m

M

chapter

CHAPTER 5

ACCRUAL BASIS

CASH AND

_ cash

Purchases

_______‘____-_____._________._

Chapter Outline:

5

customers.

in

Expenses,

general

Bad debts

To $011:

WML—m____

15 T—accounts of retained earnings

//

SYSIEII] [Hal FBCUgIllLCb

received and expenses when cash is paid.

\S a

l'cvcuuc wuc‘u

Luau

Com 3 arison of Cash Basis and

Items of

‘

I

Comarison

Sales

-

1

Z

0

Cash sales

Collection

of

trade

accounts receivable

Collection

of

notes recivlable

‘

Includes

0

Income

other

when eai ned rather

it is incurred Father tthan

Accrual Basis Accountin

Cash Basis

Includes:

n

74

1

Accrual BaSis

Includes:

0

Cash Sales

o

Credit sales (Sale

account)

on;

Includes

those

payable

Payment in advance to

0

su - liers

lnCIUdeS

only

thOSe

expenses that are paid

“in C05“

'

‘

i

items

-

.

I

T-account approach

“5mg

1m.“ m

W112:

are:

1usmg T,-account. the procedures

P1 0t

the gwen data in the T-account

75

‘

I

0

Cash purchases

0

Purchase on account

t

i

5.

.i‘

Includes those items that

are incurred regardless of

when aid

Depreciation is typically

provided.

K

,3

t

I

‘J

)

i’

g

1:,

5

Doubtful

accounts

treated as bad debts.

are

I

following:

1) Accounts receivable /notes receivables/advances from customers;

2) Allowance for doubtful accounts;

3) Accounts payable / notes payable/ advances to supplier;

4) Merchandise inventory;

5) Property, plant and equipment;

6] Accumulated depreciation;

7) Rent receivable / Unearned rent income;

8) Prepaid rent/Rent payable;

9) Capital;

10) Retained earnings;

11) Net Assets.

Gui

trade

those

Payment

0f

trade

accounts payable

Payment of trade notes

Includes:

T-ACCOUNTS APPROACH

In order to compute for the cash payments or collections for certain

account, it is suggested that the T~account approach will be used on the

1::

Accrual Basis Accounting

It is an accounting SYStem that recognizes revenue

when cash is received and recognizes expenses as

when cash is paid.

°

Cash purchase

DepreCIation is typically

provided except when the

cost of equipment was

treated as exense

No bad debts expense is

recognized since cash basis

not

does

recognlze

Eceivables. Although some

problem may give an

indication that the accounts

written off were charged to

bad debts ex ense.

Depreciation

m

Lash U‘dSlS 'dCCOUHUllg

0

_

allowance for bad debts

7. T-accounts of

payable / advances to suppli

accounts payable / notes

8. T—accounts of

er“

merchandise inventory

9. T-accounts of

property, plant and equipment

10. T-accounts of

accumulated depreciation

11. T-accounts of

receivable / unearned rent income

12. T-accounts of rent

rent/rent payable

13. T-accounts of prepaid

14. T-accounts of capital

Cash Basis Accounting

Includes the following;

0

“‘

accounting

basis

1. Cash

.

’

basis accounting

accrual baSlS accounting

2. Accrual

and

basis

Comparison of cash

3.

approach

T-accounts

4.

T-account apPrOaCh

Guidelines in using

5.

receivable / notes receivables / advances fro

6‘

T-accounts of accounts

and Accrual Basis

4:;

f

£

I,

g

E

l

i

g

'i

3

i-

I

5

?

g3

9W / \

W

f,

________________’I___

_______ it ng

A

customers

Accounts receivable {Notes receivable trade /Advances from

XX XX Balance end AR

Beg. balance - AR

XX XX Balance end - NR

Beg. balance — NR

ac coun

Recoveries

r

XX

XX

XX

XX

XX

XX

.

XX.

Beg- balance - Advances

Sales rmums and allowance*

Sales discounts

Collections including recoveries

erteioff

X

.

,

,

/-————--——\

balance - AR

XX

I

xx

XX

iicoveries

}

I

l

|

l

Balance end - AR

Sales returnsand

/WEN

Beg

account

leg on

XX

I

1

allowance,“

sales discounts

Collections includin

‘

grecoveries/

Write-off

i

5,

l

i

i

Allowance for doubtful accounts

E

t

\.

Accounts

-

written Off

Balance end

.

.

XX

XX

XX

XX

Beginning balance

Doubtful accounts expense

XX,

RCCOVerieS

..

.

,.

._

_

,

,

.

The format

of the T-accounts was derived from the following journal

1.

To

g;

record sales on account

Accounts receivable

cr

Sales

2.

To

record receipt of note from sales on account

Notes receivable

Sales

3.

xx

/

record sales return from a cus:omer

/

returns and allowance

Accounts receivable

t

To

To

' un

the (11560

record collection wrthm

Cash

~

r

/

I;

XX

4

XX

Sales

4.

;,

XX

XX

L

mad

P

E

:‘V

52’

XX

1:1?

‘33::

XX

/

i?

XX

Q

g‘

77

‘

/

/

T.ACCOUNT: ALLOWANCE FOR DOUBTFUL ACCOUNTS

l

Accounts receivable

[/Qf

t

Accounts receivable

Sales discount

76

.

CCOUNT: ACCOUNTS RECEIVABLE

T—A

—

k

alloy/yam:ct

entries:

T-ACCOUNT: ACCOUNTS RECEIVABLE, NOTES RECEIVABLE AND

ADVANCES FROM SUPPLIER

Balance end - Advances

Sales on account

and

S

.

If the

‘I

‘ roccivwble

’ c an d adVan from

are no notes

ces

When tthoefrtehe Account receivable is:

Customers, the T.

.

collections from customers.

5

I

005k

(

rfcciva

For example, let's use T-account ofaccounts receivable, notes receivable a

"d

advances from supplier below.

The same procedures are to be applied when computing for the collections

from customers. Get the sum of the debits [this includes the beginning

balances of the accounts and notes receivable, balance end of the advances

from customers and recoveries and sales on account) and deduct the sum of

the credits (this is the total of the balance end of the accounts and notes

receivable, beginning balance of the advances from customer sales returns

and allowance, sales discounts and accounts written off]. The difference is

the squeezed figure in the credit side which is the total amount of

cash and Accrual Basis

sales returns and mgaltal‘e deducted from

the

aCcougt-w custB—mcr, it should not be

included inatfies arise from cash

lawn files.

‘3 t-account of the

To facilitate computation, the beginning balance iS Placed m the n9rmal

balance of an account and the ending balance will be at the Other S'de of

its normal balana? (e.g- the normal balance 0fthe aCCOU”ts .recewable is

debit so the beginning balance will be placed at the debit Side while the

ending balance will be placed at the credit side.)

‘ 3. Compute the total debit and the total credit.

4. The difference between the total debit and the total credit is th

6

squeezed figure.

When computing for sales on account, plot the given data on the T-account

get the sum of the credits (this is the total of the balance end of the accounts.

and notes receivable, beginning balance of the advances from customer

sales returns and allowance, sales discounts and collection and accounts

written off) then deduct the sum of the debits (this includes the beginnin

balances of the accounts and notes receivable, balance end of the advance:

from customers and recoveries). The difference is the squeezed figure in the

debit side which is the sales on account.

r

-

’

only those

*mcludidreceivable.

2.

\.

5

/

5

,

l

l

l

Chapter 5

i

6'

To record

XX

Accounts receivable

accounts

Allowancrz for doubtful

?

