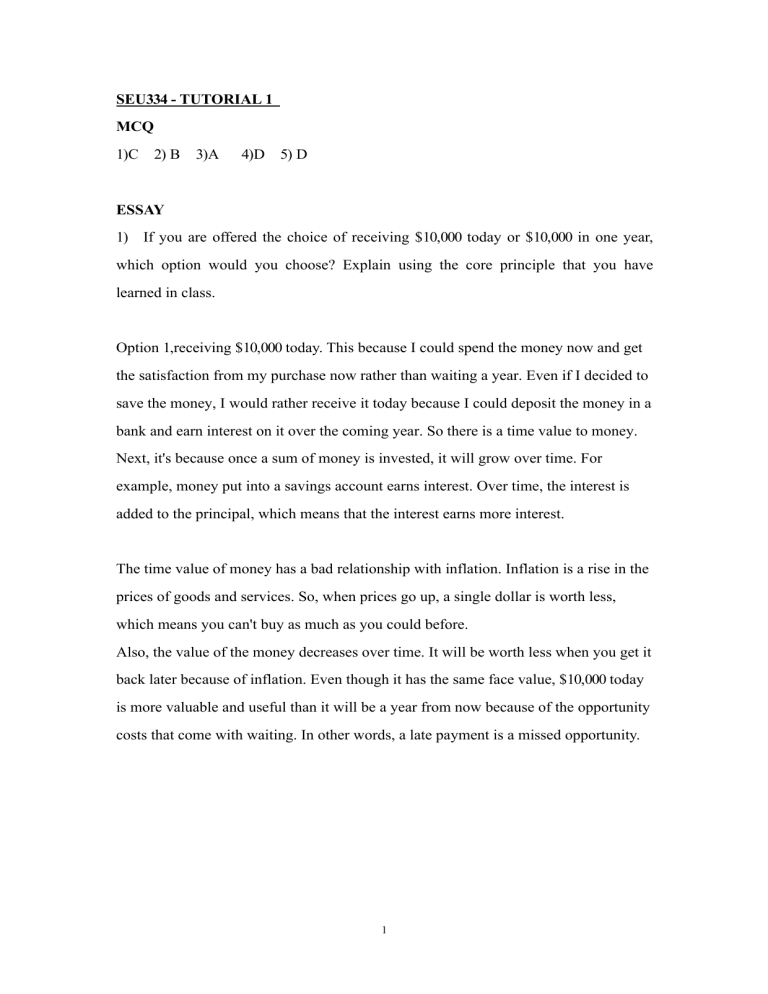

SEU334 - TUTORIAL 1 MCQ 1)C 2) B 3)A 4)D 5) D ESSAY 1) If you are offered the choice of receiving $10,000 today or $10,000 in one year, which option would you choose? Explain using the core principle that you have learned in class. Option 1,receiving $10,000 today. This because I could spend the money now and get the satisfaction from my purchase now rather than waiting a year. Even if I decided to save the money, I would rather receive it today because I could deposit the money in a bank and earn interest on it over the coming year. So there is a time value to money. Next, it's because once a sum of money is invested, it will grow over time. For example, money put into a savings account earns interest. Over time, the interest is added to the principal, which means that the interest earns more interest. The time value of money has a bad relationship with inflation. Inflation is a rise in the prices of goods and services. So, when prices go up, a single dollar is worth less, which means you can't buy as much as you could before. Also, the value of the money decreases over time. It will be worth less when you get it back later because of inflation. Even though it has the same face value, $10,000 today is more valuable and useful than it will be a year from now because of the opportunity costs that come with waiting. In other words, a late payment is a missed opportunity. 1 2) If the U.S. Securities and Exchange Commission eliminated its requirement for public companies to disclose information about their finances, what would you expect to happen to the stock prices for these companies? I would expect that the stock price will decline. First because the investors cannot obtain the companies’s specific information. Then, they cannot make right investment decisions and not able to improve the pricing efficiency in the stock market. Healy et al’(1999)[4] research showed that as different stocks in the same market were given, the higher degree of information transparency of a company, the more firm-specific information was contained in the stock price. Besides, the company’s accounting information is major component of voluntary information disclosure, Cheng(2012)[8] indicated that accounting information was seen as one of the most important information sources for investors, the quality of accounting information directly influenced the efficiency of resource allocation in stock market, which in turn, influenced the formation of stock price. Furthurmore, voluntary information disclosure, as one of the main forms of information disclosure, has played an important role in the stock price. As the conclusion, the information about the companies’s finances will give impact on the stock prices. SEU334 - TUTORIAL 2 MCQ 1)A 2)D 3)B 4)C ESSAY 1) Various financial instruments usually serve one of two distinct purposes: to store value or to transfer risk. Name a financial instrument used for each purpose There are financial instruments that are used with the purpose of storing value.First of all bank loans, a loan is the giving of money by one or more parties in which the 2 recipient is obliged to return the amount borrowed as well as pay a certain interest on the debt.Next, bonds , a bond is a loan made or given by an investor to a company or the government. Besides, home mortgages, a home mortgage is a loan given by a bank or other entity to someone who intends to buy a residential property. Afterwards, a stock is a form of security