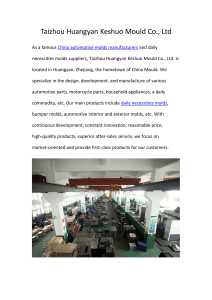

ATENEO DE MANILA UNIVERSITY Graduate School of Business A Study on Establishing Standard Managerial Accounting Procedures for Vaquform Inc.’s Spin Off Projects In partial fulfillment of the requirement in Managerial Accounting - S20 Submitted by: Florendo, Marinella Labrador, Angelo Gabriel Leyran, Lorraine Keeshia Submitted to: Prof. Susana L. De Jesus May 13, 2023 TABLE OF CONTENTS I. Introduction A. The Manufacturing Industry B. Company Background C. Case Presentation & Discussion a. Current Situation b. Statement of the Problem c. Objectives d. Scope & Limitations of the Study II. Case Analysis A. Analysis of the Case and Its Effects on Financial Metrics of the Firm B. Proposed Spin-Off Development Stages and Corresponding Accounting Tools C. Results III. Recommendations & Conclusions 2 INTRODUCTION I. The Manufacturing Industry The history of the manufacturing industry can be dated back to the 19th century when raw materials were transformed into usable products; this period was referred to as the Industrial Revolution (Zeidan, 2023). The advancements in technology lead to the rise of factories, powered by steam engines, where mass production became possible. As manufacturing techniques developed over the years, the industry saw an increase in the implementation of assembly line production (Cooper & Wilkinson, 2022). This enabled companies to have a standard in production of goods, improve efficiency and productivity. Mass production reduced the cost of production which resulted in more affordable products for consumers. There was a significant change in the industry after World War II wherein the use of computers led to the automation of the production processes (Burton, N.A.). Computer-controlled machinery and robotics increased productivity, precision, and flexibility in manufacturing. This period saw the rise of industries such as automotive, aerospace, electronics, and consumer goods. In the latter part of the 20th century, there was an increase in the globalization of manufacturing (Manufacturing Business Technology, N.A.). Companies began to establish global supply chains while sourcing raw materials from different countries to reduce cost. In the 21st century, it is characterized by the digital transformation and integration of technology into manufacturing processes. Automation, robotics, artificial intelligence (AI), Internet of Things (IoT), and big data analytics are revolutionizing production systems nowadays (Craig, 2018). Smart factories and interconnected systems enable real-time data analysis, predictive maintenance, and customization of products to meet individual customer needs. As it has been proven throughout the history of the manufacturing industry, it has undergone significant transformations which were driven by technological advancements, 3 economic changes, and evolving customer needs. To this day, the industry still continues to evolve as it embraces new technologies that improve efficiency, sustainability, and innovation. II. Company Background Vaquform Inc., founded in 2017, is a hardware technology startup company focused on designing and manufacturing vacuum forming machines. Since its founding, it has sold thousands of its flagship machine, the DT2 Desktop Vacuum Forming Machine, around the world. What was once designed specifically for product designers, the DT2 is now used in many different industries such as toy design, cosplay, food and beverage, soap making, furniture design, sustainable manufacturing, medical equipment, packaging, and many more. Image 1. DT2 Desktop Vacuum Forming Machine As part of Vaquform’s efforts to be the leading vacuum forming technology company in the world, the company has started conducting research and development on niche industries with the intention of developing projects into spinoff companies or brands. Among these efforts are in the custom chocolate mold making industry through their spinoff brand, Yummy Molds. 4 Yummy Molds provides custom chocolate molds for local Filipino chocolatiers. Before Yummy Molds, chocolatiers would usually purchase custom molds through large scale manufacturers, requiring them to pay hundreds of thousands of pesos for a single mold. The huge cost prevents small scale chocolatiers from availing their services and causes them to settle with generic off-the-shelf molds. With Yummy Molds, small scale chocolatiers can purchase molds customized with their own or their client’s branding and logo at affordable prices. Image 2. Custom Molds by Yummy Molds Yummy Molds has given their clients the capability to cater to more customers, thereby increasing their profits. This is a testament to the brand’s mission to empower chocolatiers with the ability to expand their creations beyond what standard chocolate molds can provide. Yummy Molds continues to work towards its vision of a Filipino chocolate industry where chocolates look as delicious as they taste, thanks to their technology. III. Case Presentation and Discussion A. Current Situation As a hardware technology startup company focused on design innovations, Vaquform Inc. does not set limited budgets on research and development projects. This is due to the fact that product development expenses constantly change, depending on the 5 direction it has taken. Research and development expenses are approved by the company’s owner and Chief Executive Officer as long as the prices are reasonable and the company has generated enough revenue to afford it. However, as Vaquform Inc. launches more segmented projects such as spin off projects, the company needs to establish standard operating procedures to ensure proper planning, monitoring, and control of projects. B. Statement of the Problem Given the issue at hand, this study aims to answer the following questions: 1. From a managerial accounting perspective, what tools can be used to establish standard control and monitoring procedures for spin off projects? 