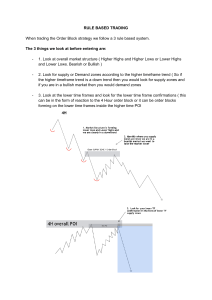

[EN] Smart Money Concepts by JordyBanks Introduction The Smart Money Concepts are the most reliable concepts that will help you succeed in trading. When it comes to investing in general, we only want to find opportunities with high probabilities of return and great risk-reward ratio. In Forex Trading it's the same thing. Fortunately, Smart Money Concepts can assist us finding those opportunities. We will go through all of those concepts one by one, and at the conclusion, you will be able to identify great opportunities by combining all of them. 1. Market Structure The first part of charts analysis is Market Structure. The market structure gives us the bias, allow us to have a first approach of the behavior of the market and help us situate the price in a recent timeframe which give us odds on which direction it may probably move. The market moves in 3 distinct ways: Uptrend also knowed as a Bullish Market Downtrend also knowed as a Bearish Market Sideways or Ranging Market Identify the Market Structure The market always prints what we call Highs and Lows, identifying them is key to market structure. When price go significantly enough over the last printed high or the last printed low, we call that a break of structure (bos). In a trending market, the movement that breaks the structure is known as an impulsive move, and is usually followed by a corrective move before continuing the trend with another impulsive move. Note that market may do two impulsive move in a row, it happens when market wants to shift in structure. So an uptrend and a downtrend are nothing more than a series of structure breaks, to the upside and the downward, printing higher highs/higher lows and lower highs/lower lows respectively. When price fails to break structure to continue the trend, it shows weakness wich may indicate a trend reversal; similary, when price breaks structure to the downside in a bullish market, it may indicate a trend shift to a bearish market, same thing may occurs in a bearish market. The sideways market happens when the market prints equal highs and equal lows in a row. Price stays in a range during this point of the market and is in consolidation. This range is broken if the price breaks out from the top or bottom of the range. This could be the beginning of a trend. [EN] Smart Money Concepts by JordyBanks 1 The Fractal Nature/Multi-timeframe Analysis The market has a fractal nature, meaning that it happens in every timeframe. For example, a long term downtrend seen on H4 timeframe will most likely show short terms uptrends in a 30min timeframe while correcting an impulsive move; you can also find other structure if you go deeper in lower timeframe. It's true for every type of structure and every timeframe (from monthly to seconds). Here is real-time charts illustration of fractal market: Very important thing to understand, when you are trading on a particular timeframe, don't forget the higher timeframe trend. Here, we have to keep in mind that on the H4 timeframe we are bearish, so we have to be careful when trading the bullish market on the 30min timeframe as it may reverse at any moment. Conclusion, always do a 'MultiTimeframe Analysis', and don't forget the higher timeframe trend. Market will not always shows perfect and obvious structure. Our role is to find highs and lows that protect the structure we are following. When searching opportunities we always want to follow the actual trend on our actual timeframe. In a bullish market we look for buys opportunities as long as our recent higher low protect the trend, since we believe the price has more chance to rise. Same thing for a bearish market, as long as the last lower high is not broken, we follow the trend and we look for sells opportunity because the price has higher odds of falling. We want to avoid a ranging market since we don't know where the price wants to head. However, if you understand market structure, you may spot some trending structure at smaller timeframe and catch some opportunities. Structure Mapping Structure mapping concerns break of structures. You have to know when you admit that there is a break of structure. There are a few variations of market structure breaks. It is important that you choose between those variations and stick to it. See models: model a: break of structure is based on the candle's body of the low. model b: break of structure is based on the entire candle of the low and price closed below that low. model c: break of structure is based on the entire candle of the low but price failed to close below that low. So price just wicked the low. You must stick to your model since it will serve as the foundation of your market structure. [EN] Smart Money Concepts by JordyBanks 2 Buy low & Sell high Buying low and selling high is the strategy that market structure offered us. This strategy is our first green light in Smart Money Concepts. In a trending market, we simply wait for a deep correction. A correction is deeper enough when it corrects at least 50% of the impulsive move. The market respect this law almost all the time, that is why we are taking advantage of it. Above 50% is the premium zone, under is the discount zone, and 50% is considered equilibrium. So you understand that we only buy when the price is in the discount zone, and sell when it is in the premium zone. On the illustration on the right, you can see that price broke structure to the downside with a nice impulsive move. At this moment we expect a corrective move. As we are most likely in a bearish market, we want price to reach our premium zone to start looking for sell entry. As you can see, price has fallen after it reached our premium zone ,broke structure to continue his trend and respected our last lower high. Keep in mind that market