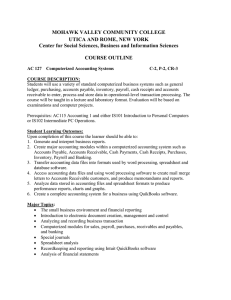

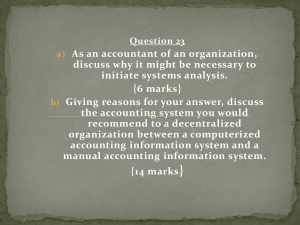

COMPUTERIZED ACCOUNTING ACCOUNTING INFORMATION SYSTEM System A System is a set of interacting parts or components that attempts to achieve one or more goals. A system must have Multiple Components and should be related, although each part functions independently of the others, all parts serve a common objective. System has three basic interacting components or Functions, i.e. Input, processing and output. And these are explained below:a) Input. Input involves capturing and assembling elements that is entered in the system to be processed. In other words, inputs provide the system with what it needs to be able to operate. b) Process. Processing involves the transformation of an input into an output. Processes may involve tasks performed by humans, plant, computers, chemicals and a wide range of other actions. Processes may consist of assembly, for example where electronic consumer goods are being manufactured, or disassembly e.g. where oil is refined. c) Output. Output is the end result of the transformation process. Output involves transferring elements that have been produced by a transformation process to their ultimate destination. They could be said to represent the purpose for which the system exists, and many outputs are used as inputs to other systems. E.g. Reports d) System boundary. Systems boundaries may be natural or artificially created for example, an organizations department structures are artificially created. Every system has a boundary that separates it from its environment, for instance a cost accounting departments boundary can be expressed in terms of who works in it and what work it does. This boundary will separate it from other departments such as the financial accounts department. e) The environment. Anything which is outside the system boundary belongs to the systems environment and not to the system itself. A system accepts inputs from the environment. The parts of the environment from which the system receives inputs may not be the same as those to which it delivers outputs. The environment exerts a considerable influence on the behavior of a system; at the same time the system can do little to control the behavior of the environment. f) Feedback. Feedback is referred to as control information generated by the system itself and involves a comparison of actual results against the target or plan. In a business organization, feedback is information produced from within the organization, for example management control reports, intended to help management and other employee to trigger control decisions. Feedback may be negative or positive depending on what control action it initiates. i) Negative feedback. This is information which indicates that the system is deviating from its planned or prescribed course and that some re-adjustment is necessary to bring it back on to course. This feedback is called negative Page 1 of 12 ii) because control action would seek to reverse the direction or movement of the system back towards its planned course. Positive feedback. Positive feedback occurs when there is some kind of problem in the feedback loop. It results in control action which causes actual results to maintain or increase their path of deviation from planned results. Systems Boundary Inputs Processing Output s Feedback Environment g) Control system. Control involves monitoring and evaluating feedback to determine whether a system is moving toward the achievement of its goals. The control function then makes necessary adjustments to a systems input and processing components to ensure that proper output is produced. Control is required because unpredictable disturbances arise and enter the system, so that actual results, that is, outputs of the system deviate from the expected results. Subsystem: A subsystem is the interrelated parts that have come together, or integrated, as a single system. Most systems are composed of smaller subsystems a part of a system. Data and information Data refers to streams of raw facts representing events occurring in organizations or the physical environment before they have been organized and arranged into a form that people can understand and use. Therefore, data are facts that are collected, recorded, stored, and processed by an information system. Organizations collect data about: Events that occur Resources that are affected by those events Accounting Data: This comprise of numerical facts which only relate to those transactions and events that are financial and economic in character and nature This accounting data is disorganized and disjointed in its raw form. It is not capable of being understood and support financial decision making. Page 2 of 12 Sources of Accounting Data: Accounting data must be supported by documentary evidence, e.g. vouchers, receipts, invoices etc support the data Examples of Accounting Data: Raw accounting data may include but not limited to; vendor names, sales dates, amounts, hours worked, units processed or even planned, employee vacation days earned, and customer telephone numbers are all data that are entered into the accounting information system. Accounting data are captured, processed, stored, and reported by the accounting system, and represent information used for decision making by managers Difference between data & information Information is different from data. Information is data that have been organized and processed to provide meaning to a user. Hence information is processed data that is capable creating a meaning to the users. Types of information system The information system is the set of formal procedures by which data are collected, processed into information, and distributed to users There are broad classes of information systems: the accounting information system (AIS) and the management information system (MIS). Accounting has been defined as: the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are of financial character, and interpreting the results thereof. It is a process of identifying, recording, summarizing, and reporting economic information to decision makers in the form of financial statements. Accounting allows a company to analyze the financial records to allow informed decision