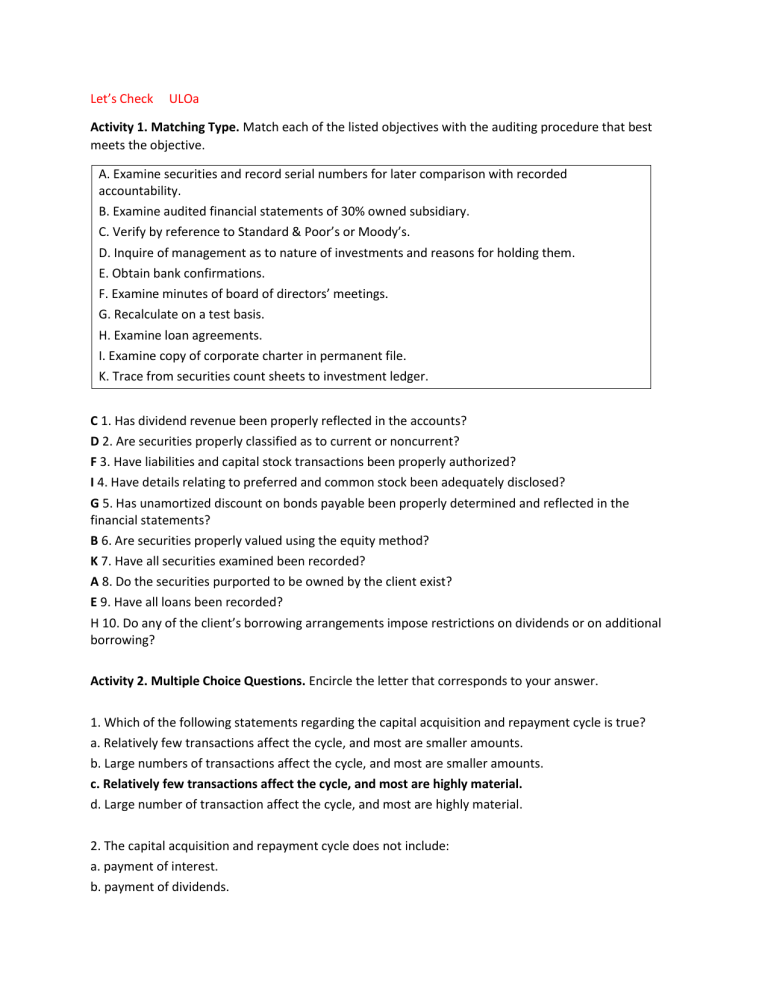

Let’s Check ULOa Activity 1. Matching Type. Match each of the listed objectives with the auditing procedure that best meets the objective. A. Examine securities and record serial numbers for later comparison with recorded accountability. B. Examine audited financial statements of 30% owned subsidiary. C. Verify by reference to Standard & Poor’s or Moody’s. D. Inquire of management as to nature of investments and reasons for holding them. E. Obtain bank confirmations. F. Examine minutes of board of directors’ meetings. G. Recalculate on a test basis. H. Examine loan agreements. I. Examine copy of corporate charter in permanent file. K. Trace from securities count sheets to investment ledger. C 1. Has dividend revenue been properly reflected in the accounts? D 2. Are securities properly classified as to current or noncurrent? F 3. Have liabilities and capital stock transactions been properly authorized? I 4. Have details relating to preferred and common stock been adequately disclosed? G 5. Has unamortized discount on bonds payable been properly determined and reflected in the financial statements? B 6. Are securities properly valued using the equity method? K 7. Have all securities examined been recorded? A 8. Do the securities purported to be owned by the client exist? E 9. Have all loans been recorded? H 10. Do any of the client’s borrowing arrangements impose restrictions on dividends or on additional borrowing? Activity 2. Multiple Choice Questions. Encircle the letter that corresponds to your answer. 1. Which of the following statements regarding the capital acquisition and repayment cycle is true? a. Relatively few transactions affect the cycle, and most are smaller amounts. b. Large numbers of transactions affect the cycle, and most are smaller amounts. c. Relatively few transactions affect the cycle, and most are highly material. d. Large number of transaction affect the cycle, and most are highly material. 2. The capital acquisition and repayment cycle does not include: a. payment of interest. b. payment of dividends. c. payment of vendor invoices. d. acquisition of capital through interest-bearing debt. 3. The primary focuses of the audit of debt are: a. accuracy and completeness. c. completeness and valuation. b. accuracy and existence. d. accuracy and valuation. 4. Which of the following accounts is not audited within the capital acquisition and repayment cycle? a. Notes payable. b. Interest expense. c. Accounts payable. d. Bonds payable. 5. A logical substantive test for accrued interest receivable would be to a. Compare the interest income with published interest- investment records. b. Verify the interest income by a calculation based on the face amount of notes and the nominal interest rate. c. Verify the cost, carrying value, and market value of notes receivable. d. Recalculate interest earned and compare it to the amounts received. 6. An audit program for the examination of the retained earnings account should include a step that requires verification of the a. Market value used to charge retained earnings for a two-for-one stock split. b. Approval of the adjustment to the beginning balance as a result of a write-down of an account receivable. c. Authorization for both cash and stock dividends. d. Gain or loss resulting from disposition of treasury shares. 7. Two months before the year end, the bookkeeper erroneously recorded the receipt of a long-term bank loan by a debit to cash and a credit to sales. Which of the following is the most effective procedure for detecting this type of error? a. Analyze the notes payable journal. b. Analyze bank confirmation information. c. Prepare a year-end bank reconciliation. d. Prepare a year-end bank transfer schedule. 8. The auditee has just acquired another company by purchasing all its assets. As a result of the purchase, "goodwill" has been recorded on the auditee's books. Which of the following comparisons would be the most appropriate audit test for the amount of recorded goodwill? a. The purchase price and the book value of assets purchased. b. The figure for goodwill specified in the contract for purchase. c. Earnings in excess of 15% of net assets for the past five years. d. The purchase price and the fair market value of assets purchased. 9. All corporate capital stock transactions should ultimately be traced to the a. Minutes of the Board of Directors. b. Cash receipts journal. c. Cash disbursements journal. d. Numbered stock certificates. 