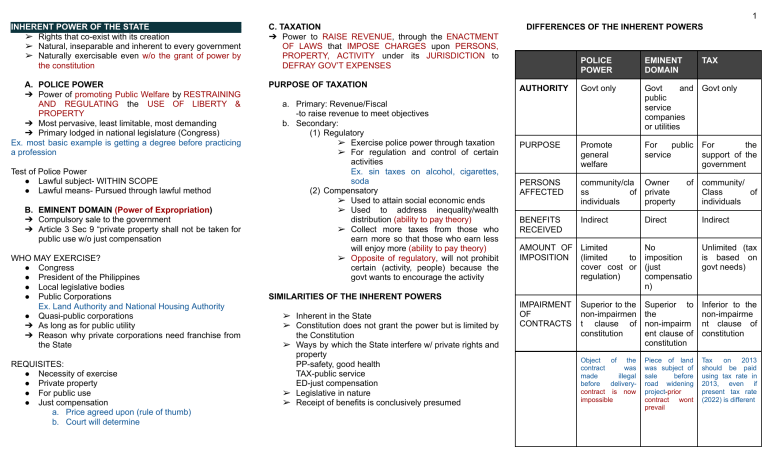

1 INHERENT POWER OF THE STATE ➢ Rights that co-exist with its creation ➢ Natural, inseparable and inherent to every government ➢ Naturally exercisable even w/o the grant of power by the constitution C. TAXATION ➔ Power to RAISE REVENUE, through the ENACTMENT OF LAWS that IMPOSE CHARGES upon PERSONS, PROPERTY, ACTIVITY under its JURISDICTION to DEFRAY GOV’T EXPENSES A. POLICE POWER ➔ Power of promoting Public Welfare by RESTRAINING AND REGULATING the USE OF LIBERTY & PROPERTY ➔ Most pervasive, least limitable, most demanding ➔ Primary lodged in national legislature (Congress) Ex. most basic example is getting a degree before practicing a profession PURPOSE OF TAXATION Test of Police Power ● Lawful subject- WITHIN SCOPE ● Lawful means- Pursued through lawful method B. EMINENT DOMAIN (Power of Expropriation) ➔ Compulsory sale to the government ➔ Article 3 Sec 9 “private property shall not be taken for public use w/o just compensation WHO MAY EXERCISE? ● Congress ● President of the Philippines ● Local legislative bodies ● Public Corporations Ex. Land Authority and National Housing Authority ● Quasi-public corporations ➔ As long as for public utility ➔ Reason why private corporations need franchise from the State REQUISITES: ● Necessity of exercise ● Private property ● For public use ● Just compensation a. Price agreed upon (rule of thumb) b. Court will determine a. Primary: Revenue/Fiscal -to raise revenue to meet objectives b. Secondary: (1) Regulatory ➢ Exercise police power through taxation ➢ For regulation and control of certain activities Ex. sin taxes on alcohol, cigarettes, soda (2) Compensatory ➢ Used to attain social economic ends ➢ Used to address inequality/wealth distribution (ability to pay theory) ➢ Collect more taxes from those who earn more so that those who earn less will enjoy more (ability to pay theory) ➢ Opposite of regulatory, will not prohibit certain (activity, people) because the govt wants to encourage the activity SIMILARITIES OF THE INHERENT POWERS ➢ Inherent in the State ➢ Constitution does not grant the power but is limited by the Constitution ➢ Ways by which the State interfere w/ private rights and property PP-safety, good health TAX-public service ED-just compensation ➢ Legislative in nature ➢ Receipt of benefits is conclusively presumed DIFFERENCES OF THE INHERENT POWERS POLICE POWER EMINENT DOMAIN TAX AUTHORITY Govt only Govt and Govt only public service companies or utilities PURPOSE Promote general welfare For public For the service support of the government PERSONS AFFECTED community/cla Owner ss of private individuals property BENEFITS RECEIVED Indirect of community/ Class of individuals Direct Indirect AMOUNT OF Limited No IMPOSITION (limited to imposition cover cost or (just regulation) compensatio n) Unlimited (tax is based on govt needs) IMPAIRMENT OF CONTRACTS Superior to the non-impairmen t clause of constitution Superior to the non-impairm ent clause of constitution Inferior to the non-impairme nt clause of constitution Object of the contract was made illegal before deliverycontract is now impossible Piece of land was subject of sale before road widening project-prior contract wont prevail Tax on 2013 should be paid using tax rate in 2013, even if present tax rate (2022) is different 2 ASPECTS OF TAXATION c. Non-compensation or set-off GR: taxes could not be subject for set-off because taxes are not debt PLENARY: avail remedies just to endure collection : it is a process, there needs to be a law UNLIMITED: w/o restrictions EXC: ● Budget is readily available ● Cases of obvious overpayment of taxes ● Local taxes COMPREHENSIVE: may cover person, business, activities, professions, rights & privileges LIMITATIONS OF TAXATION d. ➢ ➢ ● ● ● ● ● ● ● Right to select objects (subjects) of taxation Rests with the Congress Includes determination of: subject/object Purpose amount/rate Kind of tax Apportionment of tax Situs of taxation Manner, means, agency of collection e. Marshall Doctrine (Destruction of Taxpayer’s Property) ➢ Can be used as instrument of Police Power THEORY OF TAXATION ➢ Lifeblood Theory ➔ w/o taxes, govt cannot exist nor endure ➔ w/o taxes, govt would be paralyzed for lack of motive power to activate and operate it ➔ WE NEED TO COLLECT TAXES BY ALL MEANS Concept that support the Lifeblood theory a. Rule of No Estoppel against the Govt ➢ Error of any govt employee does not bind the govt b. Collection of Taxes cannot be enjoined by injunction GR: judicial non-interference because it will unnecessarily defer tax collection Ex. issue TRO against BIR to stop them from collecting taxes EXC: Courts of Tax Appeals (CTA) shall have the authority in some cases POWER TO DESTROY- its exercise would be destructive or would bring about insolvency to a taxpayer or forfeiture of properties ➢ Used to discourage undesirable activities BASIS OF TAXATION ➢ Benefits Received Theory (Mutuality of Support) ➔ Govt provides benefits to the people in the form of public services and the people provides funds that finance the government ➔ Receipt the benefits is presumed ➔ Taxpayers cannot use a justification not to pay taxes because they did not receive benefits SCOPE OF THE TAXATION POWER ➢ SUPREME: can impose tax on anything -PP and ED cannot be properly imposed w/o taxation A. INHERENT LIMITATION- limitations that co-exist with the grant of power 1. Public Purpose 2. No Improper Delegation of Power 3. Territorial Jurisdiction 4. Exemption of Govt Entities 5. International Comity 1. Public Purpose ➢ For the welfare of the nation/ greater portion of the population ➢ Should not discriminate anyone ➢ Affects the area as a community, rather than as individuals Ex. govt spend money to build catholic church - NOT for public purpose because it only benefits a certain group - It discriminates those who are not catholics Ex. govt use funds to fix Sto. Nino Church that was destroyed by earthquake - It is for public purpose because it is considered a NATIONAL HERITAGE and tourist spot - Not a matter of region, but rather culture and history 2. Non-delegation of the taxing power (Inherently legislative) ➢ Power to tax is exercised by Congress as delegates of people GR: Congress cannot delegate this delegated power Congress: (1) House of Representative (lower house) (2) Senators (upper house) -lawmakers represent the people in the creation of law -taxation needs a law for its proper implementation EXC: ● Delegation to local government ● Delegation to the President of the Philippines ● Delegation to Administrative Bodies A. Delegation to Local Governments ➢ Local Government Code of the Philippines ➢ Each local govt shall have the power: (subject to guidelines and limitations of Congress) 1. To create its own sources of revenue 2. To levy taxes, fees and charges B. Delegation to the President ➢ Sec 28 (2) Art VI: President is authorized to fix within specified limits and subject to such limitations and restrictions as it may impose, tariff rates, import and export within the framework of the national development programs of the govt C. Delegation To Administrative Bodies ➢ To be valid, law must be complete itself, setting forth therein the policy to be executed, carried out, or implemented by the senate ➢ Only thing left for the delegate is to implement the law Ex. BIR ➢ Law fixes a standard ➢ Law is always superior than the delegate 3. Situs of Taxation (TERRITORIALITY) ➢ Place