E

accounts

record collection of

3

‘

xx

customers

advances receivedfrom

To record

8.

l

«’/

Cosh

Advances from customers

1

xx

~

advances

goods to customers with

To record delivery of

xx

7

Advances from customers

9.

g

Sales

F

To

H).

of

during the year

record the provision for bad debts

Bad debts

xx

'

500,000-

547,000

4,000

865,000

865,000

th

Balance end AR

Balance end » NR

Beg.

balance Sales ret. and Advances

allowance

Sales

discounts

Collections

including

—

recoveries

Write-off

W

ii

E.

I

.

1.

.

Year:

xx

for do”btful accounts-Ia!nuary 1

'

doubthI acco untS-December

31

5

for

Ilowance

30.000

the

nts

000

written;

off

accou

durmg

f

current

collectible

year

'

ts

Un

A

L000

.

p reViOUSIY Wnttend 0f

Recoveries ofaCCOun

nt

te

bts

for

the total bad e

- d; Comp”

expense during the curre

Requ're

AIIOWan cc

xx

year:

Advances from customers - December 31

Sales returns and allowance

Sales discounts

Uncollectible accounts written off during the current year

Recoveries of accounts previously written off

Sales - accrual basis

.

“[ustrationl

.11 Complxzrt'grzported by

Helium Company during

data

the current

The f0 How1 g

Illustration: Computation of Collections

Hydrogen Company during the current

The following data were reported by

1

,

Total

‘

example sales on account, the

Observe that in the journal entries, for

T-account of the accounts

accounts receivable is debited, so in the

receivable, that same amount is also debited

Accounts receivable - January 1

Accounts receivable ~ December 31

Notes receivable - January 1

Notes receivable - December 31

Advances from customers — January

N. "

trade/Adm"

150,000

120,000

40,000

3,000

1,000

xx

Note:

~/

- dvances

Sales

Recoveries

XX

Allowance for bad debts

100,000

210,000

55,000

- GER

R

end - A

Balanon account

previously written off

Accounts receivable

E

balance

XX

.

‘

ivabug/Notes receivable

‘

Beg,

balance

Beg. C6

XX

To

Cash

7.

i

:

n:

ucl b l5

1

xx

rc—cstublishment of accounts previously written

r5ebabua'w’m”'uu.

.

written

0/7

accounts

To record

accounts

doubtful

Allowance for

Accounts receivable

5_

5

E

:Eesle'lgjcggatw

te

100,000

150,000

210.000

120,000

40.000

55.000

3000

1,000

4,000

500,000

Required: Determine the gross sales under the cash basis of accounting

year-7

Solution:

\ Allowance for bad debts

Ending balance

Write-off

30,000

5,000

20,000

14,000

1,000

5

1":

Beginning balance

Bad debts expense

Recoveries

i

i

x

4

PAYABLE, NOTES PAYABLE AND

ADVANCES T0 SUPPLIER

T-ACCOUNT: ACCOUNTS

Accounts Pazable {Notes Paxable TradelAdvances to SuBElier

Payments

PUrChase

returns and allow.

PurChase

Beg.

discount

balance - Advances

Balance end

Balance 0nd

_

XX

XX

XX

XX

XX

XX

XX

XX

XX

_

Beg. balance - AP

Beg- balance ' NP

79

[3

f

‘

Balance and Advances

Purchases

i‘:

I“

‘/’,/

_

78

{V

't.

I

V,

,,

I

92:;th

and advances t

notes payable

are no

there

When

0

payable is:

Account

of the

PAYABLE TRADE

T-ACCOUNT:

Suppliers the T-acc0u

ACCOUNTS

‘

xx

xx

and allow.

Purchase returns

Purchase discounts

Balance

J

AD

GDd'AP

‘

,,

_‘

‘

The

1.

’_"‘ IL

-

=

N

To

XX

Purchases

XX

XX

Notes payable

To record return

3.

of merchandise to supplier

XX

Purchase returns and allowances

4.

To

record payment within the discount period.

XX

Accounts payable

Purchase discount

XX

XX

Cash

To record advances to suppliers

hH

Advances to suppliers

XX

xx

Cash

6.

To record receipt ofgoods from

Purchases

Advances to suppliers

suppliers arising from advances

XX

AM»

XX

T-ACCOUNT: MERCHANDISE INVENTORY

7,

_

Merchandise lnvento

Beg. Balance

Net Purchases

Total

XX

XX

AA

XX

'1

:

XX

AA

80

Balance end

Cost 0r

LOSI

Of bales

Sales

Less:

Cost of sales

computed as follow5;===

Net purchases is

TX

xx

Gross purchases

XX

Freight-in

Add;

discount

XX

Purchase

Less:

allowance

Purchase

xx

Purchase returns

Net Purchases

presented is applicable to finished goods inventory of

The T-account

merchandising company. Kindly refer to Chapter 12 inventories for

discussion of T—accounts of the Work-in-Process and Raw Materials:

/

Tor

Illustration: Computation of Purchases

following data were reported by Lithium

The

year:

XX

Accounts payable

6

‘

XX

account

record issuance of note for purchase on

_

*XT

H

c_ll_...:..n :nnrnnl nnfrincfrom the following journal entries:

T-accounts were derived

To

I

entries,

it follows m

,

.

account

record purchase on

I

‘

7%

Accounts payable

5.

/

,

Purchases

2.

m

XX

.

Total

,,

'“

3

following form” the computation ofthe Co StofSales;

xx

Merchandise inventory, beginning

purchases

XX

Add; Net

for

available

sale

TOT

Total goods

Merchandise inventory, end

XX

\

Accounts Pa able Trade

balance AP

Burchases [gross]

xx xx peg.

xx

Payments

s:

got?“ using this T—account, aside frOm the joum

w

“WWW

rflfl/

___.—I

Company during the current

100,000

150,000

210,000

120,000

40,000

55,000

3.000

1,000

500,000

Accounts payable - lanuary 1

Accounts payable — December 31

Notes payable - January 1

Notes payable - December 31

Advances to suppliers Ianuary 1

Advances to suppliers - December 31

Purchase returns and allowance

Purchase discounts

Payment

—

under the

Required: Determine the gross purchases

/

accounting.

Accounts Pa able

Payments

Purchase ret. and allow.

Purchase discount

Beg. balance - Advances

Balance end - AP

Balance end - NP

/

/

/

’

accrual basis of

YMW,

Advances to Su hers

Notes Pa able

balance ' AP

100,000 Beg500,000

balance— N:

es)

210,000 Beg.

3,000

end - Aos‘snc

Balance

55,000

1,000

Purchases (gr

40,000 {9,000

150,000

120,000

81

\

_

W

y

.

1"]

;

11125531221;

year:

nts

ring the CUrrEn

Cost of Sales

Com utation of

t

Beryllium Company d”

reported

by

datapwere

ayable-Ianuary

100 I 000

1

December 31

2:231:15 Sayable January

Merchandise inventory

1

120'000

3’000

1,000

500,000

20,000

Dec- 31

Merchandise inventoI'Y‘

allowance

Purchase returns and

Purchase discounts

'

Paymem

:

.ACCOUNT A

D DEP

I/w———«-v~-~*---—-—--——~—~~~.~._.JEE951§on

Accum.

Solution:

Notes Pa able NP

Accounts Pa able AP

100,000 Beg. balance - AP

500,000

Payments

NP

3,000

- Beg. balance Purchase ret and allow.

(gross)

Purchases

554,000

1,000

Purchase discount

150,000

Balance end - AP

Balance 6nd,,

W

210,000

570,000

120,000

660,000

Computation of the net purchases:

purchases on account

Ending balance

Cost ofsales

554,000

on nnn

Ithuuu

3,000

11011

570,000

D

Total

Less: Purchase returns and allowances

Purchase discount

Net purchases

T-ACCOUNT: PROPERTY, PLANT AND EQUIPMENT

!

Prnnertz, Plant, and Equipment

Hag:nr»irr.;{k,gnanccv-~-~.

