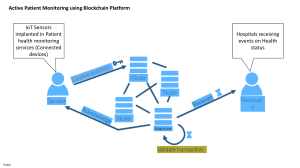

Gerardo Martinez Rivera (150351) Term Paper: INNOVATING BBVA May 15th 2017 Prof. Alexandros Fakos ITAM Business Strategy 2 Innovating BBVA BBVA is a financial group that offers banking services in 35 countries to 70 million customers. It has a strong leadership position in the Spanish market, it is Mexico's largest financial institution and has leading franchises in South America and the US. In addition, it has a relevant presence in Turkey and operates in a wide network of offices around the world. Its diversified business is focused on high growth markets and sees technology as a key competitive advantage.1 Given the development of new technologies, BBVA intends to take advantage of all these innovations to face the process of transformation that the financial sector is experiencing. Currently focused on Blockchain as a technology that can irreversibly transform the Fintech world. But also considered as a technology that can transform many other sectors: energy companies, telecommunications, public administration, logistics, transport, media, etc. 2 Blockchain can be defined as a peer-to-peer public accounting technology that is maintained through a distributed computer network and does not require any central authority or third parties acting as intermediaries. As a database with stamped and unchanging time information for every transaction that is replicated on servers around the world, as today, participants in business networks are all maintaining their own traditional ledgers to record transactions between them within their ecosystems with frequent inefficient, expensive and slow results.3,4 A technological change, which will reveal previously unseen results, as well as new challenges, costs, ways of operating, rules, and better service tools. With respect to Blockchain interest in the financial sector, BBVA in the future wants to focus on reducing the role of the bank's essential intermediary and guarantees security in certain transactions, such as financial transfers between individuals, purchase of financial assets, financing or personal loans. As well as the control of all operations from a single source, in a transparent and centralized way. The possibility of using it to create intelligent contracts between people, entities and even machines. And to be able to use the technology to support millions of transactions almost simultaneously, offering the maximum performance, speed and quality service to all their customers. Although Blockchain is still at a very primitive stage, it has begun to show all the possibilities it will offer in the next few years. Meanwhile BBVA has been developing the instrument to make international payments in seconds through Blockchain, sending from Spain to Mexico a money transaction that normally would take days to be completed. Assuming the development of this technology as an investment that will provide greater security, flexibility and comfort to users, as well as greater positioning and added value to BBVA.2,5 In view of the new environment introduced by Blockchain, the strategy proposed is to continue with the technological bet in which 30 different international banks have made. BBVA being one of the financial institutes to have founded this offer, with the aim of being one of the few first banks to innovate and have a competitive advantage in its service through Blockchain technology. A strategy that chooses to carry and absorb the necessary expenses and costs that Blockchain implies in various aspects both internal and external. 1. Focusing first on the total value that Blockchain generates both in its development in the Innovating BBVA medium and long term, as well as the extra implications in exchange for technological equipment, application development, and the creation of new systems in the banking network necessary to give better financial quality. 2. Analyze the different benefits that the Blockchain system generates, which will cause a change in the current mode of operations that BBVA handles. Seeking to reduce fixed and variable expenses that will be unnecessary, as well as an adjustment in the plate to generate greater performance and less expenses. The inclusion of R3 (Blockchain development startup for BBVA) as a new player providing the service system, as well as making a difference between the players who compete against us in the current banking system and those with the Blockchain system. 3. Take into account the change that Blockchain caused in the demand for services. Each of the clients have a special place in BBVA, but it will be necessary to make a distinction between the types of clients that they have. Homogeneous customers without access to sufficient technology to manage their accounts based on the current banking system, as well as customers with access to a technology network that can manage their accounts from any type of device with the Blockchain system. As well as an estimated increase in these customers, which the new services, costs and operations will attract to BBVA as new users. 4. To use Blockchain as an expansion system, which benefits in quality and speed of operation allowing in the medium and long term to have a better performance and growth in the countries that BBVA is already in, as well as to achieve better connectivity and global services among all BBVA branches around the world. A strategy that allows us to compare the new system of BBVA against our old way of operating, as well as banks that are stuck in its technological development. All these changes allow us to see BBVA as a bank in constant innovation to everything that happens "today", which seeks to be a leader in the financial sector of the countries in which it has a presence, involving its clients in a new experience in services. Because the most important thing is to be focused on the results for customers in this development that will bring great opportunities and ways of working. References: 1 https://www.bbva.com/es/informacion-corporativa/carta-del-presidente/ 2 https://www.bbva.com/es/mx/noticias/ciencia-tecnologia/tecnologia/las-claves-entenderfin-la-importancia-blockchain/ 3 http://www.centrodeinnovacionbbva.com/ebook/ebook-tecnologia-blockchain 4 https://www.ingwb.com/media/1609652/banking-on-blockchain.pdf 5 http://retina.elpais.com/retina/2017/05/09/tendencias/1494351285_324845.html