Accounting for Intangible Assets: Journal Entries & Amortization

advertisement

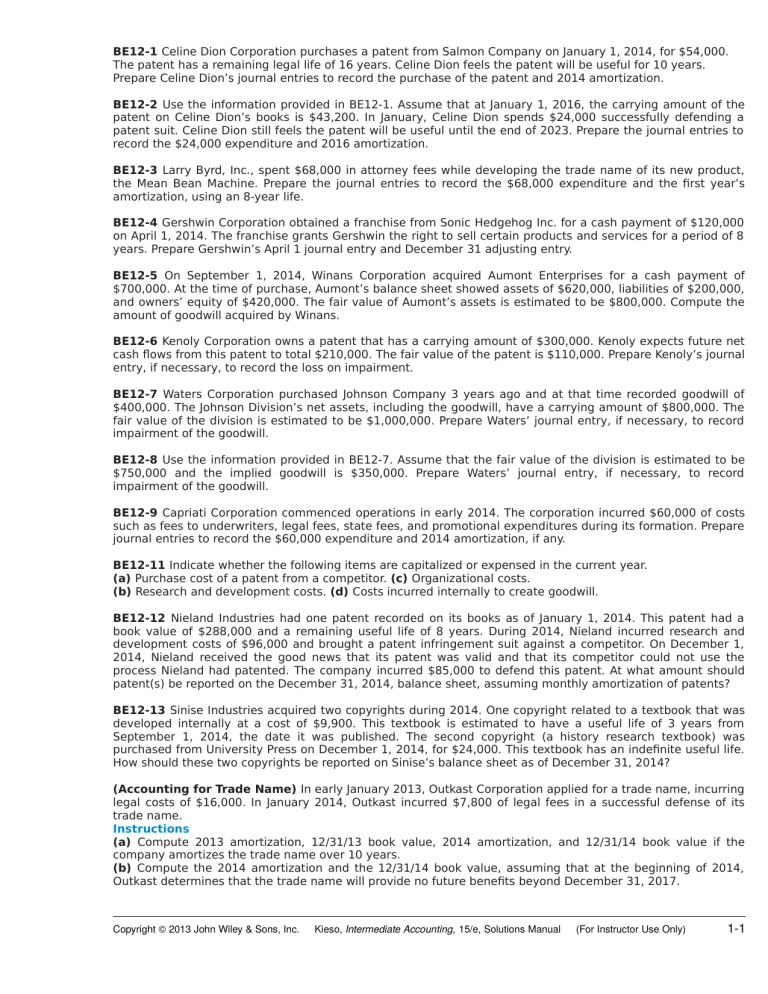

BE12-1 Celine Dion Corporation purchases a patent from Salmon Company on January 1, 2014, for $54,000. The patent has a remaining legal life of 16 years. Celine Dion feels the patent will be useful for 10 years. Prepare Celine Dion’s journal entries to record the purchase of the patent and 2014 amortization. BE12-2 Use the information provided in BE12-1. Assume that at January 1, 2016, the carrying amount of the patent on Celine Dion’s books is $43,200. In January, Celine Dion spends $24,000 successfully defending a patent suit. Celine Dion still feels the patent will be useful until the end of 2023. Prepare the journal entries to record the $24,000 expenditure and 2016 amortization. BE12-3 Larry Byrd, Inc., spent $68,000 in attorney fees while developing the trade name of its new product, the Mean Bean Machine. Prepare the journal entries to record the $68,000 expenditure and the first year’s amortization, using an 8-year life. BE12-4 Gershwin Corporation obtained a franchise from Sonic Hedgehog Inc. for a cash payment of $120,000 on April 1, 2014. The franchise grants Gershwin the right to sell certain products and services for a period of 8 years. Prepare Gershwin’s April 1 journal entry and December 31 adjusting entry. BE12-5 On September 1, 2014, Winans Corporation acquired Aumont Enterprises for a cash payment of $700,000. At the time of purchase, Aumont’s balance sheet showed assets of $620,000, liabilities of $200,000, and owners’ equity of $420,000. The fair value of Aumont’s assets is estimated to be $800,000. Compute the amount of goodwill acquired by Winans. BE12-6 Kenoly Corporation owns a patent that has a carrying amount of $300,000. Kenoly expects future net cash flows from this patent to total $210,000. The fair value of the patent is $110,000. Prepare Kenoly’s journal entry, if necessary, to record the loss on impairment. BE12-7 Waters Corporation purchased Johnson Company 3 years ago and at that time recorded goodwill of $400,000. The Johnson Division’s net assets, including the goodwill, have a carrying amount of $800,000. The fair value of the division is estimated to be $1,000,000. Prepare Waters’ journal entry, if necessary, to record impairment of the goodwill. BE12-8 Use the information provided in BE12-7. Assume that the fair value of the division is estimated to be $750,000 and the implied goodwill is $350,000. Prepare Waters’ journal entry, if necessary, to record impairment of the goodwill. BE12-9 Capriati Corporation commenced operations in early 2014. The corporation incurred $60,000 of costs such as fees to underwriters, legal fees, state fees, and promotional expenditures during its formation. Prepare journal entries to record the $60,000 expenditure and 2014 amortization, if any. BE12-11 Indicate whether the following items are capitalized or expensed in the current year. (a) Purchase cost of a patent from a competitor. (c) Organizational costs. (b) Research and development costs. (d) Costs incurred internally to create goodwill. BE12-12 Nieland Industries had one patent recorded on its books as of January 1, 2014. This patent had a book value of $288,000 and a remaining useful life of 8 years. During 2014, Nieland incurred research and development costs of $96,000 and brought a patent infringement suit against a competitor. On December 1, 2014, Nieland received the good news that its patent was valid and that its competitor could not use the process Nieland had patented. The company incurred $85,000 to defend this patent. At what amount should patent(s) be reported on the December 31, 2014, balance sheet, assuming monthly amortization of patents? BE12-13 Sinise Industries acquired two copyrights during 2014. One copyright related to a textbook that was developed internally at a cost of $9,900. This textbook is estimated to have a useful life of 3 years from September 1, 2014, the date it was published. The second copyright (a history research textbook) was purchased from University Press on December 1, 2014, for $24,000. This textbook has an indefinite useful life. How should these two copyrights be reported on Sinise’s balance sheet as of December 31, 2014? 