structure itself is not enough to determine if we are taking a position. It increases probabilities of winning but we need many confluences to be able to open a position, and market structure is just one of them and the first one. 2. Supply And Demand Zone or Order Block Supply and demand (SnD) zones, or Order Blocks, are footprints left by the market when an impulsive move occurs. Price is most likely to come back to those zones before it trigger another impulse move to continue his trend. Demand zones stand as buying area and supply zones as selling area. The footprints left may be either a ranging market or opposite candles before an impulse move. By opposite candles we mean, brearish candles before a bullish impulse move, or bullish candles before bearish impulsion. There is multitude of SnD zones printed, since impulse move and break of structure happen on every timeframe. But we understand that the market is fractal, and depending of the struture, we know our bias and we can already get rid of some SnD zones. So we have to combine our market structure analysis, such as the buy low and sell high strategy, and SnD Zones. Once price reaches and react to an order block, we are saying that this order block has been mitigated, and can never be mitigated a second time. Our task here is to identify SnD zones as points of interest (poi). Here are some examples of how we have to view the market in Structure and SnD point of view, follow numbers for better comprehension: In this section, we attempt to comprehend the combination of market structure and Supply & Demand Zones. Demonstrating that we can identify various points of interest on which we will put full attention for potential future opportunities. Spending times on charts will train your eyes to spot them instantly. You may also note that price tends to react to a supply zone in the premium area and a demand zone in the discount area. Here is another example of combining market structure and SnD zones: [EN] Smart Money Concepts by JordyBanks 3 You can already employ a really good strategy using market structure analysis and SnD zones. But we can push the analysis deeper to see if the price we react at our SnD zone or no. Also, we can understand price movement and why they want to head to a direction before continuing to another one. That is what we'll cover next with concepts of liquidity. 3. Liquidity Concepts Banks control market movements, they manipulate it. They run it in order to profit from it. As a result, their purpose is to move the market's price to where liquidities exist. There are several types of liquidity. Knowing them all will help us comprehend price movements and will allow us to follow the banks. They will mostly assist us in determining the best SnD zone for our entry and in placing our take profit/stop loss order. Once again, remember the market in fractal so all of these concepts are true in every timeframe. Swing highs / Swing lows & Trendlines Swing highs and swing lows are just highs and lows of the structure. They are the first type of liquidity. All you have to understand is that there are liquidities aboves highs and below lows. Price may grab those liquidities by break of structure (bos). Note that equal highs and equal lows, and trendlines build more liquidity than a simple high or low. Trendlines liquidities are simply highs and lows of a trending market. These concept is due to the fact that most of traders, those who are told to trade the wrong way by "Guru's" on the internet, tend to put order at those area, such as stop loss orders or buy/sell orders. Triggering those orders would add liquidity to the market and banks profit on that. Session: highs and lows of sessions may also act as liquidity. Also, at the opening of sessions, volume is kicking in, and a manipulation can occurs resulting to a grab of liquidities. The picture may be more obvious after that manipulation and may give opportunities. Imbalance Imbalance occurs on a regular basis in the market. They are market voids that are most of the time immediately filled, also knowed as inefficiency. Once again, keep in mind the fractal nature of the market. If we take three successive candles, the second one is the one that may have left an imbalance, which we may notice by checking for space between the high of the first candle and the low of the third. The space between is the source of the imbalance, and future candles may fill it. When we analyze the charts candle by candle, we can observe that there are imbalances everywhere and price is always filling them. However, it becomes important to us when they are not immediately filled. Especially when combine with SnD zones. [EN] Smart Money Concepts by JordyBanks 4 Order Block Yes an order block also act as liquidity since it attracts the price. We previously showed how to draw SnD zones using a certain candle and a ranging market. We may, however, be more precise and reduce these zones. Combining with the concept of imbalance, we can refine an order block until there is no more imbalance in it. We can go to the lowest timeframe and refine our SnD zone, since we understand that price still may fill all the imbalance before reacting. For example, if you draw a SnD Zone on 15min timeframe, you may notice an imbalance in that order block on the 5min timeframe, and so refine it until you have find the last point of liquidity that price may reach. By doing that, you will dramatically boost your risk-reward ratio by lowering your stop loss. However, you must develop your own method of refining that is appropriate for your plan. Because over-refining might cause you to miss certain trades and affect your trading psychology. We'll go over this section in greater detail later in last chapter. Inducement Inducement occurs when the market adds liquidity to a SnD zone. It might be highs and lows, equal highs and lows, or a trendline. For example, when a price approached a demand zone but failed to enter and finally reversed, liquidity is created by generating this swing low. We now have this swing low as inducement, which leads us to assume that price will seize it and react to the demand zone. As an inducement, equal lows and highs, or trendline would signal an even stronger SnD zone. We primarily employ inducement and imbalance to increase the trustworthiness of our SnD zones. Follow the numbers for better comprehension: We've previously combined several ideas. Let's do a quick recap: 1. Market Structure: Build your bias and give odds to where the price wants to head on a higher scale. Added to this, the Buy Low/Sell High Strategy. 