_

a

-r

(105101

UM f)? ix’YJEt qunirml

X]

[NEH

I

2mmdefémfi’fiyéa,

‘

BuI/gmU: (-1.”

:IV

82

'I.

Be

/

,, ,

.,

.,,,XX

1“

"M

m“

gmmng balance

xx

.

‘1

f,,

1

L

xx

Do

.

.

r

1'.

PPE

Cash

2

I

3

.

T-accounts were derived from the fou - Journal

entries:

owmg

acquisition

of

cash

PPE

record

To

To

XX

|

w

XX

'

.

record derecognition (cg. sale, do nation,

retirementggofppg

cash

Accumulated depreciation

Loss on sale

or Gain on sale

x);

xx

XX

XX

illustration: Computation of Cost of Machine Acquired and Sold

information in relation to its property,

Boron Co. provided you the following

account:

equipment

plant, and

01/01[16

Merchandise lnvento

Beginning balance

Net urchases

XX

PPE

/_____—__———

V,

*

L

;

\

-

Balance end - NP

degreciation of asset

derecogmzed

Cash purchases

accounting?

ww-

1‘

The

1,

under the accrual basis of

total cost of sales

Required. How much is the

CCUMULARH”

Machinery

Accumulated depreciation

P135000

50,000

12[31[1_6__

P150000

45,000

Additional information:

a) Depreciation is 10% per annum. As a company policy, newly acquired

of purchase and no

assets are depreciated for a whole year at the year

year of'disposal.

depreciation is provided for assets disposed at the

value

b) At the start of the year, a fully depreCiated machine without scrap

acquired.

machine was

was sold for P5,000, at the same date, a new

following:

Required: Based on above data, answer the

acquired?

How much is the cost of the machine

50W

2) How much is the historical cost of the machine

1)

SOLUTION:

Machiner

Beginning balance

c0“ of asset act uired

Total

135,000

20,000

35,000

150.000

170,000

170,000

83

C(istofznsset

den-609.“Zed

Balance end

Accumulated

depreciation of asset

derecognized

Balance end

50.000

15,000

20,000

45,000

Beginning balance

Depreciation expms

3

(150,000 x 10%)

65,000

65,000

{Unearned rent income

Rent receivable

Balance end — Rent rece-

Beg. balance

—

balance end —

I XX

Unearned rent

XX

XX

Beg. balance

Unearnediaeble

560,000

60,000

500,000

Total

710.000

710,000

following journal entries:

Prepaid RentzRent Bazable

Ce — Prepaid

bCadZIlld — Accrued

N 0 te:

XX

XX

XX

XX

XX

XX

XX

2.

3.

XX

Prepaid rent/ Rent payable

.

.

‘

xx

~.

To record adjusting entry for the expired portion of rent

XX

XX

XX

of rent expense

XX

XX

Illustration: Computation of Rent Expense

The following data were reported by Nitrogen

Illustration: Computation of Rent Income

The following data were reported by Carbon Company during the current

year:

100,000

150,000

60,000

50,000

500,000

Required: How much is the total rent income

under the accrual basis

To record accrual

XX

Rent expense

Rent payable

To record accrual of rent receivable

Rent receivable-lanuary 1

Rent receivable-December 31

Unearned rent income - January 1

Uneamed rent income - December 31

Collection of rent

..

a

payable.

This T-account is also applicable to prepaid salaries/salaries

‘

Rent expense

Prepaid rent

XX

Rent receivable

Rent income

a.

Cash

of the rent income

Unearned rent income

Rent income

:

Balance end — Prepaid aaset

Beg. balance — Accrued llab.

Expense ,

h T—accounts were derived from the following journal entries:

To record payment of rent in advance

XX

Ie

XX

Unearned rent income / Rent receivable

accounting?

asset

liab.

12L—————————___________

I

Cash

_

Beg. balance - URI

Collections

T_ACCOUNT: PREPAID RENT / RENT PAYABLE

l

The T-accounts were derived from the

To record collection of rent

1.

3.

Unearned Rent income

URI

150,000 Balance end RR

100,000

50,000

Ea'filems

receivable/unearned interest

applicable to interest

This T-account is also

receivable/unearned royalty income and other deferred

income, royalty

assets.

To record adjusting entry

- RR

,

Rent income

Beg.

—

______—

2.

Cash and Accrual Basis

Beginning balance

Balance end - URI

RENT INCOME

RECEIVABLE / UNEARNED

RENT

T-ACCOUNT:

XX

—

Rent Receivable RR

\\

Total

Rent receivable

WIII-fix.“

Chapter 5

reciation

Accumulated De

year:

Prepaid Rent - January 1

Prepaid Rent - December 31

Rent payable - January 1

Rent payable - December 31

Payment of rent

Requh‘ed:

of

Company during the current

100,000

150,000

60,000

50,000

500,000

accrual

expense under the

How much is the total rent

i

1

i

b23515

of

E

e

‘f

i.

s

accounting?

i

5

w

RentPa able RP

Rent PR

Pre aid 100,000

Beginningbalanca~PR

50,000

500,000

Balunceend—RP

mentol‘rent

650,000

Solution:

[)a

Total

T-ACCOUNT:

if

Balance end_PR

150,000

60.000

T-ACCOUNT: RETAINED EARNINGS

,

Beg. balance_RP

650,000

V

W,

XX]

XX

.VA

inventories or other

withdrew merchandise

2,

n

owner

debited to an amoum equaloh

Note: When the

account should be

drawings

the

cash assets,

the merchandise or “OM l0

of

value

selling price or fair

the cost, not the

ash

asset withdrawn.

l

‘aiita

2.

XX

I

To record withdrawal by the

3.

Cash

xx

3.

or any other appropriate account

To close the drawing account to

4.

XX

net income to capital account

Income summary

To close the

Capital

5.

To close the net loss to

E

9.

e;

g.

‘r

E

i

1

3

¢

i

i

XX

XX

To close net loss to retained earnings

/

/

XX

XX

Capital -]anuary1

Capital - December 31

Cost of merchandise withdrawn by Oxygen

Sales value of merchandise withdrawn by Oxygen

Principal amount of Notes payable paid by Oxygen with her

personal checking account

No. of months on the notes payable also paid by Oxygen

Interest rate of notes payable paid by Oxygen

xx

XX

Drawings

XX

/

E

Illustration: Computation of Net Income or Loss

.

The following data were reported by Oxygen Company during the current

year:

XX

capital

Capital

”

/

:

To close net income to retained earnings

Retained earnings

Income summary

owner

Drawings

‘

Prior perfiiyoddezl'x:

Net income

:

To record

Cash

‘ ML

BLrigmnm

'

' I b!

Income summary

Retained earnings

journal entries;

derived from the following

'l‘he 'F-ziccounts were

investment made by the owner

1.

,,

,

XX

XX

XX

I

The T-accounts were derived from the following journal entries:

To record declaration ofdiw'dends

1.

Retained earnings

XX

Dividends payable (cash, stocks, property, etc.)

XX

.

M I] A“

Balance and

Prior period error

Dividends declared

Netlosfi

,,

XX

,

XX

XX

Total

Begmnjng balance

lel

~m‘uw

mm—

end

Balance

i

’

CAPITW

W'

Wunurdwg.

lUldl '2 '

l

’

Retained earnings

Rent ex enSe

440,000

I

C

XX

XX

Required: How much

100,000

400,000

60,000

80,000

200,000

6

12%

is the Net income (or loss) during the year?

capital account

Capital

Income summary

Balance end

Withdrawal at cost

Net loss

Total

,

L'a ital

400,000 I 100,000

212,000

60,000

148,000

460,000

460,000

Beginning balance

Additional investment

Net income

i

I

l

i

9

5

,r

'r

[

?