2. Based on the tools recommended, what information about the spinoff projects should be determined to properly utilize the procedures? 3. How can these tools be applied to Yummy Molds? C. Objectives This study aims to achieve the following objectives: 4. Identify managerial accounting tools that can be used to establish standard control and monitoring procedures for Vaquform Inc. spinoff projects. 5. Determine the minimum information needed from spin off projects to properly utilize the recommended procedures. 6. Apply recommended managerial accounting tools to Yummy Molds. D. Scope and Limitations of the Study Vaquform Inc. is a company primarily composed of designers and engineers. To reduce the learning curve needed to properly implement the recommendations, this study will simplify some of the managerial accounting tools recommended. 6 This study is also conducted with the assumption that Yummy Molds has only one type of product. Arbitrary costs were assigned to honor the company’s request to keep details confidential. 7 CASE ANALYSIS I. Analysis of the Case and Its Effects on Financial Metrics of the Firm A manufacturing company is a type of business that deals with the production of goods by converting raw materials, components, or parts into finished goods (U.S. Bureau of Labor Statistics, N.A.). Typically, these companies usually have factories, equipment, and a workforce to carry out the various functions of the manufacturing operations such as assembly, fabrication, or chemical processing. Manufacturing companies play an important role in the development of economic growth. Meanwhile, managerial accounting focuses on providing financial and analysis to key stakeholders — primarily the management and internal users (CFI Team, 2023). The gathered information usually becomes the basis for making critical business decisions for the benefit of the company and improve its overall performance. In the context of a manufacturing company, the managerial accounting framework can help address several challenges that the company faces. In addition, accounting tools offer several benefits to manufacturing companies by helping them manage their financial information, track costs, and make informed decisions. The benefits of having established accounting tools are as follows: 1. Financial record-keeping: It provides an overall structure on how a company organizes its financial transactions. Accounting allows companies to maintain accurate data and up-to-date financial information which includes sales, expenses, acquisitions, and revenue. 2. Cost tracking & control: Manufacturing companies usually have numerous costs such as raw materials, direct labor, overhead, and inventory. The accounting tools help companies organize and track their cost associated with different production processes, departments, and/or products. This benefits the companies in which they can identify cost drivers and implement cost control measures to optimize production process & efficiency. 8 3. Inventory management: Most of the time, manufacturing companies have a significant amount of investments tied up in inventory. With accounting, it helps manage the tracking of inventory by establishing an inventory control. It helps identify the slow-moving stocks, manage inventory levels, and calculate inventory turnover. 4. Budgeting and forecasting: It is important for manufacturing companies to have an established process of managing budgeting and financial forecasting. This can help in setting appropriate production targets, allocating of resources, and monitoring actual performance against targeted figures. These tools allow a company to analyze “what-if” scenarios to evaluate financial performance depending on different scenarios. 5. Streamlined process and efficiency: Accounting tools help automate various accounting tasks such as data entry, calculations, and report generation. It reduces the need to perform manual effort and minimizes the risk of inaccuracy in financial processes. Readily available data can allow different departments to collaborate easily and effectively. 6. Informed decision-making: Accounting tools make it possible to provide relevant financial information to decision makers. The management can address the need for making critical decisions by taking financial reports into consideration. In other areas, manufacturing companies can also evaluate the profitability of new product lines, analyze the feasibility of capital investments, or assess the impact of pricing decisions; these tools offer valuable insights to aid in decision-making processes. II. Spin-Off Development Stages and Corresponding Proposed Accounting Tools Vaquform’s spinoff projects go through four development stages: 1) Research & Development (R&D); 2) Approval; 3) Execution; and 4) Evaluation. 