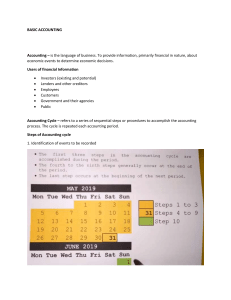

INVESTMENT ENVIRONMENT INVESTMENT ENVIRONMENT The term ‘investing” could be associated with different activities, but the common target in these activities is to “employ” the money (funds) during the time period seeking to enhance the investor’s wealth. Funds to be invested come from assets already owned, borrowed money and savings. By foregoing consumption today and investing their savings, investors expect to enhance their future consumption possibilities by increasing their wealth. For most of your life, you will be earning and spending money. Rarely, though, will your current money income exactly balance with your consumption desires. Sometimes, you may have more money than you want to spend; at other times, you may want to purchase more than you can afford. INVESTMENT ENVIRONMENT These imbalances will lead you either to borrow or to save to maximize the long-run benefits from your income. When current income exceeds current consumption desires, people tend to save the excess. They can do any of several things with these savings. One possibility is to put the money under a mattress or bury it in the backyard until some future time when consumption desires exceed current income. When they retrieve their savings from the mattress or backyard, they have the same amount they saved. Another possibility is that they can give up the immediate possession of these savings for a future larger amount of money that will be available for future consumption. This tradeoff of present consumption for a higher level of future consumption is the reason for saving. What you do with the savings to make them increase over time is investment. INVESTMENT ENVIRONMENT Together with the investment the term speculation is frequently used. Speculation can be described as investment too, but it is related with the short-term investment horizons and usually involves purchasing the salable securities with the hope that its price will increase rapidly, providing a quick profit. Speculators try to buy low and to sell high, their primary concern is with anticipating and profiting from market fluctuations. But as the fluctuations in the financial markets are and become more and more unpredictable speculations are treated as the investments of highest risk. In contrast, an investment is based upon the analysis and its main goal is to promise safety of principle sum invested and to earn the satisfactory risk. INVESTMENT ENVIRONMENT It is useful to make a distinction between real and financial investments. Real investments generally involve some kind of tangible asset, such as land, machinery, factories, buildings etc. Financial investments involve contracts in paper or electronic form such as stocks, bonds, financial derivatives etc. It is also important to distinguish individual investors from institutional investors. Individual investors are individuals who are investing on their own. Sometimes individual investors are called retail investors. Institutional investors are entities such as investment companies, commercial banks, insurance companies, pension funds and other financial institutions. INVESTMENT ENVIRONMENT Whether individual or institutional investors, those who give up immediate possession of savings (that is, defer consumption) expect to receive in the future a greater amount than they gave up. Conversely, those who consume more than their current income (that is, borrow) must be willing to pay back in the future more than they borrowed. The rate of exchange between future consumption (future dollars) and current consumption (current dollars) is the pure rate of interest. Both people’s willingness to pay this difference for borrowed funds and their desire to receive a surplus on their savings give rise to an interest rate referred to as the pure time value of money. This interest rate is established in the capital market by a comparison of the supply of excess income available (savings) to be invested and the demand for excess consumption (borrowing) at a given time. INVESTMENT ENVIRONMENT Example: If you can exchange $100 of certain income today for $104 of certain income one year from today, then the pure rate of exchange on a risk-free investment (that is, the time value of money) is 4 percent. That is (104 - 100/100)*100 = 4% The investor who gives up $100 today expects to consume $104 of goods and services in future. This assumes that the general price level in the economy stays the same. This price stability has rarely been the case during the past several decades when inflation rates have varied drastically. That is (106 - 100/100)*100 % = 6% INVESTMENT ENVIRONMENT When investors expect a change in prices, they will require a higher rate of return to compensate for it. Example: If an investor expects a rise in prices (that is, he or she expects inflation) at the rate of 2 percent during the period of investment, he or she will increase the required interest rate by 2 percent. In this case, the investor would require $106 in the future to defer the $100 of consumption during an inflationary period (a 6 percent nominal, risk-free interest rate will be required instead of 4 percent). INVESTMENT ENVIRONMENT Further, if the future payment from the investment is not certain, the investor will demand an interest rate that exceeds the pure time value of money plus the inflation rate. The uncertainty of the payments from an investment is the investment risk. The additional return added to the nominal, risk-free interest rate is called a risk premium. In the previous example, the investor would require more than $106 one year from today to compensate for the uncertainty. As an example, if the required amount was $110, $4, or 4 percent, would be considered a risk premium. That is (110 - 100/100)*100 = 10 – 6% INVESTMENT ENVIRONMENT To recapitulate therefore, we can define investment as the current commitment of dollars for a period of time in order to derive future payments that will compensate the investor for; the time the funds are committed, the expected rate of inflation, and the uncertainty of the future payments. The “investor” can be an individual, a government, a pension fund, or a corporation. This definition includes all