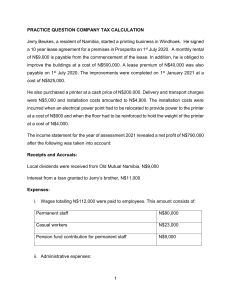

Intermediate Financial Reporting Quiz 1 & 2

advertisement