Transfer Pricing Self-Test: Strategic Cost Management

advertisement

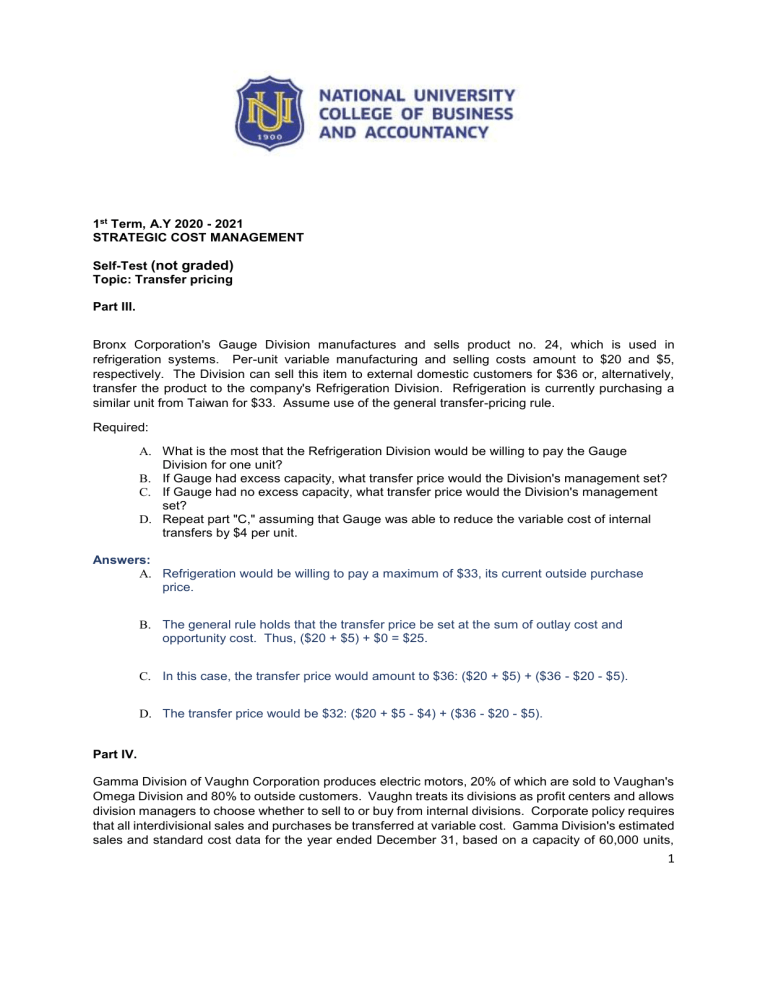

1st Term, A.Y 2020 - 2021 STRATEGIC COST MANAGEMENT Self-Test (not graded) Topic: Transfer pricing Part III. Bronx Corporation's Gauge Division manufactures and sells product no. 24, which is used in refrigeration systems. Per-unit variable manufacturing and selling costs amount to $20 and $5, respectively. The Division can sell this item to external domestic customers for $36 or, alternatively, transfer the product to the company's Refrigeration Division. Refrigeration is currently purchasing a similar unit from Taiwan for $33. Assume use of the general transfer-pricing rule. Required: A. What is the most that the Refrigeration Division would be willing to pay the Gauge Division for one unit? B. If Gauge had excess capacity, what transfer price would the Division's management set? C. If Gauge had no excess capacity, what transfer price would the Division's management set? D. Repeat part "C," assuming that Gauge was able to reduce the variable cost of internal transfers by $4 per unit. Answers: A. Refrigeration would be willing to pay a maximum of $33, its current outside purchase price. B. The general rule holds that the transfer price be set at the sum of outlay cost and opportunity cost. Thus, ($20 + $5) + $0 = $25. C. In this case, the transfer price would amount to $36: ($20 + $5) + ($36 - $20 - $5). D. The transfer price would be $32: ($20 + $5 - $4) + ($36 - $20 - $5). Part IV. Gamma Division of Vaughn Corporation produces electric motors, 20% of which are sold to Vaughan's Omega Division and 80% to outside customers. Vaughn treats its divisions as profit centers and allows division managers to choose whether to sell to or buy from internal divisions. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on a capacity of 60,000 units, 1 are as follows: Omega Sales Less: Variable costs Contribution margin Less: Fixed costs Operating income (loss) Unit sales Outsiders $ 660,000 $5,760,000 660,000 2,640,000 $ ---- $3,120,000 175,000 900,000 $ (175,000) $2,220,000 12,000 48,000 Gamma has an opportunity to sell the 12,000 units shown above to an outside customer at $80 per unit. Omega can purchase the units it needs from an outside supplier for $92 each. Required: A. Assuming that Gamma desires to maximize operating income, should it take on the new customer and discontinue sales to Omega? Why? (Note: Answer this question from Gamma's perspective.) B. Assume that Vaughn allows division managers to negotiate transfer prices. The managers agreed on a tentative price of $80 per unit, to be reduced by an equal sharing of the additional Gamma income that results from the sale to Omega of 12,000 motors at $80 per unit. On the basis of this information, compute the company's new transfer price. Answers: A. Yes. Gamma is currently selling motors to Omega at a transfer price of $55 per unit ($660,000 ÷ 12,000 units). A price of $80 to the new customer will increase Gamma Division's operating income by $300,000 [($80 - $55) x 12,000 units]. B. The additional operating income to Gamma is $300,000 [($80 - $55) x 12,000 units]. Splitting this amount equally results in a new transfer price of $67.50, calculated as follows: Transfer price before reduction $80.00 Less: Omega's per-unit share of additional income [($300,000 x 50%) ÷ 12,000 units] New transfer price 12.50 $67.50 Part V. STRATEGIC COST MANAGMENT 2 Sonoma Corporation is a multi-divisional company whose managers have been delegated full profit responsibility and complete autonomy to accept or reject transfers from other divisions. Division X produces 2,000 units of a subassembly that has a ready market. One of these subassemblies is currently