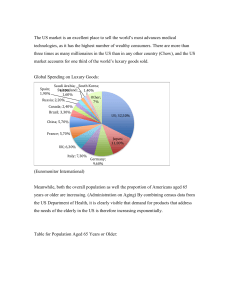

LVMH: Riding the Wave of Luxury's Resurgence Amidst the Pandemic and Beyond Investment Recommendation BUY The COVID-19 pandemic brought about widespread unemployment and economic hardships for many across the globe, but it also witnessed a surge in the popularity of luxury goods. The years 2021 and 2022 were recordbreaking years for the luxury industry, with sales soaring like never before. People indulged in designer handbags, limited-edition sneakers, classic watches, and highly coveted beauty products that gained viral fame on platforms like TikTok. Likewise, the value of luxury companies reached unprecedented heights during this time, as Moët Hennessy Louis Vuitton (LVMH) emerged as the world's most valuable luxury company, recently surpassing a market cap of half a trillion dollars and becoming the first European company to do so as economies across the world submerged from the pandemic and China eased its zero-covid lockdown policy. While the luxury sector thrived, other industries faced difficulties recovering from the pandemic's impact, grappling with supply chain issues, labor shortages, and plummeting stock values. Revenues and profits for most luxury brands swelled in 2022, with Hermès, Richemont, Kering, Chanel, and others experiencing significant increases. The luxury industry exhibited resilience, standing strong amidst economic headwinds and attracting not only the wealthy but also middle- and low-income consumers. The demand for premium products has not only transcended wealth boundaries, but age boundaries as well. Millennials and Gen-Z comprise a significant portion of luxury consumers and are projected to drive 80 percent of luxury spending by 2030 as luxury goods have become deeply embedded in pop culture and internet culture, with the internet serving as a platform for discovering trends, making purchases, and engaging in resale activities. The global luxury goods market is poised for significant growth, with a projected increase from US$349.1 billion in 2022 to US$419 billion by 2027, representing a compound annual growth rate (CAGR) of 3.7%. This growth will be primarily driven by the growing demand for a wide range of luxury products, including bags, handbags, and clothing, as consumers seek to enhance their overall presentation and "status", and the younger generation's increasing preference for premium perfumes and cosmetics to improve their appearance and boost self-confidence is expected to further propel market growth. To gain exposure to this market, taking a bet on the strongest player may be the wisest choice. LVMH's strong brand portfolio, resilience in the luxury market, global reach, focus on innovation, solid financial performance, commitment to sustainability, and an excellent management team make it an attractive investment opportunity for those looking to capitalise on the longterm growth potential of the luxury goods industry. Company data Price: €823,80 Date of price: 30/05/2023 52-week range: €535-€ 904.60 Market Cap: €419.7b Fiscal Year End: Dec Shares O/S: 502m Price Target: €1 014.56 LVMH Overview LVMH is a global luxury goods conglomerate that operates an extensive portfolio of prestigious brands. Founded in 1987 through the merger of two prominent French companies, Louis Vuitton and Moët Hennessy, LVMH has since grown to become a leader in the luxury industry. As the world's largest luxury group, LVMH encompasses a diverse range of businesses, including fashion and leather goods, wines and spirits, watches and jewelry, perfumes and cosmetics, and selective retailing. The company's brand portfolio features renowned names that resonate with elegance, craftsmanship, and exclusivity. LVMH's fashion and leather goods division includes iconic brands like Louis Vuitton, Dior, Fendi, Givenchy, and Celine, each known for their exceptional craftsmanship, innovative design, and timeless appeal. In the wines and spirits sector, LVMH boasts legendary labels such as Moët & Chandon, Dom Pérignon, Veuve Clicquot, Hennessy, and Krug, renowned for their exceptional quality and heritage. The luxury conglomerate's commitment to excellence extends to its watch and jewelry brands, which include TAG Heuer, Hublot, Bulgari, and Zenith, known for their precision, innovation, and exquisite craftsmanship. LVMH also holds a strong presence in the perfumes and cosmetics industry, with brands such as Christian Dior, Guerlain, Givenchy, Fenty, and Benefit Cosmetics, offering a wide range of luxurious and innovative beauty products. In addition to its brand holdings, LVMH operates a network of selective retail stores, including the prestigious department