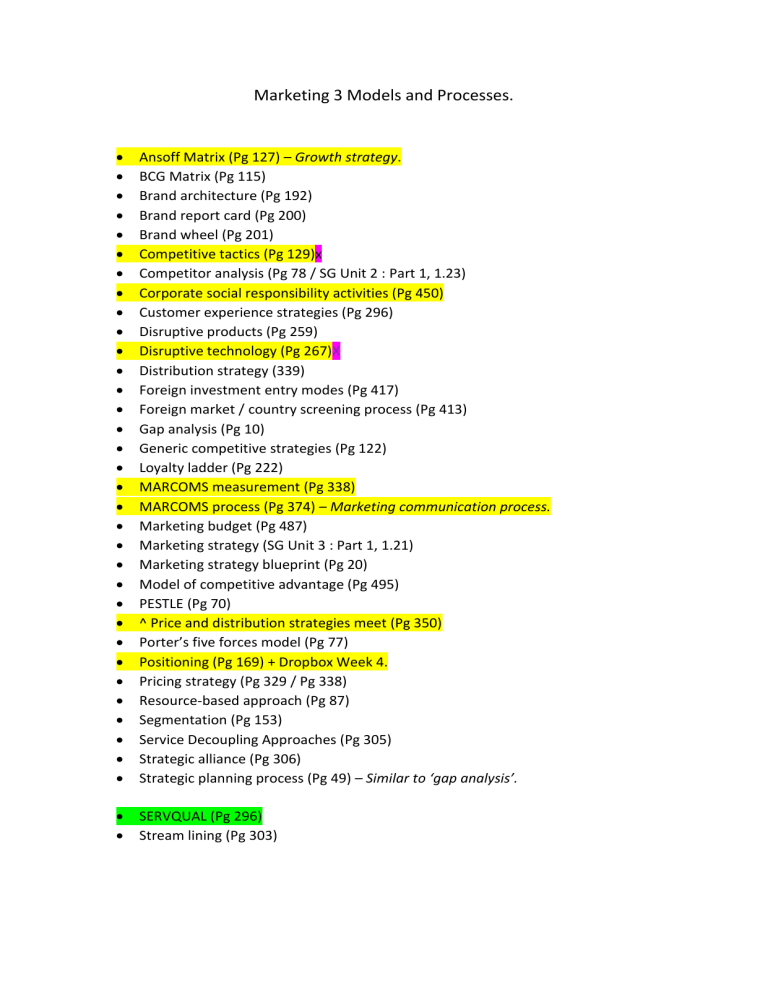

Marketing 3 Models and Processes. Ansoff Matrix (Pg 127) – Growth strategy. BCG Matrix (Pg 115) Brand architecture (Pg 192) Brand report card (Pg 200) Brand wheel (Pg 201) Competitive tactics (Pg 129)x Competitor analysis (Pg 78 / SG Unit 2 : Part 1, 1.23) Corporate social responsibility activities (Pg 450) Customer experience strategies (Pg 296) Disruptive products (Pg 259) Disruptive technology (Pg 267)X Distribution strategy (339) Foreign investment entry modes (Pg 417) Foreign market / country screening process (Pg 413) Gap analysis (Pg 10) Generic competitive strategies (Pg 122) Loyalty ladder (Pg 222) MARCOMS measurement (Pg 338) MARCOMS process (Pg 374) – Marketing communication process. Marketing budget (Pg 487) Marketing strategy (SG Unit 3 : Part 1, 1.21) Marketing strategy blueprint (Pg 20) Model of competitive advantage (Pg 495) PESTLE (Pg 70) ^ Price and distribution strategies meet (Pg 350) Porter’s five forces model (Pg 77) Positioning (Pg 169) + Dropbox Week 4. Pricing strategy (Pg 329 / Pg 338) Resource-based approach (Pg 87) Segmentation (Pg 153) Service Decoupling Approaches (Pg 305) Strategic alliance (Pg 306) Strategic planning process (Pg 49) – Similar to ‘gap analysis’. SERVQUAL (Pg 296) Stream lining (Pg 303) 2022 Brand strategies (120) Competitive strategy (129) Competitive strategy (120) CSR / Corporate social responsibilities (457) Customer value and relationships (312) Growth/exit strategies (113) International marketing (405) International marketing decision-making process (405) Product development (260) Resources allocation Revenue based approach Strategic fit for 6G Value chain Value chain Vision/mission Macro factors in the international marketing environment (409) SERVQUAL (Pg 296) Service (ch9) Chaper 3 & 4 Porters PG 14 and 495 Competitive tactics (Pg 129)x To keep ahead of the competition, Betway must focus on differentiation and innovation. To attract and retain clients, it should emphasise its distinctive offers, customer-centric approach, and technological developments. Increasing Regulatory Scrutiny: This is a threat because increased regulatory scrutiny can result in increased compliance requirements and potential penalties for noncompliance. To avoid legal and reputational risks, Betway's strategy will prioritise ensuring compliance with evolving regulations. Intense Competition from New Entrants: This is a threat because new entrants have the potential to disrupt the market and capture market share. To stay ahead of new competitors, Betway's strategy will focus on differentiation strategies such as offering unique features, improving customer service, and strengthening brand loyalty. Shift in Customer Preferences towards Mobile Betting: This issue is categorised as an opportunity because it represents a growing market trend that Betway can capitalise on. Betway's strategy will include the developing the user-friendly mobile app, the optimisation of the mobile betting experience, and the targeting of mobile users with tailored promotions and offers. Increasing the Focus on Responsible Gambling: