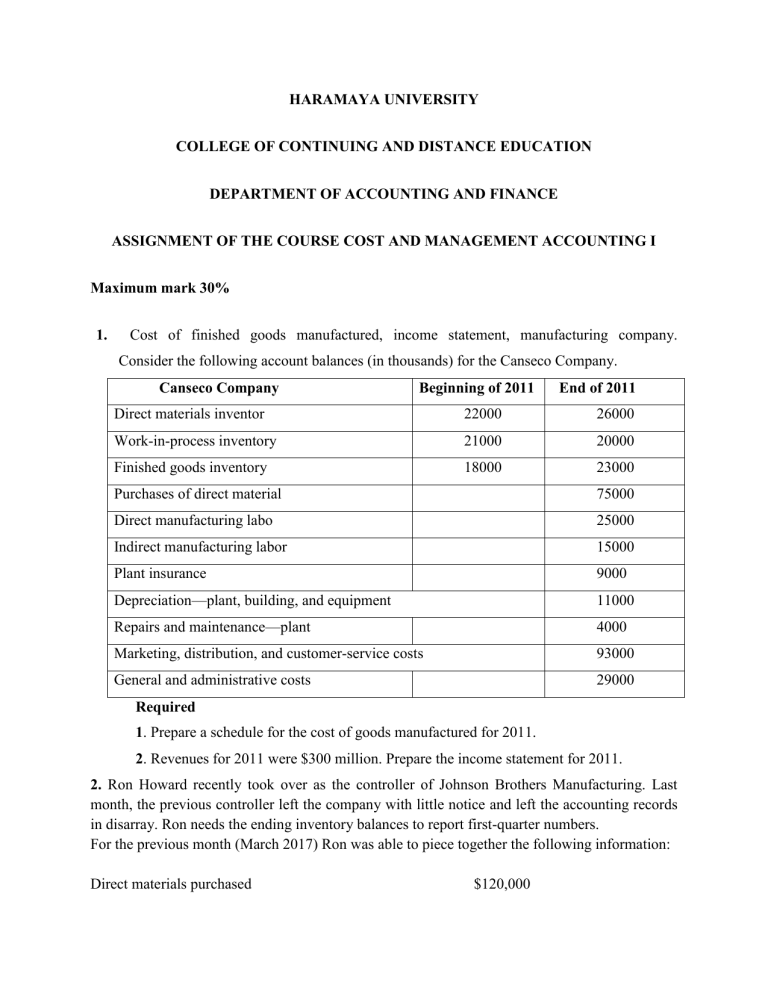

HARAMAYA UNIVERSITY COLLEGE OF CONTINUING AND DISTANCE EDUCATION DEPARTMENT OF ACCOUNTING AND FINANCE ASSIGNMENT OF THE COURSE COST AND MANAGEMENT ACCOUNTING I Maximum mark 30% 1. Cost of finished goods manufactured, income statement, manufacturing company. Consider the following account balances (in thousands) for the Canseco Company. Canseco Company Beginning of 2011 End of 2011 Direct materials inventor 22000 26000 Work-in-process inventory 21000 20000 Finished goods inventory 18000 23000 Purchases of direct material 75000 Direct manufacturing labo 25000 Indirect manufacturing labor 15000 Plant insurance 9000 Depreciation—plant, building, and equipment 11000 Repairs and maintenance—plant 4000 Marketing, distribution, and customer-service costs 93000 General and administrative costs 29000 Required 1. Prepare a schedule for the cost of goods manufactured for 2011. 2. Revenues for 2011 were $300 million. Prepare the income statement for 2011. 2. Ron Howard recently took over as the controller of Johnson Brothers Manufacturing. Last month, the previous controller left the company with little notice and left the accounting records in disarray. Ron needs the ending inventory balances to report first-quarter numbers. For the previous month (March 2017) Ron was able to piece together the following information: Direct materials purchased $120,000 Work-in-process inventory,3/1/2017 Direct materials inventory, 3/1/2017 Finished-goods inventory, 3/1/2017 Conversion costs Total manufacturing costs added during the period Cost of goods manufactured Gross margin as a percentage of revenues Revenues Calculate the cost of: I. Finished-goods inventory, 3/31/2017 II. Work-in-process inventory, 3/31/2017 III. Direct materials inventory, 3/31/2017 3. $ 35,000 $ 12,500 $160,000 $330,000 $420,000 4 times direct materials used 20% $518,750 The Stanton Processing Company had work in process at the beginning and end of March 2017 in its Painting Department as follows: Percentage of Completion Direct Materials Conversion Costs March 1 (3,000 units) 40% 10% March 31 (2,000 units) 80% 40% The company completed 30,000 units during March. Manufacturing costs incurred during March were direct materials costs of $ 176,320 and conversion costs of $ 312,625. Inventory at March 1 was carried at a cost of $ 16,155 (direct materials, $5,380 and conversion costs, $10,775). Required 1. Assuming Stanton uses First in First Out; determine the equivalent units of work Done in March, and calculate the cost of units completed and the cost of units in ending Inventory. 2. The assembly division of Fenton Watches, Inc. uses the weighted-average method of process costing. Consider the following data for the month of May 2017: Physical Units (Watches) Beginning work in process (May 1)a 80 Direct Materials $493,360 Conversion Costs $ 91,040 Started in May 2017 500 Completed during May 2017 460 Ending work in process (May 31)b 120 Total costs added during May 2017 $3,220,000 $1,392,000 A. Degree of completion: direct materials, 90%; conversion costs, 40%. B. Degree of completion: direct materials, 60%; conversion costs, 30%. Required 1. Assuming Fenton watches Inc. Uses Weighted average method; determine the equivalent units of work done in May, and calculate the cost of units completed and the cost of units in ending Inventory. 