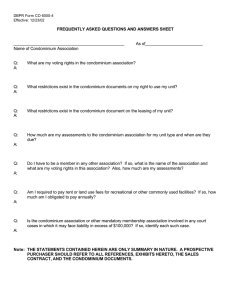

Table of Contents 1.0 PROBLEM STATEMENT ................................................................................................... 1 2.0 OBJECTIVES ..................................................................................................................... 1 3.0 CASE CHALLENGES ........................................................................................................ 1 4.0 CASE ANALYSIS ............................................................................................................... 2 5.0 DISCUSSION ..................................................................................................................... 3 6.0 RECOMMENDATION AND CONCLUSION ....................................................................... 5 7.0 APPENDIX ......................................................................................................................... 6 1.0 PROBLEM STATEMENT Rebecca Young moved to Toronto for a new job in an investment bank after completing her MBA. She is in a dilemma of deciding on whether to buy a condominium or continue to live in her rented condominium. 2.0 OBJECTIVES The purpose of the document is to evaluate the present situation and the various scenarios that may likely occur in the future and help Rebecca make a decision. The decision and recommendation will be based not only on quantitative factors but also on qualitative considerations. 3.0 CASE CHALLENGES To make a decision, Rebecca needs first to determine the required monthly mortgage payments. Exhibit 1 Then she needs to determine the opportunity cost on a monthly basis of using the lump-sum funds needed for the condominium purchase rather than leaving the fund invested and yielding the same effective monthly rate as the mortgage. And the opportunity cost of the additional monthly payments required to buy the condominium compares to renting. Exhibit 2 Finally, she wants to consider different scenarios that might occur in the future if she decides to sell the condo unit then. Exhibit 4 We are evaluating two options: 1. To continue with the monthly rent of $3000 and leave those funds invested to earning the same effective monthly rate assumed to be equivalent to the mortgage rate. 2. Purchasing the condominium unit for $600,000 with a 20% down payment ($120,000), a principal mortgage for 80% of the purchase price ($480,000), a local deed-transfer tax 1.5% ($9,000), a provincial deed-transfer tax 1.5% ($9,000) and other closing fees $2,000. However, we will ignore any other tax considerations throughout this analysis. If she decides to sell the condominium in the next ten years, she will pay 5% of the selling price to realtor fees plus $2,000 in other closing fees. 1|Page 4.0 CASE ANALYSIS Exhibit 1 shows the monthly cash flow if she purchases the condominium unit. From the table, the required monthly payment of the mortgage is estimated from Annuity computation. The required monthly amount for the mortgage is $ 2,533.62. This gives a monthly cash flow of $ 3,938.62including taxes, condo fees and repair and general maintenance of the unit. The “opportunity” costs, on a monthly basis, of using the required funds for closing (down payment plus all closing costs), rather than leaving those funds invested and earning the effective monthly rate same as the mortgage interest rate is $414.21. This is shown in Exhibit 2.And it also showed the Future value (FV) of the funds after 2, 5 and 10 years. There are additional monthly payments required to buy versus rent which can be obtained by finding the difference between the monthly cash flow to buy ($3,938.62) and monthly rent ($3,000). The monthly addition payment is $938.62.Refer to Exhibit 2 for the FV after 2, 5, 10 years. The outstanding payment is shown in Exhibit 3. This shows the beginning principal plus the interest on the principal minus the monthly payment gives the ending the principal (i.e., principal outstanding on the mortgage) at every month. At 24 months (2 years), ending principal is$456,712.90 At 60 months (5 years), ending principal is $418,102.16 At 120 months (10 years), ending principal is $342,525.10 The final task is to compute the “net” future gain or loss after two, five and ten years under the different scenarios, which Rebecca Young has determined are possible after some “due diligence” regarding future real-estate prices in the Toronto condo market. Exhibit 4 shows the four different scenarios Rebecca Young has determined are possible after some “due diligence” regarding future real-estate prices in the Toronto condo market. (1) If the price of condominium remains unchanged then Rebecca will not incur any gain or loss however, in considering the time value of money her initial closing fund of $122,000after ten years would have yielded$181,881.59if invested and the additional payments required to buy versus rent would have yielded$138,211.61 using the same rate 2|Page as the mortgage. She would have also pay $360,000(120 months x $3000/month) in rent. This gives an opportunity cost of about -$40,000. If she had purchased the