types of investments classified and real assets and financial assets. They include stocks, bonds, commodities, real estate among others. Individual and institutional investors invest to earn a return from savings due to their deferred consumption. They want a rate of return that compensates them for the time, the expected rate of inflation, and the uncertainty of the return. That return is referred to as required rate of return. FINANCIAL SYSTEM The financial system comprises the financial markets, financial intermediaries and other financial institutions that execute the financial decisions of individual and institutional investors. The scope of the financial system is global. Extensive international telecommunication networks link financial markets and intermediaries so that the trading of securities and transfer of payments can take place 24 hours a day. The financial system has four elements that interact continually namely: Lenders (surplus economic units) and borrowers (deficit economic units); Financial institutions; Financial instruments; and Financial markets. FINANCIAL SYSTEM FINANCIAL SYSTEM Investors can use direct or indirect type of investing. Direct investing is realized using financial markets and indirect investing involves financial intermediaries. The primary difference between these two types of investing is that applying direct investing investors buy and sell financial assets and manage individual investment portfolio themselves. Consequently, investing directly through financial markets investors take all the risk and their successful investing depends on their understanding of financial markets, its fluctuations and on their abilities to analyze and to evaluate the investments and to manage their investment portfolio. FINANCIAL SYSTEM Using indirect type of investing investors are buying or selling financial instruments of financial intermediaries (financial institutions) which invest large pools of funds in the financial markets and hold portfolios. Indirect investing relieves investors from making decisions about their portfolio. As shareholders with the ownership interest in the portfolios managed by financial institutions (investment companies, pension funds, insurance companies, commercial banks) the investors are entitled to their share of dividends, interest and capital gains generated and pay their share of the institution’s expenses and portfolio management fee. FINANCIAL SYSTEM The risk for investor using indirect investing is related more with the credibility of chosen institution and the professionalism of portfolio managers. In general, indirect investing is more related with the financial institutions which are primarily in the business of investing in and managing a portfolio of securities (various types of investment funds or investment companies, private pension funds). By pooling the funds of thousands of investors, those companies can offer them a variety of services, in addition to diversification, including professional management of their financial assets and liquidity. FINANCIAL SYSTEM Investors can “employ” their funds by performing direct transactions, bypassing both financial institutions and financial markets (for example, direct lending). But such transactions are very risky, if a large amount of money is transferred only to one’s hands, following the well known proverb “don't put all your eggs in one basket”. Direct financing can only occur if lenders’ requirements in terms of risk, return and liquidity exactly match borrowers’ needs in terms of cost and term to maturity. Direct financing usually involves the use of a financial market broker who acts as a conduit between lenders and borrowers in return for a commission. Financial intermediaries perform indirect financing by making markets in two types of financial instruments – one for lenders and one for borrowers. To lenders they offer claims against themselves – termed indirect securities - tailored to the risk, return and liquidity requirements of the lenders. In turn they acquire claims on borrowers known as primary securities. Thus the surplus funds of lenders are invested with financial intermediaries that then re-invest the funds with borrowers. FINANCIAL SYSTEM Lenders and borrowers Lenders are the ultimate providers of savings while borrowers are the ultimate users of those savings. Both are non-financial entities and are referred to as surplus and deficit economic units respectively. Lenders and borrowers can be categorized into four sectors: household; business or corporate; government; and foreign. The household sector consists of individuals and families. It also includes private charitable, religious and non-profit bodies as well as unincorporated businesses such as farmers and professional partnerships. The corporate sector comprises all non-financial companies producing and distributing goods and services. The government sector consists of central and provincial governments as well as local authorities. The foreign sector encompasses all individuals and institutions situated in the rest of the world. FINANCIAL SYSTEM Usually the household sector is a net saver and thus a net provider of loanable or investable funds to the other three sectors. While the other three sectors are net users of funds they also participate on an individual basis as providers of funds. For example a business with a temporary excess of funds will typically lend those funds for a brief period rather than reduce its indebtedness i.e., repay its loans. Similarly while the household sector is a net provider of funds, individual households do borrow funds to purchase homes and cars. The excess funds of surplus units can be transferred to deficit units either through direct financing or indirectly via financial intermediaries. Financial intermediaries are financial institutions that expedite the flow of funds from lenders to borrowers. Types of financial intermediaries include banks, insurance companies, pension and provident funds, unit trusts, mutual funds. FINANCIAL SYSTEM Banks accept deposits from lenders and on-lend the funds to borrowers. Insurers and pension and provident funds receive contractual savings from households and reinvest the funds mainly in shares