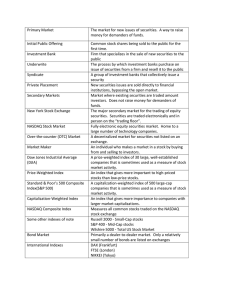

FINS5513 Lecture 1A Financial Instruments and Securities Trading Lecture Outline ❑ 1.1 Financial Instruments ➢ Overview ➢ Debt Securities • Money market • Bonds and bond indices ➢ Equity Securities • Equity indices (price weighted vs value weighted) ➢ Derivatives ❑ 1.2 Securities Trading ➢ Issuing Securities ➢ Costs of Trading • Order types • Spreads and commissions 2 1.1 Financial Instruments FINS5513 Introduction FINS5513 Overview of Asset Classes Debt Securities Promises a fixed stream of income or a stream of income determined by a specified formula Financial Assets Equity Securities A non-physical, liquid asset that derives its value from a claim on future cash flows Represents an ownership share in a corporation Derivatives Provide payoffs that are determined by the prices of other assets 5 Overview of Asset Classes Money Markets Debt Securities Bond Markets Preferred Stock Financial Assets Equity Securities Common Stock Futures Derivatives Options 6 Debt Securities FINS5513 Money Market Instruments Short term debts (maturity of less than 1 year), highly marketable and liquid: ❑ Treasury bills – T-Bills (Government issued) ❑ Certificates of Deposit - CDs (Bank issued) ❑ Commercial Paper - CP (Company issued) ❑ Bankers Acceptances ❑ Eurodollars: dollar-denominated deposits in banks outside the U.S. ❑ Repos and reverse repos: Short-term loan (typically overnight) backed by government securities ❑ Fed Funds: Overnight loans between banks for Fed deposits ❑ Brokers’ Calls – rate brokers borrow from banks ❑ LIBOR Market – interbank lending. Reference rate for many loans 8 Money Market Instruments ❑ LIBOR (London Inter-Bank Offer Rate) has historically been an important reference rate for a wide variety of transactions, both in the interbank market and the corporate loan market ➢ Based on a survey of rates reported by participating banks rather than actual transactions ➢ Interbank lending has become more sparse recently, resulting in less reference points ➢ As the sample size is decreasing and following a scandal arising from manipulation of the rate in 2012, the search for a replacement is on Further Reading 1AR1: “Understanding the LIBOR Scandal” ❑ LIBOR proposed to be phased out by 2021 and replaced by averages using actual transactions ➢ SONIA: Sterling overnight interbank average rate (GBP) ➢ SOFR: Secured overnight funding rate (USD) ➢ TONA/ TONAR: Tokyo overnight average rate (JPY) ➢ ESTER / €STR: Euro short term rate (EUR) ➢ AONIA: RBA interbank overnight cash rate (“cash rate”) (AUD) 9 Bond Markets Medium to long term debts (1 - 30+ years) ❑ US Treasury Notes and Bonds (T-Notes and T-Bonds) ❑ Inflation-Protected Treasury Bonds (TIPS) ❑ Federal Agency Issues eg Federal Home Loan Bank (FHLB), Fannie Mae, Freddie Mac ❑ International Bonds ➢ Eurobonds – bond denominated in a currency different to the country where it’s issued • E.g. Dollar bond issued in UK = Eurodollar bond ➢ Foreign bonds – same currency as the country of issue but issued by a foreign borrower • E.g. Yankee bond = dollar bond, sold in US, by non-US issuers ❑ Municipal Bonds – tax advantaged ❑ Corporate Bonds ❑ Mortgage-Backed Securities 10 Bond Indices ❑ ❑ Major indices: Merrill Lynch, Barclays, Citigroup Challenges: ➢ Wider universe: While a company may have 1 or 2 types of stocks, a company may have numerous bonds on issue (10+) ➢ Illiquid: A significant number of bonds are illiquid and infrequently traded ➢ Turnover: Bond indices turn over more than stock indices as the bonds mature (highly dynamic) 11 Equity Securities FINS5513 Equity Securities ❑ Common stock ➢ Limited liability ➢ Residual claim ➢ Perpetuity – no fixed term ❑ Preferred stock: Fixed dividends ➢ Dividend is cumulative (and commonly fixed) ➢ Priority over common stock ➢ Often a perpetuity ❑ American Depository Receipts (ADRs) ➢ Certificates traded on US exchanges representing ownership of shares in foreign firms ➢ Created as a simplified way for foreign firms to satisfy US security registration requirements ➢ Most common way for US investors to trade shares in foreign corporations 13 Stock Market Indices ❑ Many stock market indices exist: ➢ Dow Jones Industrial Average (DJIA) – 30 large U.S. blue-chip stocks ➢ S&P500 – 500 largest U.S. stocks by market capitalisation ➢ NASDAQ Composite; NYSE Composite; Wilshire 5000 ➢ ASX200 for Australia; FTSE for UK; Shanghai Index for China; Hang Seng for Hong Kong; Nikkei for Japan ❑ How are stocks weighted? ➢ Price weighted (DJIA) ➢ Market-value weighted (S&P500, NASDAQ) ➢ Equally weighted (Value Line Index) ❑ Indices are not traded – however investors can buy into funds which track an index such as: ➢ Index mutual funds – see 1.4 ➢ Exchange traded funds (ETFs) – see 1.4 14 Price Weighted Index ❑ Price Weighted Index = average price of all stocks in the index ❑ In its simplest form, add up all the prices of stocks in the index and divide by the number of stocks in the index: 𝑃𝑟𝑖𝑐𝑒 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑖𝑛𝑑𝑒𝑥 = 𝑃𝑊𝐼 = 𝑆𝑢𝑚 𝑜𝑓 𝑎𝑙𝑙 𝑠𝑡𝑜𝑐𝑘 𝑝𝑟𝑖𝑐𝑒𝑠 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑖𝑛𝑑𝑒𝑥 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠𝑡𝑜𝑐𝑘𝑠 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑖𝑛𝑑𝑒𝑥 ❑ The % change in a price weighted index is equal to the return on a portfolio that invests in one share in each stock in the index ❑ Example 1A1: Calculate the change in a price weighted index of the following stocks: Period GS KO APPL JNJ Period 1 $370 $55 $135 $160 Period 2 $350 $45 $140 $165 ➢ ➢ ➢ Step #1: Calculate PWI in Period 1 = (370 + 55 + 135 + 160) / 4 = 180.0 Step #2: Calculate PWI in Period 2 = (350 + 45 + 140 + 165) / 4 = 175.0 Change / return on a 4-stock portfolio = 175 / 180 - 1= -2.78% or (175 – 180) / 180 = -2.78% 15 Price Weighted Index ❑ In the simplest case, the divisor (d) in the PWI is the number of stocks ❑ However, when stocks are replaced in the index or undertake a stock split, the divisor needs to be amended. We do this as follows: Revised divisor = 𝑑 = ❑ 𝑅𝑒𝑣𝑖𝑠𝑒𝑑 𝑠𝑢𝑚 𝑜𝑓 𝑎𝑙𝑙 𝑠𝑡𝑜𝑐𝑘 𝑝𝑟𝑖𝑐𝑒𝑠 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑖𝑛𝑑𝑒𝑥 𝑎𝑓𝑡𝑒𝑟 𝑡ℎ𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑃𝑊𝐼 𝑏𝑒𝑓𝑜𝑟𝑒 𝑡ℎ𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 Example 1A2: Suppose Coca-Cola (KO) were replaced in the index by Microsoft (MSFT). Keep all other prices equal. Calculate the PWI divisor: Period GS KO MSFT APPL JNJ Pre-change prices $370 $55 N/A $135 $160 Post-change prices $370 N/A $280 $135 $160 ➢ ➢ ➢ Step #1: Calculate PWI in Period 1 = (370 + 55 + 135 + 160) / 4 = 180.0 Step #2: Calculate revised divisor (from above) d = (370 + 280 + 135 + 160) / 180.0 = 5.25 Verify revised divisor 5.25 (from 4 previously) gives the same PWI as before the replacement of KO with MSFT: (370 + 280 + 135 + 160) / 5.25 = 180.0 16 Value Weighted Index ❑ A Value Weighted Index (VWI) is calculated based on market capitalisation of index stocks ❑ Each stock is weighted in the index proportional to its current market capitalisation ❑ Label the current period t and the previous period t-1. To calculate 𝑉𝑊𝐼𝑡 we need 𝑉𝑊𝐼𝑡 − 1 : 𝑉𝑊𝐼𝑡 = 𝑉𝑊𝐼𝑡 − 1 ❑ 𝑆𝑢𝑚 𝑜𝑓 𝑎𝑙𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑐𝑎𝑝𝑖𝑡𝑎𝑙𝑖𝑠𝑎𝑡𝑖𝑜𝑛 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑖𝑛𝑑𝑒𝑥 𝑖𝑛 𝑡ℎ𝑒 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑝𝑒𝑟𝑖𝑜𝑑 𝑡 × 𝑆𝑢𝑚 𝑜𝑓 𝑎𝑙𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑐𝑎𝑝𝑖𝑡𝑎𝑙𝑖𝑠𝑎𝑡𝑖𝑜𝑛 𝑖𝑛𝑐𝑙𝑢𝑑𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑖𝑛𝑑𝑒𝑥 