9 In the first stage, spinoff projects start out as research and development initiatives of Vaquform Inc. As the project becomes more viable, it will undergo the approval process for becoming a separate entity from the research and development team. Under the approval process, information pertaining to the project’s funding, financial goals, costs, and profitability must be determined. Once approved, the spinoff project will transition into execution. In this stage, it is important that accounts are properly recorded in preparation for the next stage. In the evaluation stage, actual accounts will be evaluated to determine the actual profitability of the project. This will determine its financial impact to the mother company, Vaquform, and whether it will be continued or not. It is important that accounting information is properly recorded in all stages especially in the Approval, Execution, and Evaluation Stages as the spinoff projects will function as segments of the company. The table below shows the proposed key accounting tools that can be used for the last three stages of the Spin-Off Development Process: DEVELOPMENT ACCOUNTING TOOLS STAGE PURPOSE 1. Approval 1. Master Budget (Partial) To identify costs and 2. CVP Analysis profitability and the capital allocation needed. 2. Execution 1. Job Order Costing To monitor sales. 2. Standard Costs and Variances To adjust processes and pricing strategies in case U/F. 3. Evaluation 1. Budgeted Income Statement To determine if the 2. Return on Investment spin off or segment is profitable. Table 1. Key accounting tools that can be used by Yummy Molds. 10 A. Approval Stage a. Master Budget The Master Budget is essential for planning and control of the project. It takes into account assumptions to create sales, cash collections, production, direct materials, direct labor, manufacturing overhead, selling and administrative expenses, and cash budgets. For the Sales Budget, it was assumed that the unit sales is 100 units for July, 8 units for August, 300 units for September, 400 units for October, 200 units for November, and 100 units for December for a total of 1180 units for the latter half of 2023. The increase in sales for the months of September and November are due to the demand for Halloween and Christmas themed molds. Selling price per unit is at Php250.00 resulting in a total sales of Php295,000.00. For the Cash Collections Budget, it was assumed that 50% of monthly sales will be collected in the same month and 50% in the succeeding month. This results to a total cash collection of Php282,500.00 for the latter half of 2023. With accounts receivable ending balance of Php12,500.00. For the Production Budget, it was assumed that the desired ending inventory is 50% of the production needs for the succeeding month. 11 For the Direct Materials Budget, it was assumed that the desired ending inventory of raw materials is 100% of the production needs for the succeeding month. The cost of raw materials per unit is Php100.00. The Direct Labor Budget takes into consideration the production budget and uses the required production units per month to compute the cost of total direct labor hours. With direct labor cost per hour of Php200.00 and 0.1hours per unit produced, the total direct labor budget is Php23,600.00 The Manufacturing Overhead Budget takes into account the production budget and computes the budgeted total Manufacturing Overhead Cost of Php29,800.00 based on the variable manufacturing overhead cost of Php10.00 per unit. 12 The Selling and Administrative Expense Budget on the other hand takes into consideration the budgeted unit sales and the variable selling and administrative expenses per unit of Php10.00. This results in a total budgeted S&A expense of Php41,800.00. The Cash Budget takes into account all the budgets listed beforehand and determines the total cash flows, and the borrowings or financing needed per month. In the case of Vaquform and Yummy Molds, this is one of the most important information that can be obtained from the Master Budget as this can be considered as the amount of capital that Vaquform needs to finance for Yummy Molds. For the cash budget, it is assumed that the required cash ending balance is Php5,000.00 per month. The borrowings needed per month are highlighted in yellow in the table below. b. Cost-Volume-Profit Analysis According to Managerial Accounting by Garrison, et. al., “Cost-Volume-Profit Analysis helps managers make many important decisions such as what products and services to offer, what prices to 13 charge, what marketing strategy to use, and what cost structure to maintain.” In this study, CVP analysis is used to determine the contribution margin of each unit sale, break even point, target profit, and margin of safety for Yummy Molds. The table below shows the contribution format income statement for yummy molds based on the budgeted sales units from the Master Budget. CVP Analysis can also be used to determine the breakeven point for the 3rd to 4th quarter of 2023. Yummy Molds needs to sell 436 units to reach breakeven or zero profit/deficit. Considering the Contribution Margin Ratio of 0.44, the Peso Sales required to breakeven is Php109,090.91. 