“Sm,

F

86

87

l

w’

Chapter 5

—

Accrual Basns

Cash and

T-ACCOUNT: NET

,

V

r

i

ASSETS

Statement of

_

increase 1.”

la l

Decreasemaft-aims

Dividends declared

/

,

:

Net Assets

Financial Position

xx xx DecreaSe in asset '

IncreaSe in liabilities r

XX

xx

xx XX / Increase in share ca pital

xx XX Increase 1n share premi

Illustration: Computation of Net Income or Loss

\

Changes in the accounts of Neon Co. for 2016 are as follows:

~

Cash

_

w

¥

XX,“

Net "’55

Accounts receivable

Allowance for bad debts

Merchandise inventory

Investment in associate

Property, plant and equipment

Accumulated depreciation

Notes payable

Bonds payable

Discount on bonds payable /

Ordinary share capital

Share premium

r_

W

Net. income,

<

Note:

'

,

.

_

J This T-account follows the ba51c rule In making )ournal enny th

its normal balance while it is decreasatfi

account is increased through

normal balance, for example increase in as eds,

the other side of the

deeresett

4

balance of an asset while

debited which is the normal

normal balance.

of

credited which is at other side the

Illustration: Computation of Net Income or Loss

Company for the current year

Changes in the accounts of Fluorine

follows:

Total Assets

Total liabilities

Share capital

Share Premium

Retained earnings

Jan. 1

,

2,000,000

800,000

1,500,000

450,000

7

Dec. 31

3,000,000

1,100,000

asel

a

g

093

6

/

'

.

OJ

fie

%

capiti'

currrent ysar,dthe company issued 80,000, P10 par

per 5 are- ivi ends paid on December 31

the Current yea]

0f

amounted to P750000.

fDourilnlgsthe

.

.

. . .

Decrease in

liabilities

. .

DiVidends

declared

Net loss

Total

.

-

300,000

75 0,000

/ 800,000

_

-

'

.

.5"

400.000

250,000

1,750,000

1,750,000

800,000 12/

2,600,000 /

(2,800,000)

[600,000] /

3,900,000

200,000

2,600,000

320,000

‘

Solution:

\

Net Assets SFP

-

Increase in asset (Cash

Net Assets SFP

- Decrease in asse

2_400,000

/

Solution:

1,000,000

m"

3000300

Required: Compute for the net loss during the year.

Required: How much is the net income (or loss) during the year?

Increase in asset (3 M2M)

"

Additional information:

o

On December 31, 2016, Neon Co. declared Cash dividends amounting to

P500000 and share dividends amounting to P800000. Also during the

year, the company appropriatedytained earnings for the retirement of

'

bonds amounting to P100,000.

paid off

and

P2,000,000

of

loan

bank

0

obtained

a

Neon

year,

During the

lnterest

of

0F?100,000.

interest

and

P1,600,000

of

amortization

loan

interest

no

was

There

2016.

31,

December

on

accrued

is

P180000

payable at the end of 2015. In 2016, Neon Company acquired treasury

gm, 5*

shares from its existing shareholders.

reas

duo

7

é

1102

/

Revaluation surplus

Treasury shares

(g0

/

/

Lucrease

1.0951359)

500,000

(4.600300)

(460,000)

.

4,800,000

5,760,000

to PPE)

t

Decrease in liabilities

Dividends declared -

Increase in liabilities

(1.1M_800’000)

' Share Cal"Ital

Increase m

(80,000 x 10)

Increase in share

premium (80,000 x 5)

Net income

caSh

Treasury shares

N“ 1055

.

—

‘

(

500,000

320,000

1,100,000

400,000

3,900,000

200,000

2,600,000

400,000

180,000

__T0tal

,

7,680,000

7,680,000

89

88

I

H

Decrease in asset

Increase in NP, Net

value ofBP (2.6M2.8M+600,000)

increase in share capital

increase in share premium

Increase in reval'n surplus

lncrease in loans payable

[2M — 1.6M)

lncrease in int. 3 able

'

/

We» My

fl’h"

‘VH

N—h‘w'fiwfl' -"""‘"""”“"“"“~‘-‘“MAJ-v4.2. 4_.A_4 __,_‘{W_._W‘V“ MM _

VL

‘ '12“

________.__,_2_____'.

5= REV‘.

,

Chapter

'

Computation of Sales

Company during the Current y

were reported by Franz

e

The following data

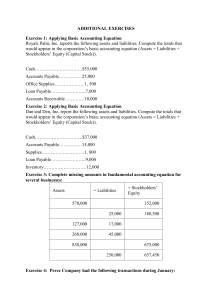

PROBLEM 5-1

January 1

Accounts receivable December 31

receivable

Accounts

January 1

Notes receivable December 31

reCeivable

Notes

January 1

Advances from customers

December 31

customers

—

Advances from

allowance

Sales returns and

'

180,000

240,000

V

1

170,000

55,000

40.000

—

-

'

.

.000

Sales discounts

,

3:000

600 00.

Determine the gross sales under the cash basis ofaccounting

P666,000\

b.

P668,000

I

.

PROBLEM 5-5 Computation of Income Other Than Sales

The following data were reported by Chaste Company during the current year:

0

c. 19696300

PROBLEM 5-2 Computation of Bad Debts

The following data were reported by Azul Company during the current year,

Allowance for doubtful accounts—January 1

Allowance for doubtful accounts-December 31

Uncollectible accounts written off during the current year

Recoveries of accounts previously written off

p 25

000

How much is the total rent income under the agrual basis ofaccounting?

C. P800,000

P650,000

a.

d. P970,000

b. P770,000

40’000

8,000

2:000

How much is the total bad debts expense during the current year?

c. P21,000 \_

P9,000

a.

d. P23,000

b. P15,000

PROBLEM 5-6 Computation of Expenses in General

The following data were reported by Chessy Company during the current year:

PROBLEM 5-3 Computation of Purchases

200,000

250,000

400,000

2100.000

50,000

68,000

6,000

3,000

800,000

P

\

Determine the gross purchases under the accrual basis ofaccounting

21.

P651000

c. P687,000

b. 13654000

d_ p678,000

200,000

250,000

80,000

65,000

850,000

Prepaid Rent - January 1

Prepaid Rent - December 31

Rent payable - January 1

Rent payable - December 31

Payment of rent

The following data were reported by Sipag Company during the current year:

—

200,000

250,000

90,000

30,000

660,000

Rent receivable-January 1

Rent receivable-December 31

Unearned rent income - January 1

Unearned rent income - December 31

'

Collection ofrent

d. P699,000

Aceounts payable - January 1

Accounts payable December 31

Notes payable - January 1

Notes payable - December 31

Advances to suppliers ~1anuary 1

Advances to suppliers - December 31

Purchase returns and allowance

Purchase discounts

Payment

fi" 4

How much is the total cost of sales under the accrual basis of accounting?

C. P1,040,000

P859,000

3.

d. P1,049,000

.

b., 191,050,000 \_

2'000

Sales - accrual basis

a.

FROBLEM 5-4 Computation of Cost of Sales

The following data were reported by Haste Company during the current year:

200,000

Accounts payable January 1

250,000

Accounts payable - December 31

Merchandise inventory - January 1

400,000

Merchandise inventory — Dec. 31

210,000

6,000

Purchase returns and allowance

3000

Purchase discounts

Payment

' 800,000

10,000

Cash purchases

,

4,000

the current year

Uncollectible accounts written off during

off

written

Recoveries of accounts previously

5 — Cash and Accrual Basis

—

an

P 200

'

.