10.Hall accepted an engagement to audit the 2002 financial statements of XYZ Company. XYZ completed the preparation of the 2002 financial statements on February 13, 2003, and Hall began the field work on February 17, 2003. Hall completed the field work on March 24, 2003, and completed the report on March 28, 2003. The client's representation letter normally would be dated a. February 13, 2003 c. February 17, 2003 b. March 24, 2003 d. March 28, 2003 Let’s Check ULOb Activity 1. Mutiple Choice Questions. Encircle the letter that corresponds to your answer. 1. A client has a large and active investment portfolio that is kept in a bank safedeposit box. If the auditor is unable to count the securities at the balance sheet date, the auditor most likely will a. Request the bank to confirm to the auditor the contents of the safe deposit box at the balance sheet date. b. Examine supporting evidence for transactions occurring during the year. c. Count the securities at a subsequent date and confirm with bank whether securities were added or removed since the balance sheet date. d. Request the client to have a bank seal the safe-deposit box until the auditor can count the securities at a subsequent date. 2. When an auditor is unable to inspect and count a client’s investment securities until after the balance sheet date, the bank where the securities are held in a safe deposit box should be asked to a. Verify any differences between the contents of the box and the balances in the client’s subsidiary ledger. b. Provide a list of securities added and removed from the box between the balance sheet date and the security count date. c. Count the securities in the box so that the auditor will have an independent direct verification. d. Confirm that there has been no access to the box between the balance- sheet date and the securitycount date. 3. Which of the following is not one of the auditor’s primary objectives in an audit of trading securities? a. To determine whether securities are authentic. b. To determine whether securities are the property of the client. c. To determine whether securities actually exist. d. To determine whether securities are properly classified on the balance sheet date. 4. Apol Boba, CPA, observes the count of securities on December 31. She records the serial numbers of the securities and reconciles them and the number of shares with company records. Which fraud should be detected by this procedure? a. An investee company declared and paid a stock dividend on December 15. The stock certificate for the additional shares was received directly by the treasurer who made no record of the receipt and embezzled the shares. b. The treasurer embezzled and sold securities on April 4. She speculated successfully with the proceeds and replaced the securities on December 29. c. The treasurer borrowed securities on July 15 to use as collateral for a personal loan. He repaid the loan and returned the securities on December 2. d. The treasurer embezzled interest receipts from bonds by having the payments mailed directly to him. 5. Which of the following is the least effective audit procedure regarding the existence assertion for the securities held by the auditee? a. Examination of paid checks issued in payment of securities purchased. b. Vouching all changes during the year to supporting documents. c. Simultaneous count of liquid assets. d. Confirmation from the custodian. 6. An auditee is holding equity securities as collateral for a debt. The auditor should a. Determine from data published in the financial press that the auditee has recorded dividend income from the collateral. b. Ascertain the value of the securities. c. Ascertain that the amount recorded for the collateral in the investment account is equal to its fair value at the balance sheet date. d. Verify that the client has taken title to the securities. 7. Which of the following is the most effective audit procedure for verification of dividends earned on investments in equity securities? a. Tracing deposited dividend checks to the cash receipts book. b. Reconciling amount received with published dividend records. c. Comparing the amounts received with preceding year dividends received. d. Recomputing selected extensions and footings of dividend schedules and comparing totals to the general ledger. 