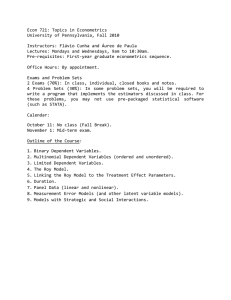

Journal of Economic Perspectives—Volume 15, Number 4 —Fall 2001—Pages 169 –182 Teaching Statistics and Econometrics to Undergraduates William E. Becker and William H. Greene L ittle has been written on the subject of teaching econometrics. An early exception is an article by Sowey (1983), in which econometrics is defined (p. 257) as “the discipline in which one studies theoretical and practical aspects of applying statistical methods to economic data for the purpose of testing economic theories (represented by carefully constructed models) and of forecasting and controlling the future path of economic variables.” In the era of Sowey’s article, instructors and their students interested in “applying statistical methods to economic data” had to trek over to a university computing center with their punch cards in tow. Data were typically provided by the instructor for hand entry by students, and machine calculations required knowledge of programming syntax, which was also keypunched on cards. It is not surprising that econometrician Sowey downplayed the “practical aspects of applying” and presented a highbrow view of what econometricians should teach, leaving the teaching of applications to others. Although Becker (1987) provided an alternative view involving the use of then innovative computer labs stocked with microcomputers, the “chalk-and-talk” mode of instruction continues to dominate the teaching of econometrics, as well as business and economic statistics. Here we take another try at advancing the use of computer technology in the teaching of quantitative methods. We assert that the essential tasks for those who teach these courses are to identify important issues that lend themselves to quan- y William E. Becker is Professor of Economics, Indiana University, Bloomington, Indiana, and Adjunct Professor of International Business, University of South Australia. William H. Greene is Professor of Economics, Stern School of Business, New York University, New York, New York. Their e-mail addresses are 具beckerw@indiana.edu典 and 具wgreene@stern.nyu.edu典, respectively. 170 Journal of Economic Perspectives titative analyses and then to help students develop an understanding of the appropriate key concepts for those analyses. How We Teach Econometrics and statistics are often taught as branches of mathematics, even when taught in business schools. Table 1 lists some contemporary textbooks in econometrics. A vast supply of statistics textbooks is available, most of which provide a common, familiar presentation of definitions, concepts, teaching resources and so on. Rather than attempt to select a few from a large set, we have listed in Table 2 some of the compilations of concepts, definitions and courses that can be found online.1 A cursory review of the material in Tables 1 and 2 suggests considerable agreement on the concepts and procedures to be presented. It also suggests that the focus in the textbooks and teaching materials is on presenting and explaining theory and technical details with secondary attention given to applications, which are often manufactured to fit the procedure at hand.2 At the extreme, this renders quantitative methods dry and abstract to the novice. In two national surveys, Becker and Watts (1996, 2001) found that problem sets are used more heavily in statistics and econometrics courses than in other undergraduate economics courses. Surprisingly, however, those applications are rarely based on events reported in financial newspapers, business magazines or scholarly journals in economics. Instead, they appear to be contrived situations with made-up data, as in textbooks that are characteristic of the chalk-and-talk teaching methods predominant across the undergraduate curriculum in economics. Especially troubling are authors’ comments, such as, “This numerical example is not econometrically realistic.” In reply, students are likely thinking, “So why do it?” Gary Becker’s (1996, p. 19) admonition that “students have unnecessary difficulties learning economics because textbooks generally do not have enough good examples of real-world applications” may be more troubling in econometrics than in other courses offered by departments of economics. Descriptions of actual situations and easily retrievable data are abundant today. There are at least three sources for vivid examples to engage students: history, news and the classroom itself. Stephen Stigler, in his work on the history of statistics, has pointed out a number of episodes that can make vivid classroom examples. For 1 There do not yet seem to be comparable websites for econometrics, although a “Glossary of Econometrics” can be found at 具http://www.oswego.edu/⬃kane/econometrics/glossaries.htm典. 2 Several of the econometric texts listed, such as Lawler (2000), Ramanathan (1998), Studenmund (2001) and Wooldridge (2000), are oriented to theory, yet contain many applications. Although now somewhat dated, Berndt (1991) is especially noteworthy for its emphasis on empirical applications while containing a fair amount of theory. William E. Becker and William H. Greene 171 Table 1 Undergraduate Econometrics Textbooks Amemiya, T., Introduction to Statistics and Econometrics, Oxford University Press, 1994. Berndt, E., Practice of Econometrics: Classic and Contemporary, Addison-Wesley, 1991. Dougherty, C., Introduction to Econometrics, Oxford University