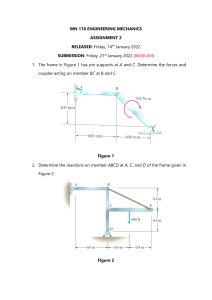

TASHKENT INSTITUTE OF FINANCE ЖЖ DEPARTMENT «FINANCE» ЖЖ PRESENTATION ЖЖ Theme 42. «Credit risk» Lecturer: ass. prof. Ye. Akhunova Copyright © Ye. Akhunova, 2022 Plan: 1. The concept of credit risk. 2. Methods for assessing the risks of lending to legal entities. 3. Risk assessment of lending to individuals based on credit scoring. 4. Credit rating. Copyright © Ye. Akhunova, 2022 1. The concept of credit risk Copyright © Ye. Akhunova, 2022 Essence of credit risk (1) Traditionally, credit risk is defined as the risk that a debtor will not repay money in accordance with the terms and conditions of a loan agreement. There are different approaches to determining the essence of credit risk. So, for example, the concept of "credit risk" includes the danger of non-payment by the borrower of the principal and interest due to the creditor. Others associate the concept of credit risk with the profits received by banks: credit risk is a possible drop in a bank's profits and even the loss of part of the equity capital as a result of the inability of the borrower to repay and service the debt. This approach reflects only one side of the impact of credit risk on the bank's profit negative, associated with the negative consequences of lending. At the same time, the outcome of a loan transaction can be positive, without excluding the presence of a certain level of risk throughout the term of the loan agreement. Copyright © Ye. Akhunova, 2022 Essence of credit risk (2) Credit risk is the probability that the value of the bank's assets, primarily loans, will decrease due to the inability or unwillingness of customers (borrower) to repay the debt or part of the debt, including interest due under the agreement. In its most general form, credit risk can be defined as the risk of losing assets as a result of a borrower's default on contractual obligations. Another definition of credit risk is based on the lender's uncertainty that the debtor will be able to meet its obligations in accordance with the terms and conditions of the loan agreement. Copyright © Ye. Akhunova, 2022 Essence of credit risk (3) It could also be proposed to understand credit risk as “the probability of complete or partial non-fulfillment by the borrower of the main conditions of the loan agreement”. The inability of the debtor to fulfill its obligations in accordance with the terms and conditions of the loan agreement may be caused by: • the inability of the debtor to generate adequate future cash flow due to unforeseen adverse changes in the business, economic or political environment in which the borrower operates; • uncertainty about the future value and quality (liquidity and the possibility of selling on the market) of collateral for an issued loan; • crises in the business reputation of the borrower. Copyright © Ye. Akhunova, 2022 Factors affecting the risk of each individual loan (1) • appointment of a loan (to increase capital, to temporarily replenish funds, to form current assets, capital construction); • type of credit (consumer, mortgage, investment, payment, leasing); • loan size (large, medium, small); • loan term (short-term, medium-term, long-term); • repayment procedure (as proceeds are received, one-time); • sectoral affiliation (agro-industrial complex, industry, commerce); Copyright © Ye. Akhunova, 2022 Factors affecting the risk of each individual loan (2) • form of ownership (private, joint-stock);the size of the borrower (by the size of the authorized capital, by the amount of own funds); • creditworthiness (in accordance with the rating score); • the degree of relationship between the bank and the client (the presence of a current account in the bank, one-time relations); • degree of awareness of the bank about the client; • methods of security (collateral, guarantees, guarantees). Copyright © Ye. Akhunova, 2022 Classification of credit risks (1) No. Criteria classification Types of credit risks risks at the macro level of relations (external); risks at the micro level of relations (internal). 1. Level of risk 2. The degree of risk dependence independent of the activities of the credit institution; on the bank dependent on the activities of a credit institution. 3. Sectoral focus of lending 4. Scale of lending 5. Loan types 6. Loan structure risks at the provision stage; use of the loan by the borrower; release of resources needed to pay off the debt; loan repayment 7. Acceptance stage solutions risks at the preliminary stage of lending, the subsequent stage of lending industrial; trade; agricultural, etc. complex risk; private risk risks by subjects, objects, terms, security Copyright © Ye. Akhunova, 2022 Classification of credit risks (2) No. Criteria classification Types of credit risks 8. Degree of acceptance minimal, elevated, critical, invalid. 