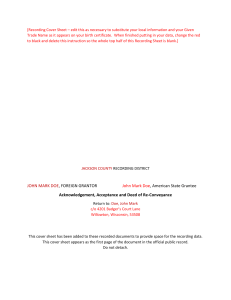

Land Services Department Recorder’s Office 635 2nd Ste SE Milaca, MN 56353 DOUG HANSEN MILLE LACS COUNTY RECORDER Registrar of Titles recorder@millelacs.mn.gov TO: Jan Jude Law 157 South Central Avenue Milaca, MN 56353 Fax: (320)983-8336 Phone: (320)983-8236 Date: 05/01/2023 Re: VanGrinsven Estate Your File # We have received your document(s) for recording but cannot record because: X (Payable to Mille Lacs County Recorder) The recording fee must be paid at the time the document is presented for recording. $ The deed must contain a statement of the amount of Deed Tax Stamps pursuant to MS §287.241. Example: “Deed Tax Due = $1.65” A deed must contain a statement as to why it qualifies for minimum deed tax pursuant to MS §287.20, Subd. 2(g) OR you need to provide a DT-1 form that is filled out, signed, and attached to the Deed Deed tax must be paid at time of recording (MS §287.21) (Amount of purchase price multiplied by $.0033. If the third digit after the decimal is 5 or higher, you must round up the penny. Minimum deed tax is $1.65 for $3,000 or less) $ (Payable to Mille Lacs County Auditor/Treasurer) Mortgage Registration Tax (MRT) must be paid at time of recording. (per MS §287.035) (Amount of mortgage multiplied by $.0023. If the third digit after the decimal is 5 or higher, you must round up the penny.) MRT Amount due on $ is $ (Payable to Mille Lacs County Auditor/Treasurer) All delinquent real estate taxes must be paid in full at time of recording per MS §272.12. $ (Payable to Mille Lacs County Auditor/Treasurer (Payable to Mille Lacs Co. Auditor/Treasurer) Current taxes must be paid in full when a split occurs pursuant to MS §272.121 $ An electronic Certificate of Real Estate Value (eCRV) is required pursuant to MS §272.115. (Effective 10-1-2014) You may enter an eCRV form at: http.//www.revenue.state.mn.us/CRV/Pages/eCRV.aspx. AND the eCRV number that is assigned to your eCRV must show on the deed. The electronic Certificate of Real Estate Value (eCRV) is incomplete or incorrect. The electronic Certificate of Real Estate Value (eCRV) must contain Social Security numbers for all buyers and all sellers. A Well Disclosure Certificate is required or, a statement by Sellers as to “No Wells on Property” or “No Change in Well Status” is required pursuant to MS 103I.235. (The recording fee for a Well Disclosure Certificate is $50.00). An electronic version of the Well Cert. is available at: https://edisclosures.web.health.state.mn.us/wells-disclosure-ssl/euserlogin.cfm. Well Disclosure Certificate must be completed. Draftsman: The document must state the name and complete address of whoever prepared the document pursuant to MS §507.091. Tax Statements: The document must state the name and complete address to whom tax statements are to be sent pursuant to MS §507.092 Any document effecting real estate shall be executed and acknowledged including: Proper Venue (Name of State and County where document is notarized); complete date of document (MM/DD/YY); original signatures by grantors: complete date of notarization (MM/DD/YY); complete & correct notary acknowledgment; original signature of notary public; notary stamp or seal (must be legible & reproduceable) with the expiration date of the term of the commission of the notary public pursuant to MS §507.24. Any document of conveyance must state the marital status of the grantor(s), i.e. a single person, husband and wife, married to each other, etc. pursuant to MS §507.02 et. seq. (If property is homestead property, spouse must also sign the document.) Incorrect, Incomplete or Missing Legal Description – Please see attached document specifying the legal description for the DOD and TODD Other: X YOUR DOCUMENTS AND CHECKS ARE BEING RETURNED. WHEN ALL OF THE ABOVE REQUIREMENTS ARE MET, PLEASE RETURN FOR RECORDING.