store Le Bon Marché, Sephora, and DFS (Duty Free Stores). These retail outlets provide customers with an immersive luxury shopping experience and offer a curated selection of the finest products across different categories. Ownership structure LVMH's business model emphasizes a combination of brand ownership, vertical integration, and global distribution networks. The company focuses on nurturing and developing its brands while leveraging synergies and economies of scale across its diverse business segments. By maintaining the highest standards of quality, craftsmanship, and exclusivity, LVMH aims to provide exceptional luxury experiences and meet the evolving demands of discerning consumers worldwide. Segment Revenue Growth (€'billion) In 2022, the largest share of LVMH's revenues came from the Fashion and Leather Goods segment, accounting for nearly half of the total revenues. The 45000 next significant contributors were the Selective Retailing, Watches and 40000 35000 Jewelry, Perfumes and Cosmetics, and Wine and Spirits segments. Among 30000 25000 these, the Fashion and Leather Goods segment exhibited the strongest profit 20000 15000 margins, followed by the Wine and Spirits and Watches and Jewelry 10000 5000 segments. 0 LVMH generates revenue globally, with a strong focus on the Asia-Pacific region, particularly China, which has been a key growth driver. The rising middle class and their increasing demand for luxury goods have contributed to LVMH's success in this region. The company has expanded its presence in China, catering to the preferences of Chinese consumers. Europe, especially Western Europe, is another significant revenue contributor, with France as the company's home base. Countries like -5000 2018 2019 2020 2021 2022 Italy, the United Kingdom, Germany, and Spain also contribute to LVMH's Segment profits from recurring operations (€'billion) European revenue. The United States, with its large consumer base and high 18000 spending power, represents a substantial portion of LVMH's revenue. Other 16000 regions, including the Middle East, Latin America, and emerging markets, also 14000 contribute, albeit to a lesser extent compared to Europe, North America, and 12000 Asia-Pacific. 10000 8000 SWOT Analysis 6000 4000 Strengths 2000 0 -2000 Strong Brand Portfolio: LVMH owns a diverse portfolio of prestigious and internationally recognized luxury brands across multiple sectors, including fashion, perfumes, cosmetics, watches, jewelry, and wines and spirits. This extensive brand portfolio contributes to its global market presence and customer loyalty. Market Leadership: LVMH is a market leader in the luxury goods industry, with a strong market position and a track record of consistent growth. Its brands are often synonymous with luxury, craftsmanship, and innovation, enabling the company to command premium prices and attract affluent customers. Innovation and Creativity: LVMH places a strong emphasis on innovation and creativity in its product offerings, design, and marketing strategies. The company constantly seeks to push boundaries and introduce new concepts, collaborations, and limited editions to maintain its competitive edge and captivate consumers. Fashion and leather goods Watches Perfumes Wines and Selective and and spirits retailing jewellery cosmetics 2018 2019 2020 2021 2022 Number of stores 2000 1800 1600 1400 1200 1000 800 600 400 200 0 Vertical Integration: LVMH has a well-established vertically integrated business model. By owning and controlling various stages of the value chain, including production, distribution, and retail, the company has greater control over quality, exclusivity, and customer experience. 2020 2021 2022 Revenue per store 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 0 Asia (excl. United Japan) States 2020 Europe (excl. France) France 2021 2022 Japan Other countries Weaknesses: Exposure to Economic Conditions: The luxury goods industry is sensitive to changes in economic conditions. During economic downturns, consumer spending on luxury items may decline, impacting LVMH's sales and profitability. Overreliance on Fashion and Leather Goods: While LVMH has a diverse portfolio, it heavily depends on its fashion and leather goods segment, which contributes a significant portion of its revenue. Any downturn in this segment could have a significant impact on the company's overall performance. Opportunities: Expanding Emerging Markets: LVMH has opportunities to tap into the growing consumer markets in emerging economies, such as China, India, and Southeast Asia. Rising disposable incomes, changing consumer preferences, and increasing brand awareness provide avenues