Press, 1992. Goldberger, A., A Course in Econometrics, Harvard University Press, 1991. Goldberger, A., Introductory Econometrics, Harvard University Press, 1998. Griffiths, W. et al., Learning and Practicing Econometrics, John Wiley and Sons, 1993. Griffiths, W. et al., Undergraduate Econometrics, John Wiley and Sons, 2001. Gujarati, D., Basic Econometrics, McGraw-Hill, 1995. Gujarati, D., Essentials of Econometrics, McGraw-Hill, 1999. Intriligator, M. et al., Econometric Models, Techniques and Applications, Prentice Hall, 1996. Judge, G. et al., Introduction to the Theory and Practice of Econometrics, John Wiley and Sons, 1988. Johnston, J. and DiNardo, Econometric Methods, McGraw-Hill, 1997. Kennedy, P., Guide to Econometrics, MIT Press, 1998. Kmenta, J., Elements of Econometrics, University of Michigan Press, 1998. Lawler, K. et al., Econometrics: A Practical Approach, Routledge Press, 2001. Maddala, G., Introduction to Econometrics, John Wiley and Sons, 2001. Mirer, T., Econometric Statistics and Econometrics, Prentice Hall, 1994. Peracchi, F., Econometrics, John Wiley and Sons, 2001. Pindyck, R. and Rubinfeld, Econometric Models and Economic Forecasts, McGraw-Hill, 1998. Poirier, D., Intermediate Statistics and Econometrics, MIT Press, 1995. Ramanathan, R., Introductory Econometrics with Applications, Harcourt, 1998. Studenmund, A., Using Econometrics: A Practical Guide, Addison-Wesley, 2001. Wooldridge, J., Introductory Econometrics: A Modern Approach, Southwestern, 2000. Table 2 Statistics Curriculum Websites Glossaries of Statistics: 具http://www.stats.gla.ac.uk/steps/glossary/index.html典 HyperStat Online Contents (resources arranged by concepts): 具http://davidmlane.com/hyperstat/index.html典 Statistical Science Web Courses with Online Materials: 具http://www.maths.uq.oz.au/⬃gks/webguide/courses.html典 Statistics on the Web (resources arranged by teaching, research, other areas): 具http://www.execpc.com/⬃helberg/statistics.html典 example, Stigler (1999, pp. 13– 41) describes an exchange between statistician Karl Pearson and three renowned economists—Alfred Marshall, John M. Keynes and Arthur C. Pigou—about a study Pearson did that suggested that alcoholism is not inherited and does not wreak havoc on offspring. The debate was widely covered by major newspapers in 1910 when, then as now, the reasons for and consequences of alcohol consumption were a hotly debated issue. In another vignette, Stigler (1996, pp. 355–357) related a disagreement between Pigou and statistician G. Udny Yule regarding the policy relevance of Yule’s multiple regression analyses of the per- 172 Journal of Economic Perspectives centage of persons living in poverty. Pigou argued that statistical reasoning alone could not be used to establish a relationship between poverty and relief because even with multiple regression, the most important influences could not be measured quantitatively. Naturally, issues such as whether certain traits are heritable or the extent to which antipoverty policies are effective continue to have considerable relevance for many students. Headline-grabbing events in the news can often be used to engage students in applications that establish the importance of economics and statistics for use in real situations. During work on this paragraph, for example, there were featured stories in Business Week ( June 11, 2001) about the potential costs connected with the analyses of conflicting data on the rollover characteristics of Ford Explorers and tread separation of Firestone tires; on television ( June 5, 2001), Larry King asked guest James Randi (a critic of psychics) for the number of binary questions and number of correct answers that guest Rosemary Altea (a spiritual medium) would have to achieve to win the $1 million Randi has pledged to anyone who can prove psychic powers; and a front page article in the Wall Street Journal ( June 8, 2001) begged for calculation of an implied mean and variance of family income from the information that 15 percent of Duke University students come from families making less than $50,000 per year and 60 percent come from families making more than $100,000. Many timely issues reported in the press can certainly be discussed, critiqued and used for data at the undergraduate level. There are resources available for teachers who want to consider including more such examples in their classes. Becker (1998) provides numerous examples of how the news media can be used to teach quantitative methods in an economics context. There is a course in “quantitative literacy” called Chance, which is available on the web at 具http://www.dartmouth.edu/⬃chance典. The course material includes many examples drawn from the media, and one can even receive a web newsletter with recent examples. However, much of the analysis found at this website is focused broadly on quantitative literacy rather than on examples connected to economic theory. A final step is to draw on the ample examples of instructors who have found ways to teach econometrics and statistics in more active ways in the classroom. The Journal of Statistics Education, available on the web at 具http://www.amstat.org/ publications/jse典, often has articles that suggest active learning techniques—for instance, Anderson-Cook offers “An In-Class Demonstration to Help Students Understand Confidence Intervals” in the Fall 1999 issue—although, again, many of the examples are not in an economics