2. Supply & Demand Zone: Zones created by the structure that may trigger the next impulse moves. 3. Liquidity: Give us a "narrative" about where the price is most likely to move before moving in another direction. These examples demonstrated how to mix them all. What you have to understand is, either you spot the liquidity or be the liquidity. Now that we've covered market structure, SnD Zones, and concepts of liquidity, let's take a look at how we may open positions as precisely as possible. [EN] Smart Money Concepts by JordyBanks 5 4. Entry Types Taking a market position is always predicated on a smaller timeframe than your market structure and SnD zones analysis. This is when the market's fractal nature comes into its own. All of the prior concepts we've learnt up until that point will help us be as precise as possible. Weak Hands to Strong Hands When price is approaching our point of interest (SnD zone), we jump on lower timeframe to see the behavior of the price. What we want to see is what we call the transfer from weak hands to strong hands. For example, at a supply zone, weak hands would be buyers and strong hands would be sellers. A schematic will be developed if this transfer occurs. So, we will be interested to sell at this supply zone. This transfer is nothing more than a reverse of the trend on your entry timeframe. Fortunately, there are 2 schematics that market tends to print at those area showing us this transfer. To be valid, the schematic must follow to a set of rules. First, there must be a grab of liquidity; the more he has to grab, the better the scheme. The price then have to break structure to indicate a trend reversal. It may construct an inner structure before revealing his plan to reverse. (like the example here) Finally, the price must move to the last order block that triggered the last bos. This is where we will open a trade since it will certainly trigger the major impulse move from which we will profit. As you can see, we just repeat the analysis from higher to lower timeframes. The market constantly shows us what it intends to do, and we must wait for a clear situation. Don't forget that the direction you choose to trade is always based on market structure. And you have to correlate your structure analysis from your higher to entry timeframe. SnD zones and order blocks are here to trigger a move that we may profit on. We now understand that we never predict the market, but rather react to it. However, the difficulty here is to recognize the schematics and be ready to open our positions. The 2 types of schematics that show us the transfer from weak hands to strong hands are as follow: To avoid any confusion with our higher timeframe analysis, we use other terms on our entry timeframe. Sweep stands as liquidity grab. SB is an abbreviation for Sub-Break of Structure. Personally I am using the term Major-Break (MB) for higher timeframe break of structure, Inner-Break (IB) for inner structure break, and, SubBreak (SB) for break of structure when it comes to my entry timeframe. MB would be for H4 timeframe structure analysis, IB for 15min and finally SB for 1-3min timeframe charts. This keep me out of any confusion of all the structure analysis I am doing. [EN] Smart Money Concepts by JordyBanks 6 Order Flow and Scale In Order flow is just a reflection of the trend. When we have confirmation of weak hands to strong hands on our choosen timeframe chart, the market may continue to print SnD zones on the same timeframe. So we have the possibility to take positions on each of those SnD zones as long as we recognize that a change from weak to strong hands occurred and agree that the price must move in the right direction. For example, I look to see if the transition from weak to strong hands occurs on '1min' timeframe chart. And if that happens, I'll keep an eye on the market and add positions, scale in, on each SnD zones until the price hits our final liquidity, which is acting as our take profit. Here is a real chart example of order flow / scale in trade, on 1min timeframe : There are more examples of trades that I breakdown on our Discord Server. We have covered all the most important concepts of Smart Money. There are still some little points to consider. 