condominium and decide to sell it after ten years, she would have $282,474.90 after selling the house. Considering the fact that she has paid $137,474.90 in her mortgage means $88000 ($225,474.90 - $137,474.90) is the opportunity cost. Refer to Exhibit 4. (2) If the price of the condominium increases by 10%, then Rebecca will gain $60000. Considering time value of money; her investment yield is the same as case. But her yield if she had purchase the condominium and decide to sell it after ten years, she would have $282,474.90 after selling the house. Considering the fact that she has paid $137,474.90 in her mortgage means $145,000 ($282,474.90 - $137,474.90) is the opportunity cost. Refer to Exhibit 4. (3) Considering market inflation rate of 2% for next 10 years that will offer a gross gain of $ 131397. Considering time value of money; her investment yield is the same as a case or probably has reduced in value due to the market inflation. But her yield if she had purchased the condominium and decide to sell it after ten years, she would have $350301.72 after selling the house. Considering the fact that she has paid $137,474.90 in her mortgage means $212,826.82 ($350301.72 - $137,474.90) is the opportunity cost. Refer to Exhibit 4. (4) And if the prices rise by 5% then she will get the gross profit of $377,366 as a return. Considering time value of money; her investment yield is the same as the case. But her yield if she had purchased the condominium and decide to sell it after ten years, she would have $583,944.83 after selling the house. Considering the fact that she has paid $137,474.90 in her mortgage means $446469.93 ($583,944.83 - $137,474.90) is the opportunity cost. Refer to Exhibit 4. 5.0 DISCUSSION This is a case of time value of money where Rebecca needs to decide the best possible way to utilize her money. She has the option of continuing living in her rented condominium paying $3,000 per month. With this decision, she would also have the opportunity to continue to invest 3|Page her fund which is the yield on the average about $475 per month. The benefit of renting is to invest the additional monthly payments required to buy versus rent into other investment options that have a higher rate of return. The other option available is for Rebecca to purchase the virtually identical unit next door to hers. But she will need to acquire a mortgage loan to pay 80% of the condo price. Her monthly cash flow will be $3938.62 per including condo fees, taxes and repairs and general maintenance of the condo. This is about $938.62 higher than the pay she is paying in the form of rent. In addition to these payments, she would also have to use her invested funds for 20% of the purchase price and closing fees. One good thing about the 20% down payment is that it lowers the monthly payments on the mortgage. That is acquiring a mortgage loan to pay 100% of the condo price will give higher principal for the loan which will in turn increase the interest on the principal and end up increasing the monthly payments on the loan. With these facts laid out, the rented condo is a liability that will not transfer the ownership of the condominium to Rebecca even if she lives there for 25 years. Unlike the mortgage loan option that the liability offers the ownership of the condominium, but she will need to pay more per month and use her invested fund. Considering her investment yielding about $475 monthly will only offset the inflation cost for her returns in future. Even if the additional payment on buying ($938.62) is invested monthly, it will not give her a better return than buying. Buying on the other hand requires some level of investment and taking a risk. However, buying the condominium has a high chance that the price of land will increase in future and this will bring more returns on the condominium which will in 10 years be a valuable asset. At the beginning, considering the loan payment that needs to make every month and forgoing ones invested fund to purchase the condominium is a tough decision. This is a decision that will yield a better return than renting. In addition to the above, if Rebecca decides to move to a house or even a larger penthouse condominium within five to ten years, she can maintain her mortgage payment by leasing out the property to another tenant. And due to inflation, the rental price of the property would have gone up at least to close up the gap between the mortgage payment and the rental price of the condominium unit. 4|Page 6.0 RECOMMENDATION AND CONCLUSION Buying the apartment by acquiring mortgage loan is the best option for Rebecca. This option offers the ownership of a condominium in the long run. And return on the property will be higher when the land appreciates. This option is more costly than renting but renting is an unlimited liability because it does not offer ownership even if she lives in a rented condominium for more 25 years. Rebecca also has the option of renting out her unit if she decides to move to a house or even a larger penthouse condominium within the next five to ten years. 5|Page 7.0 APPENDIX 6|Page 7|Page 8|Page 9|Page