context. The Journal of Economic Education, at 具http://www.indiana.edu/⬃econed典, also offers some examples of active learning strategies aimed at economists teaching quantitative methods. For example, Monte Carlo laboratory experiments that were presented at a conference at Middlebury College were recently featured (Murray, 1999; Kennedy, 2001; Matthews, 2001). Teaching Statistics and Econometrics to Undergraduates 173 Key Concepts and Skills The starting point for any course in statistics and econometrics is the calculation and use of descriptive statistics—mean, median, standard deviation and such— and mastery of basic spreadsheet skills related to data management, computation and graphing. With these fundamentals in place, what concepts and skills are essential for analyses of actual situations confronted by economists, which students have difficulty learning? We submit that a short list includes probability, sampling distribution of an estimator, hypotheses testing, regression to the mean, the least squares estimator and alternatives to the least squares estimator. Probability Students are typically able to regurgitate basic rules and formulas for probability as found in elementary statistics textbooks, but in applications, the distinctions among marginal, joint and conditional probabilities continue to confuse students and teachers alike. The “Let’s Make a Deal” problem offers a vivid illustration of this confusion. As discussed by Nalebuff (1987) in this journal and popularized by Marilyn vos Savant (1990) in her Parade magazine column, the question involves a contestant on a game show who chooses one of three doors. Behind one door is a valuable car; behind the other two are goats. After the contestant picks a door, the host opens one of the other doors and reveals one of the goats. (The host never reveals the car, since that would spoil the suspense.) Then the host says to the contestant, “Do you want to stay with your original choice or pick the other door?” The immediate reaction of many players is that switching cannot matter, since after one of the goats is revealed there are still two doors and only one desirable prize, which seems to imply that it is a 50:50 chance whether to switch or not. But this is incorrect. To see the intuition behind the correct answer, recognize that the player’s chance of being correct in the first choice is one in three. If the player is correct in the first choice, then switching will be wrong. However, if the player is incorrect with their first choice, which happens two times out of three, then switching will lead to winning the prize. Thus, two times out of three, switching is a winning strategy. At a more subtle level, the key to the problem is to understand the nature of the information revealed in the second stage. As long as the game show host reveals one of the goats, switching in this sequential game is equivalent to a single-choice game in which the host says, “Do you want one door or a set of two?”3 Examples involving probability such as this abound. Marilyn vos Savant’s 3 For a detailed discussion of how this problem depends on the details of the question asked and the situation, see the article in American Statistician by Morgan et al. (1991), the letter from vos Savant and the rejoinder from the authors. Students can find and play the “Let’s Make a Deal” game at 具http:// www.stat.sc.edu/⬃west/javahtml/LetsMakeaDeal.htm典. There is a collection of similar Java applets written by several different authors at 具http://www.stat.duke.edu/sites/java.html典. 174 Journal of Economic Perspectives weekly Parade magazine column is a great source of everyday problems people have with probabilities associated with state lotteries, insurance, genetics and the like. For those interested in results of a more systematic search, Paulos (1995) contains a collection of useful vignettes. Sampling and Sampling Distributions Students have little trouble grasping randomness in sampling—that is, the notion that their data represent random draws and that other samples would yield somewhat different values. They often have tremendous difficulty, however, grasping the notion that statistics calculated from sample data, and used to estimate corresponding population parameters, are themselves random, with values represented in a histogram known as the sampling distribution of the statistic. Students are typically asked to understand this concept purely through an exercise of imagination: “Imagine that we went back to the population and drew another sample of n items, calculated another sample mean . . . and another . . . .” Given the importance of understanding the notion of a sampling distribution in econometrics, it is unfortunate that we leave its development to the imagination when modern-day computers (as well as old-fashioned dice throwing) could make real the development of a histogram of possible values of a sample statistic. In small groups, students can quickly and easily discover the principles in experiments that they carry out (and modify) themselves in a computer laboratory. Some econometric textbooks show what happens to the sampling distribution of the mean for increasing sample sizes for draws out of uniform and skewed populations (as was done nicely by Wonnacott and Wonnacott, 1980), but none that we have seen go the full distance of actively pursuing an inquiry method of teaching. Robert Wolf, at 