𝑖𝑛 𝑡ℎ𝑒 𝑝𝑟𝑒𝑣𝑖𝑜𝑢𝑠 𝑝𝑒𝑟𝑖𝑜𝑑 𝑡−1 Example 1A3: The index value of the S&P500 in the previous period (t-1) was 4000. Based on the prices and market capitalisations below, calculate the S&P500 in the current period (t) Period GS KO APPL JNJ # of Shares mn 340 4,300 16,700 2,630 Price MV $bn Price MV $bn Price MV $bn Price MV $bn Period t-1 $370 125.8 $55 236.5 $135 2,254.5 $160 420.8 Period t $350 119.0 $45 193.5 $140 2,338.0 $165 433.95 17 PWI vs VWI ➢ Use formula to calculate revised S&P500: 𝑉𝑊𝐼𝑡 = 4000 × ➢ ❑ 119.0 + 193.5 + 2,338 + 433.95 = 3084.45 125.8 + 236.5 + 2,254.5 + 420.8 = 3,037.6 VWIt = 4,061.7 which is an increase of 4061.7 / 4000 -1 = +1.54% Price movements were the same as for the PWI, but the PWI index moves down -2.78%, while the VWI moves up +1.54% ➢ This is because Apple moving up has a much greater impact on the VWI due to its market cap being significantly greater than the other stocks ❑ The example demonstrates that in a VWI, larger companies account for much of the movement; while for a PWI, smaller companies have more of an impact ❑ VWI do not have to be adjusted for events such as stock splits, dividends etc ❑ As fund managers focus on maximising the risk-adjusted value of their portfolios they are significantly more likely to benchmark against a VWI (S&P500) than a PWI (DJIA) Video 1AV1: “Here’s how stocks get booted from the Dow” Excel 1AE1: “1A PWI vs VWI” 18 Derivatives FINS5513 Futures and Forwards ❑ Derivatives are securities whose value is dependent on the value of other assets, such as commodity prices, bond and stock prices, or market index values ❑ Forward – a deferred-delivery sale/purchase of an asset with the sales price agreed on today ❑ Futures – similar to a forward ➢ Carries an obligation to make or take delivery of an underlying asset at a price determined today but settled at a future date ➢ Stipulates the quantity and specifications of the underlying asset ➢ Differences to a forward include: • Standardised contract – more liquid and tradeable • Trades on an exchange – mitigates counterparty risk (the exchange is the counterparty) • Marked to market, with (daily) margin requirements – see 1.3 20 Options ❑ A call (put) option gives the holder the right (but not the obligation) to buy (sell) an underlying asset: ➢ At the exercise or strike price ➢ On or before the expiration date (depending on the type) ❑ Exercise the call option to buy the asset if market value > strike ❑ Exercise the put option to sell the asset if market value < strike ❑ ❑ The purchase price of the option is called the premium (both calls and puts) ➢ Buyer pays the premium / Seller (writer) receives the premium If the holder exercises the option, the option writer must make (call) or take (put) delivery of the underlying asset 21 1.2 Securities Trading FINS5513 Issuing Securities FINS5513 Security Issues ❑ Public companies ➢ Issued stock is publicly listed on an exchange such as the NYSE, ASX ➢ Known as publicly traded, public companies, or listed companies ❑ Private companies ➢ Issued stock do not trade on an exchange – also known as unlisted companies ➢ Lower liquidity and less public disclosures ❑ Primary Market ➢ Market for newly-issued securities ➢ Proceeds raised from the issue flow directly to the company ➢ Firms issue new securities to the public (often through an underwriter) ❑ Secondary Market ➢ Investors trade previously issued securities among themselves ➢ Proceeds flow between investors that purchase/sell securities and not to the company 24 Primary vs Secondary Market ❑ The primary market (first time issue of securities) consists of: Further Reading 1AR2: “IPOs: Profiles are high: Returns?” ➢ Initial Public Offerings (IPOs) ➢ Follow-on