This issue is classified as an opportunity because focusing on responsible gambling practises can improve Betway's reputation and attract socially conscious customers. Betway's strategy creation will include stricter age verification measures, selfexclusion options, and educational resources to promote responsible gambling. Technological advancements in data analytics and artificial intelligence (AI): This topic is classified as an opportunity because utilising AI and data analytics can offer important customer insights and improve operations. To harness the power of advanced analytics and AI for customised offerings and targeted marketing, Betway will invest in data infrastructure, talent acquisition, and technology partnerships. The Ansoff Matrix is a strategic planning tool that provides a framework to help executives, senior managers, and marketers devise strategies for future growth. It consists of four strategies: Market Penetration, Market Development, Product Development, and Diversification. Let's analyze each quadrant for Kingsley Beverages: 1. Market Penetration (Existing Markets, Existing Products): Kingsley Beverages is already selling its range of carbonated soft drinks, fruit juices, energy drinks, sports drinks, iced teas, and bottled water in its existing markets such as South Africa, North America, the Middle East, and Europe. The company can increase its market share in these areas by increasing marketing efforts, offering promotional deals, or implementing a competitive pricing strategy. 2. Market Development (New Markets, Existing Products): Kingsley Beverages, with its regional offices in Dubai, Johannesburg, Peterborough, and Houston, has the potential to enter new markets within these regions where it isn't currently operating. For example, the company could expand to new countries in Africa, the Middle East, Europe, or North America, using its existing product line. 3. Product Development (Existing Markets, New Products): Kingsley Beverages has showcased its ability to innovate and introduce new products in its existing markets. For instance, the company introduced Dragon energy drink and has expanded the offering to include merchandise and an expanded media presence with Dragon TV. The company could continue this trend by developing new flavors or new types of beverages tailored to the preferences of its existing markets. 4. Diversification (New Markets, New Products): This is the riskiest growth strategy as it involves venturing into unfamiliar territories. However, Kingsley Beverages could consider this if it identifies potential opportunities. For example, the company could consider introducing a new line of health and wellness drinks (a new product category) in emerging markets like Asia, where the demand for such products is growing. It's important to note that each of these strategies carries different levels of risk and would require different resources and capabilities from the company. Therefore, Kingsley Beverages would need to carefully consider its strategic moves in line with its overall corporate strategy and available resources.