for revenue growth in these regions. Digital Transformation: The increasing shift towards online shopping and digital platforms presents opportunities for LVMH to enhance its e-commerce presence and engage with customers through digital channels. Investing in digital marketing, online retailing, and personalized customer experiences can drive sales and strengthen customer relationships. Sustainable and Ethical Practices: The demand for sustainable and ethical products is on the rise. LVMH can capitalize on this trend by further integrating sustainable practices, responsible sourcing, and environmentally friendly initiatives across its brands, appealing to environmentally conscious consumers. Threats: Intense Competition: The luxury goods industry is highly competitive, with several established players vying for market share. Competitors with strong brand recognition, extensive product offerings, and substantial financial resources pose a threat to LVMH's market position. Counterfeit Products: The luxury goods industry is prone to counterfeit products, which can negatively impact brand reputation and revenues. LVMH faces the ongoing challenge of combating counterfeits and protecting its brands from infringement. Geopolitical and Trade Uncertainties: Global political and trade uncertainties, such as trade disputes, tariffs, and regulatory changes, can affect LVMH's international operations, supply chain, and profitability. Fluctuations in exchange rates and geopolitical tensions may also impact consumer demand in certain regions. Industry overview Fashion and Leather goods The luxury fashion and leather goods industry represent a significant segment within the broader luxury goods sector. It encompasses prestigious fashion houses and renowned brands that specialize in high-quality clothing, accessories, handbags, shoes, and leather goods. The industry represents encompasses prestigious fashion houses and renowned brands that specialize in high-quality clothing, accessories, handbags, shoes, and leather goods that are often handmade by skilled artisans, ensuring impeccable quality, durability, and exclusivity. The leaders in the industry include Louis Vuitton (LVMH brand), Gucci, Chanel, Hermès, Prada, Dior (LVMH), Fendi (LVMH), and Givenchy, which have rich histories and iconic status. They have cultivated a distinct brand identity and storytelling that resonates with consumers seeking aspirational and prestigious products. Luxury fashion and leather goods are distributed through a mix of channels, including flagship stores, high-end department stores, specialty boutiques, and e-commerce platforms. Flagship stores, often located in prestigious shopping districts, provide immersive brand experiences and personalized services, while e-commerce platforms enable brands to reach a broader global audience. According to Statista, revenue in the Luxury Fashion industry is projected to reach US$111.50 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.39% from 2023 to 2028, while revenue for the Luxury Leather industry is projected to reach US$75.79 billion 2023 and grow at a CAGR of 4.03% from 2023 to 2028. In 2021 and 2022, LVMH experienced significant organic revenue growth in its fashion and leather goods segment, with a notable increase of 47% and 20% respectively. This growth was fueled by pent-up demand resulting from the pandemic-induced lockdowns. Additionally, the first quarter of 2023 witnessed a remarkable 18% increase in organic revenue growth, highlighting the strength of demand as Chinese consumers emerged from the strictest lockdown measures implemented worldwide. Profits from recurring operations for this segment during these periods experienced substantial growth, with an impressive increase of 79% and 22% respectively. The profit margins also remained strong, standing at 42% and 41% respectively. Watches and Jewellery The luxury watches and jewelry industry represents a prestigious and highly specialized sector within the broader luxury goods market. The luxury watch industry encompasses renowned brands such as Rolex, Patek Philippe, Omega, TAG Heuer (LVMH), Audemars Piguet, and Jaeger-LeCoultre are revered for their technical expertise, heritage, and iconic timepieces. Luxury watches often feature complex movements, precious materials, and limited editions that appeal to collectors and enthusiasts. Luxury jewelry encompasses a wide range of exquisite pieces, including rings, necklaces, bracelets, earrings, and brooches. Brands such as Cartier, Tiffany & Co(LVMH)., Bulgari, Chopard, Van Cleef & Arpels, and Harry Winston are renowned for their exceptional craftsmanship, gemstones, and innovative designs