Best Practices in Lean Six Sigma Process Improvement by Richard J. Schonberger (z-lib.org)

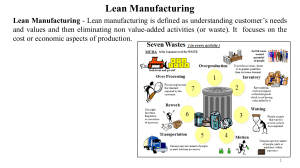

advertisement