8. In confirming with an outside agent, such as a financial institution, that the agent is holding investment securities in the client’s name an auditor most likely gathers evidence in support of management’s financial statement assertions of existence and a. Valuation c. Completeness b. Rights and obligations d. Presentation and disclosure 9. In establishing the existence and ownership of an investment held by a corporation in the form of publicity traded stock and auditor should inspect the securities or a. Obtain written representations from management confirming that the securities are properly classified as trading securities. b. Inspect the audited financial statements of the investee company. c. Confirm the number of shares held by an independent custodian. d. Determine that the investment is carried at the lower of cost or market. 10.An auditor most likely to verify the interest earned on bond investment by a. Verifying the receipt and deposit of interest checks. b. Confirming the bond interest rate with the issuer of the bonds. c. Recomputing the interest earned on the basis of face amount, interest rate, and period held. d. Testing controls relevant to cash receipts. 11.Which of the following provides the best form of evidence pertaining to the annual valuation of an investment in which the independent auditor’s client owns a 30% voting interest? a. Market quotations of the investee company’s stock. b. Current fair value of the investee company’s assets. c. Historical cost of the investee company’s assets. d. Audited financial statements of the investee company. 12.In verifying the amount of goodwill recorded by a client, the most convincing evidence an auditor can obtain is by comparing the recorded value of assets acquired with the a. Assessed value as evidenced by tax bills. b. Seller’s book value as evidenced by financial statements. c. Insured value as evidenced by insurance policies. d. Appraised value as evidenced by independent appraisals. 13.The auditor can best verify a client’s bond sinking-fund transactions and year-end balance by a. Confirmation with individual holders of retired bonds. b. Confirmation with the bond trustee. c. Recomputation of interest expense, interest payable, and amortization of bond discount or premium. d. Examination and count of the bonds retired during the year. 14.An auditor who physically examines securities should insist that a client representative be present in order to a. Detect fraudulent securities. b. Lend authority to the auditor’s directives. c. Coordinate the return of securities to the proper locations. d. Acknowledge the receipt of securities returned. 15.In testing long-term investments, an auditor ordinarily would use analytical procedures to ascertain the reasonableness of the a. Classification between current and noncurrent portfolios. b. Valuation of marketable equity securities. c. Existence of unrealized gains or losses in the portfolio. d. Completeness of recorded investment income. Let’s Check ULOc Activity 1. Mutiple Choice Questions. Encircle the letter that corresponds to your answer. 1. Property, plant and equipment is typically judged to be one of the accounts least susceptible to fraud because a. The amounts recorded on the balance sheet for most companies are immaterial. b. The inherent risk is usually low. c. The depreciated values are always smaller than cost. d. Internal control is inherently effective regarding this account. 2. Which is the best audit procedure to obtain evidence to support the legal ownership of real property? a. Examination of corporate minutes and board resolutions with regard to approvals to acquire real property. b. Examination of closing documents, deeds and ownership documents registered and on file at the register of deeds. c. Discussion with corporate legal counsel concerning the acquisition of a specific piece of property. d. Confirmation with the title company that handled the escrow account and disbursement of proceeds for the closing of the property. 3. When few property and equipment transactions occur during the year the continuing auditor usually obtains and understanding of internal control and performs a. Tests of controls b. Analytical procedures to verify current year additions to property and equipment c. A thorough examination of the balances at the beginning of the year. d. Extensive tests of current year property and equipment transactions. 4. Which of the following combinations of procedures is an auditor most likely to perform to obtain evidence about fixed asset addition? a. Inspecting documents and physically examining assets. b. Recomputing calculations and obtaining written management representations. c. Observing operating activities and comparing balances to prior period balances. d. Confirming ownership and corroborating transactions through inquiries of client personnel. 