9. Sphere of occurrence borrower risk, loan product risk, risk of changes in the external environment of the bank and the borrower 10. Type of borrower country risk, corporate lending risk, retail lending risk 11. The nature of the manifestation of risk moral, business, financial risks, collateral risk 12. Type of operation risks arising from loan, leasing, factoring transactions, as well as the provision of bank guarantees and guarantees, the conclusion of transactions using promissory notes 13. Nature of actions of the borrower the risk of the borrower's refusal to pay interest and (or) principal; misuse of the loan; obstruction of bank control Copyright © Ye. Akhunova, 2022 Basic principles of credit risk management in commercial banks – compliance with the credit policy developed by the bank; – accounting for external and internal factors when the bank conducts credit operations; – continuity of the nature of managerial decision-making; – risk control; – availability of a clear methodology for managing credit risks. Copyright © Ye. Akhunova, 2022 2. Methods for assessing the risks of lending to legal entities. Copyright © Ye. Akhunova, 2022 The work on assessing credit risk in a bank is carried out in the following three main stages At the first stage, the quality indicators of the borrower's activity are assessed. To this end, the bank examines the reputation of the borrower; determines the purpose of the loan and the sources of repayment of the principal debt and interest due; assesses the borrower's risks assumed by the bank indirectly. At the second stage, quantitative indicators are evaluated, i.e. calculation of financial ratios, analysis of the borrower's cash flows, and assessment of business risk. At the final stage, a summary assessment-forecast and the formation of the final analytical conclusion are made. Copyright © Ye. Akhunova, 2022 Altman’s Z-Score Model Altman’s Z-Score model is a numerical measurement that is used to predict the chances of a business going bankrupt in the next two years. The model was developed by American finance professor Edward Altman in 1968 as a measure of the financial stability of companies. Altman’s Z-score model is considered an effective method of predicting the state of financial distress of any organization by using multiple balance sheet values and corporate income. Copyright © Ye. Akhunova, 2022 Altman’s Z-Score Model Formula The Z-score model is based on five key financial ratios, and it relies on the information contained in financial statements. It increases the model’s accuracy when measuring the financial health of a company and its probability of going bankrupt. The Altman’s Z-score formula is written as follows: ζ = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E Where: •Zeta (ζ) is the Altman’s Z-score; •A is the Working Capital/Total Assets ratio; •B is the Retained Earnings/Total Assets ratio; •C is the Earnings Before Interest and Tax/Total Assets ratio; •D is the Market Value of Equity/Total Liabilities ratio; •E is the Total Sales/Total Assets ratio. Copyright © Ye. Akhunova, 2022 What Z-Scores Mean Usually, the lower the Z-score, the higher the odds that a company is heading for bankruptcy. A Z-score that is lower than 1.8 means that the company is in financial distress and with a high probability of going bankrupt. On the other hand, a score of 3 and above means that the company is in a safe zone and is unlikely to file for bankruptcy. A score of between 1.8 and 3 means that the company is in a grey area and with a moderate chance of filing for bankruptcy. Investors use Altman’s Z-score to make a decision on whether to buy or sell a company’s stock, depending on the assessed financial strength. If a company shows a Z-score closer to 3, investors may consider purchasing the company’s stock since there is minimal risk of the business going bankrupt in the next two years. However, if a company shows a Z-score closer to 1.8, the investors may consider selling the company’s stock to avoid losing their investments since the score implies a high probability of going bankrupt. Copyright © Ye. Akhunova, 2022 What are Credit Analysis Ratios? Credit analysis ratios are tools that assist the credit analysis process. These ratios help analysts and investors determine whether individuals or corporations are capable of fulfilling financial obligations. Credit analysis involves both qualitative and quantitative aspects. Ratios cover the quantitative part of the analysis. Key ratios can be roughly separated into four groups: (1)Profitability; (2)Leverage; (3)Coverage; (4)Liquidity. Copyright © Ye. Akhunova, 2022 Profitability Ratios As the name suggests, profitability ratios measure the ability of the company to generate profit relative to revenue, balance sheet assets, and shareholders’ equity. It is important to investors, as they can use it to help project whether stock prices are likely to appreciate. They also help lenders determine the growth rate of corporations and their ability to pay back loans. Profitability ratios are split into margin ratios and return ratios. Margin