I

‘

'A

CHAPTER

[VIM

(19:57.13:

r

How much is the total rent expense under the accrual basis ofaccounting?

a. P785,000

c. P850.000

b. P820,000

d. P915,000

'\

I

PROBLEM 5-7 Computation of Cost ofMachine Acquired and Sold

Phosphorus Co. provided you the following information in relation to its

Property, plant, and equipment account:

End

Beginning

.

-'.

_

Equ1pment

Accumulated depreciation

100,000

15,000

120,000

18,000

-

91

90

,';5

Chapter 5

a)

b)

—

Cash and Accrual Basis

W

f

.

Depreciation is 15% per annumAt the Start Of the year: Phosphorus C0"achIred a.“ eqmpment

same time disposed of an equxpment With a carrying amount a“dah

of P250“:

accumulated depreciation of P15,000 for P35,000.

5

~

"7

Questions:

1.

'

How much is the cost of the machine disposed?

c. P120,000

a. P60,000

b_

d. P40,000

[3160,000

b-

\

2.

\\

i

12/31/16

12/31/15

6,000

3,700

61,500

550,000

40,000

14500

53,000

415,000

2 5,000

items:

Additional dam:

Accounts receivable written off

Cash received from customers

Cash paid to creditors

Sales discounts

Sales returns and allowances

:urcgase discounts

~

P 41,500

123,500

481,000

1,980,000

Sales

Questions;

Based on the above data, answer the following:

1.

How much IS the insurance expense on the income statement for 2016?

a.

b.

P40,000

_

2.

,

'

3.

C2; iiifggrfrrim tenants

d. P55,000

p

‘

Questions:

questions:

Based on the above data, answer the following

1. What is the amount of gross sales?

c. 4,210,000

4,110,000

a.

4'160'000

d' 4’260'000\

How much 15 the interest reVEnue on the income statement for 2016?

P90,500.

C. P117500.

b. P112,700. m

d. P156500.

How much is the salary expense on the income statement for 2016?

a. P366,500_

C_ 13489500$

b. P472500.

d. 9595,500

No uncollectible accounts

2.

were written off during 2016. Had the cash bag.

of accounting been used instead, how much would have been reported;

receipts for 2016?

it:

‘

'

400,000

Interest

,

4.

10,000

4,200,000

2,800,000

30,000

20,000

C.

a.

Cl

P1383000

d. P2,115,000

b'

What is the amount of gross purchases?

c. 2,600,000

3,000,000

:1).

.

3,050,000

.

,650 ,00 0

\

d 2

What IS the amount of the cost of sales for the year?

.

3.

i:-

I:g.

.

balances have been excerpted from Chlorine's Statement of

The following

for the year 2016:

Position

Financial

P100000

Accounts receivable, decrease

25.000

Merchandise inventory, decrease

200,000

decrease

Accounts payable,

100,000

Notes receivable-trade, increase

14,000

Rental receivables, increase

40,000

decrease

income,

Unearned rental

5.500

decrease

interest,

Prepaid

8500

IntereSt payable, Increase

7,500

Sulfur Com p an y rep0 rte d th e fo ll owmg

'

d urmg

'

2 016 the followmg

‘

Insurance premiums paid

Interest collected

Salaries paid

\

PROBLEM 5-9

The following balances have been excerpted from Sulfur’s statement Off

maml

Posmon:

Prepaid Insurance

Interest Receivable

Salaries Payable

Accounts receivable

Allowance for bad debts

recovered

Assuming that the company wrote-off P25,000 and subsequently

much

how

instead,

used

accounting

been

of

basis

p20,000. Had the cash

2016?

receipts

for

as

reported

been

would have

“£25,000

c_ p1I390'000

a_

d. P1,905,000

P1,840,000

b.

PROBLEM 5-8

J

\

6.

How much is the cost of the machine acquired?

P60,000

a.

6- P120.000

d. P40,000

b. P160,000

5..

Assuming that the company wrote-off P25,000. Had the cash basis of

accounting been used instead, how much would have been reported as

receipts for 20167

a. Ellingooo

P1,820,000

a, P1343000

'

’ 8 ’000

c. 2.673000

§:2251000\

75,000

(1.

.

93

2,725,000

(.

I

Chapter

1

5 —

BaSIS

Cash and Accrual

rePOrt for the

year,

Mental revenue should the company

What amount

a, 454,000

b. 426,000

\‘

‘

'

222%?)

5'

'

report for the year?

company

expense should the

How much interest

103,000

1

5

'

i)‘

.

86 000

c.

97'000

,

(1.

January 1

200'000

,

Accounts receivable

NotIes receiva M e

C,

:ielVCd {ralllncfgorilclgs

urns an a v

c

.

300 I 000

_

Si:

15031352”?

Account1 5811:)?“er

5,1303

200 0

' 00

50,000

100,000

6

NoteSpa} able

p

p:::h::: 3:353:55“

allowances

Payments to suppliers

Accrued rem receivable

unearned rent income

Collection ofrent

prepaid salaries

Accrued salaries payable

payment “salaries

70 000

80'000

'

100 000

75.000

'

‘

.

QUCSUOHS: Determine the following:

1. The Gross Sales for the year 2016.

1,000,000

:

.

2_

b.

6501000

600,000

:1.

The Gross income fort

a.

b,

4.

1,030,000

The net purchases for the year 2016'

3'

3.

c, 970,000

d. 1,240,000

300 000

350’000

he

550

500,00?)

Year 2016-

"

C-

d~

270,000

320000

, 00

b.

300 ' 000

d-

c. 460,000

d. 500,000

.

“l

I

I

mm”

StatememS

D

°C- 31

250

,000

100000

1,120,000

20 , 00 0

10000

100:000

25,000

75,000

40,000

6&0'000

40'000

0’000

40'000

4801000

125,000

50'000

350'000

é

P

:

I

I

l

.

|

Additional information:

o

Collections from customers included customer’s deposit of P80,000 ol

which P20,000 selling price ofgoods were already shipped and received by

the customer. The shipment of goods was not recorded by the company

although the cost of merchandise was properly excluded in the count.

. Collections from customers also included P30,000 payment from customer

of accounts receivable in which a check dated January 15, 2017 was

received.

- Collections also included recovery of accounts previously written off

amounting to 138.000included in the payment to trade creditors was a check drawn and recorded

0

by the company to the supplier in December 2016 amounting to P20,000

which was delivered to the payee on Ianuary 10, 2017.

the company did not record payment to supplier amounting to

- Also

P30'000'

|

i

I

I

i

"l

i:

|

ii

‘I

II

ll

QuesuonS:

Determine the accrual balance ofthe following as ofDecember 31, 2016:

1.

.

c. 350,%%%

450'

“AM

have Egon excerpted from Potassium’s Statement of

The {01lowmg balzfancels

16:

.

' 1Position ortieyear

January 1

DCC' 31

.

200,000

300,000

Accounts receivable

20,000

30,000

Allowance for bad debts

380,000

330,000

Merchandise inventory

100,000

150,000

.

Accounts payable

50,000

Accounts receivable written off

1,498,000

customers

from

received

Cash

creditors

1 200 000

.

,

Cash pal-dt O trade

20,000

discounts

Sales

10,000

Purchase returns

80.000

70.000

receivables

Rental

35,000

60,000

Rental payable

120,000

tenants

Cash received from

Theiglggies expense for the year 2016.

3'

-

“(0131301541

7

-

income for the year 2010.

The rent

a, 470.000

490,000

1),

114,000.\

PROBLEM 5-10

- u r

have been excerpted from Argon's financial

gift?“o:vttgbol;2lanccs

In ytdl

W

""

ll

2.

Net Sales

a.

1,400,000

1'550'000

b'

55

i!

fl

|

1,470,000

d' 1'570'000

c.

Net Purchases

1,130,000

b. 1,160,000

all

1:

:Fl

55!

c. 1,140,000

d. 1,170,000

a.

