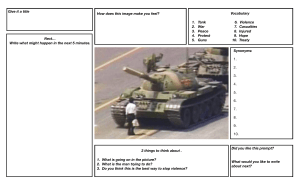

Political Violence Political Risks United Insurance Brokers Ltd Political Violence Introduction Due to the often complex nature of the subject known generically as Political Risk and Credit Insurance, we have compiled an information sheet to address key issues, and types of coverage which may be provided to protect your investment. The aim of political risk insurance is to protect you from those unforeseen perils which arise from trading / operating in a Foreign Country, as opposed to the general business risk operating/contracting in a Foreign Country. Therefore, the crucial initial step is to identify which political risks could affect your specific investment, and to seek protection as early as possible in the planning of your investment. Should you require any further information, please contact Julian Ball at: United Insurance Brokers Ltd., 69 Mansell Street, London, E1 8AN, England. Tel: 020 7488 0551 Fax: 020 7480 5182 Email: julian.ball@uib.co.uk We look forward to the opportunity of working with you in the future. 2 Political Risks United Insurance Brokers Ltd Political Violence Brief descriptions of various political risk and credit exposures Confiscation, Expropriation, Nationalisation The theft or effective closure of your investment by a foreign government without the provision of fair compensation. Deprivation The deprivation of use of stocks/mobile plant and equipment etc. outside your host country because of your inability to obtain an export licence (where such licences were previously obtainable). Deprivation cover is generally grouped with Confiscation, Expropriation and Nationalisation to form the abbreviation ‘CEND’ insurance. Import/Export Licence Cancellation The prevention of import/export of goods from any country due to the cancellation of previously obtained valid import or export licences. Investments are most at risk from this peril during the construction phase of a project where operations depend on the continued sourcing of foreign goods. Cover can also be tailored to reflect the costs of switching supply only. Forced Abandonment You are forced to permanently abandon your investment, as it is unsafe for your staff to continue operations. Selective Discrimination A foreign government specifically targeting your investment, and permanently preventing you from operation, e.g. cancellation of operating licences or other special agreements with the foreign government. Political Risks 3 United Insurance Brokers Ltd Political Violence Forced Divestiture Insufficient compensation is paid to you as a result of your own government obliging you to divest. Political Violence Physical damage to your investment as a result of civil commotion, malicious damage, war, civil war, terrorism etc. Cover can be tailor-made to wrap around All Risk policies. (To qualify for war and civil war cover, companies must not originate from the actual risk country). Business Interruption Loss of earnings and additional expenses as a result of any of the perils mentioned above. This coverage is usually provided in addition to one of the base covers mentioned above. Contingent Business Interruption Loss of earnings and additional expenses due to the physical damage of transmission lines or essential utility services or equipment as a result of an act of Political Violence. Contract Abrogation The abrogation of agreements with a majority government owned joint venture partner, or the imposition of a law, order, decree or regulation by either your own government or a Foreign Government which directly or indirectly prevents the operation of the joint-venture or the performance of a contract. 4 Political Risks United Insurance Brokers Ltd Political Violence Cover for contracts Currency Inconvertibility and Transfer Risk The inability to obtain earnings, dividends, management fees, loan repayments etc. because of the failure of the Foreign Country to exchange local currency deposits into hard currency, or transfer the hard currency out of the Foreign Country. Contract Frustration Indemnity Contract Frustration Insurance is required for any contract where a foreign government is involved. Coverage is tailor-made to respond to: (a) The said government company failing to meet its contractual obligations. This includes non-payment of any due amounts under the contract as well as damages which fall due in the event of the repudiation of the said contract or, the said government company failing to meet its contractual obligation. (b) The failure of the Insured to perform its obligations under the contract due to reasons of political Force Majeure such as embargo, war, etc. Cover is designed to track the Insured’s actual net financial exposure throughout the life of the contract. Wrongful Calling of Guarantees The wrongful drawing down of on-demand bonds, standby Letters of Credit etc. by the beneficiary where all contract terms have been fulfilled, or The rightful drawing down of similar instruments as a result of the inability to conclude the contract due to political events of Force Majeure. Political Risks 5 United Insurance Brokers Ltd Political Violence Credit risk Loss as a result of the failure of a private entity to pay trade related debt (usually due to insolvency). Underwriting considerations In addition to a basic description of the project including its scope, all parties involved, and their role in the project. Underwriters will also consider the following key factors to determine whether they will accept this risk and at what cost: (i) Previous trading experience with the said Foreign Country (whether or not with the same contracted parties). (ii) Involvement of the Foreign Government in the project. (iii) Project/Contract timetable. (iv) Exact location. 6 Political Risks This document is intended merely to highlight issues and not to be comprehensive, nor to provide legal or other advice. United Insurance Brokers Limited (UIBL) accepts no responsibility for loss which may arise from relying on information contained in this presentation. The contents of this document are protected by copyright under international conventions. You may read it and make copies for your own personal use. You may also give copies (in paper or electronic form) of reasonable extracts on an occasional basis free of charge to others for their personal use, on terms that (i) UIBL is acknowledged as the source, (ii) the text is not altered in any way, and (iii) the attention of recipients is drawn to this notice. Except with the prior written consent of UIBL all other use and copying of any of the contents of this presentation in any way are prohibited. © United Insurance Brokers Limited 2020. All Rights reserved. Contact us: Julian Ball – Global Head of Property & Political Violence | E: jhb@uib.co.uk Carlos Rueda – Associate Director | E: cxr@uib.co.uk James Musgrove – Senior Account Executive | E: jam@uib.co.uk Fiona Wilson – Senior Account Executive | E: fsw@uib.co.uk Parmida Djalilvand – Account Executive | E: pzd@uib.co.uk Edward Hearn – Account Executive | E: ejh@uib.co.uk United Insurance Brokers Ltd 69 Mansell Street, London, E1 8AN T: +44 (0)20 7488 0551 | W: www.uib.co.uk United Insurance Brokers Limited is authorised and regulated by the Financial Conduct Authority, firm reference number 307812. The company is registered in England and Wales, registration number 2034497. Registered office: 69 Mansell Street, London, E1 8AN.