14 Based on the Total Budgeted Sales and Breakeven Sales of Yummy Molds, the Margin of Safety is Php185,909.09. In order for Yummy Molds to reach target profits of Php400,000.00, Php300,000.00, Php200,000.00, and Php100,000.00, a total of 4073, 3164, 2255, and 1345 unit sales must be attained. Computing the unit sales needed to attain target profit will help Yummy Molds in determining how achievable each target profit amount will be. B. Stage 2 — Execution a. Job Order Costing Job Order Costing can be utilized to ensure that Yummy Molds can keep track of the actual costs incurred for each job. As a new venture, there are risks associated with production which may lead to differences in 15 actual and budgeted costs. Job Order Costing aids the business in estimating the cost of the materials, labor, and overhead that will be incurred while carrying out that specific job. Effective job order costing enables businesses to generate quotes that are affordable enough to be appealing to customers while maintaining a profit margin. Below is a sample Job Order Costing sheet for Yummy Molds. b. Standard Costs and Variances Standard Costs and Variances can assist managers in locating areas where costs need to be cut and determining the necessary steps to increase profitability. Using the records from Job Order Costing sheets, variances in actual and budgeted costs can be determined. C. Stage 3 — Evaluation a. Budgeted Income Statement 16 The purpose of a Budgeted Income Statement is to provide a forecast on the expected outcome of revenues and expenses and resulting in a profit or loss of a specific period. It is based on a budget, which is a financial plan that estimates the expected inflow and outflow of transactions. For the budget income statement of Yummy Molds, it shows that there is a significant loss incurred by the company in Q3. The factors which may affect this is low sales revenue due to it being an off-peak season. Also, there were a number of unavoidable expenses that the company has incurred which led to a P27,200 loss. In Q4, the company had a better position with a net income of P95,920. Since there are a number of festivities celebrated on Q4—like Halloween & Christmas, the total revenue increased by P55,000. This contributed to the overall net income of the company of P71,984. With this information, the management can make changes in the marketing approach for Q3 so that it will boost the total sales revenue. b. Return on Investment By utilizing the actual financing incurred by Vaquform, and other accounting records of Yummy Molds during the execution stage, Vaquform’s Return on Investment for Yummy Molds can be calculated. Determining the Return on Investment will help Vaquform decide whether the spin off brand is profitable and is worth investing in moving forward. 17 III. Results Results from the examination and use of managerial accounting tools to the Yummy Molds example have been significant and have given important insights into the management and financial performance of spin-off initiatives. These tools enable Vaquform Inc. to create standardized control and monitoring processes for its spin-off initiatives, resulting in effective resource management, cost control, and well-informed decision-making. A number of management accounting tools have been identified to be essential for developing control and monitoring procedures for Vaquform Inc.'s spin-off initiatives through the analysis. These tools consist of: a. Master Budget: The master budget offers a thorough financial strategy that incorporates all pertinent data, such as sales projections, production costs, and operational costs. Vaquform Inc. can set up a common control mechanism for monitoring actual performance versus set goals by creating a master budget for each spin-off project. This enables proactive management and the detection of any anomalies or deviations that call for remedial action. b. CVP analysis: CVP analysis aids managers in comprehending the connection between expenses, volume, and profitability. Vaquform Inc. can establish the breakeven point, weigh the effects of changes in sales volume or pricing, and analyze the profitability of each project by using CVP analysis to spin-off ventures. This application facilitates sound decision-making by illuminating the financial ramifications of various scenarios. c. Job Order Costing: For spin-off initiatives involving specialized or specific orders, job order costing is especially important. Vaquform Inc. is able to efficiently allocate resources, correctly track expenses, and determine the profitability of each task by allocating costs to specific activities or projects. Better cost control and the identification of cost drivers for future improvement are made possible by this tool 18 d. Standard Costs and Variances: While variations track the discrepancies between actual costs and standard costs, standard costs indicate the anticipated expenses of manufacturing goods or providing services. Vaquform Inc. may monitor and assess the effectiveness of its spin-off projects by putting basic costs and variances analyses into practice. Cost variations reveal potential inefficiencies or opportunities for improvement, allowing for proactive cost management and ongoing process improvement. e. Budgeted Income Statement: Over a certain time period, the budgeted income statement projects the anticipated revenues, costs, and profitability of a spin-off project. Vaquform Inc. may evaluate the financial success of each project and pinpoint areas that need improvement by comparing the actual performance to the planned figures. This tool supports decision-making processes and aids in assessing the overall financial impact of spin-off ventures on the business. To properly employ the recommended control and monitoring techniques, some minimum information needs to be determined from spin-off projects. This data consists of: a. Sales and Revenue Data: The master budget, CVP analysis, and budgeted income statement may all be created with the help of accurate sales and revenue data. This data makes it possible to estimate sales volume, pricing