_a!

15

'r.

I'

g

I

‘I

u'.

,

I.

o'.

94

95

.

Chapter 5

3,

b.

5.

ofsales

1,180,000

1,210,000

C.

b.

Bad

debts expense

'

5)

of

1,

d.

'

d.

00

233‘”

12,000

c-

2_

Comprehensive

PROBLEM 5-12

basis. The balance sheet 0 December

statements on the cash

Calcium prepares

n

the year 2016 are as follows;

income statement for

31, 2016 and

Statement of Financial Position:

1,500,000

'7 r'nn nnn

“35"

3.

Balance, January

Add: Net income

Total

5.

Income Statement:

5'000'000

7.

1,200,000

800,000

750,000

You decided that the

statements should be

you assemble the

prepared on the accrual basis and

information below:

The furniture and

equipment were acquired on July 1, 2015. The estimated

life is 10 years.

The 12% Promissory

note is

2)

Year”

were“ is PaYable on the datedated April 1, 2016 and matures in one

of maturity.

3) Accounts receivable:

1)

,

2

l

4)

:

.

32::2lger311016

"3112015

AC “mad

rent on

750,000

500,000

[/Tf‘ \\

2,400,000

d. 2,200,000

c.

Noncurrent asset

2,125,000

3.

b. 2,225,000

C.

(1.

Total Asset

2,600,000

2,200,000

2,400,000

4,800,000

d. 4,600,000

4,625,000

4,525,000

c.

Current liabilities

1,000,000

a.

b. 1,090,000

'

c.

(1.

Total Owner's equity

1,190,000

1,200,000

;

F

3,610,000

d. 3,400,000

3,625,000

3,435,000

c.

5

PROBLEM 5-13 Comprehensive

financial statements of JULIE ANN

You are engaged in the audit of the

The following information

Corporation for the year ended December 31, 2016.

was prepared by the bookkeeper.

receipts:

Collection on accounts receivable

Less: Cash discounts taken

Cash sales of merchandise

Sale of warehouse equipment

Insurance proceeds from boiler explosion

Sale ofland on November 3

Cash

Cash

December 31, 2016,

13100000.

96

c.

Current Asset

2,500,000

b. 2,300,000

b.

2,750,000

2,250,000

a

I

d. 2,210,000

a.

Expenses:

'

2,010,000

b.

Total

Rent

Supplies

Other operating expenses

Netincome

I

] b alance

Net income

a.

6.

Professional fees

'

3_

1,600,000

2,250,000

3,850,000

1

-

V~\\-\

250,000

300.000

The Professional fees

5,000,000

a.

5,250,000

b.

b.

1,000,000

Capital:

Cash and Accrual Basis

9 supplles unuse

OffiCDecember 31, 2016

December 31. 2015

aI

4.

Note payable

—

Questions:

above and the result of

.

audlt,

determine the accru

Based on the

as of December 31' 203;?”

following

the

145,000

c. 135,000

130,000

155,000

2'

1,490,000

1,220,000

d.

Rentlncome

a.

Chap ter 5

Accrual Basis

Cost

3.

4.

r

Cash and

a"

at

P1,513,000

13,000

I

2

_

P15001000

160'000

12'000

42'000

20‘000

l:

i'

disbursements:

:

Payments to trade creditors

General and administrative expenses

I

'

97

f.

.

[II/"w"

.0:

A”

929329.19?” 3"" “We”

%

Cash

Bas's

x—x

’

mers

merchandise

warranty contracts

on May 1

Purchase of land

November 10

purchase on

pter

Accounts receivable

P

inventory

admin. Expenses

Prepaid gen. and

Expenses

gen. and admin.

expenses

Total Operating

p 146

b.

7'

0

.000

8-

3.000

Gain

9-

5

10,

b.

2.

Cash

3.

4.

co

P12341100

h.

P1,178,000

P1,522,000

c. P1,682,000

d. P1,349,000

C~

."

5

‘1

a,

F3000 gain

136,000 1055'

C-

P14,000 gam

d-

/

/‘

ACE:“m8 payable

a

'

(1.

I

-

“2'000

1

gain

1347.400

740,000

100,000

x

z'

i

'5:

\

n

.

30.000

'J

l,

.7

518,000

200,000

and there

h

fi

200,000

220,000

180,000

99

_

5

400,000

are also available:

\

1

I

‘

c. P35,400

lecemble

:4???“

“‘59 i“ventory

..

?

13283001055

12/31/2016

P1,174,000

d. P1.358,000

c.

_/

i!

receipts:

The following data

98

A

or loss as a result ofjanuary 15, explosion.

(“the sales 0“ account, P10,000 was returned because of poor quality

return of P8,000.

’4

K

9

d' P12,000

gain

was a Purchase

c. P1,298,000

d. P1,354.000

P1.350,000

P1,230,000

p16,0001055

(1 Nil

[)5'0001055

P13,000 '055

Cost of Sales

3‘

b.

P295200

.

Total purchases

a.

'

Cash disbursements:

Purchase ofland and building on April 1, 2016

Full payment of furniture and fixtures

purchased on July 1, 2016.

On accounts payable and administrative expenses

Selling expenses

d. P1,362,000

P1,522,000

P1,509,000

6-

P211200

P204300

Collection on sale on account

Cash Sales

2016 and due

Proceeds of a note payable dated Oct b

0 er 1’

October 1, 2018, discounted at 18%

Net Sales

b.

3.

P1,S35,000

P1,695,000

P4,000 33‘“

P4300 loss

Netilrlcome

955,400

b, P61,800

Cit

Gross sales

a.

"1+-

pROBLEM 5-14 Comprehensive

in your second annu

engaged

.

daglvixammaunn

of the financial

You have been

The

Co.

following

Scandlum

PmVlded to you by the

statements of

ere

company accountant:

Questions:

adjusted balances of the following

Based on the above information, compute the

accounts as of December 31, 2016:

J

(1.

a_

2016.

1.

a.

b.

.5

I

a.

b.

V

f

'

sale of warehouse equipment

Gain or loss on

(8,400

-'

’ 2016 and Was used as a Storage facili

Land was purchased on Mav 1

this purpose and “’35 501d on Novembgr

for

unsuitable

be

to

was found

a.

b.

00

190'

P291200

sale of land

Gain or [055 on

.v

e

explosion.

5]

d.

24,000

Accrued

4 10,000

Accounts payable

z) Depreciation for 2016was meson.

acquired in 2009

3]

equipment sold during 2016 was

ata Cost

The warehouse

method of depreciation wa

double—declining

and

"Fed

The

of P25,000.

P16,000 at date of sale, If the S: raight—line

accumulated charges were

the accumulated depreciation at date f Sale Wou|d

method had been used,

0

have been P10i000.

4)

occurred on January 15, 2016 in which a b ‘1 er' not the

An explosion

01

dest

building. was completely

It was

depreciatiODFSVYed.

structural component of a

P48,000,

of

cost

chrde

gughased inhlalnuary 2008 at a

had accumulated at theasdate of th:

straig t— ine method and P20.000

I

C-

16.000

W

Ls

‘

P2040008

1220720

b.

information:

ledger:

Supplementary

were taken from the general

1)

account balances

12¢;ng

following

‘

December

The

124,000

186,000

9,600

7,000

382,000

3

5'

6,400

Co. stock

Drum shares of Tommy

Cash and Accrual Basis

5

and

120,000

purchases of

made on

,

chap/f“?

admlnlStrath

12/31/2015

150,000

190,000

230,000

1:

5:

I,

_

3

pter 5

40,000

30,000

expenses .

Accrued rent

allocated to the

and

buildin

Land

the

purchase price of

is

0f the total depreciation is 5% on the building andgl’o‘f;% the fumlture an d

Land. Annual

on

fixtures.

