3.36. But the price is $1.17. Currently, they're not going to be able to sell this. They can keep it there as long as they want until it maybe gets that price. But, until then, it's not being sold. They have to drop it to $1.17, if not $1.16, to be sold immediately because this is what people are buying it as. So, on the left, these are the buyers’ offers. You, the other market participants, express the wish to buy SPY at this price of $1.16. The people over here are willing to sell right now but for $1.17 or more. That's what the sales are coming in as. Now, in this example image, you can see a lot more sellers than buyers just by looking in the red since there is a higher number there than on the green side. This is because people are trying to get out of these tickers, especially with the price going up so quickly. Some people don't typically like looking at level two, just for the pure fact that some people can put up lies. Hence, like this one here, it has hypothetically 3000 sell orders at $1.20. So this could be kind of a fluff order to say that, "Hey, someone's selling at $1.20." That technically means there needs to be $1.20 over here of about 3000 orders. If there are not about 3000 orders, so 300 over here at a bid of $1.20, it can't go higher than that because you'd have to buy all of those shares before it can push 65 BOOK TITLE up. So the buyers have to win over the sellers. If that's the case, they need to actually do that. That's the only way for it to move. And, with that being said, you have to ask yourself, "Is this a real order, or is it fake order?" Sometimes, they can technically put up $1.20 at 3000, and then, two seconds later, take it down and put it back up again. Then, five seconds later, take it down just to make sure that it isn't actually executed. But that can happen. It often does or vice versa. They could do it on the bid and buy at this price to scare the sellers away, whatever it is. But whether it's the buyer trying to scare away sellers or the seller trying to scare away buyers, it happens both ways. As the retail trader, watch what the hedge funds are doing and react accordingly. You can react ahead of time because you have fewer things to look at than the hedge funds. But this is your window here to understand what's going to happen next. This level two shows you what's happening in the future. Based on that, you can make your prediction: do you stay in or do you not? We'll be talking about a lot of that later on. For now, you can ignore the middle piece here. This is what's called an active trader. 66 AUTHOR NAME This is where you're buying and selling shares, just in and out in seconds. So I love the platform just purely because of that, because essentially, you click the green buyer area, you click the red sell area as long as it's at the money high amount of volume, you're in and out within two seconds. So, something starts rubbing against you extremely quickly, and you're afraid to be down, say hypothetically, $10000, whatever the number is. You could just click one time, and you're out. Compared to other platforms where it's starting to come down, and you have to flip to the next screen, open up the options chart, and say that you want to sell at, hypothetically, $1.14. When it gets to $1.14, you want to sell 20 shares, but by the time you put the order in, it's at $1.11, and there's no order to fill yours, and you have to go back to the chart and all that mess. With this, you click the area where you're buying the price as you get filled; that's great. Then, when you are ready to sell, click the order over here on the right side, and you're good to go. That simple. 67 BOOK TITLE Now let's talk about the time and sales window. The time and sales window here is broken up into three different areas. The first one is time, the second one is price, and the third one is size. Now, the time is exactly when this is being executed. So here's the date and hour. The price is the price that everything's being executed for. The size, similar to before, if you add a zero, that's 40 option contracts, 20 option contracts, 100, etc. Now, you may be asking, "Well, these are much lower. So that's interesting." The reason why there's so much lower, even though that can join to the level two down here in the blue, is because these are real-time, this is real-time flow, showing you exactly what orders are being placed successfully executed in your system at that point in time. So, usually, if you open this up, these prices are flying through. You see $1.16, $1.17, $1.17, $1.16, $1.15, $1.14, $1.18 just back to back different colors is revving everything. And that's basically if you get your order placed, let's 68 AUTHOR NAME say hypothetically $1.20. It pops up here $1.20 and then flies down. See your order here live, basically, but you'll maybe see it down here in level two as well. But it would probably be grouped in with the batch size down here. If there is, say, a $1.20 right here with also another 50 or 500 contracts down here, you'll be filled in, and they’ll be filled here. So this is the bucket. And these are the real-time executions. Now, here's the breakdown of what the colors mean. From a color perspective, the green is the ask. That’s why you see $1.17 on level 2 and then also $1.17 on this Time & Sales. Like this top one here, a recent fill was the $1.16, which are the bids over here. So you can see the live transactions going back and forth. The reason why those are first is because they are near the current price. So if you were to scroll down further to see more of the level two on the platform, more than likely, there would be $1.14 there because the price was originally that low before. So you can clearly know that because one, the time in sales says so if we did scroll down, but also in level two, there are orders sitting at $1.15 currently that did not get filled. This is extremely valuable from a hedge fund perspective because it shows you at any point what's your market, what the other market makers are doing, what the other hedge funds are doing. And, for you, you can say that you want to buy at $1.17, which means you need a whole bunch of other people to buy at $1.17, $1.18. You need those orders being 69 BOOK TITLE filled in. So if you buy a $1.17 and start seeing red orders above yours, that means, more than likely, your stock will start shooting up. Or if you see $1.17 orders as well. You see there's some movement there, and you have a stable backbone. But if you're saying, “Well, I want to enter at $1.17, I entered my play.” And I see all of this blocking me, 300 or 3000 1000, so on and so forth. That's going to scare you. These orders haven't been placed necessarily yet. That's why they're sitting here. These are coming up soon. That means those are going to transfer over there. You need to pay attention to those orders. Maybe it's not going to bounce as you want it to, but it's a good indicator to be able to watch and a reference to so you can know what the hedge funds are thinking and why they think what they think before you act. 70 AUTHOR NAME Chapter 6 How To Draw Supply & Demand Zones As an added bonus, if you learn from watching me walk through it, I put together a free 10 min lesson where I show you how to draw these zones. You can watch that lesson from my course by clicking “HERE”. Now, let's talk about drawing our first supply zone and what will be called, more specifically, a major supply zone. In the following image is what’s called a major supply zone. It is essentially the red rectangle & the blue line above it, which together create the zone. 71 BOOK TITLE The concept is that, from a high level, you're essentially drawing this zone here, waiting for it to retest. Buying an option put in this case means you're making money on the way down. So, the way it works is: first, you check out the five-minute chart of SPY. For SPY, on this specific day for November 20, the way we draw this is by looking at the chart and waiting for this to happen versus the red five-minute chart. There's a Doji candle coming afterwards; then there's the first green candle, which means the buyers are pushing up. And then, there's the red candle with the sellers trying to push it back downward. And then there's this movement coming back downward. So, a large number of sellers to more candles and a large number of sellers coming down, and it kind of continues on before it comes back up to this for retesting. Now, this here, if I get my circle, is extremely important. 