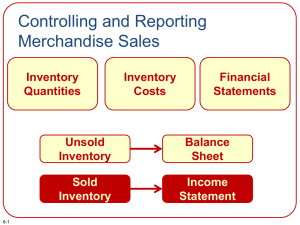

CHAPTER 9: PROCESSING TRANSACTIONS FOR A MERCHANDISER Merchandising entity purchases inventory sells the inventory and uses the cash to purchase more inventory and the cycle continues. Merchandiser uses the title Sales Revenue for receipts coming from goods sold to customers. Merchandisers must maintain a stock of goods held for sale called Merchandise Inventory. Once these goods are delivered to the customer, it is recognized in the income statement as Cost of Goods Sold or Cost of Sales. Sales Revenue Less: Cost of Sales Gross Profit Less: Operating Expenses Operating Profit Add: Other Revenues and Gains Less: Other Expenses and Losses Net Profit Elements Income Statement ● ● ● Gross Profit - Gross profit or mark-up indicates the adequacy of margin of profit set up by the merchandiser. Operating Profit - Expenses such as salaries, rent, utilities, freight, and advertising are necessary to support the operation of the business. Non-Operating Activities - Non-operating activities are considered to arrive at net profit. They are minor income and expenses not recurring and not part of regular operation. These are classified in two: 1. Other Revenues and Gains such as rent income, interest income, and gain from the sale of land. 2. Other expenses and Losses such as interest expense and loss from the sale of equipment. INVENTORY SYSTEM ● Merchandise Inventory refers to goods purchased for resale in the normal course of business. ➔ Cost of Goods Sold (Income Statement) ➔ Cost of the Merchandise Inventory (SFP) Is determined using either Perpetual Method or Periodic Method. Perpetual Method This method records continuously or perpetually the movement of merchandise and shows the balance of inventory at any point in time. This method is usually adopted by a business that sells high-priced - low-volume goods such as cars and appliances. Periodic Method under this method there is no detailed recording hence no inventory balance can be determined at any point in time. The cost of goods sold is determined only at the end of the accounting period. INVENTORY COST ● Internal control requires that a physical count be made to determine the veracity of the closing inventory. A list of closing stock is contained in a source document called Inventory Sheet. Cost of Sales Purchase (No. of Items x Price) Less: Merchandise Inventory, Dec 31 (No. of Items x Price Cost of Goods Sold Gross Profit Sales (No. of Items x Selling Price) Less: Cost of Sales Gross Income on Sales SALES REVENUE ● Gross Sales - sales revenue is earned when the merchandiser transfers the goods to the customer. The sale is supported by a source document called an Invoice. ● Gross Invoice Price - In accounting for merchandising operations, we always record the Gross Invoice Price in the books. Merchandises are always quoted in the original price, called List Price.