which essentially describes the ownership share in a certain company.Lastly, asset backed securities. An asset backed security is a form of security created by various assets such as loans, leases and more. As for the financial instruments that are used with the purpose of transferring risk, we have insurance contracts, an insurance contract is a contract which is made between the insurance company and the insured individual. Secondly, futures contract, a futures contract is a contract made between two parties to trade a certain asset at a specific price at some point in the future. Next, options, options allow but do not oblige a buyer to trade an asset at a prespecified price on a certain date. At last,swaps, a swap contract is a contract which describes the agreement between two parties to exchange one financial instrument with another. 2) Explain with example, what is stock and bond. Why the stock and bond markets are important in an economy. Stocks give you partial ownership in a corporation, while bonds are a loan from you to a company or government. Stock generate profit by appreciate it value and be sold later on the stock market, while most bonds pay fixed interest over time. Stocks are a form of partial ownership, or equity, in a company. When you buy stock, you are actually buying a tiny piece of the company, called a "share." And the more shares you buy, the more of that company you own. Let's say a company's stock costs $50 per share, and you invest $2,500 (that's 50 shares at $50 each). 3 Now imagine that the company does well year after year for a few years. Because you own some of the company, its success is also your success, and the value of your shares will grow along with the value of the company. If the stock price goes up by 50%, to $75, the value of your investment would rise by 50%, to $3,750. You could then sell those shares to another investor and get a $1,250 profit. If that company does poorly, the value of your shares could drop below what you paid for them. In this case, if you sold them, you'd lose money. Stocks are also called common stock, corporate shares, equity shares, and equity securities. Companies can sell shares to the public for a number of reasons, but the most common one is to raise cash that can be used to fuel future growth. Bonds are a loan that you make to a company or government. There’s no equity involved, and there are no shares to buy. When you buy a bond, a company or government owes you money, and it will pay you interest on the loan for a certain amount of time. After that, it will pay back the full amount you bought the bond for. But bonds are not completely risk-free. If the company goes bankrupt during the bond’s term, you won’t get any more interest payments and may not get back your full principal. Let's say you buy a bond for $2,500 that pays 2% interest annually for 10 years. That means you'd get $50 in interest payments every year, usually spread out evenly throughout the year. After 10 years, you’d have $500 in interest and your initial investment of $2,500 back. "Holding until maturity" means to keep a bond until the end of its time period. When you buy a bond, you usually know exactly what you're getting into, and the regular interest payments can be used as a steady source of income over long periods. Bonds usually last from a few days to 30 years, but this depends on the type you buy. In the same way, the interest rate, also called yield, will change depending on the type and length of the bond. 4