O

de

The Depreciation

gross profit

P200,000 are 40% of

amount.

expenses of

expense

administrative

Selling

preciafiOn

part of the

expenses are to be

administratiVe expenses. There are no UH pald Selimg

total

ofthe

31.

expense is 20%

of December

administrative expenses as

2.

d.

c. 528,000

d. 520,000

I

3.

Payment ofaccounts payable

462,000

3.

b. 470,000

478,000

d. 486,000

4.

5.

6.

c.

e:

f.

'

,

40000

.

ed

made on March 31,

108n em

The -bank

2016. A note

of

paym

umng

'

° - interest and principal on March 31,$331571?“

.

Fetirest rate IS 12/3

furniture were purchased

'llPhe equipments:

on January

2016. and

useful

life- of 10 years Wlth “0 anuclp‘Eited

‘3

estima

have an

salvage

per year Is p4,000.

value- DEPT.eciation

at the end 0 fthe y earrecost P100000or; hand

Inventories

at

as

s

I

December 31, 2016 We

follows:

P20

Amountners ofinventory

000

To

i

i

To :hlggtility compban-ilding

1,000D

re U1

PLOOO per month. On 8C ember 1’ 2016'

Rent on the S“) t was -d is

m

P31

advance.

ths ren

four.n:;(())rrlne for the year was P7

in

t

Ne

_

y

.

g

h.

Questions:

for the fouowmgl

data co

Based on the above

mpme

Total selling and administrative expenses

c. 260,000

718,000

3.

d. 248,000

b. 710,000

1.

Cost of furniture and fixtures

a.

60,000

2,

Cash

3.

b.

c. 120,000

d. 240,000

PROBLEM 5-15 Comprehensive

The I WANT TO HOLD YOUR HAND Company was started by Paul McCartney

early in 2016. Initial capital was acquired by issuing shares of ordinary Shares

to various investors and by obtaining a bank

loan. The company operates a

retail store that sells records, tapes, and compact

discs. Business was so good

during the first year of operations that Paul

is considering opening a second

store on the other side of town. The funds

necessary for expansion will come

bank loan. In order to approve the loan, the bank

requires financial

:zzgnziergi:

Paul aSkS for your he‘ll in preparing the

balance sheet and presents you

following information for the year ending

December 31, 2016:

a.

Cash receipts consisted ofthe

following:

100

000

15,000

30,000

and furniture

PurChaseo fequipment

as

c.

30,000

’

P300

Utilities

Insurance

d.

Payment ofadministrative expenses

c. 56,000

48,000

3.

d. 40,000

b. 60,000

b.

100,000

v

ent

Salaries

900,000

790,000

Net Purchases

420,000

b. 428,000

a.

P360000

of Inventory

Signage

1

1"

audit, determine the balance of the fOnowing

data and your

above

the

Based on

31,2016:

as ofDecember

c.

as

155“

1

Questions:

account

m

bank loan

Fro d_

is bursements were as follows:

and

Gross Sales on

a. 800,000

b. 890,000

cash and Accrual Basis

From

m

_

1.

’

/

//

'

3.

l

i

!

i

c. 532,000

306,000

393.000

Current Liabilities

70,000

b. 100,000

(1.

699,000

C.

121,000

d. 130,000

g

i

I

i

1

Shareholders' equity

3.

176,000

b. 323,000

l

with the

I

101

l

i

i

a.

5.

1

i

496,000

d. 663.000

c.

Total Assets

b.

z

i

Current Assets

103,000

a.

b. 270,000

a.

4.

393'000

3'. 560,000

Nil

167,000

I

c. 411,000

l

d. 599,000

s

,

.j_

I‘

i

Prepared in

201

Volks Company

Entry

the

Hon

Single

for

5-16

PROBLEM

P051

6

Fmancnal

The Statement of‘

lances:

Han

report the followmg ba

31-Dec

330,000

750,000

P

Assets

p

200,000

210,000

6‘35"

740,000

950 000

Notes Receivable

1,600,000

1 500'000

Accounts Receivable

120,000

Inventory

:

' 00

1000

400 000

Prepaid Expenses

1001000

000'000

Investment (at cost)

Equipment

Liabilities and Equity

Notes payable

Accounts payable

W

P

Interest payable

Accrued expenses

Bonds payable

par

Share capital, P100

Share Premium

Retained earnings

580,000

750,000

30,000

50,000

P

-

750,000

600,000

-

1,300,000

1,500,000

40,000

500,000

1,000,000

1,000,000

P4,810,000

P4,390,000

—

M

r5

—

.

Cash an d Accrual BaSls

data, compute for the

2016

in

sales

total

Baserlghe

Quesfi:::;,e above

370,000

P1170 000

b. P

I

purchases in 2016

total

The

3' PNBO'OOO

1’

a.

1

2.

b.

132,080,000

4

The

3_

.

b.

5

.

interest expenses in 2016

Nil.

P10.000

income in 2016

The total net

a, P1,000,000

P1.550.000

b.

.

.

Wing:

133,570,000

:-

I

.

C-

(1.

'\

P1.880,ooo

[32,380,000

depreciation in 2016

The total

3_

Nil.

b, P100,000.

3:

£0110

‘«.. a"

.

c. PBO'OOO

d. P480000

E“

1330300

c.

d. 1340.000

x

E

C.

d_

13950300

P5001000

\.

‘g

Y.

i

1

discloses the following:

receipts and disbursements

An analysis of cash

Receipts

800,000

issue of share capital

accounts

Trade debtors-notes and

discounted:

receivable

Note

Face value, P200,000, proceeds

12% one-year note issued to bank,

issued and discounted on March 1, 2016

Sale of investment

13

1.

2,9 50,000

190,000

300,000

250 0 00

4,49 0,000

Tm

Disbursements:

Trade creditors-notes and accounts

P2,100,000

790,000

400,000

280,000

500,000

4,070,000

Expenses

Dividends

Equipment

Bonds

Total

102

103

I,

("1),

g

I

g

;

r

.

-

Chapter

“wees.”

6

—

CHAPTER 6

CORRECTION OF

I

ll

COM

EM

“‘-

iii

»

Chapter Outline:

i

1.

'

2.

3.

4-.

5.

6.

7.

Errors

Prior Period Errors

ofprior period error

Accounting treatment

oferrors

concepts in the correction

Cha

Accounting

.

'l‘i'cillmC"t or P 1‘10!“ Period lirroi-

Accordingr m

i

“‘5. 8.1])2Fr

i'ctl‘OSPCC“,vL y m

I'

U‘

"

~»

~

"v

i

w

.dh Lm'ty Shall correct m'

‘

r'rSt Set Ofl'inancizil rrtat ,. Mum pm)" period

x

(.mcnts authorized for

,‘rors

-'

discovery by:

qftcr their

“Sue

_.

.

,

comparative

amounts for thC prior

‘rcsmung the

l'5

’

Presented

me‘ltS)

(a)

occurred;

or

error

the

in which

error occurred before the earliest prior ier‘ t presented,

[b] if the.

dim

restating the opening balances 0f assets, liabilities

equlty lor the

‘m

Cal-[jest prior period presented.

_

retrospective restatement

.

.

error shall be corrected b retrospective

restate:"erdt

A prior

p eriod

.

.

.

I

Y

is

it

that

impracticable

to determine either the

extent

except to the

p m effects or the GumUlathC Effect 0fthe error.

Limitations on

Basic

Working capital

Types oferrors

offinanciai position errors

Balance sheet or statement

specific

errors

8. income statement

I

offinancial position «1nd inc01ne statemen errors

statement

9. Combined

errors

t

10. Counterbaiancmg

errors

Non-counterbalancing

11.