3. British Petroleum (BP) Company buys crude oil and processes it into three different products. Refining the oil till the split off point results in new products such as Gas, Benzyl and Tar. In January, 2009 BP Co. purchased 120,000 barrels crude oil for $5,000,000; in addition to this, conversion costs of $800,000 were incurred for joint processing of the products up to the split of point at which one stable product can be produced. The company has produced 55,000, 35,000, and 25,000 barrels of Gas, Benzyl and Tar respectively. The company can sell Gas, Benzyl and Tar at the split-off point for $105, $85 and $90 per barrel respectively. Alternatively, Tar can be further processed at a cost of $12 per barrel and then sold for $140 per barrel while, Gas can be further processed at additional cost of $15 per barrel and then sold for $155 per barrel, benzyl can be further processed at additional cost of $10 per barrel and then sold for $135 per barrel. The output after further processing is estimated to be 44,000 barrel for Gas and 20,000 barrel for Tar and 30,000 barrels for benzyl Required: Allocate joint cost of production A. Using estimated net realizable value (NRV) method B. using physical measure method C. Using sales value at split off point 4. The Cocoa Factory manufactures and distributes chocolate products. It purchases cocoa beans And processes them into two intermediate products: chocolate-powder liquor base and milkchocolate liquor base. These two intermediate products become separately identifiable at a single split-off point. Every 2,000 pounds of cocoa beans yields 50 gallons of chocolate-powder liquor base and 50 gallons of milk-chocolate liquor base. The chocolate-powder liquor base is further processed into chocolate powder. Every 50 gallons of chocolate-powder liquor base yield 650 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 50 gallons of milk-chocolate liquor base yield 1,070 pounds of milk chocolate. Production and sales data for August 2017 are as follows (assume no beginning inventory): ■ Cocoa beans processed, 28,000 pounds ■ Costs of processing cocoa beans to split-off point (including purchase of beans), $62,000 Production Sales Selling Price Separable Processing Costs Chocolate 9,100 pounds 6,500 pounds $ 9 per pound $50,100 14,980 pounds 13,500 pounds $10 per pound $60,115 powder Milk chocolate Cocoa Factory fully processes both of its intermediate products into chocolate powder or milk chocolate. There is an active market for these intermediate products. In August 2017, Cocoa Factory could have sold the chocolate-powder liquor base for $20 a gallon and the milkchocolate liquor base for $60 a gallon. Required 1. Calculate how the joint costs of $62,000 would be allocated between chocolate powder and milk chocolate under the following methods: a. Sales value at split off b. Physical measure (gallons) c. NRV d. Constant gross-margin percentage NRV