continually strive for design excellence and innovation, pushing the boundaries of creativity and technical mastery. These goods are distributed through a combination of channels, including authorized retailers, brand boutiques, department stores, and e-commerce platforms. Brand boutiques offer a personalized and immersive shopping experience, while authorized retailers provide a wide selection of luxury timepieces and jewelry. E-commerce platforms enable brands to reach a broader global audience and offer convenient online shopping experiences. According to Statista, global revenue in the Luxury Watches & Jewelry industry is estimated to be US$74.97 billion in 2023. The market is projected to experience at a CAGR of 2.50% during the period from 2023 to 2028. In 2021 and 2022, LVMH's Watches and Jewelry segment achieved organic revenue growth of 40% and 12% respectively. These growth rates were compared to a low base resulting from the impact of the pandemic. The segment's revenues remained robust in the first quarter of 2023, experiencing organic growth of 11%. Furthermore, profits from recurring operations saw significant increases, with a staggering 456% growth in 2021 and a 20% increase in 2022. The segment achieved a profit margin of 19%. Perfumes and Cosmetics The luxury perfumes and cosmetics industry represents a distinct and glamorous sector within the broader beauty and personal care market. It encompasses prestigious brands that create and market highquality fragrances, skincare, makeup, and other luxury beauty products such as Chanel, Dior (LVMH), Guerlain, Hermès, Tom Ford, and Creed in luxury perfumes and La Mer, La Prairie, Sisley, Fenty (LVMH), Estée Lauder, Lancôme, Yves Saint Laurent, and Charlotte Tilbury in cosmetics. The demand for luxury beauty products remains robust, driven by factors such as changing consumer preferences, increasing disposable incomes, and the desire for indulgence, self-care, and enhancing personal appearance. Luxury perfumes and cosmetics are distributed through a combination of channels, including high-end department stores, luxury beauty boutiques, brand-owned flagship stores, and e-commerce platforms. Revenue in the Luxury Cosmetics & Fragrances segment is projected to reach US$71.31 billion in 2023 according to Statista and is anticipated to witness a CAGR of 4.00% during the period from 2023 to 2028. In 2021 and 2022, LVMH's Perfumes and Cosmetics segment experienced organic revenue growth of 27% and 10% respectively. The positive revenue trend continued in the first quarter of 2023 with organic growth reaching 7%. During these periods, the profit margins remained steady at 10% and 9% respectively. Wines and Spirits The luxury wines and spirits encompasses premium and high-end brands that produce and distribute a wide range of luxury alcoholic beverages, including wines, champagnes, spirits, and liqueurs. Brands such as Moët & Chandon, Dom Pérignon, Hennessy (LVMH), Glenmorangie (LVMH), Johnnie Walker, Grey Goose, and Bacardi represent the epitome of luxury and are synonymous with superior quality and exclusivity. Luxury wines are often linked to specific regions and vineyards renowned for their terroir, which includes factors such as climate, soil, and topography that influence the characteristics of the grapes and the resulting wines. The concept of terroir adds value and uniqueness to luxury wines, with appellations and designations indicating the origin and quality of the wines. Luxury wines and spirits are distributed through a combination of channels, including high-end wine and spirits retailers, specialized boutiques, luxury hotels and restaurants, duty-free shops, and online platforms. According to Statista, the revenue in the Wine market is estimated to be US$333.00 billion in 2023. The market is projected to grow at an annual rate of 5.52% (CAGR 2023-2027). Similarly, the revenue in the Spirits market is expected to amount to US$525.30 billion in 2023, with an anticipated annual growth rate of 4.56% (CAGR 2023-2027). In 2021 and 2022, LVMH's Wines and Spirits segment achieved organic revenue growth of 26% and 11% respectively. Additionally, profits from recurring operations increased by 34% and 16% with profit margins of 31% and 30% respectively. However, in the first quarter of 2023, the segment experienced a slight decline in revenues, with organic growth reaching 3%. Selective retailing The luxury selective retailing industry represents a specialized segment within the luxury goods market. It involves the distribution and retailing of a wide range of luxury products, including fashion, accessories, cosmetics, fragrances, watches, jewelry, and