72 AUTHOR NAME This is the core principle behind the supply zones being created. This is the buyers and the sellers agreeing that this is the price it should not go above. And they agree that $357.64 is the highest price that this stock should be. And, then, as a result, they're pressing it back down. So what that means, again, they're a business like we've talked about, they care about money, they care about price, which means, if it ever comes back to that price, which is essentially over here, they've agreed that, “Hey, we've agreed that it's not going to go any higher than the top of this zone. See the following image. 73 BOOK TITLE As a result, if it gets near there, that's the highest we can sell it for at this point.” We're shooting this price back down because they care about money. Essentially, they're buying down at the bottom and selling up to the top, for the maximum amount of profit for the hedge funds. Now, let me show you how exactly I drew that. For one, there is a blue line, which I get from clicking my mouse wheel to pull up the settings, and then I click the price level. Or you can go over to “drawings” and then “drawing tools,” and you can choose it over here as well. And you just basically click it one time. You can drag it to wherever you want to, for this kind of price level. And you can do it this way. So just price level. And it's basically at the top of these candles here. 74 AUTHOR NAME So this is important because the buyers and sellers have to agree. This is basically the market makers that I talked about. The market makers are saying, “Hey, this is the highest price that both of us have agreed to.” Let's draw a line going from left to right, basically about the top of this zone. This blue line we have drawn is a resistance line in its most basic form. The next piece we're drawing is technically the supply zone, which is a combination of a little red rectangle and this resistance level. The way that you draw the supply zone is this price of $357.64 minus 10 cents. So that'd be $357.54, which is the price of our line, by the way. So we need to get to .54, and .54 is exactly where the zone will be from the earlier images where the red rectangle was drawn Also, on your settings, if it’s your first time, yours may be gray. So if you want to match the red I have from a color perspective, you can right-click on your zone to choose edit. 75 BOOK TITLE Then, you choose red and click ok. You can also change the transparency if it’s too bright for you as well by clicking more, going to what's called HSV, then transparency. This helps you clearly see the wick. So this is a supply zone. A supply zone is a 10 cent margin for error covering this resistance zone and its self down here because if you're familiar with resistance levels period, they're typically perfected 100% of the time or 90% of the time, to say the least. And they reverse back. The catch is that they don't always touch. But it works because this is exactly what the market makers agree to. So the market makers let the market open up. They set a price target of $357.64, give or take 10 cents of a margin, a margin of error. And, then, once it gets back over here, there's a retest. They make money on their way down, essentially. And this is a big move. I've taken this move myself, and this was about, if I remember correctly, a $4,000 win, which I'll show you, of course, down the line, how I made a lot of money, and how many contracts I bought, where they had the money, when I entered with their confirmations and so on. But that's the concept. And now, if we draw this out, this is a supply zone that was on this chart. Well, there are other components of this chart, and they're telling you the story of what's going on. The next piece is the demand zone. The demand zone is the opposite. At the bottom of the chart, 76 AUTHOR NAME the demand zone would be hypothetically here. And that is what is $356.28. And that would add the same thing, but it'd be green. So you can click on this exact price, plus 10 cents. So, it would be $356.38. And you may be saying, “Whoa, okay, that works. That was great. But look, it didn't touch here.” It didn't have to. You know why? Because this entire chart shows you demand and supply zones outside of the top and the bottom. This is because if I open up my text box here, this is a major supply zone up. Down here is a major demand zone. So here is a support level. The blue line is the resistance level. This whole thing is a major supply zone. There's a support level down here. And this whole thing has a major demand zone. But the amazing thing is that this is where you'd maybe hypothetically buy and sell on these big reverses. But the entire chart shows you the movement of what's called minor zones. So those minor zones could be minor supply zones or minor demand zones. Here's a perfect example. 77 BOOK TITLE There's another zone that's drawn out here. You can basically see the market was above and then came downward to even out here where this zone is before another drastic drop again. Again, this means that there's an agreement between the market makers that this is a zone even at this spot. It comes down a little bit; there's an agreement that this is the top at the moment for the most part, before it revs down to the major demand zone. Now it touches exactly this. And you can see what's interesting, it popped up a little bit through, but it still reversed back down, which is one of the reasons why confirmations are extremely important. For me, I have four confirmations I need to know before I enter a trade. For example, I would have never entered on a trade like this because, for one, it shot through, and two, my confirmations, which I'll show you down the line, were not met. Therefore, I would have never even gotten caught in this kind of trade. This is exactly the kind of thing that happens when people say, "Hey, I was right about this kind of resistance level. But it sold me out here because of my stop loss.” And then it revs back down. Well, that's intentional. Remember, they are hedge funds. The great thing about hedge funds is that all of this is intentional. Hedge funds can basically see where are your stop losses. For the most part, they can see your stop loss, use that as liquidity, buy you out, and then push the price downward, much faster in the first place. That's one of the reasons why there are these huge 78 AUTHOR NAME green and red candles. So those huge green candles coming up push directly through it with almost no friction, buying out all of your stop losses. They, getting all these stop losses from you and me, the Joe's and Jill's, the retail traders, say, "Okay, cool. We got all their stop losses. Let's reverse this, using it as liquidity to push the market back down.” And it revs downward. That's why it barely didn't. If you notice, it didn't hypothetically go all the way up here and touched this or went up here and then started consolidating a bit. It intentionally barely went above it in reverse. That's why it's intentional, you can tell. And then, there's another thing. If I draw this out, this is a minor demand zone here. Based on what we just said, as well here, if I do this as $356.56, plus 10 cents, so $356.56, that is about here. And that's a minor demand zone. See the following image. Now, here is the great part. This essentially allows you to predict exactly where the stock is going. Because if you look at it, the market opened up, came here, and created this major supply 79 BOOK TITLE zone. It did what it needed to do if you had a fundamental understanding of where the market was going based on these minor zones. But it came up, retested it, you bought in at this price. And you don't have to sit here and wonder, "Well, where is it going to go? Should I sell here? Or here? Or, maybe, here?" You don't have to wonder