具http://archives.math.utk.edu/software/msdos/ statistics/statutor/.html典, provides a computer-based tutorial on sampling distributions, estimators and related topics that can be freely downloaded for individual student and classroom use. One important lesson students can learn from their own inquires into sampling and resampling data, and looking at means and variances of their distributions, is the difference between the law of large numbers and the central limit theorem. The law of large numbers holds that as the size of the sample increases, the sample mean will converge to the true mean (the sampling distribution of the mean collapses on or degenerates to a spike at the population mean). The central limit theorem, on the other hand, states that for many samples of like and sufficiently large size, the histogram of these sample means will appear to be a normal distribution (the sampling distribution of the mean is approximately normal if the sample size is sufficiently large). Again, working in small groups, students can quickly see (as pictured in Goldberger, 1991) how standardization of a sample mean creates a standard normal random variable (with mean of zero and standard deviation of one) that does not degenerate to a single value as the sample size goes William E. Becker and William H. Greene 175 to infinity.4 With this hands-on experience, the notion of a probability limit becomes more than an algebraic expression. With students working at computers, bootstrapping is a natural real-world extension of their work with sample distributions. In the bootstrapping approach, repeated samples are taken (with replacement) from the original sample. The distribution of the desired descriptive statistic is then deduced from these samples. This sampling distribution is used to construct an interval estimate of the population parameters of interest—which requires no added assumptions about the underlying distribution of the population or the context of the real-world problem considered. Econometricians are making ever greater use of bootstrapping approaches in their work. Thus, using the bootstrap as a teaching tool gives students early and hands-on exposure to a powerful research tool that is made possible through powerful and cheap computing power. Collections of data for students to sample are readily available at many websites. Some good starting points for data are the sites maintained by Robin Lock, a statistician in the Department of Mathematics at St. Lawrence University, who provides links to data sources at 具http://it.stlawu.edu/⬃rlock典, and the sites listed by the Econometrics Laboratory at the University of California provided at 具http:// elsa.berkeley.edu/eml/emldata.html典. For information and access to a wide variety of econometrics programs, the Econometrics Journal website has a sizeable collection of links at 具http://www.econ.vu.nl/econometriclinks/software.html典. Links to information about a wide range of statistical software packages is available at 具http:// www.oswego.edu/⬃economic/econsoftware.htm典. Hypothesis Testing By the time students get to an econometrics course, instructors often assume, wrongfully, that knowledge of tradeoffs between Type I and Type II errors is fully understood and appreciated. A Type I error occurs when the null hypothesis is rejected erroneously. A Type II error occurs when the null hypothesis is not rejected when it is in fact false. Ignored by this distinction is the considerable controversy in the economics profession as well as in the rest of the social sciences over the application of statistical significance versus the magnitude and practical importance of an effect. 4 Standardization of a random variable, X, maps values of X into a new random variable, Z, which has a mean of zero and standard deviation of one. Standardization begins by subtracting X’s mean or expected value, E(X ) ⫽ , from each value of X; this creates a transformed random variable (X ⫺ ), which has a mean of zero. Dividing this transformed random variable by X’s standard deviation, , ⫺ which also creates the standardized random variable Z ⫽ (X ⫺ )/ . In the case of the sample mean X, 公 has an expected value of and standard deviation of X ⫽ / n, standardization yields Z ⫽ ⫺ ⫺ )/ . Although the distribution of X ⫺ collapses on as n goes to infinity, its standardization Z (X X (generally) converges to something normally distributed as n gets larger, a result students can see for themselves with a resampling program. The effect of standardizing X, as well as other Java applications ⫺ can be seen at 具http://www.umd.umich.edu/casl/socsci/econ/StudyAids/JavaStat/ involving X, applet.htm典. 176 Journal of Economic Perspectives In economics, McCloskey and Ziliak (1996) fired off yet another salvo on the three S’s (sign, size and significance) when they pointed out that a fixation on whether test statistics are statistically significant can result in a situation where potentially large effects are neglected purely because statistical precision is low, not because the results are untrue. A cursory review of the econometrics textbooks in Table 1 suggests an emphasis on statistical significance with minimal attention given to the size of the estimated effect. Confidence intervals (which provide a range of “plausible” values based on the sample information) can be used to emphasize the importance of all three of the S’s without the need for formal null hypothesis, but