Advanced Financial Accounting Textbook, 12th Edition

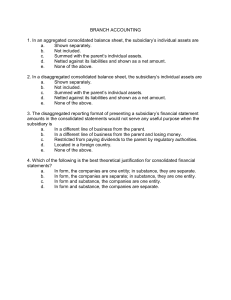

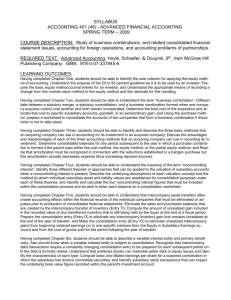

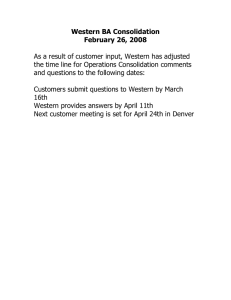

advertisement