at all. You simply sell when it gets down to the next bottom zone. Which, in this case, is the green minor zone. That is mainly because these zones, especially the minor zones, act as magnets. You buy at a major zone and sell it. The next minor zone is where all the profits are; it tells your entries, and those are your exits. And it's telling you precisely when to exit. It's just a matter of you reading the chart exactly like this, with this kind of level of analysis that will show you, "Hey, this is where I'm entering this is where I'm exiting, and no matter what, I'm sticking in until the chart tells me to sell." Now, if I go to the one-minute chart here, it will be the same 80 AUTHOR NAME thing; everything should be drawn in the exact same way. You can see exactly what we drew here. Now, look at the full picture of what you just saw on this 5 min chart we have been reviewing. It came up, the zone was created that we've drawn, did what it needed to do by coming down, then it barely came back up to touch it with just one candle before it reversed down. Here's an example of the 1 min chart where you would actually do the entries/exits. You could have bought literally at almost any time. But, again, you wouldn't because you need to enter based on confirmation, which we'll go over soon. It came down to huge candles on the last two and bounced directly off this minor demand zone, almost pushing to the next kind of major demand zone down here. Again, this is labeled here because the major demand zone, major supply zone up here, touched it and did what it needed to do. You may be saying, "Maurice, look, I could have sold here. That's bouncing off," That could have been a price target as well. 81 BOOK TITLE If we go back, where is it? Yep, about here or so, there is some friction here. As you can see in this line, this kind of support level, there was some friction here, which was definitely interesting because that's a small minor zone before it bounces up and vwap. Be careful that you need to exit based on confirmation as well, which, again, we'll go over in later lessons. But there was only that. Now we're jumping back and forth. There was only one green candle that was very small. There was no need to sell. I would have sold here for sure if there were two green candles coming directly out of it. Then, I also would have said, "Okay, I don't want to lose any profits," just in case of me getting "greedy" and going to sell, but it was just one green candle, not very much friction, and it didn't even come above the following one. And it just rubbed down there afterwards. If you want to know if you would’ve bought in there, you can hypothetically go back on November 20. At about 10:34 or so, buying an option put on here. Play it out, see what you get, see what happens, see what doesn't happen, and just play it constantly. This is exactly how to chart the SPY for November 20 for the supply and demand zones. 82 AUTHOR NAME Chapter 7 How To Read Price Action & Trade Entry Criteria Next, let's talk about price action. Price action is arguably one of the most important fundamental things you can technically do. This replaces the need for all other technical indicators. This replaces your need for, mainly, the majority of your fundamental analysis—also known as news—or understanding where the markets go from a high level. Basically, this replaces any kind of fundamental understanding of you trying to predict where the market is going by actually reading what the market is doing and telling you. In other words, as far as my personal definition goes, price action is the act of reading the chart’s story that the candles are telling you. So, each candle is telling you a specific story that's 83 BOOK TITLE happening at that particular point in time. And that can be broken down into, as an example, from a hedge fund perspective. Let's just say there are these green candles moving up. There is this kind of consolidation period that's basically bottoming out. And you can see it kind of reverses backwards before it comes up. So, in other words, the movement is purely upward. But the story that the chart is really telling you is that, “Look, it's a green candle, buyers are winning, green candle, buyers are winning, red candle, but there's a green candle. And it's topping out with one, two, three, four candles here that are saying that, no matter what, the price is not going any higher than this. As a result, as the hedge fund, I have to sell some of our shares to press down to get more liquidity at a cheaper rate. And, as a result, we're getting those stop losses from the retail traders, such as myself or you. So they're buying things that are cheaper right here. And then look what happens directly after, they're pushing the price back up with almost 100% green candles, except for this kind of one middle candle here, where they're trying to do the same thing. And it continues to push up. So, essentially, the perfect example is, say you bought here at the high, it came down, now you're at a loss. Some people might have technically held on, and it came up. You're riding it up. Some people are up here like, “Man, I could sell when I want to, but I'll sell if it goes maybe two points higher, one point higher, or whatever it is. But the idea is that this is their breakeven point 84 AUTHOR NAME at this level here. Hence they let the candlesticks come down to this exact level. Get your stop loss where you've put it, where you're at your breakeven point, and it rides back up so it can continue running upward. That's the whole idea behind price action. You don't need all this stuff down here. You don't need the RSI. You don't need MACD. You don't necessarily need VWAP, especially not all three levels of VWAP. You don't need Fibonacci levels. All you need to know is what the candlesticks are telling you at that moment, and then, on top of that, not panic just because you see a big candle like this. Because, for all you know, if you're doing a call, an option call, the chart is going exactly the way you want to. But you just have to interpret what the candlesticks are telling you in the very first place. So entry criteria is the next kind of step here. There are four entry criteria based on the supply and demand strategy that we've been basically walking through step by step. There are four things here, and I'll give you an example coming up of what that really looks like, as it relates to price action as well. This is a fundamental piece of price action so that you're looking for these exact things to happen. You basically need four candles to happen. Let's say, hypothetically, in this scenario, the zone—the candles—are coming down to touch a green demand zone, whether it be major or minor. And this all has to happen before you enter a trade. So, there has to be a lot of patience with this. So, for one, a zone candle has to happen, and these are all 85 BOOK TITLE things I've technically coined and came up with myself. A zone candle is, essentially, when the candle comes down to the green demand zone, and it has to be the final red candle that touches that green demand zone. That's your zone candle because it's touching the zone. After that, there's a second candle that needs to form, which is called the reversal candle. So that's essentially the same scenario. There'll be a green buying candle, a green candle coming upward, saying that this is reversing. So if we go back, basically, if the stock is coming down, it touches the zone. There, to me, is a zone candle because it touched the zone. After that, there'll be a green reversal candle, which is the first candle coming up. From that zone, you can think, “Hey, this is confirmation that it's reversing.” So this is the first reversal candle. Then, a third, you have what I call a confirmation candle. A confirmation candle is a candle above that reversal candle that's already formed. Within the one-minute timeframe, we saw a candle saying that “hey, above this is another confirmation,” called the confirmation candle, saying that this is green and is 100% going up at this point in time. Hence, this is going to be your third confirmation. And on the fourth one, as long as the next fourth candle is forming above the fault, that precursor, that pre candle, is called the confirmation candle, the reversal candle, and that zone candle. Then, you enter on this at this entire candlestick here, you enter right as it's forming. You don't wait till the end, but you enter right as it's forming. So, this is your 86 AUTHOR NAME entry point, hence your entry candle. So these are the four steps: 1. Zone candle because the candles touch zone. 2. Reversal candle because it's the first candle that's coming up from the zone. 3. Confirmation candle because it's another candle, the same color showing a further reversal that's about to happen. 