offerings (or a “seasoned equity offering”) ❑ Follow-on offerings refer to any issuance of new shares for companies already listed on an exchange (i.e. any new share offering subsequent to an IPO) ➢ For example: rights issues, private placements of new shares etc ➢ Proceeds raised from the issue flow directly to the company ❑ The secondary market consists of: ➢ Trading amongst investors on exchanges ➢ Secondary market offerings • Shares sold by existing shareholders (often called “block trades”) • Non-dilutive to shareholders as the share count stays the same (they sell directly to each other and the company receives none of the proceeds) 25 Costs of Trading FINS5513 Order Types ❑ Market orders: ➢ No price indication – trade at the prevailing market price ➢ An instruction to trade a quantity at the best price currently available in the market ➢ Market order example: Buy 1000 shares in BHP at market ➢ Advantage: timely, executes immediately. Avoids price moving to a disadvantageous level ➢ Disadvantage: must pay the bid-ask spread. Price may move to a more advantageous level ❑ Limit orders: ➢ Price indication – trade at the best price available if it is no worse than the specified limit price ➢ Limit order example: Buy 1000 shares in BHP at $46.50 ➢ Advantage: may get a good price for the trade. Avoids paying the bid-ask spread ➢ Disadvantage: the trade may not execute (execution risk) 27 Costs of Trading ❑ ❑ Explicit costs – direct costs of trading such as: ➢ Commission - fee paid to the broker for facilitating the transaction • Calculated based on the total transaction size • Range from 0% - 0.1% for online trading platforms to 1%+ for full-service brokers Further Reading 1AR3: ➢ Transaction taxes, stamp duties, exchange fees etc “How no-fee stock trading is changing the stock market” Implicit costs – indirect costs such as: ➢ Bid-ask spread • The difference between the bid and ask prices ➢ Market impact costs • The effect of the trade on market prices • Large buyers (sellers) must raise (lower) prices to encourage other investors to trade. Minimal impact from small orders • Delay costs (slippage) – suboptimal prices paid/received arising from delayed execution of a trade due to its size or opportunity costs – profits not realised due to unfilled trades 28 Spreads and Commissions ❑ Bid-Ask spread – cost of trading with a counterparty directly (or through a broker/dealer): ➢ Bid: price at which the counterparty is willing to buy ➢ Ask: price at which the counterparty is willing to sell ➢ Bid-Ask spread: Ask - Bid ❑ Market orders – buy at the ask price / sell at the bid price ❑ Limit orders – place an order at a preferred bid (ask) price if you wish to buy (sell) ❑ Example 1A4: Using the transaction information below, calculate the trading costs (assume the full cost of the spread) and net proceeds paid/received from a market offer trade Buyer Seller $52.00 - $52.50 $32.70 - $33.00 # of Shares 0.5 million 2 million Commission 0.20% 0.15% Bid-Ask 29 Spreads and Commissions ➢ Market offer - the buyer buys at (“hits”) the ask and the seller sells at (“hits”) the bid ➢ For the buyer, commissions add to the cost of the trade. For the seller, commissions reduce the proceeds from the trade Ask price ➢ Buyer Pays: 0.5m x 52.50 x (1 + 0.2%) = $26,302,500 Cost of trade: Spread = 52.50 – 52.00 = 50c 0.5m x 52.50 x 0.2% + 0.5m x 50c = $52,500 + $250,000 = $302,500 ➢ Seller Receives: 2m x 32.70 x (1 – 0.15%) = $65,301,900 Cost of trade: Spread = 33.00 – 32.70 = 30c Bid price 2m x 32.70 x 0.15% + 2m x 30c = $98,100 + $600,000 = $698,100 30 Next Lecture ❑ BKM Chapters 3 and 4 ❑ 1.3 Trading on Margin: Long and Short ❑ 1.4 Asset Management Industry: Investment Companies, Hedge Funds and ETFs 31