more. Luxury selective retailers curate a unique shopping experience, providing a platform for prestigious brands and catering to affluent consumers seeking personalized service and exclusivity. Luxury selective retailing is prominent in the travel retail sector, with luxury products available at airports, duty-free shops, and luxury shopping areas within hotels and resorts. Examples include Bergdorf Goodman, Harrods, Selfridges, Saks Fifth Avenue, Galeries Lafayette, and Lane Crawford In 2021 and 2022, LVMH's Selective Retailing segment achieved organic revenue growth of 18% and 17% respectively. In the first quarter of 2023, the segment experienced strong revenue growth with organic growth reaching 28%. The profit margins for this segment remained steady at 5% in both 2021 and 2022. Ratio analysis: Ratios Return on Capital Employed: LVMH Hermes Kering Richemont Prada Burberry Salvatore Ferragamo Diageo Liquidity Current ratio 1,26 3,94 1,4 2,5 1,6 2,53 2 1,53 Quick ratio 0,62 3,35 0,85 1,89 1,12 2 1,35 0,69 Debt to assets 26 0,11 0,33 0,38 0,36 0,38 0,35 0,45 Debt to equity 35% 0,15 0,8 0,83 0,77 0,87 0,8 2,12 Inventory turnover 1,36 2,04 1,28 0,95 1,25 1,92 0,34 7,32 Cash conversion cycle 116 129 167 294 163 159 143 324 Gross profit margin 68% 71% 75% 69% 79% 70,11% 72% 61% Operating profit margin 27% 42% 27% 26% 18% 17% 9% 29% Return on equity Return on capital employed 25% 31% 28% 15% 14% 29% 9% 42% 20% 35% 22% 18% 13% 19% 9% 17% 13,28% 58% 15% 20% 9% 19% 6% 11% Leverage ratios Activity ratios Profitability ratios Return on invested capital Ratio analysis: Inventory Turnover: LVMH's inventory turnover has been relatively stable over the past three years, indicating the efficiency of the company in managing its inventory. A higher inventory turnover ratio suggests that LVMH is selling its inventory more frequently, which is generally considered positive as it helps minimize holding costs, maintain exclusivity, respond to market trends, manage working capital effectively, and mitigate risks associated with slow-moving inventory. Gross Profit Margin and Operating Profit Margin: LVMH's gross profit margin and operating profit margin has been relatively consistent, with a slight increase in 2022 compared to previous years, however, they are both below the industry average of 72%, as it has exposure to comparatively lower margins through perfumes, cosmetics and selective retailing. Return on Equity LVMH's return on equity (ROE) has shown a significant improvement from 2020 to 2021, indicating a higher return generated for the shareholders' investment. The ROE of 25% in 2022 and 33% in 2021 indicates that LVMH has been successful in generating profit for its shareholders. It is also above the industry average of 22%, suggesting that LVMH is utilising its shareholders' equity more efficiently than its industry peers. LVMH's return on capital employed (ROCE) has been consistently above 10% over the past three years, indicating effective utilization of capital to generate profits. The ROCE of 20% in 2022 and 18% in 2021 suggests that LVMH has been successful in generating returns for its invested capital. It is also above the industry average of 19%, indicating relatively better capital efficiency compared to its industry peers. Valuation Intrinsic valuation Revenue Fundamentals: To forecast revenues, I have analyzed each segment by considering organic growth rates and foreign exchange impacts. For organic growth assumptions, I took into account the revenue growth in the first quarter of 2023, management guidance, and applied a sales growth damping factor. To project foreign exchange impacts, I assumed a weakening of the euro for the rest of 2023 into 2024, followed by stabilization in the subsequent years. 2022A 2023E 2024E 2025E 2026E 2027E Revenue €79,184 €89,468 €96,739 €101,59 €101,74 €101,99 Gross Profit €54,196 €61,235 €66,211 €69,535 €69,631 €69,803 Net income €14,085 €15,687 €17,029 €17,947 €18,377 €18,378 CAGR Revenue 5,19% Gross Profit 5,19% Net Income 5.47% Discounted Cash Flow Cost of revenue, capital expenditures and working capital DCF Entry 2023 Date 31/05/2023 Time Periods Year Fraction EBIT Less: Cash Taxes Plus: D&A Less: Capex Less: Changes in NWC Unlevere d FCF (Entry)/E xit Transacti on CF Transacti on CF Intrinsic Value Enterpris e Value Plus: Cash Less: Debt Equity Value 2024 2025 2026 31/12/2023 31/12/2024 31/12/2025 0 1 0.5 Exit 31/12/2026 31/12/2027 31/12/2027 2 1.0 2027 3 1. 