this is seldom done in econometrics textbooks. Utts (1991) provides an intriguing hypothetical example for stimulating student discussion of significance versus effect size. Two professors wish to test whether a population proportion is greater than 0.25. One professor conducts the experiment twice on two separate groups of 100 and finds statistically significant results in each. The other professor carries out ten separate experiments on a total of 200 subjects, but in none of the ten individual experiments are the results statistically significant. The question for students is this: “Which results are most impressive?” If the students are careful, they observe that in the first case of significant results for the aggregate of 200, there were 69 successes, but in the second case with ten insignificant results, there were 71 successes for the 200 subjects. The presentation of Utts’s data in class leads to fun classroom discussion on sample size, effect size, the meaning and importance of statistical significance and the meaning of replication. It provides a starting point for students to attempt their own meta-analysis to assess the effect of sample size and alternative methods of combining study results. Students who understand the idea of a sampling distribution usually have little trouble grasping the idea of a Type I error. But the conditional nature of a Type II error is more difficult because initial intuition seems to suggest that the probability of a Type II error is one minus the probability of a Type I error. That the probability of a Type II error depends on the true value of the parameter being tested is a stretch without a demonstration. Here again, hands-on computer experience can be very useful. R. Todd Ogden, in the Department of Statistics at the University of South Carolina, provides a Java applet that gives students the opportunity to see the changing size of the Type II error as sample size is increased at 具http://www. stat.sc.edu/⬃ogden/javahtml/power/power.html典. Regression to the Mean A common fallacy in statistical analysis involves claims of regression to the mean; that is, a claim that relatively high values are likely to fall toward the average and relatively low values are likely to rise to the average. Indeed, Milton Friedman (1992, p. 2131) wrote: “I suspect that the regression fallacy is the most common fallacy in the statistical analysis of economic data. . . .” The fallacy often arises when the analyst first splits the sample into high-value Teaching Statistics and Econometrics to Undergraduates 177 and low-value points and then analyzes these points separately. In a classic example, Secrist (1933) argued that business enterprises were converging in size based on the observation that the group of the largest enterprises tended to decrease in size over time while the group of smaller enterprises tended to increase over time. Similarly, Sharpe (1985, p. 430) looked at the return on equity for firms that started in the top quintile and found that it tended to decline over time, whereas return on equity for firms that started in the bottom quintile tended to rise over time. The issue also arises in comparative studies of national economic growth, when the sample is divided into fast- and slow-growth countries. The discussion of growth patterns of various countries in Baumol, Blackman and Wolff (1989) serves as an excellent vehicle for explaining the issues and showing the difficulty of rooting out appealing fallacies. As Hotelling (1933) pointed out in a review of the work of Secrist (1933), Wainer (2000) points out in a discussion of Sharpe’s (1985) book, and Friedman (1992) points out in a number of contexts including the Baumol, Blackman and Wolff analysis, if regression to the mean truly exists, then over time, the variance of the distribution as a whole should decline; that is, all the values should cluster ever closer to the mean. Looking at subgroup averages does not show, one way or another, whether the variance of the entire distribution has declined. Motivating the Least Squares Estimator Scatterplots traditionally have provided the means for introducing linear least squares regression. However, there remains a difficult leap of intellectual faith from the idea of estimating a mean value of the dependent variable, Y, conditional on the values of the independent variables, X, to understanding why minimizing the sum of the squares of the residuals should be the right tool to accomplish this goal. There are several familiar approaches to motivating the least squares estimator. Murray (1999) demonstrates how to get students to come up with them on their own. First, one can seek to draw best-fit lines through a scatterplot. As a second step, students can consider alternative ways of getting an equation for such a line. The instructor can lead the discussion to possibilities like the algebraic equation of the line drawn through extreme points, least absolute deviations from such a line, minimum sum of deviations, and so on. A third approach is to rely on the intellectual pedigree of the least squares approach, while a fourth approach is to promise to show later that a least squares approach has good properties. Unfortunately, it must be said that although these approaches can help students understand a variety of ways of looking at data, together with fallacies that may arise, it remains true that many students still