ratios include: •Gross profit margin; •EBITDA margin; •Operating profit margin. Return Ratios include •Return on assets; •Risk-adjusted return; •Return on equity. Higher margin and return ratios are an indication that a company has a greater ability to pay back debts. Copyright © Ye. Akhunova, 2022 Leverage Ratios Leverage ratios compare the level of debt against other accounts on a balance sheet, income statement, or cash flow statement. They help credit analysts gauge the ability of a business to repay its debts. Common leverage ratios include: •Debt to assets ratio; •Asset to equity ratio; •Debt to equity ratio; •Debt to capital ratio. For leverage ratios, a lower leverage ratio indicates less leverage. For example, if the debt to asset ratio is 0.1, it means that debt funds 10% of the assets and equity funds the remaining 90%. A lower leverage ratio means less asset or capital funded by debt. Banks or creditors like this, as it indicates less existing risk. Copyright © Ye. Akhunova, 2022 Coverage Credit Analysis Ratios Coverage ratios measure the coverage that income, cash, or assets provide for debt or interest expenses. The higher the coverage ratio, the greater the ability of a company to meet its financial obligations. Coverage ratios include: • Interest coverage ratio; • Debt-service coverage ratio; • Cash coverage ratio; • Asset coverage ratio. Example A bank is deciding whether to lend money to Company A, which has a debt-service coverage ratio of 10, or Company B, with a debt service ratio of 5. Company A is a better choice as the ratio suggests this company’s operating income can cover its total outstanding debt 10 times. It is more than Company B, which can only cover its debt 5 times. Copyright © Ye. Akhunova, 2022 Liquidity Ratios Liquidity ratios indicate the ability of companies to convert assets into cash. In terms of credit analysis, the ratios show a borrower’s ability to pay off current debt. Higher liquidity ratios suggest a company is more liquid and can, therefore, more easily pay off outstanding debts. Liquidity ratios include: • Current ratio; • Quick ratio; • Cash ratio; • Working capital. Example The quick ratio is the current assets of a company, less inventory and prepaid expenses, divided by current liabilities. A person is deciding whether to invest in two companies that are very similar except that company A has a quick ratio of 10 and the other has a ratio of 5. Company A is a better choice, as a ratio of 10 suggests the company has enough liquid assets to cover upcoming liabilities 10 times over. Copyright © Ye. Akhunova, 2022 PARSER method in credit risk analysis As a borrower carefully consider the following: The Lending Manager’s task is the MANAGEMENT OF RISK and to be successful at this he needs to be conversant with certain principles which can best be remembered by the mnemonic PARSER. There are very few ideal propositions and as a result it is a matter of judgement whether funds can be safely and profitably lent. The Lending Manager’s function in this respect is 1.To identify in what ways any proposition falls short of ideal 2.To establish what the risks are and whether they are acceptable to the Bank 3.If acceptable, to structure the borrowing in such a way as to minimize that risk and negotiate an acceptable reward in return. Whether the funds are to be advanced by short, medium or long term financer or through equity capital or export finance the general principles stay the same. Copyright © Ye. Akhunova, 2022 P = PERSONALITY CHARACTER – Who is the borrower? How long has he been a customer? What is his background? Is he a man of integrity and reliability? COMPETENCE – What is his record? Has he the management, accounting and technical skills? What is his experience in the particular field for which the finance is required? What is the strength of the management team? CAPACITY – Has he the energy for hard work to use the advance and make sufficient profit to ensure repayment? What is the condition of existing resources? Are they adequate? Are there any constraints of an economic, legal or local nature? What are market conditions? Has he put together a business plan? Has he taken advice or had training? Copyright © Ye. Akhunova, 2022 A = AMOUNT & PURPOSE AMOUNT – How much is required? Is it sufficient or too much? Is the proposition supported by a cash flow forecast and accurate costings? Has allowance been made for increased working capital requirements? Is the proprietor’s stake acceptable? PURPOSE- What is the reason for the advance? Is it suitable as a banking proposal? How should the borrowing be structured? Is a ‘Group’ package worth considering? Is it a new venture? Copyright © Ye. Akhunova, 2022 R = REPAYMENT SOURCE – Where is repayment to come from? income? sale of assets? profits? Is it reliable and reasonably certain? Do we have a profit and/or cash forecast? Is there a secondary source of repayment as a ‘back-up’? WHEN – Have repayments