4. Finally, your entry candle; the candle that you're entering on the trade because it's continuing this trend. This is the four-part entry criteria for day trading when it comes to the supply and demand strategy for SPY. Now, when it comes to this, you can tell that a lot of this is a big waiting game. So, you create the zones of, say, 9 AM, which is 30 minutes after the market opens, and you're waiting for hypothetically an hour for everything to come back down to touch your zone. That's kind of step one of what we did earlier. So, drawing those zones, they will be our supply and demand zones. And then, there's step two, which is waiting for our four confirmations to happen—from the zone candle, to the reversal candle, to the confirmation candle, and finally, the entry candle being formed. And, again, you can see that's a very big waiting game. So, you don't need to stare at the screen the entire day. Have a software to set an alert, which I've talked about before, to announce you when this stock gets to X price. You need to have an alert set to give you a notification. That could be in 87 BOOK TITLE text, that can be on the phone, or a notification on the internet, whatever it is, but you need an application to tell you to do so. So you can go ahead and do other things you want to in life. You don't have to stare at the chart all day, every day, reading price action constantly. So two software that I've played around with that do get the job done and are just fine are: Stock Alarm, which you can download as an app or use on the internet. It's 100% free, so use that basic feature of the stock alarm. But if you want to remember correctly, at the time of writing this book, in early 2021, they have a paid version. If you want to buy, you can have more than five alarms that you can set. But, if you're like me, you only need to set one alarm per day, maybe two. And that's all you need so you don't have to pay. So the free version worked 100% well for this. Weeble is the second option here. You can use it if you already have an account with them. I think some other brokers are decent when it comes to this. But I don't trade on the Weeble platform. I can basically set alerts or alarms on there to announce me when SPY gets up to X price, and give me a big bell sound so I can come running back to the office to trade if I have the volume up pretty high. Or you can do it on the phone since there's an app as well. For day trading, I use thinkorswim. The previous platforms are just for setting alarms, or that’s the only thing I need from 88 AUTHOR NAME them. The only reason I don't particularly use thinkorswim, from an alarm perspective, is that it’s not the best to use. Since you can go in there, you can put your alarm by right-clicking and going to alarm and setting the price you want to. But if it's too far away, for example, more than 20 to 30 cents, it doesn't let you do it because it gives you an error, saying it's too far away. So because of that one restriction thinkorswim has, these are two alternative options. You don't have to set an alarm, but I highly recommend it. So you can set it, forget it, have no FOMO, walk away, forget about it and just come back only once your alarm has sounded, turn the alarm off, and get ready to trade. These are my two recommendations, so you don't have to stare at the screen all day. So here, this zone is called zone and reversal candle movement. This essentially shows you, no matter what, these are the three main ways when the candlesticks hit these zones what happens next. The only fourth one that's not displayed here is if 89 BOOK TITLE the candlesticks touch the zone but run straight through it and never come back up. That means that the zone you picked is not strong enough. It wasn't a very sturdy zone, if you will, having many orders sitting there, or it was too tight between one demand zone and one supply zone, especially if they're minor zones. And the bounce could not necessarily happen. Or, worst-case scenario, you can also say that from a holiday volatility perspective, which is one chart we've gone over for the analysis perspective. Things act a little iffy when it comes to holidays. When it comes to days like that, there are much more people involved in trading than normal. So some wild moves can happen. But other than those special occasions, these are the main three things of what can happen. So let's walk through that. So these are all one-minute charts, but we can walk through them step by step, starting with the top one. We can go step by step to show you the candles from a price action perspective and what they tell you. So, what happened here, on the overall chart, there was a zone formed in the past before as a demand zone. Then, we waited for it to come back to retest with one candle to touch it. Now, the first red candle to touch the zone here is what we're going to call the zone candle. And, essentially, the reason why we're calling it the zone candle is that it's the last candle closest to the zone—or even touching the zone—before a reversal starts happening. So this is your final zone candle here and the red here. The next candle here is going to be your second candle, 90 AUTHOR NAME which is called the reversal candle. This is called a reversal candle because it's the start of a new candle color before the trend ended. So, the trend was red candlesticks coming down, so that was the zone candle, then the new trend starts, which is supposed to be a green candle. And that's this reversal candle. After that, we finally have the next candle here, which will be called the confirmation candle because it's a continuation of the trend that happened before. So, we have a red candle for the zone candle, then a green candle because it's reversing, so this is a reversal candle. The next candle is this confirmation candle, which is confirming that, yes, it's still green. So, it's still going up. And yes, it's actually above the candle before it. So this is that green kind of confirmation candle. The candle after that, you guessed it, is the entry candle. And you're not waiting for this entire candle to form here, you're waiting for it the first maybe one to three seconds, five seconds max of this candle, and then you're buying in as long as that final confirmation that that candle is being formed above the previous one, which shows that it's still a movement upward. And then, two, it's a green candle that tells you can start buying it. So you'd hypothetically buy here and get all your money on the upside as well. From a five-minute chart perspective, I would imagine that kind of zone’s probably about right here. If we go over to the right, it's probably ended at about $337.2, depending on what the chart said. But from a price action perspective, that would have been kind of our targeted exit from 91 BOOK TITLE that perspective. And imagine it pushes down to about this so we would have exited about probably at this kind of wick here. This makes sense because you can see the red candles starting to come down, a green candle that goes up a little bit, almost meeting it. And then, just kind of constant friction as far as we can see of a little bit above this but basically below it. A few Doji candles that are upside down etc. But this is the flow of what the confirmation looks like. There's a zone candle, reversal candle, confirmation candle, and then your entry candle. Now, this is the best-case scenario. The second scenario is down here in the middle of the original image