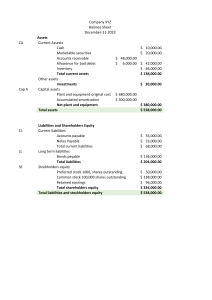

Name: ________________________________ Section _________________ Student #: _________________________________ Wilfrid Laurier University, School of Business and Economics Introductory Financial Accounting BU 127 (all sections) Mid-Term Examination Sunday, February 11, 2018 9:00 – 10:30 am, (90 minutes) Number of pages: 6 including cover page Important Instructions – Please Read Carefully 1. You should verify immediately that your examination paper is complete (10 pages). 2. Print your name, student number, and class section on the cover page. 3. You should have been provided with a Scantron card on which you will record your answers to examination multiple choice questions 1 to 14 inclusive. 4. Please answer on the Scantron card in pencil only (preferably soft pencil). Any answers that you change must be erased completely. If the scan picks up multiple responses to a question you will receive a grade of zero on that question. 5. On the front of your Scantron card, ensure that you have printed the following: a. Your Class (this is your class Section letter) b. Your Name 6. On the back (the answer side) of your scanner card, ensure that you have entered and coded the following: a. Your nine-digit ID Number, left justified. (U of W students must fill in a ninedigit ID: your UW ID + 0) b. Under Test Form, mark A. 7. You should answer problem-style question 15 in the exam answer booklet provided. Answers should be in blue or black pen. If you need an extra exam booklet, please ask an exam invigilator for an extra booklet. 8. Use of reference materials and receipt of assistance from other students will be penalized. (At a minimum, you would likely receive a zero score on the exam and other penalties might also be sought). 9. While you may use a calculator during the exam, a programmable calculator is not allowed. 10. To ensure that all students have the same information, neither the instructors nor the proctors will answer any questions during the examination period. 11. Please do not separate the pages of the examination paper – the entire paper must be handed in. Ensure that your Scantron card, exam paper and answer booklet(s) are handed in. 1 BU127 Section Listing: Schedule of Classes Instructor Kaleab Mamo Kaleab Mamo James Moore Kai Chen David Scallen Kai Chen Kaleab Mamo Kai Chen James Moore Section H J K L M N S1 S2 S3 Time M W 8:30-9:50 am M W 10:00- 11:20 am M W 11:30 am-12:50 pm T R 11:30am-12:50 pm T TH 1:00-2:20 pm T R 2:30-3:50 pm M W 5:30-6:50 pm T TH 5:30-6:50 pm W 7:00-9:50 pm Class Location LH1009 LH1009 LH1009 LH1011 LH1001 LH3094 LH1011 LH1011 LH1009 2 Questions 1-14 Question 15 Total Marks 14 28 42 Student’s Score Question 1: Multiple-Choice (14 marks) (each question is worth 1 mark) Instructions: To answer each of the following questions, clearly mark the letter of your answer in pencil on the scantron card provided, and circle the letter on the exam paper: 1. Financing that individuals or institutions have provided to a company is: A. always classified as liabilities. B. classified as liabilities when provided by creditors and shareholders' equity when provided by owners. C. always classified as shareholders' equity. D. classified as shareholders' equity when provided by creditors and liabilities when provided by owners. 2. At the end of last year, the company's assets totalled $860,000 and its liabilities totalled $740,000. During the current year, the company's total assets increased by $58,000 and its total liabilities increased by $24,000. At the end of the current year: A. shareholders' equity was $154,000. B. shareholders' equity was $120,000. C. shareholders' equity was $34,000. D. shareholders' equity was $178,000. 3. The Whackem-Smackem Software Company sold $11 million of computer games in its first year of operations. The company received payments of $7.5 million for these computer games. The company's income statement would report: A. sales revenue of $7.5 million. B. accounts receivable of $3.5 million. C. expenses of $3.5 million. D. sales revenue of $11 million. 4. Every financial statement should have "who, what, and when" in its heading. These are: A. the name of the person preparing the statement, the type of financial statement, and when the financial statement was reported to the Stock Exchange. B. the name of the person preparing the statement, the name of the company, and the date the statement was prepared. C. the name of the company, the type of financial statement, and the time period from which the data were taken. D. the name of the company, the purpose of the statement, and when the financial statement was reported to the Canada Revenue Agency. 5. Which of the following are the two fundamental characteristics financial information must possess to be judged useful to decision makers? A. Relevance and faithful representation B. Truthful and clarity C. Complete and relevant D. Elaborate and faithful representation 6. Which of the following are elements to be measure and reported? A. Assets, liabilities, shareholders equity, revenues, expenses, dividends B. Unit of measure, separate entity, going concern, time period C. Cost, revenue recognition, matching, full disclosure D. Cost-benefit, materiality, industry practices 3 7. The effects of net income and its distribution on the financial position of the company is reported in: A. Balance sheet B. Income statement C. Statement of retained earnings D. Statement of cash flows 8. Which of the following equations is correct? A. net income - expenses = revenues B. ending retained earnings - beginning retained earnings = net income - dividends C. asset = liabilities - shareholders equity D. none of the choices are correct 9. The Sweet Smell of Success Fragrance Company borrowed $60,000 from the bank and used all of the money to re-design its new store. Sweet Smell's balance sheet would show this as: A. $60,000 under Furnishings & Equipment and $60,000 under Notes Payable. B. $60,000 under Supplies and $60,000 under Accounts Payable. C. $60,000 under Prepaid Expenses and $60,000 under Accrued Liabilities. D. $60,000 under Other Assets and $60,000 under Other Liabilities. 