and other securities such as bonds. In addition insurers perform the function of risk diversification i.e., they enable individuals or firms to distribute their risk amongst a large population of insured individuals or firms. A unit trust invests funds subscribed by the public in securities such as shares and bonds and in return issues units that it may repurchase.. A mutual fund pools the funds of many small investors and re-invests the funds in shares, bonds and other financial claims with each investor having a proportional claim on the assets of the fund. Both unit trusts and mutual funds play a risk diversification role in that they are large enough to spread their investments widely i.e., they can spread the risk by investing in number of different securities. FINANCIAL SYSTEM Financial instruments or claims can be defined as promises to pay money in the future in exchange for present funds i.e., money today. They are created to satisfy the needs of financial system participants and as a result of financial innovation in the borrowing and financial intermediation processes, a wide range of financial instruments and products exists. Financial claims can be categorized as indirect or primary securities. Within these two categories, financial instruments can be characterized as marketable or nonmarketable. Marketable instruments can be traded in secondary markets while non-marketable instruments cannot. To recover their investment, holders of nonmarketable financial instruments have recourse only to the issuers of the claims. Non-marketable claims generally involve the household sector while marketable claims are usually issued by the corporate and government sectors. FINANCIAL SYSTEM Financial markets can be defined as the institutional arrangements, mechanisms and conventions that exist for the issuing and trading of financial instruments. A financial market is not a single physical place but millions of participants, spread across the world and linked by vast telecommunications networks that brings together buyers and sellers of financial instruments and sets prices of those instruments in the process. Financial market participants include: • Borrowers: the issuers of securities; • Lenders: the buyers of securities; • Financial intermediaries: issuers and buyers of securities and other debt instruments; and • Brokers: act as conduits between lenders and borrowers in return for a commission. Financial market terminology includes terms such as cash and derivatives markets; spot and forward markets, primary and secondary markets; financial exchanges and over-thecounter markets. THE INVESTMENT PROCESS Five steps: Set investment policy Perform security analysis Construct a portfolio Revise the portfolio Evaluate performance STEP 1: INVESTMENT POLICY Identify investor’s unique objective Determine amount of investable wealth State objectives in terms of risk and return Identify potential investment categories STEP 2: SECURITY ANALYSIS Using potential investment categories, find mispriced securities Using fundamental analysis Intrinsic value should equal discounted present value Compare current market price to true market value Identify undervalued securities STEP 3: CONSTRUCT A PORTFOLIO Identify specific assets and proportion of wealth in which to invest Address issues of Selectivity Timing Diversification STEP 4: PORTFOLIO REVISION Periodically repeat step 3 Revise if necessary Increase/decrease existing securities Delete some securities Add new securities STEP 5: PORTFOLIO PERFORMANCE EVALUATION Involves periodic determination of portfolio performance with respect to risk and return Requires appropriate measures of risk and return FINANCIAL MARKET RATES There are essentially three financial market rates: Interest rates; Exchange rates; and Rates of return. An interest rate is the price, levied as a percentage, paid by borrowers for the use of money they do not own and received by lenders for deferring consumption or giving up liquidity. Factors affecting the supply and demand for money and hence the interest rate include: • Production opportunities: potential returns within an economy from investing in productive, cash-generating assets; • Liquidity: lenders demand compensation for loss of liquidity. A security is considered to be liquid if it can be converted into cash at short notice at a reasonable price; • Time preference: lenders require compensation for saving money for use in the future rather than spending it in the present; • Risk: lenders charge a premium if investment returns are uncertain i.e., if there is a risk that the borrower will default. The risk premium increases as the borrowers’ creditworthiness decreases. Sovereign debt generally has no risk premium within a country. A country risk premium may apply outside a country’s borders; • Inflation: lenders require a premium equal to the expected inflation rate over the life of the security. FINANCIAL MARKET RATES The exchange rate is the price at which one currency is exchanged for another currency. The actual exchange rate at any one time is determined by supply and demand conditions for the relevant currencies with the foreign exchange market. Rates of return Interest rates are promised rates i.e., they are based on contractual obligation. However other assets such as property, shares, commodities and works of art do not carry promised rates of return. The return from holding these assets comes from two sources: • Price appreciation (depreciation) i.e., any gain (loss) in the market price of the asset; • Cash flow (if any) produced by the asset e.g., cash dividends paid to shareholders, rental income from property. FINANCIAL MARKET RATES Calculating the RATE OF RETURN : R = (p1 - p0)/ p0 where R = the rate of return P0 = the beginning price P1 = the ending price FINANCIAL MARKET RATES Examples: Assume at the beginning of the year a share is bought for $50. At the end of the year the share pays a dividend of $2.50 and its price is $55. Compute the Return, Capital gain and Current yield. Assume a painting is purchased at the beginning of the year for $2,000. At an auction at the end of the year, the painting is sold for $3,000. Compute the Return, Capital gain and Current yield. THE END