perceive the least squares estimator as essentially drawn out of midair, with no obvious reason as to why it should produce an estimate of the population parameter of interest. An approach to regression analysis that has not yet received adequate attention in undergraduate textbooks (with the notable exception of Goldberger’s books) is estimation based on the method of moments, which is now the norm in graduate 178 Journal of Economic Perspectives and more advanced treatments. In keeping with the history of thought and recent developments in the theory of estimation, the intuition for this approach rests on the insight that an estimator of a population parameter comes from the corresponding or analogous feature of the sample—that is, population parameter estimators must have sample properties that mimic similar properties in the population model. Instead of starting from the data, a method-of-moments analysis starts with the properties of the population. For example, the standard starting point for a population model calls for a linear deterministic relationship between Y and X, where deviations in the Y values from that expected from this linear relationship are assumed to be unrelated to the X value and have a zero mean at each value of X. Thus, the expected deviations in Y must be zero regardless of the X values considered. The method of moments says that sample data generated from this population model must have the same properties, which are forced on the data through the selection of the intercept and slope of the sample regression line. Once obtained in this fashion, method-of-moments estimates can be compared to the least squares estimates. Multiple regression (an extension of the preceding to more than one explanatory variable) and instrumental variables regression (an intuitively appealing modification of the preceding least squares procedure) can easily be motivated in the method-of-moments framework. We note that good examples for least squares estimation abound, but accessible and interesting examples for instrumental variables are less common. We suggest Ashenfelter and Krueger’s (1994) study of twins and the returns to education as an intriguing candidate. Alternatives to Least Squares The conventional “blackboard” course in econometrics focuses on the algebra of least squares estimation of parameters in highly structured models, with some discussion of applications requiring data transformations (like logarithms, powers and differencing), dummy variables, time trends, instrumental variables and so on. However, recent developments in computational procedures and the underlying theory place a greater variety of tools easily within students’ reach. Nonlinear modeling of all sorts as well as nonparametric regression techniques are now available to students working in a computer lab. As an example of what can be done in computer labs, consider a widely circulated application in Spector and Mazzeo (1980). They estimate a model to shed light on how a student’s performance in a principles of macroeconomics class relates to his/her grade in an intermediate macroeconomics class, after controlling for such things as grade point average (GPA) going into the class. The effect of GPA on future performance is less obvious than it might appear at first. Certainly, it is possible that students with the highest GPA would get the most from the second course. On the other hand, perhaps the best students were already well equipped, and if the second course catered to the mediocre (who had more to gain and more William E. Becker and William H. Greene 179 room to improve), then a negative relationship between GPA and increase in grades (GRADE) might arise. In Figure 1, we provide an analysis similar to that done by Spector and Mazzeo (using a subset of their data). The horizontal axis shows the initial grade point average of students in the study. The vertical axis shows the relative frequency of the incremental grades that increase from the first to the second course. The solid curve shows the estimated relative frequency of grades that improve in the second course using a probit model (the one used by the authors). These estimates suggest a positive relationship between GPA and the probability of grade improvement in the second macroeconomics course throughout the GPA range. The dashed curve in Figure 1 provides the results using a much less structured nonparametric regression model.5 The conclusion reached with this technique is qualitatively similar to that obtained with the probit model for GPAs above 2.6, where the positive relationship between GPA and the probability of grade improvement can be seen, but it is materially different for those with GPAs lower than 2.6, where a negative relationship between GPA and the probability of grade improvement is found. We note that the economics literature now abounds with interesting, relevant 5 The plot for the probability model was produced by first fitting a probit model of the binary variable GRADE as a function of GPA. This produces a functional relationship of the form Prob(GRADE ⫽ 1) ⫽ ⌽(␣ ⫹ GRADE), where estimates of ␣ and  are produced by maximum likelihood techniques. The graph is produced by plotting the standard normal CDF, ⌽(␣ ⫹ GRADE) for the values of GRADE in the sample, which range between 2.0 and 4.0, then connecting the dots. The nonparametric regression, although intuitively appealing because it