options, and revenue projections—all important factors in financial planning and performance assessment. b. Cost information: For job order costing, standard costs, and variations analysis, comprehensive cost information, including direct materials, direct labor, and overhead expenses, is required. It makes it possible to estimate project-specific costs, identify cost drivers, and assess cost-effectiveness and profitability. c. Project-specific Financial Goals: Establishing project-specific financial objectives, such as target profit margins or returns on investment, offers a 19 standard by which to judge how well spin-off projects are performing. These objectives provide a framework for decision-making and resource allocation, as well as a more focused assessment of profitability. Vaquform Inc. can use these accounting tools and techniques to gather the data required to set up standardized control and monitoring procedures for spin-off projects like Yummy Molds. Vaquform can effectively analyze expenditures, gauge profitability, make wise judgments, and assess the financial performance of spin-off initiatives by applying these solutions. Overall, the results illustrate the relevance of applying management accounting techniques in the different stages of spin-off project development. Vaquform Inc. may make data-driven decisions, manage costs, optimize efficiency, and streamline processes with the use of these tools to successfully execute and evaluate spin-off projects. 20 RECOMMENDATIONS & CONCLUSIONS I. Recommendations The following recommendations are made in light of the case's analysis and results: 1. Developing and implementing standard managerial accounting procedures that are adapted specifically for spin-off ventures is something Vaquform Inc. should do. All phases of the creation of a spin-off project, including research and development, approval, execution, and assessment, should be covered by these procedures. Vaquform Inc. can guarantee adequate planning, monitoring, and control of spin-off projects by putting standardized procedures in place. 2. Utilize Recommended Accounting Tools: For each step of the development of the spin-off project, Vaquform Inc. should make use of the recommended accounting tools outlined in the study. The master budget, cost-volume-profit (CVP) analysis, job order costing, standard costs and variances analysis, and budgeted income statement are a few examples of these instruments. Vaquform Inc. is able to effectively monitor costs, gauge profitability, make wise judgments, and measure the financial success of spin-off ventures by employing these tools. 3. Collect vital Information: Vaquform Inc. must collect vital data from spin-off initiatives in order to fully use the suggested processes and accounting tools. Accurate sales and revenue data, thorough cost data (direct materials, direct labor, and overhead expenses), and project-specific financial objectives are all included in this data. By gathering this data, Vaquform Inc. will be able to make data-driven decisions, realistic budgets, and cost and profitability analyses. 4. Reduce Learning Curve and Ensure Effective Implementation by Simplifying Accounting Tools: Given that Vaquform Inc. is mostly made up of designers and engineers, it is 21 advised to simplify some of the managerial accounting tools. This could entail giving clear instructions, templates, and instructions on how to utilize the tools efficiently. II. Conclusions The report concludes by emphasizing the significance of creating standardized managerial accounting methods for Vaquform Inc. Vaquform Inc. may successfully plan, monitor, and control spin-off initiatives by making use of suggested accounting tools and acquiring crucial data. This improves resource management, cost control, and decision-making. The analysis's findings show the value and advantages of using management accounting methodologies at various phases of the development of spin-off projects. Vaquform Inc. may improve overall performance and succeed in its mission to become a leading provider of vacuum-forming technology by putting the recommendations into practice. 22 REFERENCES Burton, K. D. (N.A., N.A. N.A.). The Scientific and Technological Advances of World War II. The National WWII Museum. https://www.nationalww2museum.org/war/articles/scientific-and-technological-advancesworld-war-ii CFI Team. (2023, March 14). Managerial Accounting - Definition and Techniques Used. Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/accounting/managerial-accounting/ Cooper, A., & Wilkinson, F. (2022, June 2). Industrial Revolution and Technology. National Geographic Society. https://education.nationalgeographic.org/resource/industrial-revolution-and-technology/ Craig, J. (2018, July 30). The Effects of Automation on Manufacturing. Production Machining. https://www.productionmachining.com/articles/the-effects-of-automation-on-manufacturi ng Manufacturing Business Technology. (N.A., N.A. N.A). Three Ways Globalization Is Influencing Manufacturing. Manufacturing Business Technology. https://www.mbtmag.com/global/article/13226537/three-ways-globalization-is-influencin g-manufacturing U.S. Bureau of Labor Statistics. (N.A., N.A. N.A.). Industries at a Glance: Manufacturing: NAICS 31‐33 : U.S. Bureau of Labor Statistics. https://www.bls.gov/iag/tgs/iag31-33.htm Zeidan, A. (2023, April 2). Industrial Revolution | Definition, History, Dates, Summary, & Facts. Encyclopedia Britannica. https://www.britannica.com/event/Industrial-Revolution 23