4 1.0 1.0 8 0 00 0 0 22,459,832,5 24,473,299,5 25,855,383,61 26,315,179,7 26,503,923,4 39 64 0 02 26 6,258,294,10 6,872,106,77 9 4 7,291,889,106 6,052,194,58 6,653,068,20 7 9 7,238,647,601 7,166,222,35 7,248,123,33 4 3 7,702,636,73 8,114,506,45 3 9 3578743674 3869578264 4063829924 4464758972 4079522301 4,391,083,01 1,573,904,37 1 918,587,795 2,438,212,548 3 736,705,353 14,283,906, 19,466,094, 19,300,099, 20,812,930, 24,027,489, 332 940 633 736 604 (427,532,617, 120) 668,295,693, 730 8,332,278, 19,466,094, 19,300,099, 20,812,930, 24,027,489, 668,295,693, 694 940 633 736 604 730 (427,532,617, 8,332,278, 19,466,094, 19,300,099, 20,812,930, 24,027,489, 668,295,693, 120) 694 940 633 736 604 730 Market Value 521,796,794, 791 7,300,000, 000 19,739,000, 000 509,357,794, 791 Equity Value/Sha re 56 1,014. Less: Cash Enterprise Value 415,093,617, 120 19,739,000, 000 7,300,000, 000 427,532,617, 120 Equity Value/Share 80 Market Cap Plus: Debt 826. To estimate the costs of revenue, I analyzed the historical relationship between cost of revenues and revenue. By calculating the historical average of cost of revenues over the past five years, I obtained a reliable indicator to project future costs in relation to revenue. I did the same for capital expenditures and net working capital items. Depreciation and amortisation To estimate the depreciation and amortization expense, I relied on the historical proportion of this expense to the net opening balances. This approach was chosen due to a strong correlation observed in the past, allowing for a reliable projection of depreciation and amortization expenses in relation to the net opening balances. Other investment activities and other non-cash adjustments Considering the uncertainty and difficulty in forecasting various variables involved in other investment activities, such as business acquisitions and proceeds from the purchase of short-term marketable securities, I assumed a moving historical average level of investment for future periods. Dividend policy To estimate the dividend payout ratio, I analyzed the historical data and calculated the average payout ratio over a certain period. I then applied this historical average to my forecast to project the future dividend payments. Opportunities The economic and psychological factors that contribute to the strength of the luxury market are substantial. From an economic standpoint, the industry showcases resilience thanks to its affluent customer base, who are less influenced by high price tags. The psychology of purchasing designer products revolves around the status they represent. Luxury goods serve as symbols of wealth and exclusivity, and the higher the price, the greater the perceived status they convey. Younger generations have adopted a different perspective on luxury spending, leveraging the resale market and placing more emphasis on emotional fulfillment rather than traditional wealth signaling. Bain & Co research indicates that Gen Z members are making their initial luxury purchases at a younger age, around 15, surpassing the age at which millennials made their first luxury buys. This trend presents an opportunity for luxury brands to establish long-term consumer relationships. Looking ahead, Gen Z and Gen Alpha's spending is projected to grow three times faster than other generations until 2030, eventually comprising a significant one-third of the market. Adoption of digital technologies: Brands can leverage digital technologies like artificial intelligence (AI), virtual and augmented reality (VR/AR), and 3D printing to enhance the customer experience both online and in physical stores. These technologies can provide personalized interactions, improve marketing efforts, and create intricate and unique luxury products. Investment Risks Slowdown in the US luxury market: The US market, which has been a significant driver of luxury fortunes in recent years, is showing signs of slowing down. This is evident from weak credit-card spending and reports of declining sales in luxury brands such as Burberry. The slowdown raises concerns about the future performance of luxury brands in the US market. Uncertainty in China's recovery: Luxury brands have heavily relied on China's post-Covid recovery to drive sales. However, there are indications that Chinese consumers remain cautious, and there is a need for largescale group tours to Europe to sustain Chinese consumption. Any faltering in the Chinese recovery story could pose a setback for luxury stocks. Dependency on economic and market factors: Luxury stocks' future performance relies on a perfect scenario where the US market decelerates while China maintains robust growth. The economic and market conditions, including factors such as stimulus payments, stock market performance, and cryptocurrency gains, play a crucial role in sustaining luxury spending and driving the performance of luxury companies.