above. This is a little different, but it's about the same. The five-minute chart actually had a zone created here, came all the way over, and there's the candle that finally touched it. So, this first candle here will be your zone candle because it's the last, and it's the end of the trend. It's the final candle that's finally touching this green demand zone here. The next candle here, this small little guy, will be called your reversal candle because it's the end of the trend before. So, this is finally that new color coming into the market that's bouncing off the demand zone. The next candle here is also your reversal candle. These are both reversal candles mainly because they are going parallel next to each other, they're side by side. This is not necessarily telling you more news from a price action perspective than this little guy over here. As a result, these are both reversal candles. So, that 92 AUTHOR NAME means you have to wait again for the next candle to form above it. Remember, our following candles for the confirmation need to form above the candles, which is the reversal candle. So that's what happened here. This next candle form is finally our first confirmation candle that we would be saying we're going to enter this. We actually wanted this to happen because it's above our previous reversal candles. That's great. After that, we have our entry candle, and we technically would have entered at the bottom, if not somewhere in this candlestick period. It also proves it because the previous has proved to us that it's going to go up. So it's going to go up. As seen on the chart, there is a significantly large red candle here on the chart that finally touches the green demand zone. So you may be a little worried, but it's only one red candle in the first place. So it's not necessarily the worst news in the world. The good news is that there have been four candles to prove that it's going up. And it was finding one candle to say, well, there's a little pressure to push down. So it may not be the easiest trade like the one up here, which you can call an easy trade since it just runs up for the most part. This is more of a medium trade, per se. So there is a little friction. But, again, it's all upside from here. You can see how high it goes and even goes off the chart for the most part, even up to the top of the chart, depending on which wicks you look at, which is above the supply zone over here in the first place. Again, we'll walk through actual examples very soon, very 93 BOOK TITLE quickly. But this is kind of the second scenario of what can happen. Now, if we go again to the bottom chart from the original example, this is another one-minute view where we would be reading price action, but drawing the zones on the 5 minute chart. It moves over to the right, and here's what starts to happen. We have our first candle that touches the green demands on, and what will be that called? The first candle that touches the green demand zone is called the zone candle. As a result, that's good news. So far, we don't know what the rest is doing. Let's just pretend we can't see it. So this is good news. This is the zone candle. The following candle after that will be your reversal candle because it's a new color. It's a new trend that will form after that. So, so far, it's good news. The next candle after that is supposed to be our confirmation candle. The catch is that it's supposed to be above the following, the candle from before as a green candle, and it's supposed to be green as well. But, unfortunately, there was a huge red candle, small waves, but a huge red candle coming down, so the price action said “No, we're not going to be able to get that constant moving up yet.” From a hedge fund perspective, we need to get some of that liquidity and get some little stop losses from the retail traders if they have some of that there. And let's just start pressuring them out because some people want to enter purely based on this. So, some people enter here, they're getting their stop losses taken out, 94 AUTHOR NAME and that's one reason why this body of the candle is so long in the first place when you look back at the chart. And you can see there's this casual, small build up back to go above the zone where it should have been going in the first place. So this was to panic you out to sell. This is them trying to push their way back up, which they can only do slowly. So that's exactly what the price action is telling you. So, let's kind of review, and I can show you where the actual true entry is. So, for one, this is the zone candle. Two, this is the reversal candle. Three, this is a failed confirmation candle, so you don't worry about it. So you need a new confirmation candle and a new reversal candle. You need the whole pattern to show and prove it to yourself. As far as a reversal candle goes, it will be the first green candle coming outside of the zone. Then, the next one will be the confirmation candle. Followed by the final next green candle will be your entry criteria. The good news is that if you can get on one of these kinds of hard entry points on a SPY trade, you can easily see how easy it is to enter as long as you're waiting. The catch is that you have to wait, have to be patient, and wait for those candles to form. I’ll show you in the next lesson coming up what it looks like on live and how patient you have to be as a trader for this to work. If you're not patient, you're going to enter too early or get caught on false breakouts, false pullbacks, and it's not exactly the best scenario you should be in. So, without further ado, let's go ahead 95 BOOK TITLE and jump into the next lesson. 96 AUTHOR NAME Chapter 8 How To Use Price Action To Enter A Trade Now, as an added bonus, if you learn from watching me walk through it, then I put together a free 10 min lesson where I show you how to enter a trade using price action. You can watch that 1 lesson from my course by clicking “HERE”. Playing out November 20th, we can walk through the entire criteria for entries, which will be the zone candles, the reversal candles, confirmation candles, and the entry candles. Starting off, if we look down here, we have this chart we went through before when we were drawing our supply and demand zones. 97 BOOK TITLE Initially, this was a red supply zone, just like that. And this is that five-minute window. Remember, there was a zone created, went over waiting for this retest to happen. And this is what we're drawing those zones, but now, we're finally jumping into the phase where we can go on the one-minute here, and plan our entries and plan our exits, and plan all waiting for the confirmations to exactly happen. So, on maximizing sales, basically draw on a few things out here for you to get a better idea. These supply zones are essentially marked with this little circle because what touched here is exactly our zone candle. It's a green candle that touched the top. Since this is a supply zone, it's going to be a green candle. And what we want is a reversal candle, which is this red candle coming down after. This would hypothetically be our reversal candle. But you can see, right after that, there was not a next candle forming to look like this but red, going downward. Hence, that would have been a perfect entry for us to start following 98 AUTHOR NAME along. But, instead, it became this green candle. This is basically X-ed out because it kind of cancels itself out, it has to start over. See the image above where the red X crosses out those two candles. So, first, there is a zone candle which is labeled at 0, the next two candles form ^ they essentially canceled themselves out. So neither one of these reversal candles would be #1. Then, the following one is our first reversal candle. This is labeled #1 Next is our confirmation candle. And here's where we're entering on our entry candle, here at about 10:41 AM if you look at the bottom of the image. So we can let everything play through step by step. Starting with before the candles touched the zone. 99 BOOK TITLE So you can see, it touched our zone candle. So what we want next, best-case scenario, is our next candle to start coming down, but