23 (Accounting for Trade Name) In early January 2013, Outkast Corporation applied for a trade name, incurring legal costs of $16,000. In January 2014, Outkast incurred $7,800 of legal fees in a successful defense of its trade name. Instructions (a) Compute 2013 amortization, 12/31/13 book value, 2014 amortization, and 12/31/14 book value if the company amortizes the trade name over 10 years. (b) Compute the 2014 amortization and the 12/31/14 book value, assuming that at the beginning of 2014, Outkast determines that the trade name will provide no future benefits beyond December 31, 2017. Copyright © 2013 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only) 1-1 (c) Ignoring the response for part (b), compute the 2015 amortization and the 12/31/15 book value, assuming that at the beginning of 2015, based on new market research, Outkast determines that the fair value of the trade name is $15,000. Estimated total future cash flows from the trade name is $16,000 on January 3, 2015. E12-9 (Accounting for Patents, Franchises, and R&D) Jimmy Carter Company has provided information on intangible assets as follows. A patent was purchased from Gerald Ford Company for $2,000,000 on January 1, 2013. Carter estimated the remaining useful life of the patent to be 10 years. The patent was carried in Ford’s accounting records at a net book value of $2,000,000 when Ford sold it to Carter. During 2014, a franchise was purchased from Ronald Reagan Company for $480,000. In addition, 5% of revenue from the franchise must be paid to Reagan. Revenue from the franchise for 2014 was $2,500,000. Carter estimates the useful life of the franchise to be 10 years and takes a full year’s amortization in the year of purchase. Carter incurred research and development costs in 2014 as follows. Materials and equipment $142,000 Personnel 189,000 Indirect costs 102,000 $433,000 Carter estimates that these costs will be recouped by December 31, 2017. The materials and equipment purchased have no alternative uses. On January 1, 2014, because of recent events in the field, Carter estimates that the remaining life of the patent purchased on January 1, 2013, is only 5 years from January 1, 2014. Instructions (a) Prepare a schedule showing the intangibles section of Carter’s balance sheet at December 31, 2014. Show supporting computations in good form. (b) Prepare a schedule showing the income statement effect (related to expenses) for the year ended December 31, 2014, as a result of the facts above. Show supporting computations in good form. (AICPA adapted) E12-10 (Accounting for Patents) During 2010, George Winston Corporation spent $170,000 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2010, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $18,000 related to the patent were incurred as of October 1, 2010. 23 Instructions (a) Prepare all journal entries required in 2010 and 2011 as a result of the transactions above. (b) On June 1, 2012, Winston spent $9,480 to successfully prosecute a patent infringement suit. As a result, the estimate of useful life was extended to 12 years from June 1, 2012. Prepare all journal entries required in 2012 and 2013. (c) In 2014, Winston determined that a competitor’s product would make the New Age Piano obsolete and the patent worthless by December 31, 2015. Prepare all journal entries required in 2014 and 2015. E12-11 (Accounting for Patents) Tones Industries has the following patents on its December 31, 2013, balance sheet. The following events occurred during the year ended December 31, 2014. 1. Research and development costs of $245,700 were incurred during the year. 2. Patent D was purchased on July 1 for $36,480. This patent has a useful life of 9½ years. 3. As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B’s value may have occurred at December 31, 2014. The controller for Tones estimates the expected future cash flows from Patent B will be as follows. The proper discount rate to be used for these flows is 8%. (Assume that the cash flows occur at the end of the year.) Instructions (a) Compute the total carrying amount of Tones’ patents on its December 31, 2013, balance sheet. (b) Compute the total carrying amount of Tones’ patents on its December 31, 2014, balance sheet. 1-2 Copyright © 2013 John Wiley & Sons, Inc. Kieso, Intermediate Accounting, 15/e, Solutions Manual (For Instructor Use Only)