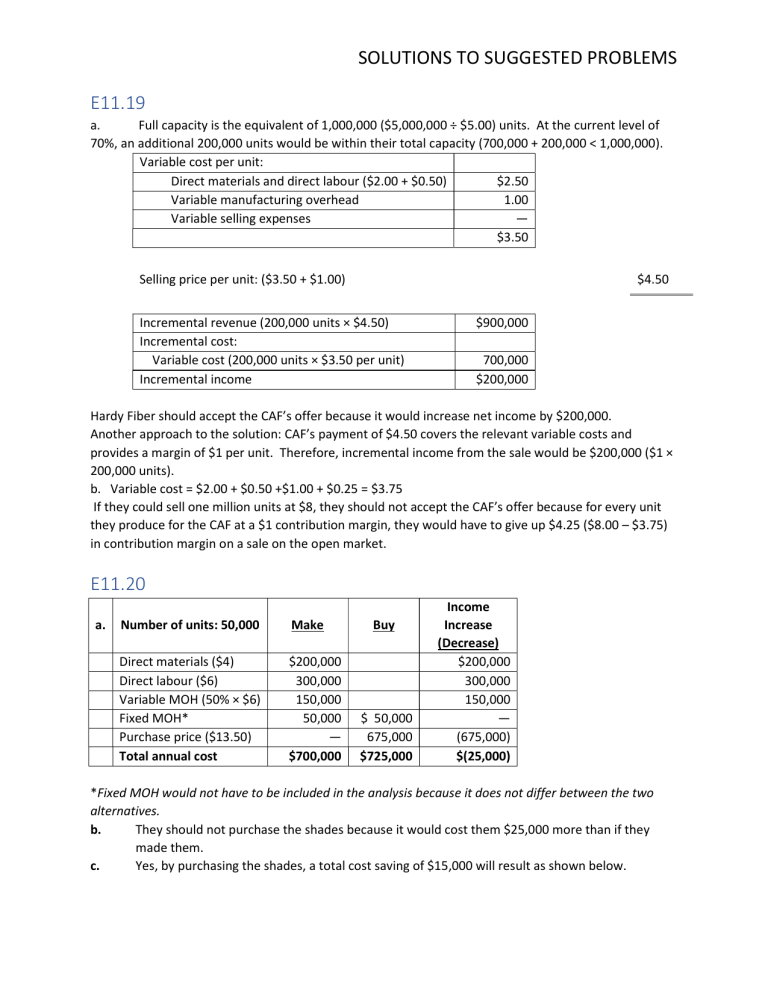

SOLUTIONS TO SUGGESTED PROBLEMS E11.19 a. Full capacity is the equivalent of 1,000,000 ($5,000,000 ÷ $5.00) units. At the current level of 70%, an additional 200,000 units would be within their total capacity (700,000 + 200,000 < 1,000,000). Variable cost per unit: Direct materials and direct labour ($2.00 + $0.50) $2.50 Variable manufacturing overhead 1.00 Variable selling expenses — $3.50 Selling price per unit: ($3.50 + $1.00) $4.50 Incremental revenue (200,000 units × $4.50) Incremental cost: Variable cost (200,000 units × $3.50 per unit) Incremental income $900,000 700,000 $200,000 Hardy Fiber should accept the CAF’s offer because it would increase net income by $200,000. Another approach to the solution: CAF’s payment of $4.50 covers the relevant variable costs and provides a margin of $1 per unit. Therefore, incremental income from the sale would be $200,000 ($1 × 200,000 units). b. Variable cost = $2.00 + $0.50 +$1.00 + $0.25 = $3.75 If they could sell one million units at $8, they should not accept the CAF’s offer because for every unit they produce for the CAF at a $1 contribution margin, they would have to give up $4.25 ($8.00 – $3.75) in contribution margin on a sale on the open market. E11.20 a. Number of units: 50,000 Make Direct materials ($4) Direct labour ($6) Variable MOH (50% × $6) Fixed MOH* Purchase price ($13.50) Total annual cost $200,000 300,000 150,000 50,000 — $700,000 Buy $ 50,000 675,000 $725,000 Income Increase (Decrease) $200,000 300,000 150,000 — (675,000) $(25,000) *Fixed MOH would not have to be included in the analysis because it does not differ between the two alternatives. b. They should not purchase the shades because it would cost them $25,000 more than if they made them. c. Yes, by purchasing the shades, a total cost saving of $15,000 will result as shown below. SOLUTIONS TO SUGGESTED PROBLEMS Number of units: 50,000 Direct material ($4) Direct labour ($6) Variable MOH ($3) Fixed MOH Purchase price ($13.50) Opportunity cost Total annual cost Make $200,000 300,000 150,000 50,000 — 40,000 $740,000 Buy $ 50,000 675,000 $725,000 Income Increase (Decrease) $200,000 300,000 150,000 — (675,000) 40,000 $15,000 E11.21 a. (1) Direct materials Direct labour Variable overhead Fixed overhead Purchase price Total annual cost Make Buy $ 700,000 — 600,000 — 200,000 — 500,000 $ 100,000 — 1,600,000 $2,000,000 $1,700,000 Net Income Increase /(Decrease) $700,000 600,000 200,000 400,000 (1,600,000) $300,000 Yes. The offer should be accepted because net income will increase by $300,000. (2) Direct materials Direct labour Variable overhead Fixed overhead Opportunity cost Purchase price Total annual cost b. Make $700,000 600,000 200,000 500,000 200,000 — $2,200,000 Buy — — — 500,000 — 1,600,000 $2,100,000 Net Income Increase (Decrease) $700,000 600,000 200,000 — 200,000 (1,600,000) $100,000 Yes. The offer should be accepted because net income will increase by $100,000. Qualitative factors include the possibility of laying off those employees that produced the robot and the resulting poor morale of the remaining employees; maintaining quality standards; ensuring that the supplier can increase/decrease their activity levels sufficiently to meet SY Telc's activity levels should they grow/contract; and controlling the purchase price in the future. SOLUTIONS TO SUGGESTED PROBLEMS E11.22 Per unit selling price Sell Basic Kit Per unit selling price Costs: Materials Labour Total costs Incremental revenue $30 Process Further Stage 2 Kit $35 (14) -0(14) $16 (14) (9) (23) $12 Net Income Increase (Decrease ) $5 (9) $(4) Josee should not carry the Stage 2 kits. The incremental revenue of $5 does not cover the incremental processing costs of $9 ($18 × 0.5 hours). Thus, she would be better off selling just the basic kits. E11.23 a. Sales ($50,000 + $10,000 + $60,000) $120,000 Less: Joint costs 100,000 Net income $20,000 b. Sales ($190,000 + $35,000 + $220,000) Joint costs Additional costs ($100,000 + $30,000 + 150,000) Net income c. $445,000 (100,000) (280,000) $ 65,000 Product 12 Product 14 Product 16 Revenue of final product $190,000 $35,000 $220,000 Revenue at split-off 50,000 10,000 60,000 Incremental revenue 140,000 25,000 160,000 Less: Incremental costs 100,000 30,000 150,000 Incremental profit (loss) $40,000 $(5,000) $10,000 Products 12 and 16 should be processed further and product 14 should be sold at the split-off point. d. Sales ($190,000 + $10,000 + $220,000) Joint costs Additional costs ($100,000 + $150,000) Net income $420,000 (100,000) (250,000) $ 70,000 Net income is $5,000 ($70,000 – $65,000) higher in d. than in b. because Product 14 is not processed further, thereby increasing overall profit by $5,000. SOLUTIONS TO SUGGESTED PROBLEMS E11.24 Sarco $310,000 200,000 110,000 100,000 $10,000 Revenue of final product Revenue at split-off Incremental revenue Less: Incremental costs Incremental profit (loss) Barco $380,000 300,000 80,000 89,000 $(9,000) Larco $800,000 500,000 300,000 250,000 $ 50,000 From this analysis we see that Sarco and Larco should be processed further because the incremental revenue exceeds the incremental costs, but Barco should be sold as is. E11.26 Total operating costs Retain Replace Net Income Computer Computer Increase (Decrease) $125,0001 $100,0002 $25,000 New computer cost 25,000 (25,000) Salvage for old computer (6,000) 6,000 Total $125,000 $119,000 $ 6,000 1 (5 years × $25,000) 2 (5 years × $20,000) The current computer should be replaced. The incremental analysis shows that net income for the fiveyear period will be $6,000 higher by replacing the current computer. E11.27 Continue Sales Variable costs ($70,000 + $15,000) Contribution margin Fixed costs ($6,470 + $28,600) Net income (loss) $96,200 85,000 11,200 35,070 $(23,870) Eliminate $ -0-0-035,070 $(35,070) Net Income Increase (Decrease) $(96,200) 85,000 (11,200) -0$(11,200) Nicole is incorrect. The incremental analysis above shows that net income will be $11,200 less if the Erie Division is eliminated. This amount equals the contribution margin that would be lost through discontinuing the division. Note that none of the fixed costs can be avoided, and therefore the amount does not differ between alternatives, making fixed costs irrelevant. SOLUTIONS TO SUGGESTED PROBLEMS P11.49B a. Number of units: 40,000 Make Buy Net Income Increase (Decrease) $120,000 112,500 9,500 (240,000) (20,000) (10,000) 9,000 $(19,000) Direct material ($3.00) $120,000 — Direct labour (2,500 × 3 × $15) 112,500 — 1 Manufacturing costs 9,500 — Purchase price ($6.00) — $240,000 Freight costs ($0.50) — 20,000 Receiving clerk — 10,000 Opportunity cost (6,000 × $1.50) 9,000 — Total annual cost $251,000 $270,000 1 ($6,000 + $1,500 + $2,000) Dunham should continue to make the part because net income would be $19,000 less if it is purchased from the supplier. b. The decision would not be different. The opportunity cost of $15,000, will not cover the loss of $19,000 if the part is purchased as shown below: Net Income Increase Make Buy (Decrease) Total annual cost (from a) $251,000 $270,000 $(19,000) Opportunity cost 15,000 — 15,000 Total annual cost $266,000 $270,000 $(4,000) c. Non-financial factors include: (1) the adverse effect on employees if the part is purchased, (2) how long the supplier will be able to satisfy the company’s quality control standards at the quoted price per unit, and (3) whether the supplier will deliver the units when they are needed. d. E12.18 ROCHE AND YOUNG, CPAs Service Revenue Budget For the Year Ending December 31, 2022 Quarters Auditing: 1 2 3 4 Billable hours 2,200 1,600 2,000 2,400 8,200 $60 $60 $60 $60 $60 $132,000 $96,000 $120,000 $144,000 $492,000 Rate Total revenue Year