The AIS is composed of three major subsystems: (1) the transaction processing system (TPS), which supports daily business operations with numerous reports, documents, and messages for users throughout the organization such as expenditure cycle (Purchases of goods and services, cash disbursement, payroll processing, fixed asset purchase), revenue cycle (sales processing and cash receipt system), Conversion cycle (Cost accounting and production planning) Page 3 of 12 (2) the general ledger/financial reporting system (GL/FRS), which produces the traditional financial statements, such as the income statement, balance sheet, statement of cash flows, tax returns, and other reports required by law; and (3) the management reporting system (MRS), which provides internal management with special-purpose financial reports and information needed for decision making such as budgets, variance reports, and responsibility reports. Management information system Which includes, financial management system, marketing system, distribution system and human resources system Example of Management information system applicable in functional areas Functions Example of activities Finance Distribution Personnel Marketing Portfolio management system Capital budgeting system Market analysis New product development Product analysis Warehouse organization & scheduling Delivery scheduling Vehicle loading and scheduling Human resource management system Job skill tracking Employee benefit system Classification of Information System (IS) An Information system consists of an integrated set of computer-based and manual components established to collect, process, transform, manage and distribute output information to users for planning, decision making, and control. Broad Classifications of IS: They are broadly categorized into; manual and computerbased information systems as seen below; Manual Information Systems: These are systems where written data is input, processed, output and stored on paper and there is no usage of computer technologies and systems in these systems. Page 4 of 12 Manual Information Systems: Tasks are completed manually through practiced routines and there is limited reliance on information stored in, and retrieved from, either fixed computerized databases. Manual accounting implies that employees perform the whole accounting cycle manually on a periodic basis: they calculate trial balances, journalize transactions, and prepare financial statement reports and other routines. Of course it takes much time, resources and effort in large organizations Among the advantages of manual accounting there are: Comparatively cheap in terms of resources compared to computerized system. More reliability Independence from machines Skilled workers availability as compared to the other system The disadvantages include: Reduced speed Increased effort of accountants Relatively slower internal control reporting Routine work and some others Computer-based information system: includes any organized combination of people, hardware, software, communications network and data resources to perform the activities of input, processing, output and control activities that collect transform data resources into information products in an organization or disseminate information in an organization. Specific objective /Roles of accounting information system The system minimizing the duplication, recording, storing, reporting, and processing, whether manual or computer-based system, it performs the following roles: Provides information to the internal users such as accountants, employees and management for decision making Provide information to external users such government, suppliers, financial institutions, customers among others through preparation of financial reports Accounting information aids in the acquisition of loans from financial institutions, Accounting information systems help government to determine the taxes and for policy formulations Page 5 of 12 Helps suppliers in determining whether to supply goods to the business on credit or not Accounting information system help Customers in determining the quality of the firms Product This information is provided in the form of reports that fall into two main categories: i.e. financial statements and Managerial reports. COMPUTERIZED ACCOUNTING Computerized Accounting is software that runs on a computer equipment to record, store and analyze information on financial transactions from internal and external operations of both small and large businesses. Financial reports are automatically generated at the end of each accounting period of a given company. The computerized accounting eliminates paper work making it easier and faster to collect, store and trail all transactions as they occur. Types /Forms of Computerized There are various forms that include: QuickBooks software Tally accounting software Pastel Accounting software Sage accounting Sun system Navision Palladium accounting 2013 business edition and Enterprise edition Etc. Why Computerized Accounting/Advantages of Computerized Accounting Limiting Human error The biggest advantage of accounting software for businesses is that most software available has an automated system that checks for mathematical errors. Errors in accounting can occur easily when done by hand. When errors do happen, they can create chain reactions that cost a company untold amounts of money and time as they must determine how the error occurred, what other areas of the business's finance it affects and how to prevent similar errors in the future. Having a system that is fully automated reduces the possibility for human errors Automated Report Generation Accounting software has the ability to generate reports on demand--something that could take a team of humans hours or days. These reports can be customized to what the company is spending money on, such as rent, day-to-day operations, salaries and marketing. In addition, when used properly, this feature can assist the business in its budgeting needs, telling executives in a quick and easy to use format exactly where their Page 6 of 12 money is going. Reports empower executives to make informed decisions, and having instant access to them can only make success more likely Lower the cost Accounting