can be viewed as making use of weighted relative frequencies, is computationally more complicated. Today the binomial probit model can be fit with just about any statistical package, but software for nonparametric estimation is less common. LIMDEP version 8.0, produced by Econometric Software, Inc., was used for both the probit and nonparametric estimations. The nonparametric approach is based on the assumption that there is some as yet unknown functional relationship between the Prob(GRADE ⫽ 1) and the independent variable, GPA, say Prob(Grade ⫽ 1 | GPA) ⫽ F(GPA). The probit model based on the normal distribution is one functional candidate, but the normality assumption is more specific than we need at this point. We proceed to use the data to find an approximation to this function. The form of the “estimator” of this function is F(GPA*) ⫽ ⌺i⫽all observations w(GPA* ⫺ GPAi )GRADEi .The weights, w(.), are positive weight functions that sum to 1.0, so for any specific value GPA*, the approximation is a weighted average of the values of GRADE. The weights in the function are based on the desired value of GPA, that is GPA*, as well as all the data. The nature of the computation is such that if there is a positive relationship between GPA and GRADE ⫽ 1, then as GPA* gets larger, the larger weights in the average shown above will tend to be associated with the larger values of GRADE. (Because GRADE is zeros and ones, this means that for larger values of GPA*, the weights associated with the observations on GRADE that equal one will generally be larger than those associated with the zeros.) The specific form of these weights is as follows: w(GPA* ⫺ GPAi ) ⫽ (1/A) ⫻ (1/h)K[(GPA* ⫺ GPAi )/h]. The h is called the smoothing parameter, or bandwidth, K[.] is the kernel density function and A is the sum of the functions, ensuring that the entire expression sums to one. Discussion of nonparametric regression using a kernel density estimator is given in Greene (2000, pp. 844 – 846) and in the paper by DiNardo and Tobias in this issue. The nonparametric regression of GRADE on GPA plotted in the figure was produced using a logistic distribution as the kernel function and the following computation of the bandwidth: let r equal one third of the sample range of GPA, and let s equal the sample standard deviation of GPA. The bandwidth is then h ⫽ .9 ⫻ Min(r, s)/n 1/5 . 180 Journal of Economic Perspectives Figure 1 Predicted Probability of Grade Increase applications that use the sorts of techniques mentioned here. To cite one example, Kenkel and Terza (2001) apply this kind of analysis to the effect of physician advice on alcohol consumption, a perennial subject of the popular press that is in keeping with our first example, on the debate about alcoholism between Karl Pearson and his early twentieth-century counterparts. There are other alternatives to least squares that undergraduates can work with in computer labs—for example, least absolute deviations. The least absolute deviations approach is a useful device for teaching students about the sensitivity of estimation to outliers. It is also straightforward to find examples that show that even if least squares estimation of the conditional mean is a better estimator in large samples, least absolute deviations estimation of the conditional median can sometimes offer a better performance in small samples. The important point is that while students must master least squares, they also need to see alternatives to least squares. These alternatives have long been incorporated in many computer programs. What differs now is the ease with which these tools can be placed in students’ hands within computer labs without first requiring them to master complex programming syntax and several mathematical specialties. Conclusion If instructors engaged undergraduates in the identification of important issues that lend themselves to quantitative analyses and if they helped students identify the appropriate key statistical concepts for that analysis, then the teaching of business and economic statistics and econometrics would not have needed to change much over the past 20 years— other than to incorporate computer technology. Unfortunately, the identification of real-life issues has been lacking in both classrooms and Teaching Statistics and Econometrics to Undergraduates 181 textbooks. Possibly because of the effort required to find those good examples and to get the necessary data for analysis, the emphasis has been on the concepts and methods and not the applications. We have tried to help by identifying some of the electronic and hard-copy sources for finding timely applications. The availability of inexpensive computer technology can now be relied on to free up both instructor and student time to bring those applications directly into the classroom. In terms of the technology, teachers of quantitative methods no longer have an excuse for failing to incorporate into their teaching both the theoretical and practical aspects of applying statistical methods to economic data for the purpose of testing economic theories and of forecasting and controlling the future path of economic variables. Nevertheless, institutional constraints such as inappropriately supported and maintained computer labs, for example, may work against an instructor’s eagerness to abandon chalk-and-talk methods. In addition, the reward structure may not recognize the