Ethical Decision Making: Corporate Governance, Accounting & Finance

advertisement

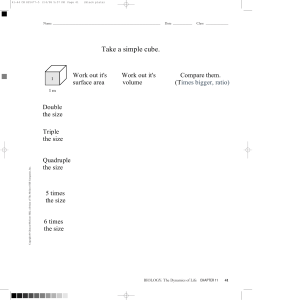

Chapter Ten: Ethical Decision Making: Corporate Governance, Accounting, and Finance Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Chapter Objectives 1 After reading this chapter, you will be able to: • Explain the role of accountants and other professionals as "gatekeepers." • Describe how conflicts of interest can arise for business professionals. • Outline the requirements of the Sarbanes-Oxley Act. • Describe the COSO framework. • Define the "control environment" and the means by which ethics and culture can impact that environment. • Discuss the legal obligations of a member of a board of directors. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Chapter Objectives 2 • Explain the ethical obligations of a member of a board of directors. • Highlight conflicts of interest in financial markets and discuss the ways in which they may be alleviated. • Describe conflicts of interest in governance created by excessive executive compensation. • Define insider trading and evaluate its potential for unethical behavior. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Ethical Decision Making 1 It astounds me how little senior management gets a basic truth: If clients don’t trust you, they will eventually stop doing business with you. It doesn’t matter how smart you are. Greg Smith, “Why I am Leaving Goldman Sachs,” The New York Times, March 14, 2012 ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Introduction 1 • The scandals of the early 2000s involved fundamental questions of corporate governance and responsibility. • There were a rash of problems associated with the financial meltdown in 2007 to 2008. • Ethics in the governance and financial arenas is now the most visible issue in business ethics. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Introduction 2 Analysts contend that corruption is evidence of a complete failure in corporate governance structures. • Corporate governance: The structure by which corporations are managed, directed, and controlled toward the objectives of fairness, accountability, and transparency. • The structures generally will determine the relationship between the board of directors, the shareholders or owners of the firm, and the firm’s executives or management. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Professional Duties and Conflicts of Interest The collapse of Enron Corporation brought the ethics of finance to prominence at the start of the 21st century. Several important categories of business professionals—for example, lawyers, auditors, accountants, and financial analysts— function based on the internal controls that exist within marketbased economic system. Role identities determine ethical duties and provide a source for rules which determine how professionals ought to act. • Gatekeepers: Act as "watchdogs" to ensure those in the marketplace play by the rules and conform to the market functions as it should. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 1 Professional Duties and Conflicts of Interest The most basic ethical business issue facing gatekeepers involves a conflict of interest. • This exists when a person holds a position of trust that requires that he or she exercise judgment on behalf of others, but where his or her personal interest and/or obligations conflict with the proper exercise of that judgment. Conflicts can arise when a person’s ethical obligations in their professional duties clash with personal interests. • Such professionals are said to have fiduciary duties—a legal duty, grounded in trust, to act on behalf of or in the interests of another—to their clients. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 2 Figure 10.1: Conflicts of Interest in Public CPA Activity Access the text alternative for slide image. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Professional Duties and Conflicts of Interest • Because professional gatekeeper duties are necessary conditions for the fair and effective functioning of economic markets, they should trump other responsibilities to one's employer. • But knowing one’s duties and fulfilling those duties are two separate issues. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 3 Professional Duties and Conflicts of Interest The gatekeeper function is necessary, but self-interest can make it difficult to fulfill gatekeeper duties. • Society has a responsibility to create institutions and structures that will minimize these conflicts. • Critics say government regulatory rules alone will not avert financial crises. • Extraordinary executive compensation and conflicts of interest within the accounting and financial industries have created an environment where watchdogs have little ability to prevent harm. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 4 The Sarbanes-Oxley Act of 2002 A string of corporate scandals shook investor confidence. The U.S. Congress passed the Public Accounting Reform and Investor Protection Act of 2002, commonly known as the Sarbanes-Oxley Act. • The act is enforced by the Securities and Exchange Commission (S E C) and applies to more than 15,000 publicly held companies in the U.S. and some foreign issuers. • The European Union 8th Directive covers many of the same issues. • Some states issues similar legislation that apply to private firms. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Sarbanes-Oxley Act of 2002 2 No regulatory "fix" is perfect. • The act is intended to provide protection where oversight did not exist. • Oversight in terms of accountability and responsibility. The following sections impact corporate governance and boards. • Section 201. • Services outside the scope of auditors—no consulting rather than auditing. • Section 301. • Public company audit committees, mandating majority of independents on any board and total absence of current or prior business relationships. • Section 307. • Rules of professional responsibility for attorneys. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Sarbanes-Oxley Act of 2002 3 • Section 404. • Management assessment of internal controls. • Section 406. • Required codes of ethics for senior financial officers. • Section 407. • Disclosure of audit committee financial expert • Requires that they actually have an expert. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Internal Control Environment 1 Internal control mechanisms are established internally to comply with financial reporting laws and regulations. One way to ensure controls is to utilize a framework advocated by the Committee of Sponsoring Organizations (COSO). • COSO: A voluntary group of audit and accounting organizations seeking to improve reporting through a combination of controls and governance standards called the Internal Control-Integrated Framework. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Internal Control Environment 2 • The elements comprising control structure are: • Control environment. • Control environment: Cultural issues such as integrity, ethical values, competence, philosophy, and operating style. • Risk assessment. • Control activities. • Information and communications. • Ongoing monitoring. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Internal Control Environment 3 • COSO standards for internal controls moved audit, compliance, and governance from a numbers orientation to concern for the organizational environment. • Both internal factors such as the COSO controls and external factors such as the Sarbanes-Oxley requirements must be supported by a culture of accountability. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. The Internal Control Environment 4 COSO developed a new system, Enterprise Risk ManagementIntegrated Framework in 2004. • Serves as a framework for management to evaluate and improve their firms’ prevention, detection, and management of risk. • Expands on the prior framework to include "objective setting." • Assists an organization in resolving ethical dilemmas based on a firm’s mission, its culture, and tolerance for risk. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Ethical Decision Making 2 Whenever an institution malfunctions as consistently as boards of directors have in nearly every major fiasco of the last forty or fifty years, it is futile to blame men. It is the institution that malfunctions. Peter Drucker ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Going Beyond the Law: Ethical Board Members The corporate failures of recent years would suggest: • A failure on the part of corporate boards. • A failure of government to impose high expectations of accountability on boards of directors. In many cases, boards and executives operated within the law. • Some actions may not have been ethical or in the best interests of stakeholders, but they were legal. The law offers some guidance on minimum standards for board member behavior, but is the law enough? ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Legal Duties of Board Members U.S. law imposes three clear duties on board members. • The duty of care is the exercise of reasonable care by ensuring that executives carry out responsibilities and comply with the law. • The duty of good faith is one of obedience, requiring faithfulness to the organization’s mission. • The duty of loyalty requires faithfulness from board members by giving undivided allegiance when making decisions affecting the organization. • Conflicts of interest are always to be resolved in favor of the organization. The Federal Sentencing Guidelines suggest the board exercise "reasonable oversight" with respect to the implementation and effectiveness of the ethics/compliance program. • The program should have adequate resources, levels of authority, and direct access to the board. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Beyond the Law, There is Ethics 1 Questions that we expect the law to answer but remains unclear. • Whom does the board represent? • Who are its primary stakeholders, ethically speaking? • If the board is aware of an unethical, but legal, practice—on what basis can the board require the practice to cease? ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Beyond the Law, There is Ethics 2 Some suggest boards have a responsibility beyond the law to explore and investigate the organizations that they represent. • What could drag the firm down and what could competitors do to help it along that path? It is the board members’ ultimate duty to provide oversight, which is impossible without knowing the answers to these questions. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Ethical Decision Making 3 It is essential that the activities of corporate executives are under constant, vigorous and public scrutiny, because those activities are crucial to the economic well-being of society. Ann Crotty ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Conflicts of Interest in Accounting and the Financial Markets Conflicts of interest extend beyond the board room to the financial arena—trust and structures that promote it are integral issues for all involved in the finance industry. • Real or perceived, conflicts can erode trust and often exist as a result of varying interests of stakeholders. Accounting, by its very nature, is a system of principles applied to present the financial position of a business and the results of its operations and cash flows. • It is hoped that adherence to these principles will result in fair and accurate reporting of this information in a format that can readily be interpreted by others. • Whether an accountant is considered a watchdog or a greyhound depends on whether he is hired internally or externally. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 1 Conflicts of Interest in Accounting and the Financial Markets The American Institute of Certified Public Accountants (AICPA) publishes professional rules to prevent accountants from being put into conflicts. • GAAP, or generally accepted accounting principles, established by the Financial Accounting Standards Board stipulates methods of gathering and reporting information. • Accountants are also governed by the AICPA's Code of Professional Conduct. Can these standards keep pace with readily changing accounting and financing activities in newly emerging firms? ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. 2 Executive Compensation 1 Few areas of corporate governance and finance have received as much public scrutiny as executive compensation. • In 1965, the average CEO pay was 20 times as much as the average worker pay. • By 2000, CEO pay had risen to 376 times as much as the average worker’s pay. • Even after a decline the ratio remained high—in 2016—271 times. Skyrocketing executive compensation packages raise numerous ethical questions. • Greed and avarice are the most apt descriptive terms for the moral character of such people from a virtue ethics perspective. • Give rise to fundamental questions of distributive justice and fairness. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Executive Compensation 2 • Serious ethical challenges arise against these practices even from within the business perspective. • Beyond issues of personal morality and economic fairness, excessive compensation raises ethical issues of corporate governance and finance. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Executive Compensation 3 In theory, compensation packages serve interests in two ways: • They provide an incentive for executive performance. • They serve as rewards for accomplishments. In practice, reasonable doubts exist for both rationales. • In many cases there is no correlation between compensation and performance. • There is a diminishing rate of return on incentives beyond a certain level. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Executive Compensation 4 Another crucial governance issue is the disincentives that compensation packages and reliance on stock options provide. • Executives have incentive to focus on short-term stock price rather than long-term corporate interests. • A case can be made that stock options may be to blame for the corruption involving managed earnings. • Excessive compensation can also involve a variety of conflicts of interests and cronyism. Another large concern is the cross-fertilization of boards. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Figure 10.2: Duties of the Board and Senior Executives That May Give Rise to Conflicts of Interest Access the text alternative for slide image. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Insider Trading 1 • Trading of securities by those who hold private inside information that would materially impact the value of the stock and that allows them to benefit from buying or selling stock. • Illegal insider trading occurs then corporate insiders provide "tips" to family members, friends, or others to buy or sell the company's stock based on that information. • "Private Information" includes privileged information that has not yet been released to the public. • The Securities and Exchange Commission has treated the detection and prosecution of insider trading violations as one of its enforcement priorities. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Insider Trading 2 Insider trading may also be based on a claim of unethical misappropriation of proprietary knowledge. • Proprietary knowledge refers to the knowledge only those in the firm should have, knowledge owned by the firm and not to be used by abusing one’s fiduciary responsibilities to the firm. Considered patently unfair and unethical as it precludes fair pricing based on equal access of information. Is there sufficient deterrent to discourage insider trading in our markets today? ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Figure 10.1: Conflicts of Interest in Public CPA Activity - Text Alternative The client’s board of directors work directly with the client and have a possible conflict with the client’s management team. The client works with its own management team and hires a CPA firm and works daily with it. The client pays the CPA firm and has a vested interest in the CPA’s report to the public. The client has a financial obligation to the CPA firm, and the CPA firm has a contractual obligation to the client. The CPA firm has a fiduciary and ethical obligation to the public to truthfully report the client's accounting information. The CPA firm has a contractual obligation with the client’s management team. Return to parent-slide containing images. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Figure 10.2: Duties of the Board and Senior Executive That May Give Rise to Conflicts of Interest - Text Alternative The duties of board members are to ensure executives are fairly and not excessively paid and to evaluate the executive's performance. The duties of senior executives are as follows: CEO often serves as chair of the board of directors. Often hand-selects members of the board of directors. Compensation received by board members is determined by the chief executive officers. Return to parent-slide containing images. ©McGraw-Hill Education Copyright © 2021 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.