been fully appraised and related to existing and future commitments? Are repayment proposals realistic or optimistic? Copyright © Ye. Akhunova, 2022 S = SECURITY SECURITY – Unsecured advances are the exception rather than the rule. No amount of security will make a bad proposition good. Balance risk with reward. APPROPRIATE– Is the security appropriate to the advance and to the structure of the business? Is it easily valued, readily realisable and of stable or increasing value? Is it properly valued? COMPLETION – It is essential that security is completed or perfection can be finalised without further recourse to borrower before advance is made. Suitable Insurance cover should be completed when appropriate. Copyright © Ye. Akhunova, 2022 E = EXPEDIENCY PERSPECTIVE – There are occasions when the principles of good lending are breached in favour of expediency, but this should be kept in the right perspective. To be fully – OBJECTIVE, consideration of this factor should be ignored and in any event expediency should not lead us to lend unwisely and unsafely. Copyright © Ye. Akhunova, 2022 R = REMUNERATION TERMS – need to be negotiated from the outset with provision for periodic review if considered necessary. MAY VARY – in the light of economic conditions and the market place in which we operate. RISK – The REWARD should relate to the RISK entailed and the customer AFFORD to borrow without impediment to his repayment programme. Copyright © Ye. Akhunova, 2022 CAMPARI METHOD (1) Bank loans are an important source of funding for any business, helping to fulfil orders, employ staff or finance patent protection applications. This guide uses a handy acronym to help you fully prepare for a loan application and maximise your chances of receiving capital. THE CAMPARI METHOD STANDS FOR •Character •Ability •Means •Purpose •Amount •Repayment •Insurance The principles it outlines are used by banks and investors worldwide. It’s an easy way of making sure that you are fully prepared when you apply for any business finance – maximising your chance of securing the funds you need. We will take you through each part of this process and explain what each letter means. Copyright © Ye. Akhunova, 2022 CAMPARI METHOD (2) CHARACTER Banks take a gamble when providing loans. The more confidence they have in your ability to deliver, the more likely you are to receive the capital you require. Naturally, presentation is very important. Dress and act like a professional and don’t be late. Interact well with your bank manager and show you are a capable business leader. Be willing to show evidence of a good trading history and the ability to provide quality services to customers while making a profit. ABILITY You must be unequivocal when telling the bank what you need the capital for and how you’ll be able to afford the repayments. There is no room for ambiguity. Many applications fail because the entrepreneur does not directly and clearly show how a profit will be made on the initial capital; bank managers cannot clearly see how they will get the money back and therefore consider the application to be too risky. When presenting your case, it must be obvious how you’ll repay the loan; use illustrations or bring in an accountant if necessary. Copyright © Ye. Akhunova, 2022 CAMPARI METHOD (3) MEANS Your business plan must be logical, display knowledge of your industry and target markets and be professionally presented. Business plans are important variables in whether a firm succeeds or fails; bank managers will be very keen to see your business plan is viable and can produce a return. Make sure yours is watertight; ask a professional to help you if required. Additionally, ensure your business model is solid. If your business model is poorly monetised, irrational or hard to make sense of, this is going to dent your chances of getting a loan. PURPOSE You must clearly show why you need the money and how you’re going to use it. There needs to be a good business case for the capital rather than simply because your business will benefit from increased revenue. Some examples are: You have an order that needs fulfilling but there’s not enough liquidity in the business to do so You need a specific piece of machinery in order to expand your range of products and services Whatever the reason for the loan, you need to show that it’s a good reason, and one that will generate a return. Copyright © Ye. Akhunova, 2022 CAMPARI METHOD (4) AMOUNT Bank managers want to know why you need the amount you’re asking for. In specific detail, you need to show precisely what the money will be spent on. This is more than about telling the bank manager the purpose of the loan. You need to explain how you’ve arrived at the figure you’re requesting and how it’s going to be spent. REPAYMENT Bank managers must be confident you’ll meet repayment terms, or your application will get rejected. Be prepared to show substantial documentation relating to profit margins, cashflow