5. If an auditor tours a production facility, which of the misstatements or questionable practices is most likely to be detected by the audit procedures specified? a. Depreciation expense on fully depreciated machinery has been recognized. b. Overhead has been overapplied. c. Necessary facility maintenance has not been performed. d. Insurance coverage on the facility has lapsed. 6. In testing for unrecorded retirements of equipment, an auditor is most likely to a. Select items of equipment from the accounting records and then locate them during the plant tour. b. Compare depreciation journal entries with similar prior-year entries in search of fully depreciated equipment. c. Inspect items of equipment observed during the plant tour and then trace them to the equipment subsidiary ledger. d. Scan the general journal for unusual equipment additions and excessive debits to repairs and maintenance expense. 7. Determining that proper amounts of depreciation are expensed provides assurance about management’s assertions of valuation and a. Presentation and disclosure. c. Rights and obligations. b. Completeness. d. Existence or occurrence. 8. The auditor may conclude that depreciation charges are insufficient by noting a. Insured values greatly in excess of book values. b. Large numbers of fully depreciated assets. c. Continuous trade-in of relatively new assets. d. Excessive recurring losses on assets retired. 9. An auditor analyzes repairs and maintenance accounts primarily to obtain evidence in support of the audit assertion that all a. Noncapitalizable expenditures for repairs and maintenance have been recorded in the proper period. b. Expenditures for property and equipment have been recorded in the proper period. c. Noncapitalizable expenditures for repairs and maintenance have been properly charged to expense. d. Expenditures for property and equipment have not been charged expense. 10. In violation of company policy, Coatsen Company erroneously capitalized the cost of painting its warehouse. An auditor would most likely detect this when a. Discussing capitalization policies with Coatsen's controller. b. Examining maintenance expense accounts. c. Observing that the warehouse had been painted. d. Examining construction work orders that support items capitalized during the year. Let’s Check ULOd Activity 1. Mutiple Choice Questions. Encircle the letter that corresponds to your answer. 1. There is goodwill involved in the acquisition of a business if the purchase price paid is in excess of the proprietorship of the business acquired. Goodwill might be viewed as the enjoyment of a profit by a company in excess of the normal or usual return for the industry as a whole but such goodwill is not recorded if it has not been purchased or paid for. a. False; True. c. True; False. b. False; False. d. True; True. 2. In auditing intangible assets, an auditor most likely would review or recompute amortization and determine whether the amortization period is reasonable in support of management’s financial statement assertion of a. Valuation. c. Completeness. b. Existence or occurrence. d. Rights and obligations. 3. The most effective means for the auditor to determine whether a recorded intangible asset possesses the characteristics of an asset is to a. Analyze research and development expenditures to determine that only those expenditures possessing future economic benefit have been capitalized. b. Vouch the purchase by reference to underlying documentation. c. Inquire as to the status of patent applications. d. Evaluate the future revenue-producing capacity of the intangible asset. 4. The auditee has just acquired another company by purchasing all its assets. As a result of the purchase, "goodwill" has been recorded on the auditee's books. Which of the following comparisons would be the most appropriate audit test for the amount of recorded goodwill? a. The purchase price and the book value of assets purchased. b. The figure for goodwill specified in the contract for purchase. c. Earnings in excess of 15% of net assets for the past five years. d. The purchase price and the fair market value of assets purchased. 5. In verifying the amount of goodwill recorded by a client, the most convincing evidence which an auditor can obtain is by comparing the recorded value of assets acquired with the a. Assessed value as evidenced by tax bills. b. Seller's book value as evidenced by financial statements. c. Insured value as evidenced by insurance policies. d. Appraised value as evidenced by independent appraisals.