10. If a company is paid $20,000 on accounts receivable and uses the money to pay $20,000 on accounts payable then: A. assets would increase by $20,000 while liabilities would decrease by $20,000. B. liabilities would decrease by $20,000 while shareholders' equity would increase by $20,000. C. Both assets and liabilities would decrease by $20,000. D. Both assets and shareholders' equity would decrease by $20,000. 11. Your company's president donates a large amount of her own money to charity and receives significant publicity that includes the company's name. How would the benefits of this publicity appear on the statement of financial position? A. It would appear as a current asset. B. It would appear as a liability. C. It would appear as a long-term asset. D. It would not appear on the statement of financial position. 12. When dealing with claims on company assets,: A. owners take precedence over creditors. B. creditors take precedence over owners. C. owners and creditors are treated equally. D. All of the choices are possible; it depends on the situation. 13. Sparkling Pools provides $1,000 of pool maintenance services during July and collects payment in August. The company performs $1,600 of pool maintenance services during July that were paid for in June. The company accepts an order to perform $500 of pool maintenance services in August and will be paid in the same month. Revenue should be credited for: A. $1,600 in June, $1,000 in July, and $500 in August. B. $1,600 in June, $0 in July, and $1,500 in August. C. $0 in June, $1,600 in July, and $1,500 in August. D. $0 in June, $2,600 in July, and $500 in August. 14. Which of the following statements is true? A. When operating income is positive, revenue is greater than expenses. B. When net income is negative, retained earnings decrease, all other things being equal. C. When net income is positive, Shareholders' equity increases, all other things being equal. D. All of the answers are acceptable. 4 Question 15 (28 marks) – Answer in Blue or Black Ink in the Exam Booklet Provided Hawks Tutoring Inc. prepares monthly financial statements. Hawks Tutoring Inc. had the following account balances at the beginning of January 2018: Name Balance Jan. 1, 2018 Cash $ 51,200 Trade receivables 2,800 Contributed capital 4,700 Deferred revenue 2,200 Supplies 2,500 Trade payables 1,900 Startup loan payable (due March 2020) 9,900 Retained earnings 37,800 The startup loan is interest free. The following transactions occurred during the month of January 2018 Jan. 1 Received $3,600 cash from a customer as a deposit for tutoring services that were scheduled to be performed equally in January, February, March and April 2018. The services were subsequently performed as scheduled. Jan. 1 Purchased computer equipment for $60,000. Paid $40,000 cash and signed a note payable for $20,000. The note payable bears interest at a rate of 6% per year. The note amount plus interest is payable on January 1, 2019. Jan. 1 Paid insurance of $4,800. The insurance payment covers the six month period Jan 1-June 30, 2018. Jan 3 Collected $2,800 cash from a customer for tutoring services performed in December 2017. Jan 5 Received $10,000 cash and issued shares in the company. Jan. 6 Purchased supplies for $1,300 on credit. The supplier will be paid in February 2018. Jan. 12 Paid trade payables of $1,900. Jan 14 Performed tutoring services and received full cash payment of $3,000. Jan 20 Performed tutoring services for Ms. Laura Allan. Ms. Allan had paid for the services in November 2017 by paying $2,200 in cash to Hawks Tutoring Services. Jan 25 Performed tutoring services in the amount of $2,000 for Mr. John Young. Mr. Young agreed to pay Hawks Tutoring Services Inc. in February 2018. Jan 31 Paid $1,500 in cash to employees for wages earned during the month. Jan 31 Received a $500 accounting bill for accounting services received in January. The accounting bill will be paid in March 2018. Jan. 31 Counted supplies and determined that there were $1,000 in supplies remaining. Jan. 31 Recorded depreciation on the computer equipment of $1000 and made other necessary month end adjusting entries. 5 Question 15 (continued) Required Use the information provided to prepare: 1) Journal entries to record all transactions and all necessary month end adjusting journal entries. You may use any reasonable account names. Ignore income taxes. 2) T accounts for each account showing opening balances (if applicable), transactions and final balances at January 31, 2018. 3) A formal Statement of Earnings for the month ended January 31, 2018. 4) A classified Statement of Financial Position at January 31, 2018. 5) Closing journal entries for the month ended January 31, 2018. DO NOT ANSWER ON THIS EXAM – USE THE EXAM BOOKLET PROVIDED TO ANSWER THIS QUESTION 6