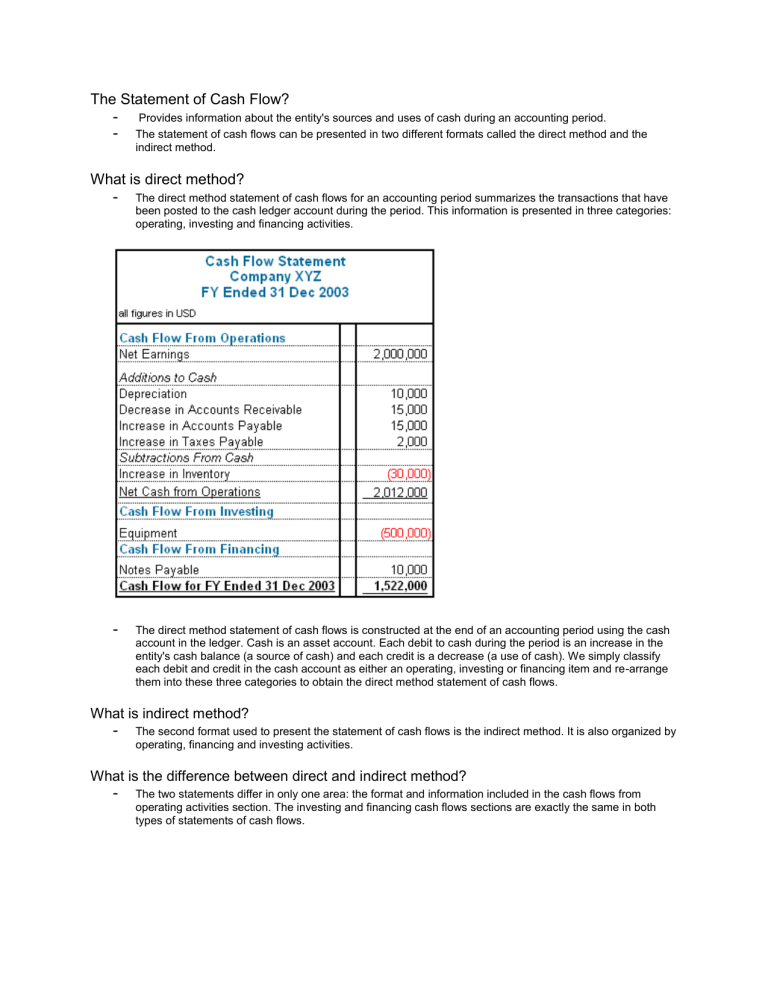

The Statement of Cash Flow? - Provides information about the entity's sources and uses of cash during an accounting period. - The statement of cash flows can be presented in two different formats called the direct method and the indirect method. What is direct method? - The direct method statement of cash flows for an accounting period summarizes the transactions that have been posted to the cash ledger account during the period. This information is presented in three categories: operating, investing and financing activities. - The direct method statement of cash flows is constructed at the end of an accounting period using the cash account in the ledger. Cash is an asset account. Each debit to cash during the period is an increase in the entity's cash balance (a source of cash) and each credit is a decrease (a use of cash). We simply classify each debit and credit in the cash account as either an operating, investing or financing item and re-arrange them into these three categories to obtain the direct method statement of cash flows. What is indirect method? - The second format used to present the statement of cash flows is the indirect method. It is also organized by operating, financing and investing activities. What is the difference between direct and indirect method? - The two statements differ in only one area: the format and information included in the cash flows from operating activities section. The investing and financing cash flows sections are exactly the same in both types of statements of cash flows. Indirect method: Accruals and De-Accruals - Recall that accrual accounting records the economic effects of transactions in the period in which those transactions occur, rather than in the periods in which cash is received or paid by the entity. Under accrual accounting, we record some accruals that have related cash flows in the future, and the resultant balance sheets and income statements reflect the effects of those accruals rather than use future cash flows. Why the indirect method? - - Given the relative complexity of the operating section of an indirect method statement of cash flows, you might wonder why do accountants use them at all? Answer: Because the operating section of the indirect method statement explains the difference between the net income and the operating cash flows of the period, it provides readers with information about the extent to which and the means by which the entity's net income of the period has resulted in operating cash flows. The Financial Accounting Standards Board requires entities that use the direct method in their statement of cash flows to present a separate reconciliation of net income to operating cash flows using the indirect method. As a result, most companies choose to present only the indirect method statement of cash flows. Cash Management? - Ensure enough cash is on hand to pay liabilities - Make sure excess cash is used to maximize interest of the business - Accurate tracking of cash for reports. - Internal controls should be in place Internal Controls? - Ensure compliance - Conduct risk assessment - Engage in oversight - Create paper trail Types of Internal Controls? - Hire qualified staff - Segregate duties - Enforce annual vacation - Assign responsibilities - Segregate bank account - Use sequentially #’s receipts - Review control system - Limit access to records - Promptly report everything - Inventory of supplies Links between financial statements?