forecasts and other key financial information. Bring your accountant or consult them in advance of the appointment if you’re unsure. Don’t exaggerate forecasts or profit margins. If your loan is secured, you may lose your property or business assets if repayment terms are not adhered to. Copyright © Ye. Akhunova, 2022 CAMPARI METHOD (5) INSURANCE Ensure you’ve taken steps to protect yourself should things go worse than expected. You’ll need a backup plan to ensure you can still pay off the loan should you receive a less than satisfactory return. Take out adequate insurance where need be and take steps to diversify revenue streams to ensure you’ll still be making a profit should the loan capital fail to make a return. INFORMED FUNDING Workspace are proud to partner with informed Funding (iF) who frequently offer free conferences, seminars and one-to-one financial consultations for our customers. They work both on and offline to help businesses identify financing issues and raise the funds they need. Copyright © Ye. Akhunova, 2022 3. Risk assessment of lending to individuals based on credit scoring Copyright © Ye. Akhunova, 2022 What Is Credit Scoring? Credit scoring is a method of separating groups of potential borrower clients in the context of the availability of information not about the parameters separating these groups, but only about some secondary variables. The idea of separating groups according to secondary characteristics was first proposed in 1936 by R.A. Fisher, who introduced a method for determining varieties of iris by measuring the size of plant parts, and a few years later the idea to use a similar approach to identify borrowers with a high and low probability of default was put forward by D. Duran. Copyright © Ye. Akhunova, 2022 Durand's scoring model D. Duran singled out a group of factors that, in his opinion, make it possible to determine with sufficient certainty the degree of credit risk when providing a consumer loan to a particular borrower. He used the following coefficients in scoring: age: 0.1 points for each year over 20 years old (maximum 0.30); sex: women - 0.40, men - 0; length of residence: 0.042 for each year of residence in the area (maximum 0.42); occupation: 0.55 for a low-risk occupation, 0 for a high-risk occupation, and 0.16 for other occupations; work in the industry: 0.21 - public utilities, government agencies, banks and brokerage firms; employment: 0.059 - for each year of work at this enterprise (maximum 0.59 points); financial indicators: 0.45 for having a bank account, 0.35 for owning real estate, 0.19 for having a life insurance policy. Applying these coefficients, D. Duran determined the boundary separating "good" and "bad" customers - 1.25 points. A client who scored more than 1.25 points was considered creditworthy, and a client who scored less than 1.25 was considered undesirable for the bank. Thus, the scoring method allows for an express analysis of a loan application. Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (1) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (2) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (3) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (4) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (5) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (6) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (7) Copyright © Ye. Akhunova, 2022 https://uaeb.uz/en/scroring (8) Copyright © Ye. Akhunova, 2022 4. Credit rating Copyright © Ye. Akhunova, 2022 The concept of credit rating A credit rating is an integral assessment of the financial stability and solvency of a country, a borrower or a particular loan product. Credit ratings are usually issued and published by specialized rating agencies, the most famous of which are Standard & Poor's, Moody's, FitchRatings. The rating expresses the agency's opinion on the future ability and intention of the borrower to make payments to creditors in repayment of principal and interest on it in a timely manner and in full. Each agency applies its own methodology for assessing creditworthiness and expresses the result of this measurement using a special rating scale. Typically, an alphabetic scale is used, which allows you to show ratings that reflect the agency's opinion on the relative level of credit risk in the range, for example, from AAA to D. The credit rating scale is usually divided into two ranges: investment quality (rating not lower than BBB on the S&P scale) and speculative quality (rating is lower than investment quality). Copyright © Ye. Akhunova, 2022 https://tradingeconomics.com/uzbekistan/rating Copyright © Ye. Akhunova, 2022 https://ipakyulibank.uz/bank-haqida/faoliyat-korsatkichlari/reytinglar Copyright © Ye. Akhunova, 2022 https://sqb.uz/en/for-investors/ratings-en/ Copyright © Ye. Akhunova, 2022 https://sqb.uz/en/for-investors/ratings-en/ Copyright © Ye. Akhunova, 2022 https://sqb.uz/en/for-investors/ratings-en/ Copyright © Ye. Akhunova, 2022