Errors

Auditing No. 240, “error refers to an

According to Philippine Standards on

statements including the omission

financial

in

unintentional misstatement

including:

of an amount or a disclosure,

processing data from which financial

1. A mistake in gathering or

statements are prepared;

estimate arising from oversight or

2. An incorrect accounting

misinterpretation of facts;

accounting principles relating to

3. A mistake in the application of

measurement, recognition,classification, presentation or disclosure."

impracticable to determine the period-specific effects of an error

When it is

Comparative information for one or more prior periods presented, the

on

restate the opening balances of assets, liabilities and equity

entity shall

earliest period for which retrospective restatement is practicable

for the

current period).

(which may be the

impracticable to determine the cumulative effect at the beginning

When it is

anerror on all prior periods, the entity shat] restate

ofthe current period of

information to correct the error prospectively from the

the comparative

earliest date practicable.

Basic Concepts in

Correction of Errors

entity’s

Prior period errors are omissions from, and misstatements in, the

to

failure

from

a

financial statements for one or more prior periods arising

use or misuse of reliable information that:

were

(a) was available when financial statements for those periods

authorized for issue; and

into

(b) could reasonably be expected to have been obtained and taken

financial

account in the preparation and presentation of those

statements.

mistakes, mistakes in

Such errors include the effects of mathematical

misinterpretations

of facts, and

or

oversights

applying accounting policies,

fraud.

,r

’,r—'~-\

\.

\Effect in the

Relationship

Direct

Inverse

Net Income

Errors affecting net income:

Overstated

Understated

Understated

IfSales are overstated

IfCost of sales is overstated

lexpenses are overstated

Prior Period Errors

104

'- I

~“‘“N~—~W‘RWM

i

Effect in

Cost of Sales

Errors affecting cost of sales:

IfBeginning inventories are overstated

If Net purchases are overstated

IfEnding inventories are overstated

Working capital

Inverse

I

I

Relationship

Direct

Direct

Inverse

Overstated

Overstated

Understated

.

.

,

capital:

Errors affecting working

If the current assets are overstated

Ifthe current liabilities are overstated

105

Effectin

'

a ital

woglfgftgtepd

U

\derstated

n

i

t

-

da uto-day

working capital is the capital of a busmess that Is ltlsesiilnnu; the)current

trading Operations_ computed as the current asse s

liabllltles.

a

i

~ts

R

E

Iatjonsmp'

Direct

Inverse

I

g

Y

813.23: 6

2.

3;

tic!“

Samuiremcl‘t N0" 1

TYPES OF ERRORS

3.

(J13?

- Ccrrectisn of Errars

Bsiaztce she-ct or statement

Income statement errors

statement errors

Combined statement of financial position and income

a. Counterbalancing errors

b. Non-counterbalancing errors

Statement ofFinancial Position or Balance Sheet Errors

Statements of Financial Position or baiance sheet errors affect only the

presentation ofan asset. Iiabifity, or stockholders’ equity account

the error is discovered in the error year, the company reclassifies th

6

item to its proper position.

\“a'hen

I

f

NR

unaffected

ha

0V

over

Ni) under and AP

unaffected

NI

:30 Nl is

3) Land unde“

.nvesgment Property

unaffecwd

but N1 is

lover

Adjusted baiance

entries

Eggsting

I

Example:

£314:

Land ofP1,0G,OOO in 2015 was erroneously debited to notes receivabl e.

i

balances

Unadjust ed

R

\

under and A

,

the error in a prior year is discovered in a subsequent pericd th

e

ccmpany should restate the statement of financial position of the prior.

year

for comparative purposes.

If

x

uireme“t NO' 2

31‘

Reclassifi'ing entries:

g

Land

Notes receivable

f

1,000,000

1,000,000

V

O

I

2014

5,000,000

2015

6,000,000

(

l

1) Notes receivable of P10,000 was

receivable.

erroneously debited to accounts

2) Notes payable ofP15,000 was erroneously credited to accounts payable.

3} Land of P100,000 was erroneously debited to

investment property

account

Required:

'

1.

2‘

0

0

Compute for the adjusted net incomes in

2014 and 2015 and Retained

earnings as ofthe years ended December 31,

2014 and 2015.‘

Prepare adjusting entries assuming

errors were discovered In (a) 2014,

[b] 2015, and (c) 2016,

.

0

0

O

53001000

3000900

5000000

11 000 003

.

if errors are

dlSCOVETEd in:

.

Notes recewable

Accounts receivable

10,000

Accounts payable

Notes payable

15909

10’000

15000

100,000

100’000

Land

100,000

100000

Land

100,000

Investment property

100,000

Note:

In 2015 and 2016,

there are no adjusting entries for the errors on the notes

receivable and payable because they are assumed to have been settled or

received at the end of those years.

Income Statement

Errors

statement

the :fififtssztjfg ent errors are errors affecting. only

131W include impmper CEaSSlficauon 0 “avenues

d- mmgxreexpenses.

vers the error in

L

,

A company must make a reclassification entry When it xsco

the error year.

the

If the error

I

‘ ear) company Should restate

dlscovered pertams t0

the income

.

statement of the prior

year for CO m p amtwe pu p

7

.

l/

1139091900

_

I

106

Earnings

2015

0

Investment property

2016:

In an audit ofthe financial statement for the year ended December 31,

2015,

the following errors are discovered (all errors were made in 2014):

5300 000

’

g

0

anestment property

2015:

Ret ,

201421111811

0

Land

[Hustrationz Statement ofFinan cial Position Error

U Can Be A Topnotcher Company reported net income for the first two years

ofoperan'on as follows:

.

W

Net Income

2014.

2015

5,000,000 600000

Reg

offinancial position errors

'

\y\

107

W

\V‘J/

Chapter 6

—

Correction of Errors

Since these errors involve two nominal accounts, net income and retained

earnings during the period are unaffected.

Illustration: Income statement Error

“I.I.‘-.

Rent income amounting to P10,000 in 2015 was credited instead of [mer

est

income.

Effect of the error:

um:

0 - Overstated

Legend:

U

- Understated

Reclassifying entries on:

2015

Rent Income

Interest income

J

!

j

chap

sol

ter 6

ution:

“irement No.

x - No effect

No adjusting entry

14

3,000,000

20

40001300

'

N1

expense

.and rent

under

0:”,

1‘”

expense

o

Supplies

and

over

2)

NI

n derI

NI

over'

lPjurchaseS

Reta-lne

.

Earnings

2014 ‘1

3‘0001000

7 2015

'000’000

0

0

0

0

0

under,

undfient income

miscellaneous

under,

:3]

NI over

over,

income

balance

Adjusted

Year

0

0

0

0

0

3900000

40001000

3 000

000

.

Office supplies expense

Purchases

25,000

In an audit of the financial statement for the year ended December 31,

2015,

the following errors are discovered:

Miscellaneous income

Rent income

30,000

1) Interest expenSe of P20,000 in 2014 was erroneously debited to rent

2015:

No adjusting entries

2016:

No adjusting

2014

3,000,000

2015

4,000,000

expense.

Office

supplies expense of P25,000 in 2014 was erroneously debited to

2)

purchases.

3) Rent income of P30,000 in 2014 was erroneously credited to

miscellaneous income.

Required:

1.

2.

Compute for the adjusted net incomes in 2014 and 2015 and Retained

earnings as of the years ended December 31, 2014 and 2015.

Prepare adjusting entries assuming errors were discovered in (a) 2014,

(b) 2015, and [c] 2016.

108

,

,-

A/

.4”... —“\

'. \x

.

)I

‘/

20

000

25,000

30,000

entries

Note:

In 2015 and 2016, there are no adjusting entries for the errors because

when these are closed to the retained earnings, the balance have already

been corrected.

Combined Statement

of Financial Position