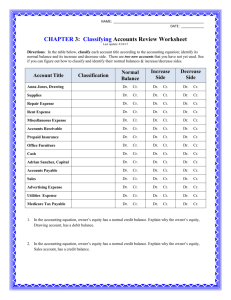

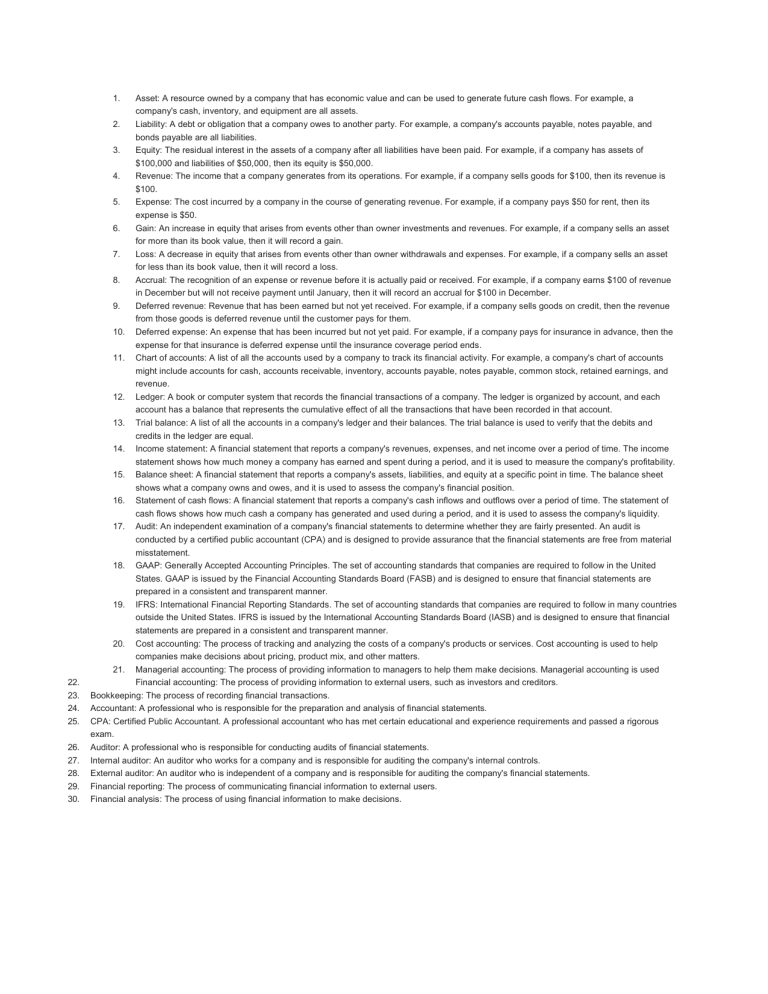

1. Asset: A resource owned by a company that has economic value and can be used to generate future cash flows. For example, a company's cash, inventory, and equipment are all assets. 2. Liability: A debt or obligation that a company owes to another party. For example, a company's accounts payable, notes payable, and bonds payable are all liabilities. Equity: The residual interest in the assets of a company after all liabilities have been paid. For example, if a company has assets of $100,000 and liabilities of $50,000, then its equity is $50,000. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 22. 23. 24. 25. 26. 27. 28. 29. 30. Revenue: The income that a company generates from its operations. For example, if a company sells goods for $100, then its revenue is $100. Expense: The cost incurred by a company in the course of generating revenue. For example, if a company pays $50 for rent, then its expense is $50. Gain: An increase in equity that arises from events other than owner investments and revenues. For example, if a company sells an asset for more than its book value, then it will record a gain. Loss: A decrease in equity that arises from events other than owner withdrawals and expenses. For example, if a company sells an asset for less than its book value, then it will record a loss. Accrual: The recognition of an expense or revenue before it is actually paid or received. For example, if a company earns $100 of revenue in December but will not receive payment until January, then it will record an accrual for $100 in December. Deferred revenue: Revenue that has been earned but not yet received. For example, if a company sells goods on credit, then the revenue from those goods is deferred revenue until the customer pays for them. Deferred expense: An expense that has been incurred but not yet paid. For example, if a company pays for insurance in advance, then the expense for that insurance is deferred expense until the insurance coverage period ends. Chart of accounts: A list of all the accounts used by a company to track its financial activity. For example, a company's chart of accounts might include accounts for cash, accounts receivable, inventory, accounts payable, notes payable, common stock, retained earnings, and revenue. Ledger: A book or computer system that records the financial transactions of a company. The ledger is organized by account, and each account has a balance that represents the cumulative effect of all the transactions that have been recorded in that account. Trial balance: A list of all the accounts in a company's ledger and their balances. The trial balance is used to verify that the debits and credits in the ledger are equal. Income statement: A financial statement that reports a company's revenues, expenses, and net income over a period of time. The income statement shows how much money a company has earned and spent during a period, and it is used to measure the company's profitability. Balance sheet: A financial statement that reports a company's assets, liabilities, and equity at a specific point in time. The balance sheet shows what a company owns and owes, and it is used to assess the company's financial position. Statement of cash flows: A financial statement that reports a company's cash inflows and outflows over a period of time. The statement of cash flows shows how much cash a company has generated and used during a period, and it is used to assess the company's liquidity. Audit: An independent examination of a company's financial statements to determine whether they are fairly presented. An audit is conducted by a certified public accountant (CPA) and is designed to provide assurance that the financial statements are free from material misstatement. 18. GAAP: Generally Accepted Accounting Principles. The set of accounting standards that companies are required to follow in the United States. GAAP is issued by the Financial Accounting Standards Board (FASB) and is designed to ensure that financial statements are prepared in a consistent and transparent manner. 19. IFRS: International Financial Reporting Standards. The set of accounting standards that companies are required to follow in many countries outside the United States. IFRS is issued by the International Accounting Standards Board (IASB) and is designed to ensure that financial statements are prepared in a consistent and transparent manner. 20. Cost accounting: The process of tracking and analyzing the costs of a company's products or services. Cost accounting is used to help companies make decisions about pricing, product mix, and other matters. 21. Managerial accounting: The process of providing information to managers to help them make decisions. Managerial accounting is used Financial accounting: The process of providing information to external users, such as investors and creditors. Bookkeeping: The process of recording financial transactions. Accountant: A professional who is responsible for the preparation and analysis of financial statements. CPA: Certified Public Accountant. A professional accountant who has met certain educational and experience requirements and passed a rigorous exam. Auditor: A professional who is responsible for conducting audits of financial statements. Internal auditor: An auditor who works for a company and is responsible for auditing the company's internal controls. External auditor: An auditor who is independent of a company and is responsible for auditing the company's financial statements. Financial reporting: The process of communicating financial information to external users. Financial analysis: The process of using financial information to make decisions.