used by Division Y for each final product manufactured, the latter of which is sold to outsiders for $1,600. Y's sales during the current period amounted to 2,000 completed units. Division X charges Division Y the $1,100 market price for the subassembly; variable costs are $850 and $600 for Divisions X and Y, respectively. The manager of Division Y feels that X should transfer the subassembly at a lower price because Y is currently unable to make a profit. Required: A. Calculate the contribution margins (total dollars and per unit) of Divisions X and Y, as well as the company as a whole, if transfers are made at market price. B. Assume that conditions have changed and X can sell only 1,000 units in the market at $900 per unit. From the company's perspective, should X transfer all 2,000 units to Y or sell 1,000 in the market and transfer the remainder? Note: Y's sales would decrease to 1,000 units if the latter alternative is pursued. Answer: A. Division X Division Y Sales at $1,600 $ 3,200,000 Transfers at $1,100 $ 2,200,000 Company $ 3,200,000 (2,200,000) Less: Variable costs at $850 (1,700,000) at $600 (1,200,000) Contribution margin Unit contribution margin B. $ 500,000 $ 250 (2,900,000) $ (200,000) $ 300,000 (100) $ 150 $ Alternative no. 1: Transfer 2,000 units to Division Y: Company sales (2,000 x $1,600) $3,200,000 Less: Variable costs [2,000 x $850) + (2,000 x $600)] Contribution margin 2,900,000 $ 300,000 STRATEGIC COST MANAGMENT 3 Alternative no. 2: Sell 1,000 units in the open market and transfer 1,000 units to Y: Company sales [(1,000 x $900) + (1,000 x $1,600)] $2,500,000 Less: Variable costs [(2,000 x $850) + (1,000 x $600)] 2,300,000 Contribution margin $ 200,000 Division X should transfer all 2,000 units to Division Y to produce an additional $100,000 ($300,000 - $200,000) of contribution margin. Part VI. Kendall Corporation has two divisions: Phoenix and Tucson. Phoenix currently sells a condenser to manufacturers of cooling systems for $520 per unit. Variable costs amount to $380, and demand for this product currently exceeds the division's ability to supply the marketplace. Kendall is considering another use for the condenser, namely, integration into an enhanced refrigeration system that would be made by Tucson. Related information about the refrigeration system follows. Selling price of refrigeration system: $1,285 Additional variable manufacturing costs required: $820 Transfer price of condenser: $490 Top management is anxious to introduce the refrigeration system; however, unless the transfer is made, an introduction will not be possible because of the difficulty of obtaining condensers in the quality and quantity desired. The company uses responsibility accounting and ROI in measuring divisional performance, and awards bonuses to divisional management. Required: A. How would Phoenix's divisional manager likely react to the decision to transfer condensers to Tucson? Show computations to support your answer. B. How would Tucson's divisional management likely react to the $490 transfer price? Show computations to support your answer. C. Assume that a lower transfer price is desired. What parties should be involved in setting the new price? D. From a contribution margin perspective, does Kendall benefit more if it sells the condensers externally or transfers the condensers to Tucson? By how much? Answer: A. The Phoenix divisional manager will likely be opposed to the transfer. Currently, the division is selling all the units it produces at $520 each. With transfers taking place at $490, Phoenix will suffer a $30 drop in sales revenue and profit on each unit that is sent to Tucson. STRATEGIC COST MANAGMENT 4 B. Although Tucson is receiving a $30 "price break" on each unit purchased