red rather than green. And you can see that's what it's doing here. So we want this red candle to start coming down. This next candle would be the reversal candle. You can see these are pretty decently-sized from a volume perspective even before as well. So, this is the key piece; we're just waiting for the next one starting as red. 100 AUTHOR NAME So it almost looks like it's going to be our confirmation candle. If it was, we needed to start forming exactly like that, but just red. Look what's happening. Now, it's coming back up, so it's essentially, for the most part, canceled out, which is exactly what we've talked about. Now we're waiting for our actual confirmation candle from the next one. So we're waiting for the true reversal candle. So this is a reversal candle now according to plan. We know this because it 101 BOOK TITLE directly formed after our zone candle and is our next candle since the previous two were canceled. So we're hoping this next one forms when it's closed at somewhere down below the previous candle so that'd be our confirmation candle. As seen here. And now, we just kind of wait for this to play out here. And that, played out, that's a confirmation candle. This is going to be our entry candle, and we'd be essentially entering at about this price. 102 AUTHOR NAME So let's go ahead with an example. We're doing a put at the strike price of $357, and we hypothetically would choose 0.82 which is the current price in cents. And let's say we're buying 75 contracts. It's about $6,100 or so. This is what it would look like So the more it goes up, the more we win. And so, you can 103 BOOK TITLE see, it's going back and forth a bit of a Doji candle, it's moving up a little bit, you don't have to panic necessarily, just because it's doing it. The idea is that there's been so much confirmation before, and it will be pushing down afterwards. So there's a little pressure as well, going upward. We already know exactly what happens. The candles are constantly going downward. If we're at 89 cents, hypothetically, we're up $300 at this point. The entire idea would be that we're entering here, best-case 104 AUTHOR NAME scenario, and we're looking to figure out if we are going to exit, say, hypothetically here. Whatever the case it is, it should have already been pre-planned. But let's draw this outward. So our exit could be right here at VWAP (pink line), just for this example, because there is an overlapping zone over it. Or it could be right down here. Either way would work because it's zone to zone, essentially because they act as magnets again. Now, let's go back here. And you can see clearly that it's about to touch that zone exactly. So worst-case scenario, really because we know it's going to blow 105 BOOK TITLE through. We can go to our charts on the right here, and if we sold, this would be up about $900 in profit, essentially. We can keep letting it play because we know that it will keep pushing down past that, much past that. See, there is a little pressure to push back up through this green demand zone in the image here. 106 AUTHOR NAME There's a little bit of a huge wick there going upward. But pushing it back through the demand zone, there is a possibility you could sell here if you're worried. For me, I'd personally rather wait for at least two candles, or it will be green kind of give me that that confirmation for an exit that it's going to be pushing through. As you can see what happens here, it's clearly trying to press to the bottom, it touched our zone. This is our exit point. Now, if we sell that, it's for a profit. You could sell it just by clicking the price in active trader a profit of about $3,000. 107 BOOK TITLE So this process works only when you respect the zones by drawing them before you enter. You need planned entries, exits, and know where the chart is going from reading the candlestick price action. 108 AUTHOR NAME Chapter 9 Stop Loss 101 On How To Not Lose All Your Money When it comes to risk management, you have to know how much money you can lose per trade. What I mean by that is to choose your magic number, if you want to call it that. So per trade, how much money are you willing to lose? Here's a perfect example, let's say you are in a trade, and you have $10,000 in that trade. You have to be willing, for one, to have your stop-loss, which we'll talk about very soon of what it is and where to place it exactly. But, from a financial perspective, you have to be willing to say, “If it ever gets to this zone, this is where I'm stopping.” From my perspective, as an example on a $10,000 trade, I 109 BOOK TITLE don't want to lose more than $700. My upside is way more than that, so I'm okay to typically earn twice that amount. Find out how much you are willing to have into your account and make a day trade over as an overall number. So if you have $10,000 in your account, are you willing to trade all of your $10,000 per trade? I hope not. Otherwise, your money could end up just burning money. If you have $10,000, your account, scale down a bit. From that perspective, maybe trade with about $5,000, maybe trade with about $2,000 until you get more comfortable with your win ratio percentages. The perfect example is, let's say you're trading with $2,000, and you make $500, which you trade now. You would make another trade with another $2,000 and make another $300. You take another trade, you make a loss, but it's only $200. So it's kind of net positive regardless. But you have that one ratio that's continuously growing, maybe then start upping your trade from trading with $2,000, maybe trading with $3,000, and so on. Because I can tell you this, trading with $2,000 is a lot different than trading with $10,000. And it's a lot different than trading with $50,000. Don’t think that if you had more money, you could make better trades. The problem is, the more money you have, the harder trading becomes. That's because if you put in $2,000, and a trade goes against you, you're only negative, let’s say, $100, maybe $200. But if you have $10,000, and it starts going against 110 AUTHOR NAME you, that same amount of change could be saying that you're down $500, you're down $700 or $800. And it's a psychological shift that you have to get in your head to say, Hey, this is going down crazy. Well, wait, no, it's not going crazy. It's just that my numbers are higher. So you can only imagine the amount of stress that you can go through if you’re not used to trading a higher amount yet. If you trade with big numbers, you have a big upside but a large downside as well. Sometimes, people can lose a lot of money, but sometimes, they can earn a lot of money. Don't get caught burning your money like this on this picture on the right and have some risk management. Find your magic number, how much you want to make per trade, and how much you are willing to play with per trading account. Now, let's talk about where to place your stop loss when it comes to using the supply and demand trading strategy. When it comes to the supply and demand trading strategy, there are only two real places where you can set those losses for the stops—it's either going to be at the top of the zone or the bottom of the zone. If you're a little more on the conservative side, you're going to place it at the top of the zone. And that would be a perfect example if there's a major demand zone. So the price is coming down to your green rectangle, which is in the green demand zone. You have a red candle forming a zone candle, a green candle forming a reversal candle, another green candle above that reversal candle that’s the confirmation candle. Then, you're going 111 BOOK TITLE to have your entry candle you're entering, which is your entry candle. You do all that perfectly as it shows you waited exactly as you should wait for the confirmations to happen. You entered the trade hopefully thinking it's going to go net positive up above the candles formed there. But, sometimes, it goes reverse and goes down to the image here. What you do then is one of two things. One, if you feel you want to be more on the conservative side, make sure you have a tight stop there to ensure you don't lose a lot of money. You're