can become expensive for businesses, as the level of work can result in the businesses needing to hire an accounting service on contract or hire several full-time employees. Accounting software eliminates much of the manual work, which may allow you to reduce your full-time staff and lower your costs. Indeed, because so many tasks can be automated, a full-time accountant may not be necessary at all. Automatic ledger update The general ledger accounting systems gets automatically updated once the entry in a subsidiary ledger is posted. For example, when invoicing a debtor through the Debtors Ledger there is an automatic entry made to the general ledger. This means if all entries are recorded the general ledger is up to date. Accounts always in balance (Debits = Credits) Computerized systems recognize double entry bookkeeping where for every debit entry there is a corresponding credit entry made. The computerized accounting system accounts are always in balance. For example, when entering a payment, the system will not allow you to record a transaction unless you have allocated to an expense (or other) account. Accuracy and speed of automatic calculations Computerized systems have automatic calculations built in and therefore there is a slim chance of making mistakes calculating invoices and VAT. The system automatically calculates VAT inclusive and exclusive figures. This means VAT reports and forms provided all relevant entries have been made. Automatic production of a trial balance from ledger entries Computerized systems create a trial balance automatically. For example, when electricity is paid, the Bank account (Asset) gets credited and Electricity (Expense) account gets debited. Both figures would be included if you were to run a trial balance. From a trial balance we produce a Profit and Loss Statement and a Balance Sheet and both are generated in seconds. Potential to create customized reports and provide additional analysis Page 7 of 12 Computerized systems allow you to customize professional looking reports (which may include your company details and logo). These reports provide additional analysis which may be needed by the bank, shareholders, suppliers and/or the owners. Far less time is spent creating reports than using a manual system. Lower accounting fees This may or may not eventuate and depends on the ability of the business to produce an accurate set of accounts from their computerized system. With competent set up and good training and accurate inputting, then yes, accounting fees should definitely be lower as you are reducing the workload of your accountant doing your bookkeeping. Accounting software can provide small business with many efficient ways of managing daily financial tasks, as well as provide management and ownership with useful reports to help analyze business performance. Without proper consideration, business owners sometimes make costly mistakes by investing in the wrong accounting software, and then they struggle to make the software work or incur even more cost by converting to different software. Factors to Consider When Choosing Accounting Software Scope of Business The first and most important thing business owners should document before choosing accounting software is the scope of the business and what accounting tasks the software should ideally perform. In addition to basic accounting requirements, make a list of other items you want the accounting software to handle, such as payroll, inventory management and cost accounting. Consider the future of the business in your decision as well as current operations. Software that fits perfectly today may not be enough a year from now. Keep business growth and expansion in mind when creating your scope list. Modules Included Once you have defined the scope of the business and the purpose of the accounting package, screening software possibilities becomes an easier task, because you can easily eliminate those that do not cover items on your scope list. For each accounting package that covers your scope, determine which modules are included in the base price and which modules have an additional cost. For example, some software manufacturers charge an additional price for a payroll module. Make a note of the entire cost of each software package so that you can accurately compare the packages. Access and Portability If you have a single business location and do not expect that to change, any accounting package that installs on a network server is suitable for your business. But if you have, or intend to have, multiple locations, you need to consider how field employees will access the accounting software, if needed. If you do not have an information technology employee, setting up exchange server logins may be too complicated a process to install Page 8 of 12 or troubleshoot when you have problems. In the case of a small business with multiple locations, or employees that work from home, Internet-based software may be the best choice. Knowledge Required Powerful, do-it-all accounting software is still useless if your employees cannot learn to use it. When choosing accounting software, you must take into account the education level of your employees and the difficulty of the software selections. Some accounting software requires high-level accounting knowledge for setup and use, while other software packages are geared toward business owners and employees who do not have accounting education or experience. Cost Once you have eliminated software packages by scope, portability, module and knowledge requirements, the last factor to consider is the cost of the remaining software packages. When considering cost, take into account fees for upgrades, annual licensing and support. Compare technical support packages and factor additional fee support packages into the overall cost of the accounting software. If you cannot perform the installation and setup of the accounting software yourself, get estimates for installation and setup and factor those figures into the overall cost. Other Factors Capacity This refers to the softwares limiting characteristics. What is the maximum number of customers, vendors, or inventory items it can handle? How many line items can be included in a single invoice, sales order, or