from Phoenix, the $490 transfer price would probably be deemed too high. The reason: Tucson will lose $25 on each refrigeration system produced and sold. Sales revenue Less: Variable manufacturing costs Transfer price paid to Phoenix Income (loss) $1,285 $820 490 $ 1,310 (25) C. Kendall uses a responsibility accounting system, awarding bonuses based on divisional performance. The two divisional managers (or their representatives) should negotiate a mutually agreeable price. D. Kendall would benefit more if it sells the condenser externally. Observe that the transfer price is ignored in this evaluation—one that looks at the firm as a whole. Sales revenue Less: Variable cost $380; $380 + $820 Contribution margin Produce Condenser; Sell Externally $520 Produce Condenser; Transfer; Sell Refrigeration System $1,285 380 $140 1,200 $ 85 Part VII. The Chemical Division of Bill Company produces lawn-care chemicals. One-third of Chemical's output is sold to the Lawn Services Division of Bill; the remainder is sold to outside customers. The Chemical Division's estimated sales and standard cost data for the year follow: Sales ................................................................................................. Variable cost...................................................................................... Fixed cost .......................................................................................... Gross profit ........................................................................................ Gallons sold....................................................................................... Lawn Services $ 15,000 (10,000) (3,000 ) $ 2,000 5,000 Outsiders $40,000 (20,000) (6,000) $14,000 10,000 The Lawn Services Division has an opportunity to purchase 5,000 gallons of identical quality from an outside supplier at a cost of $1.75 per gallon on a continuing basis. Assume that the Chemical Division cannot sell any additional products to outside customers, that the fixed costs cannot be reduced, and that no alternative use of facilities is available. Required: Should Bill allow its Lawn Services Division to purchase the chemicals from the outside supplier? Support your answer by computing the increase or decrease in Bill Company operating costs. Answers: STRATEGIC COST MANAGMENT 5 Yes, because buying the chemicals would save Bill Company $1,250 determined as follows: Variable cost to manufacture by Chemical Division Outside supplier cost $ ..... 10,000 ($1.75 x 5,000) ........... 8,750 Savings to Bill if the Lawn Services Division purchases from the outside supplier $ 1,250 Part VIII. Wire Division of XS Steel Corporation produces “bales” of steel wire that are used in various commercial applications. The bales sell for an average of $20 each and Wire Division has the capacity to produce 10,000 bales per month. Consumer Products Division of XS Steel uses approximately 2,000 bales of steel wire each month in its production of various appliances. The operating information for Wire Division at its present level of operations (8,000 bales per month) follows: Sales (all external) Variable costs per bale: Production Selling G&A Fixed costs per bale (based on a 10,000 unit capacity): Production Selling G&A $160,000 $5 2 3 $2 3 4 Consumer Products Division currently pays $15 per bale for wire obtained from its external supplier. Required. a. If 2,000 bales are transferred in one month to Consumer Products Division at $10 per bale, what would be the profit/loss of Wire Products Division? b. For the Wire Products Division to operate at break-even level, what would it need to charge for the production and transfer of 2,000 bales to the Consumer Products Division? Assume all variable costs indicated will