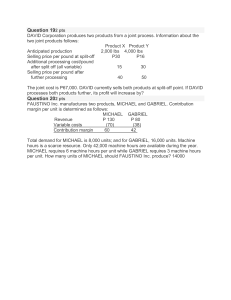

1. ZARAH has been approached by a foreigner who wants to place a special order for 15,000 units of its product ATB at P22.50 per unit. ZARAH currently sell this item for P39 per unit, and the item has a cost of P29 per unit. Further analysis reveals that ZARAH will not be paying sales commission of P2.50 a unit on the sales and its packaging requirement will save an additional P1.50 per unit. However, an additional graphics required on this job will cost ZARAH P30,000. Note also that fixed costs amounting to P400,000 for the production of 50,000 units will not change. ZARAH decided to accept the order but another customer who buys an average of 2,000 units for the period wants to pay P22.50 only rather than the regular selling price of P39.00 Accepting the special order will increase (decrease) profits by how much? 2. PATRENZ Corporation sells a product for P20 with variable cost of P8 per unit. PATRENZ could accept a special order for 1,000 units at P14. If PATRENZ accepted the order, how many units could it lose at the regular price before the decision become unwise? 3. CARO Corp produces 1,000 units of part CAM per month. The total manufacturing costs of the part are as follows: Direct materials P10,000 Direct labor 5,000 Variable overhead 5,000 Fixed overhead 30,000 Total manufacturing cost P50,000 An outside supplier has offered to supply the part at P30 per unit. It is estimated that 20% of the fixed overhead being assigned to part CAM will no longer be incurred if the company purchases the part from the outside supplier. If CARO Corp purchases 1,000 units of part CAM from the outside supplier, its monthly operating income will decrease/increase by: 4. LAMIKA Inc. is a multi-product company that currently manufactures 30,000 units of part JADA each month for use in the production of its main product. The facilities now being used to produce JADA have fixed monthly cost of P150,000 and a capacity to produce 84,000 units per month. If LAMIKA were to buy JADA from an outside supplier, the facilities would be idle, but 60% of its fixed costs would not continue. The variable production costs of part JADA are P11 per unit. If LAMIKA is able to obtain part JADA from an outside supplier at a unit purchase price of P12.875, the monthly usage at which it will be indifferent between purchasing and making part JADA is? 5. FAUSTINO Inc. manufactures two products, MICHAEL and GABRIEL. Contribution margin per unit is determined as follows: MICHAEL GABRIEL Revenue P 130 P 80 Variable costs (70) (38) Contribution margin 60 42 Total demand for MICHAEL is 16,000 units and for GABRIEL, 8,000 units. Machine hours is a scarce resource. Only 42,000 machine hours are available during the year. MICHAEL requires 6 machine hours per unit while GABRIEL requires 3 machine hours per unit. How many units of MICHAEL and GABRIEL should FAUSTINO Inc. produce? 6. CHUA Corp is deciding whether or not to eliminate GINO Segment of its business. GINO segment generates total sales of P104 000, its direct expenses are P22 000, and its indirect expenses are P26 000. Its cost of goods sold is P64 000. Only P6 000 pesos of the direct expenses and P8 000 of the indirect expenses are avoidable. Determine the incorrect statement. a. The segment has a net loss of P8 000 b. The segment’s revenue is greater than its avoidable costs. c. The segment is a good candidate for elimination d. The segment’s avoidable costs are greater than unavoidable costs. 7. DAVID Corporation produces two products from a joint process. Information about the two joint products follows: Product X Product Y Anticipated production 2,000 lbs 4,000 lbs Selling price per pound at split-off P30 P16 Additional processing cost/pound after split off (all variable) 15 30 Selling price per pound after further processing 40 50 The joint cost is P85,000. DAVID currently sells both products at split-off point. If DAVID makes the decision which maximizes profit, its profit will increase by?