5. Session / News / Broker / PropFirm Session: As previously said, session highs and lows may act as liquidty, attracting the price. Additionally, certain pairs may move more significantly during some sessions. The major pairs that I recommend you focus on tend to move and provide more opportunity during the London and New York sessions. So we need to know when the sessions are. You can make it easy by using this website: https://forex.timezoneconverter.com/ News: economic news and events can have a huge influence on the market. Traders try to avoid trading during high-impact news since we can never foresee how the news will affect the market. However, economic news may cause a significant liquidty grab, which may lead to some opportunity after that. To be aware of all the economic news and events, use this website: https://www.forexfactory.com/calendar Broker: Selecting the right broker is essential. It will charge you to link your funds to the FX market. They charge you in two ways: with a large spread or with a commission. I recommend that you go with a broker who charges you commissions and has a smaller spread. Make your own online research, study customer reviews, and keep the commission and spread in mind. Prop Firm: Prop firm is the game changing. Nowadays, we can ear big capital to trade with them. To be able to earn that big capital you have to pass their challenge. Once it's done, you split your profits with them. They take 15-30% of your returns on average, and capital may reach a million dollars depending on the prop firm. Some prop firms use their own broker which you can trust. Prop firm are really something to take in consideration to go to the next level fast. To be a profitable traders you have to create a Trading Plan that brings together all these concepts as well as rules to facilitate the psycological part of trading. [EN] Smart Money Concepts by JordyBanks 7 6. Create your Trading plan In order to be a profitable trader, you must have a trading plan. When you have your trading plan in place, you just have to repeat and repeat the plan to be consistent. Here are all the questions you have to ask yourself before and during a trade in order to build a strong trading plan. Market Environment/General Question: These questions form the backbone of your trading strategy. These are the typical questions that will determine your trading 'lifestyle'. Wich session am I trading ? Do I have time to trade this or those sessions ? Am I trading during high-impact economic news? Is this a risk I'm willing to take? Wich pairs am IE trading ? Which broker should I go with? What is the spread applied by this broker on the pairs I am trading? How much commission do they charge? I've opted to trade with a prop firm; what are the terms and conditions for trading? What spreads or commissions does their broker use? Which risk-reward setup am I trading? Market Structure: Wich Timeframe for the general bias ? SnD Zone: Wich Timeframe to draw my SnD zones ? (Must be lower that Market Structure analysis) Entry Type: Wich Timeframe am I opening position ? (Must be the lowest) Trade Mangement: How do I manage my trades ? The placement of my take profit is based on what ? Do I take partials or close all my profits at once ? Trading System The following questions are useful while analyzing the charts. When it comes to Smart Money Concepts, these are the important questions to ask yourself. Obviously, you are not required to ask all of them. Answers will come quickly with time and practice. Market Structure: Is the market trending or ranging ? If ranging, will I scale down to lower timeframe to find opportunities or stay out of the market ? Is there a recent break of structure ? Am I in a impulse move or a corrective move ? Is there possibility for me to trade the correction move ? Will I buy at discount zone or sell at premium zone ? SnD Zone: Is there obvious SnD zone I can draw ? Is the origin of the break of structure more obvious on lower timeframe ? Is that a good SnD zone ? Is that SnD zone respect the buy low or sell high rules ? Is there imbalance in it and can I refine it ? Is there liquidties where my SnD zone may trigger a move to grab them ? Is there clear structure on that timeframe that can help me understand the current price movement ? Have I spot all the liquidity around ? Is there inducement that support my SnD zone ? Are those liquidities give me a narrative of how the price may move ? Entry Type: Is the price approaching my point of interest ? Is he showing sign of weakness ? Is a schematic taking in place ? Is there a last grab of liquidy that push the price deeper into our SnD zone ? Is there a sub-break of structure right after that ? Is a new obivisous SnD zone printed on that timeframe ? Is this SnD zone the origin of that sub-break of structure ? Am I refining it ? Am I opening my position when price touch my SnD zone or wait it will go deeper into it ? Am I putting my stoploss just behind my SnD zone, or add some pips ? Is there a point a liquidty where price may reach and where I am taking profit ? Is that trade give me a good risk-reward ratio that respect my rules ? During Trade: How will I manage my trade ? When will I put my stop loss at Break Even ? Will I track my stop loss in profit depending of the structure my current trade is doing ? Will I take partials at some point and let the rest of trade running ? Or will I take all of my profits at once ? Answer all those questions, and you will just have to repeat the process on each possible trade to be consistent. [EN] Smart Money Concepts by JordyBanks 8 Conclusion You now have all of the tools you need to be a successful trader. First, understand the market structure and ensure that you can identify the trend as well as the highs and lows. Then, identify your SnD zones. These zones are your point of interest; this is where you will set your position. Liquididy ! There is always a cause for price to move. Identify the liquidities and you will be able to predict where the price will likely move. Finally, your entry criteria have to be respected and should never be altered. Stick to your strategy! All you have to do now is practice and train your eyes to spot such opportunities quickly. Remember that you will miss opportunities, and make mistakes frequently, but it is part of the game, and as long as you don't give up and keep practicing, there is no reason for you to fail. The community is here to help all of us, to be in a environment with people with the same goal. I did it, and you will do it as well. [EN] Smart Money Concepts by JordyBanks 9