at the top of that green demand zone; the top of the zone is where your stop-loss is. It touches that zone with the entire candle itself, not necessarily just the wick but the entire candle body itself, then you're selling. If it doesn't, then you're fine and let it run up. Consequently, on the flip side, on the bottom zone, the bottom of the zone is where you're actually swinging for a home run. So, now, we have to figure out which stock to use. This is a little controversial, depending on who you ask. But it's still a personal preference for me, a personal preference for most people. It's your money, after all. So you choose how you should actually interact with that, of course. When it comes to stops, there's either a physical stop loss or a mental stop loss. I personally use mental stop losses and think it works perfectly for supply and demand trading strategy. But it's up to you. Well, let's talk about the differences. A physical stop-loss in the TOS system 112 AUTHOR NAME is the indicator that shows you that you can buy at the price you want and sell at a price above it. But there's a tab in the thinkorswim platform, which is what we discussed earlier as the Active Trader window. The catch about that is that it's seen in the system. You can see where it shows you almost a chart that says, “Hey, price, hypothetically at $1.20 per option contract, this is all we're selling if it comes to this level.” So, if they say the price is at $1.30, you can place a stop loss at $1.20. If it ever gets to that price, it is not below your execution to sell at a loss, so it doesn't continue losing. But it's physical, so you can see it in the system. A mental stop loss is basically in your head. You know exactly where to exit your trade. So, rather than saying, “Hey, once it gets to $1.20, $1.21, or whatever that magic number is, you go based on the zones—the supply and demand zones we’ve learned. Once it hits the top of your zone, you're selling conservatively. That's the difference between the physical stoploss versus the mental stop loss. In the next lesson, I'll walk through why I should actually choose the mental stop loss. In continuation of the previous lesson, one of the reasons I don't use physical stop losses, and I use mental stop losses, is because of what's called “stop-hunting” by hedge funds. And that's essentially a lot of manipulation by the hedge funds where they move the candlesticks' price action to steal your physical stop losses. 113 BOOK TITLE As an example of that, let's say the option contract is at $1.20, you have your stop loss at $1.10. You have an exit of, let's say, $1.40. But your prices are that you entered it as $1.20. And your exit for a stop loss is at $1.10. What happens here is that the hedge funds can technically see the level two data and time and sales just like you. But they can also see the level three data, which is technically your actual stop losses. So if you place a stop loss at $1.10, what typically can happen if a lot of people do the same thing, the hedge funds can look at this price, $1.20, and rock the price to $1.40. But, before they do that, they want to do it as easily as possible. So they're going to press and sell their shares down to $1.10 or $1.09, whatever it is, and then start using that money as liquidity so they can buy at a lower price and rocket the cost of the share or the option contracts upward to that target at $1.40. So you were technically right about where the stocks were going to move. But you're wrong from a profit perspective because you're in the negative since you sold for a loss at the stop loss side of things. And that happens pretty often for many people. So that's one of the main reasons why I use mental stop losses. Now, if you're new to trading or early on, you can go back and forth between maybe using physical stop losses and giving mental stop losses a try. But you have to have some form of risk management in place not to get hit by this at all times. So, maybe, if you have a physical stop-loss, it may not be the best to place it above that 114 AUTHOR NAME top zone from a conservative perspective. Maybe you place it at the bottom, place it so if it goes a little bit against you, maybe you get a little worried, you can always move the stop loss to the top of the zone and just sell immediately if you would like to. Whether it's physical or mental, you need some kind of risk management in place. Now let's talk about a few examples of trades gone wrong. These are trades that I've personally done myself and had a loss on both of these coming up. What we will be referring to is the following image. These next two trades are trades I got wrong. And we'll start at the bottom here. The bottom one was a potential trade that I had. Unfortunately, I had a loss of about $700 or so mainly because I was trying to trade based on the news and not on my actual criteria of how to enter and exit. I didn’t pay attention to the zones, the flow of the market, and things like that. I did 115 BOOK TITLE something completely out of the blue, which was one trade based on news, which I never do. But just my high of thinking that I was the one going to be right about the news here. So let's walk through this example gone wrong, unfortunately, so easily predictable. This is the one-minute chart, and you can see this was December 21st, 2020. The prices opened up and rocketed downwards on that 2nd chart above, which you can see because of all the red candles moving. As you can see on the chart, I went ahead and drew two supply zones, which are the red rectangles. For the most part, the market was trending down early that morning. One of the things I wanted to happen here was that I thought this was in the US market. I thought the entire market was going to be down trending completely 100% negative because of two reasons. One, because there was a new string of the Coronavirus in the UK that had come out. So I thought there would be a mass hysteria mass panic all over the world, and not just in the UK. So, as a result, because of just that alone, for the most part, I thought the cost of everything from a SPY perspective, which was going to be down trending the entire day. But look what happened, it was up trending. And I didn't even pay attention to the uptrend here. You can clearly see this downtrend in the morning, but afterwards, it was up. I was incredibly confident that everything was going down. It gradually started to move back up slowly, but I didn't pay 116 AUTHOR NAME attention, unfortunately. And what ended up happening was, it came to the zone. I was so confident that it would touch this zone, and I didn't follow my entry criteria, which would have helped me. When you look back at the chart again, you will notice there was a zone candle and the reversal candle, which is great. But then, there was a Doji candle, which does not count as a confirmation candle. As result, I went ahead and used it as a confirmation candle and entered the next trade. Then, as you can see, it just started reversing backwards and hit the zone and just continued to run up for the entire rest of the day. It was up because, from a news perspective, there was some positive news about the stimulus check being passed. It hadn't passed the moment during this time, but it was some good news about it, per se. I thought the negative news of COVID would override it even if it wasn't different, not in the United States. Regardless, here's how I stopped out, unfortunately, but fortunately, I still followed some of my rules. So I entered this trade incorrectly, and it started reversing on me, unfortunately. I gave it some time to possibly work, and I basically exited at the back of this zone for a small loss. Now, remember what I mentioned, You can exit with a stop loss at the bottom of the supply zone. Or you can exit at the very top of the zone worstcase scenario to give it some wiggle room. The good news is you can see how tight of a move that is, so I didn't lose very much money at all. Just $700, But usually, my moves are so large that 117 BOOK TITLE they out beat that loss by three times, minimum. Other than that, I was stopped out for a pretty decent loss, which was not significant. Now, let's talk about the same image, but at the top. You've probably already seen this in one of our earlier lessons. It showed a false breakout, and then it came back to reverse this way. Now, on the left, you can see a green demand zone was created. Flow-wise, it had to bounce up from that zone and came back down to re-test the zone on the right. Here, again, it was one of the few times I got caught listening to the news. There was some positive news again. I don't remember what day this was. It was a little bit before December, probably November or October. I can't remember the news precisely. They were positive for the United States, anyway. So I thought if the news were positive, everything would be running off. So they got started up and came to the creative zone. I was hoping that it would touch this and just rush off again. 