or authority that has the right to impose and collect taxes IF THE TAX IS: A personal, capitulation THE SITUS IS poll, or Residence or citizenship of the taxpayer An excise tax The State where the right is Ex. foreigner dies in PH, he exercised or activity is will pay tax conducted A real property tax Only the state where Ex. A has a property in property is located Japan (he is a resident in PH) -he will pay property tax in Japan A sells property and obtains income in Japan -he is taxable in PH for his income A tax on Tangible property Where property is located A tax on intangible personal property Ex. A has a receivable -he has a right to collect where the debtor is located May be imposed by the state where the intangible personal property is exercised A is a stockholder of San Mig Corp (PH domestic corp). He kept the stock cert in Canada. Can PH govt impose taxes on it? -Yes because SMC is a DC 4. Exemption of Government entities, agencies and instrumentalities ➢ Transfer from one pocket and placing it in the other pocket (futile) GR: Govt does not normally tax itself EXC: activities are conducted for profit including GOCCs 5. International Comity ➢ Respect accorded by nations to each other because they are sovereign equals ➢ Rule of International Law (between equals, THERE IS NO SOVEREIGN) - A foreign govt may not be sued w/o its consent so that it is useless to impose a tax not collected Ex. Can the Philippines tax income from US Embassy generated in PH? - NO, because it is a govt activity by the US. 3 B. CONSTITUTIONAL LIMITATIONS- limitations stated in the Constitution 1. Non-imprisonment for non-payment of debt or poll tax 2. Uniformity and Equitability of Taxation 3. Prohibition against Taxation of Religious, Charitable, or Educational Purposes (Property Taxes-EXEMPT) 4. Prohibition against Taxation of Non-stock, Non-profit Institutions 5. Majority Vote of Congress for Grant of Tax Exemption 6.Non-appropriation of Public Money for Religious purposes 7. President’s VETO POWER on appropriation, revenue tariff bills 8. Due process 9. Non-impairment of the Jurisdiction of the Supreme Court 1. Non-imprisonment for non-payment of debt or poll tax ➢ Prohibition only refers to poll tax/ community tax ➢ No one shall be imprisoned for his poverty ➢ BUT non-payment of income taxes is punishable by imprisonment 2. Uniformity and Equitability of Taxation To be uniform: ➢ When the laws uniformly: - On all persons - Under similar circumstances ➢ All persons are treated in the same manner: - The conditions not being different - Both in privileges conferred and liabilities imposed - Favoritism and preference not allowed Equitable: ➢ Those who earn more, pay more and vice versa 4 3. Prohibition against Taxation of Religious Charitable, or Educational Purposes (Property taxes- EXEMPT) ➢ Charitable institutions, churches, parsonages, or convents appurtenant thereto, mosques, non-profit cemeteries, and all land, building and improvements ACTUALLY, DIRECTLY. AND EXCLUSIVELY USED FOR RELIGIOUS, CHARITABLE OR EDUCATIONAL PURPOSES- only PROPERTY TAXES Ex. An archdiocese owns a 1,000 sqm lot in Cebu. 300sqm was used for the cathedral and the rest were rented out for a 7/11 store - Only the 300 sqm will be exempted from property taxes - Religious owner does not matter 4. Prohibition against Taxation of Non-stock, Non-profit Institutions ➢ All revenues and assets used ACTUALLY, DIRECTLY AND EXCLUSIVELY for EDUCATIONAL PURPOSES shall be exempt from taxes and duties ➢ Includes grants, endowments, donations and contributions 5. Majority Vote of Congress for Grant of Tax Exemption Tax bill - must always originate from House of Representative - cannot be discussed simultaneously in BOTH houses