efforts of instructors who bring technology and current issues into their teaching. As pointed out by Becker and Watts (1999), traditional end-of-semester student evaluations of instructors may actually deter innovation because they seldom include questions about the instructor’s use of technology in real-world applications. Change can be expected only if students, instructors and their institutions are amenable to it. y This article is based in part on material presented by the authors at an Allied Social Sciences Association session (New Orleans, Louisiana, January 6, 2001) sponsored by the American Economic Association Committee on Economic Education. The authors thank participants in that session and the editors of this journal for constructive criticism in the preparation of earlier versions of this article. References Ashenfelter, Orley and Alan Kreuger. 1994. “Estimates of the Return to Schooling from a New Sample of Twins.” American Economic Review. December, 84, pp. 1157–173. Baumol, William J., Sue Anne Batey Blackman and Edward N. Wolff. 1989. Productivity and American Leadership: The Long View. Cambridge, Mass.: MIT Press. Becker, Gary. 1996. “Not-So-Dismal Scientist.” Business Week. October 21, p.19. Becker, William E. 1987. “Teaching Statistical Methods to Undergraduate Economics Stu- dents.” American Economic Review. May, 77, pp. 18 –24. Becker, William E. 1998. “Engaging Students in Quantitative Analysis with the Academic and Popular Press,” in Teaching Economics to Undergraduates: Alternatives to Chalk and Talk. W. Becker and M. Watts, eds. Cheltenham, U.K.: Edward Elgar Publishing, Ltd., pp. 241– 67. Becker, William E. and Michael Watts. 1996. “Chalk and Talk: A National Survey on Teaching Undergraduate Economics.” American Economic Review. May, 86, pp. 448 –54. 182 Journal of Economic Perspectives Becker, William E. and Michael Watts. 1999. “How Departments of Economics Evaluate Teaching.” American Economic Review. May, 89, pp. 344 –50. Becker, William E. and Michael Watts. 2001. “Teaching Economics at the Start of the 21st Century: Still Chalk and Talk.” American Economic Review. May, 91, pp. 440 – 46. Berndt, Ernst R. 1991. Practice of Econometrics: Classic and Contemporary. Boston, Mass.: AddisonWesley. Econometric Software, Inc. 2001. “LIMDEP, Version 8.0.” Plainview, N.Y. Friedman, Milton. 1992. “Communication: Do Old Fallacies Ever Die?” Journal of Economic Literature. December, 30, pp. 2129 –132. Goldberger, Arthur S. 1991. A Course in Econometrics. Cambridge: Harvard University Press. Greene, William H. 2000. Econometric Analysis. Upper Saddle River, N.J.: Prentice Hall. Hotelling, Harold. 1933. “Review of ‘The Triumph of Mediocrity in Business,’ By Horace Secrist.” Journal of American Statistics Association. December, 28, pp. 463– 65. Kenkel, Dennis and Joseph Terza. 2001. “The Effect of Physician Advice on Alcohol Consumption: Count Regression with an Endogenous Treatment Effect.” Journal of Applied Econometrics. March, 16, pp. 165– 84. Kennedy, Peter E. 2001. “Bootstrapping Student Understanding of What is Going on in Econometrics.” Journal of Economic Education. Spring, 32, pp. 110 –23. Lawler, Kevin et al. 2000. Econometrics: A Practical Approach. London: Routledge Press. Matthews, Peter H. 2001. “Positive Feedback and Path Dependence Using the Law of Large Numbers.” Journal of Economic Education. Spring, 32:2, pp. 124 –36. McCloskey, Deirdre and Stephen Ziliak. 1996. “The Standard Error of Regression.” Journal of Economic Literature. March, 34, pp. 97–114. Morgan, J.P. et al. 1991. “Let’s Make A Deal: Player’s Dilemma.” American Statistician. November, 45, pp. 284 – 87. Murray, Michael. 1999. “Econometrics Lectures in a Computer Classroom.” Journal of Economic Education. Summer, 20, pp. 308 –21. Nalebuff, Barry. 1987. “Puzzles: Choose a Curtain, Duel-ity, Two Point Conversions, and More.” Journal of Economic Perspectives. Fall, 11:4, pp. 157– 63. Paulos, John Allen. 1995. A Mathematician Reads the Newspaper. New York: Anchor Books. Ramanathan, Ramu. 1998. Introductory Econometrics with Applications. Fort Worth, Tex.: Harcourt College Publishers. Secrist, Horace. 1933. The Triumph of Mediocrity in Business. Evanston, Ill.: Bureau of Business Research, Northwestern University. Sharpe, William F. 1985. Investments, Third Edition. Englewood Cliffs, N.J.: Prentice Hall. Sowey, Eric R. 1983. “University Teaching of Econometrics: A Personal View.” Econometrics Review. May, 2, pp. 255– 89. Spector, Lee C. and Michael Mazzeo. 1980. “Probit Analysis and Economic Education.” Journal of Economic Education. Spring, 11, pp. 37– 44. Stigler, Stephen. 1996. The History of Statistics: The Measurement of Uncertainty Before 1900. Cambridge, Mass.: Harvard University Press. Stigler, Stephen. 1999. Statistics on the Table. Cambridge, Mass.: Harvard University Press. Studenmund, A. H. 2001. Using Econometrics: A Practical Guide. Boston, Mass.: Addison-Wesley. Utts, Jessica. 1991. “Replication and MetaAnalysis in Parapsychology.” Statistical Science. 6:4, pp. 363– 403. vos Savant, Marilyn. 1990. “Ask Marilyn.” Parade Magazine. December 2, p. 25. Wainer, Howard. 2000. “Visual Revelations: Kelley’s Paradox.” Chance. Winter, 13, pp. 47– 48. Wonnacott, Ronald J. and Thomas H. Wonnacott. 1980. Econometrics. New York, N.Y.: Wiley. Wooldridge, Jeffrey. 2000. Introductory Econometrics: A Modern Approach. Cincinnati, Ohio: Southwestern College Publishing.