be incurred by the Wire Division. c. d. e. If Wire Products Division transferred 2,000 wire bales to the Consumer Products Division at 200 percent of full absorption cost, what would be the transfer price? If Consumer Products Division agrees to pay Wire Products Division $16 for 2,000 bales this month, what would be Consumer’s change in total profits? Assuming, for this question only, that Wire Products Division would not incur any variable G&A costs on internal sales, what is the minimum price that it would consider accepting for sales of bales to Consumer Products Division? Answers: a. The $10 per unit would equal the Division’s variable costs ($5 + 2 + 3 = $10), so the contribution margin per unit is zero. Thus, only the 8,000 units of external sales would generate a contribution margin of $80,000 (8,000 × $10) to cover fixed costs of $90,000 (10,000 × $9). So the Division would show a $10,000 loss. b. Total fixed costs to Wire are: STRATEGIC COST MANAGMENT 6 Production Selling G&A Total $2 × 10,000 = $3 × 10,000 = $4 × 10,000 = Less: Contrib.Margin on Regular Business [$20 – (5 + 2 + 3)] × 8,000 Unrecovered Fixed Costs $20,000 30,000 40,000 $90,000 (80,000 ) $10,000 which must be covered by CM of inside sales = Trans.Price × Vol. = SP – [(5 + 2 + 3) × 2,000] SP = $15 a. Full absorption cost: Variable Production Cost = Fixed Production Cost = Total full absorption cost Doubled Transfer price d. Proposed transfer price per unit Consumer’s current market purchase price per unit Increase in cost per unit of wire to Consumer’s Times units purchased Decrease in profit due to increased costs f. $ 5 2 $ 7 × 2 $ 14 $ 16 15 $ 1 × 2,000 $ 2,000 Wire Division must cover its out of pocket costs or the relevant variable costs; the fixed costs are irrelevant since they will be incurred regardless of this extra inside business. Thus, the total cost to be covered is $7 (production, $5; selling, $2). Part IX. Carpet Division of Building Products Inc. manufactures a single grade of residential grade carpeting. The division has the capacity to produce 500,000 square yards of carpet each year. Its current costs and revenues are shown here: Sales (400,000 square yards) Variable costs per square yard: Production SG&A Fixed costs per square yard (based on 500,000 yard capacity) Production SG&A $2,000,000 $2.00 1.00 $0.50 1.00 The Housing Division currently purchases 40,000 yards of carpeting (of the grade produced by the Carpet Division) each year at a cost of $6.50 per square yard from an outside vendor. Required: a. If the autonomous Housing and Carpet Divisions enter negotiations on the internal transfer of 40,000 square yards of carpeting, what is the maximum price that will be considered? b. If the autonomous Housing and Carpet Divisions enter negotiations on the internal transfer of 40,000 square yards of carpeting, what is the Carpet Division’s minimum price? STRATEGIC COST MANAGMENT 7 c. If the Housing and Carpet Divisions agree on the internal transfer of 40,000 square yards of carpet at a price of $4.50 per square yard, how will the profits of the Housing Division be affected? d. If the Housing and Carpet Divisions agree on the internal transfer of 40,000 square yards of carpet at a price of $4.00 per square yard, how will overall corporate profits be affected? e. Assume, for this question only, that Carpet Division is producing and selling 500,000 square yards of carpet to external buyers at a price of $5 per square yard. What would be the effect on overall corporate profits if Carpet Division reduces external sales of carpet by 40,000 square yards and transfers the 40,000 square yards of carpet to the Housing Division? Answers: a. The maximum price or ceiling is the current purchase price of the buying