118 AUTHOR NAME Unfortunately, I was so confident that things would pop and push that I did not follow my criteria at all. So here's what happened: a red candle coming down, which ended up being the zone candle here. This was a reversal. And then, I was so confident that I didn't wait for any confirmation candles, I didn't wait for an entry candle, I ended up just entering right there on the very first green candle that touched the zone on the right. My thought process was thinking that was the bottom so, because of the zone, it would perfectly bounce. The reason why I thought this is that I didn’t have my full strategy at that time. So I did not have all the correct confirmation candles in place yet. Everyone does this sooner or later. So it's just a normal part of trading. And look what happened. Nevertheless, this happens to some of my students now if they get too eager to enter a trade. In this case, I didn't follow my rules. It basically went completely down quickly. I ended up selling it fast. You can see it basically bought them out for the most part here and froze up. So it's another kind of idea behind what I mentioned before that I was wrong about the entry. I was right about the overall direction of the market that day. But these are two examples of trades gone wrong. So, all to say, follow the actual criteria, all the methods, follow the strategy, and you'll be fine. It's harder to lose when you stick to your plan. When you start skipping out and adding things to this whole strategy of doing the news, looking at pre-market, and things like that, you 119 BOOK TITLE start losing money. Or when you start taking away things and not doing all the entry candles, all the criteria for entries, and things like that, you start to lose. This strategy is created to the point where, if you follow all of it, more than likely, you're going to win at a very high percentage rate. When you don't follow it, you will likely lose, unfortunately, or get lucky. Avoid my mistakes from these two trades gone wrong; ignore the news and stick to your trading rules and plan. 120 AUTHOR NAME Chapter 10 Where To Place Your Stop Loss Now on the chart we will be going over is November 20, 2020. I'm going to show you another potential trade gone wrong. I didn't take this trade myself. But this is another idea if you don't follow the rules exactly, you can get caught, especially if you don't look beforehand at what's going on. This was a minor demand zone here in the green. 121 BOOK TITLE The major zone is down here at about 9:10 AM CST, and this is a minor demand zone at about 10:40 AM CST. It touched your perfect demand zone, came up a little bit, and it touched it numerous times, for the most part. It touched it here and touched it here for a big reversal to push upward. With that being said, this typically means that the zone has been touched once or twice, but usually, once is enough. As a result, once it comes back down to it, it can bounce again. But the lower, the more it bounces, the lower probability that it actually will bounce. So, that's why over here, on the right, it didn't bounce necessarily from a five-minute candle perspective, and it just shot straight through. 122 AUTHOR NAME Now, let’s see what exactly that looks like and how you could have gotten caught on this chart here. So this is where that failed bounce happened. The market was consolidated onto the side, and it finally came down and touched the zone. So, this here is our zone candle, this one red candle coming down. Because it's such a zone, it's the red candle at the end of the trend. This next green candle is our reversal candle. And that's because the green candles are the 123 BOOK TITLE reverse of that red one here. The next one here is our actual confirmation candle. If you notice the next one, the next candle here is not an entry candle because it's not green. And also, it did not start above the next candle like this fake green candle I drew here. You want this, and then you can enter. If there's not that, then, more than likely, it's not a good entry for you. As a result, let's just say, hypothetically, you entered this trade because you got a little trigger happy. So the way you would get out is to have your stop loss either at the top or at the bottom like the following image. 124 AUTHOR NAME So this is the top of the zone here where you place your stop loss or the bottom of the zone here where you place that stop loss. Since this is somewhat fairly close, the best place to place your stop loss would be at the top of that zone. Or vice versa, let's say the three candles formed as it should, but it only got to get a line here. The height was very small, so it would be okay to stop out at the bottom of that green demand zone to give the trade some wiggle room to work. 125 BOOK TITLE What you need to remember is that the more a zone is touched, the weaker the zone becomes. The less usable it becomes. But, essentially, that's where you would stop off in a typical kind of demand zone here. The good news is that they all are about the same relatively. So if you create a zone as a 10 cent zone, you're either stopping out of the top or stopping out at the bottom. There's nothing more to it. Following this, showing you where exactly to stop out because, as long as you have your good entries and good exit targets, and you place your stop loss at the top of the zone or the bottom of the zone, you're set and ready to go. 126 AUTHOR NAME Chapter 10 Conclusion I'm happy to say that you’ve finally completed the book on how to Day Trade Like A Millionaire. You should be very proud of yourself because not everyone can complete a book on how to day trade. As an overview, you've learned how the hedge fund trading strategy works, you have a basic knowledge about options, and how to predict stock movement with the supply and demand trading strategy. Plus, you now know what major and minor zones are, how to use the minor zones to identify where things will go. You can also get your exits and entries based on the major zones, which means you can trade like a sniper by being picky with your trades. So being picking with your trades is a good thing. Last but not least, you’ve learned how to lose money 127 BOOK TITLE the correct and right way using stop losses within the supply and demand trading strategy. You should definitely be proud of yourself. I'm proud of you for completing this. I'm proud of myself for doing this and my team that's allowed me to be able to provide you with this level of content and this level of detail. Without further ado, I just want to say thank you. Hopefully, that's helpful for you, and you can continue making big money and become one of the top 10% of traders like myself and enjoy the life of the ten percenters. 128 About the Author Maurice Kenny is a world-renowned Day Trader, Investment Coach, & Author of his latest book, Day Trading Millionaire. He has helped people from the US, Canada, Europe, Australia, & more reach their financial goals. After learning from Maurice many people worldwide have been able to quit their jobs, reclaim their freedom, and take back their precious time. He offers one on one coaching, an online course, and more. Schedule a 30 min call with Maurice to see if he can help you reach your financial goals. www.MauriceKenny.com