purchase order? Reporting capabilities Does the software already have the capability to produce the reports that your organization requires? If not, can customized reports be created with a minimum of time and added effort? Ease of input You want a system in which information can be entered quickly and efficiently: full-screen editing, embedded help systems, clear prompts, etc. You also want a system that does not require excessive mouse use, slowing down entry of information by continually forcing the user to switch between keyboard and mouse. Data validation How good is the software at preventing mistakes from being entered into the system? The program should test for errors (such as duplicate customers and vendors, incorrect item numbers, and unreasonable amounts or dates). A good system also notifies the operator of unusually high quantities or unit prices for certain types of items and offers valid choices along with the notification message. Error handling Find out how well each program prevents unbalanced transactions, and how users are stopped from deleting or otherwise losing important data previously in the system. Some systems provide detailed audit trails for errors to track who is making each change. Page 9 of 12 Security The degree to which sensitive functions and reports can be protected through passwords will affect how the program rates in security. Ideally, you should be able to specify which operations each user can perform at any given time. For example, a system with strong security would allow you to specify that your accounts payable clerk could only print. Benefits of using Computers in accounting information system Computerized accounting system is the method of generating accounting information for decision making through computer with support of accounting software. This method is very beneficial and important to businesses. The following are the importance of computerized accounting system: Automatic document production Instant and reliable receipts, invoices, credit notes, sales order, purchase order, payroll documents, statement of comprehensive income and statement of financial position are generated automatically. Compatibility It makes the preparation of accounting for merger and acquisition very easy where the companies involved use the same accounting software. Manual accounting system could be too cumbersome for the preparation of accounting for merger and acquisition. Faster Processing/Speed: Computers require far less time than human beings in performing a particular task. Therefore, accounting data is processed faster using a computerized accounting system. The daily total sales, gross profit, total expenditure, total cash, total accounts receivable, total account payable can be generated within few seconds. In a nutshell, monthly, quarterly and annual financial statement can be prepared instantly. Accurate Information: There is less space for error because only one account entry is needed for each transaction unlike repeated posting of the same accounting data in manual system Reliability: Computer systems are immune to boredom, tiredness or fatigue. Therefore, these can perform repetitive functions effectively and are highly reliable as compared to human beings. Easy Availability of Information: The data can be made available to different users at the same time. This is called data sharing. Financial information is readily available to users of accounting information for decision making at any time. Up-to-date Information: Account balances will always be up to date since the records are automatically updated as and when accounting data is entered or stored. Page 10 of 12 Efficiency: The computer based accounting system ensures better use of time and resources. Storage and Retrieval: Computer based systems require a fractional amount of physical space as compared to the books of accounts in the form of journals, ledgers and accounting registers. Works as a Motivator: Employees using computer systems feel more valued as they are trained and specialized for the job. Automated Document Production: Accounting reports like cash book, trial balance and financial statements are generated automatically and are easily accessible just by a click of mouse. MIS Reports: It is easier to monitor and control the business using the real time management information reports generated by the computerized information systems. Limitations of Computerized Accounting Systems: The main limitations of computerized systems are being dependent upon the operating environment they work in. Some of them are listed as follows: Heavy Cost of Installation: Computer hardware needs replacing and software needs to be updated from time to time with the availability of newer versions. Cost of Training: To ensure effective and efficient use of computerized system of accounting, newer versions of hardware and software are introduced. This requires special training and cost is incurred to train the staff personnel as specialists. Fear of Unemployment: Reflects the feelings of the staff on the introduction of computerized accounting system, the staff fears redundancy and show less interest in computers. Disruption in Work: When computerized system is introduced, there might be loss in the work time and certain changes in the working environment. System Failure: The danger of a system crashing due to some failure in hardware can lead to subsequent loss of work. This occurs when no back-up is retained. Time Consuming: Page 11 of 12 In order to avoid loss of work at the time of system failure, there is a need for providing backup arrangements which is a time consuming process. Unanticipated Errors not Known: Unlike human beings, computers do not have the capability to judge or detect unanticipated errors in the system. Breaches of Security: The danger of viruses and hacking into the system from outside creates a strong need for security of system. Similarly, the person who has created the specific program can easily defraud by tempering with the original records. Health Dangers: Extensive use of computers may lead to many health problems such as eyestrain, muscular complaints, backache etc. resultantly reducing working efficiency as well as increasing medical expenditure. Page 12 of 12