division or $6.50 per yard. b. The minimum price acceptable to Carpet is its incremental cost of $3 ($2 + $1) per square yard. c. Current external purchase price $6.50 Proposed transfer price 4.50 Reduction in purchase price per yard $2.00 Times yards acquired ×40,000 Increase in profits $80,000 d. Current outside purchase price per square yard Carpet’s variable cost per square yard $6.50 3.00 Savings per square yard to Housing Division & corporate $3.50 Times number square yards bought × 40,000 Savings to corporate and increase in profits $140,000 e. Since Carpet is operating at full capacity, it would lose the contribution margin on the 40,000 square `yards. However, the Housing Division would not have to buy externally. Thus, Lost CM ($2 × 40,000 yd) = Gained CM ($3.50 × 40,000 yd) = Net increase in corporate profits $(80,000 ) 140,000 $ 60,000 Part X. The Hampton Division of Long Island Company sells all of its output to the Finishing Division of the company. The only product of the Hampton Division is chair legs that are used by the Finishing Division. The retail price of the legs is $20 per leg. Each chair completed by the Finishing Division requires four legs. Production quantity and cost data for 2018 are as follows: STRATEGIC COST MANAGMENT 8 Chair legs Direct materials Direct labor Factory overhead (25% is variable) 30,000 $135,000 $90,000 $90,000 Operating expenses (20% is variable) $150,000 Required: Compute the transfer price for a chair leg using: a. market price. b. variable product costs plus a fixed fee of 20 percent. c. full cost plus 20 percent markup. d. variable costs. e. full cost plus 10 percent markup. Answers: a. $20 b. 1.20 × [$135,000 + $90,000 + (0.25 × $90,000)]/30,000 = $9.90 c. 1.20 × ($135,000 + $90,000 + $90,000)/30,000 = $12.60 d. [$135,000 + $90,000 + (0.25 × $90,000) + (0.20 × $150,000)]/30,000 = $9.25 e. [1.10 × ($135,000 + $90,000 + $90,000 + $150,000)]/30,000 = $17.05 Part XI. Benjamin Manufacturing Company has two divisions, X and Y. Division X prepares the steel for processing. Division Y processes the steel into the final product. No inventories exist in either division at the beginning or end of 2018. During the year, Division X prepared 80,000 lbs. of steel at a cost of $800,000. All the steel was transferred to Division Y where additional operating costs of $5 per lb. were incurred. The final product was sold for $3,000,000. Required: b. Determine the gross profit for each division and for the company as a whole if the transfer price is $8 per lb. c. Determine the gross profit for each division and for the company as a whole if the transfer price is $12 per lb. Answers: a. Sales Cost of goods sold Gross profit Division X $ 640,000 800,000 Division Y $ 3,000,000 1,040,000* Total $3,640,000 1,840,000 $(160,000) $ 1,960,000 $1,800,000 *$640,000 + $5(80,000) STRATEGIC COST MANAGMENT 9 b. Division X Sales Cost of goods sold Gross profit Division Y Total $960,000 $ 3,000,000 $3,960,000 800,000 1,360,000* 2,160,000 $160,000 $1,640,000 $1,800,000 *$960,000 + $5(80,000) Galacia 6:1 Kaya ng, samantalang tayo’y may pagkakataon, ay magsigawa tayo ng mabuti sa lahat, at lalong lalo na sa mga kasangbahay sa pananampalataya. Kawikaan 15:29 Ang Panginoon ay malayo sa masama: nguni’t Kaniyang dinidinig ang dalangin ng matuwid. Kawikaan 24:16 Sapagka’t ang matuwid ay nabubuwal na makapito, at bumabangon uli: nguni’t ang masama ay nabubuwal sa kasakunaan. Awit 37:23 – 24 Ang lakad ng tao ay itinatatag ng Panginoon; at siya’y nasasayahan sa kaniyang lakad. Bagaman siya’y mabuwal, hindi siya lubos na mapapahiga: Sapagka’t inaalalayan siya ng Panginoon ng Kaniyang kamay. STRATEGIC COST MANAGMENT 10 STRATEGIC COST MANAGMENT 11 STRATEGIC COST MANAGMENT 12 STRATEGIC COST MANAGMENT 13