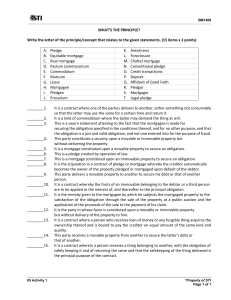

CHATTEL MORTGAGE CHATTEL MORTGAGE – contract by virtue of which personal property is recorded in the Chattel Mortgage Register as a security for the performance of the obligation 1. Between the parties o The mortgage must be recorded in the Chattel Mortgage Register of the province where the mortgagor resides and also of the province where the property is located, if it is different from the residence of the mortgagor. CHARACTERISTICS OF CHATTEL MORTGAGE 1. Accessory contract – for the purpose of securing the performance of a principal obligation 2. Formal contract – registration in Chattel Mortgage Register is indispensable for validity 3. Unilateral contract – obligation only on part of creditor to free the thing from the encumbrance on fulfillment of obligation REQUISITES OF CHATTEL MORTGAGE 1. principal obligation. mortgaged. 1. That it be constituted to secure the fulfillment of a principal obligation 2. That the mortgagor be the absolute owner of the thing 3. That the person constituting the mortgage must have the free disposal of his property, and in the absence thereof, that he be legally authorized for the purpose. 4. That the document in which the mortgage appears be recorded in the Chattel Mortgage Register. Required for validity of chattel mortgage OBJECT OF CHATTEL MORTGAGE o Only personal property may be the object of a chattel mortgage. The following things are deemed personal property: Those movables susceptible of appropriation which are not included in the list of immovables in Art. 415. Examples: Car, laptop computer, piano, ring. o Real property which by any provision of law is considered as personalty (personal, movable property) Example: chattel mortgage can be executed on growing crops and large cattles o o Forces of nature which are brought under control by science. Examples: Electricity, light, gas. In general, all things which can be transported from place to place without impairment of the real property to which they are fixed. Examples: Painting hanging on the wall, machinery not attached to land. o Obligations and actions which have for their objects movables or demandable sums. Examples: Promissory note, and the right to recover a money debt by court action. o o Shares of stock of agricultural, commercial and industrial entities, although they may have real estate. FORM OF CHATTEL MORTGAGE o Mortgagor domiciled outside the PH mortgage must be registered in the Chattel Mortgage Register of the province where the property is located. o required for the validity of the chattel mortgage between the parties. Place of registration with respect to certain movables a) Motor vehicles - Chattel Mortgage Register and Land Transportation Office (Motor Vehicles Law) b) Shares of stock - Chattel Mortgage Register in the province where the corporation has its principal office and in the domicile of the mortgagor, unless their domicile is the same, in which case, a single sufficient. c) Vessel - Office of the Collector of Customs at port of entry. 2. As regards third persons o An affidavit of good faith must be appended to the Deed of Chattel Mortgage and recorded in the Chattel Mortgage Register. o Affidavit of good faith - a sworn statement attesting to the fact that the mortgage is made for the purpose of securing the obligation specified in the conditions, and for no other purpose, and that the obligation is a just and valid obligation, and one not entered into for the purpose of fraud. FORECLOSURE OF CHATTEL MORTGAGE 1) Grounds for foreclosure a. When the principal obligation is not paid when due. b. When there is any violation of any condition, stipulation or warranty by the mortgagor. 2) Kinds of foreclosure of chattel mortgage a. Judicial foreclosure – a foreclosure made by instituting a court action, following the provisions of the Chattel Mortgage Law as far as practicable. b. Extra-judicial foreclosure - a foreclosure following the provisions of the Chattel Mortgage Law. Instituting a court action is necessary only to secure possession of the thing preparatory to extra-judicial foreclosure if the debtor refuses to deliver the thing. 3) Distribution of proceeds of foreclosure sale The proceeds of sale shall be distributed as follows: a. The costs and expenses of keeping and sale. b. Claim of the person foreclosing the mortgage/Payment of the obligation secured by the mortgage c. Claims of persons holding subsequent mortgages in their order. d. Balance, if any, shall be paid to the mortgagor. 4) Effect of sale when there are two or more mortgages a. On senior mortgagees - Foreclosure and sale by a junior mortgagee do not affect the rights of persons holding prior encumbrances. o The purchaser acquires the property subject to the right of foreclosure of a senior mortgagee. o The junior mortgagee may, however, redeem the thing. b. On junior mortgagees - Foreclosure and sale by a senior mortgagee will extinguish all subsequent mortgages. UNLESS otherwise stipulated Pledgee may appropriate thing pledge if it is not sold in two public auctions Mortgagee cannot appropriate thing mortgaged. CHATTEL MORTGAGE AND PLEDGE 1. Both executed to secure performance of principal obligation 2. Both constituted only on personal property 3. Both are indivisible 4. Both constitute a lien on property 5. Creditor cannot appropriate the property to himself in payment of debt 6. Debtor defaults – property must be sold for the payment of creditor 7. Both are extinguished by the fulfillment of principal obligation/destruction of property pledged/mortgaged 5) Deficiency judgment o o o proceeds of sale are not sufficient to satisfy the claim of the creditor - the creditor may institute a court action to recover the deficiency EXCEPTION: in the case of foreclosure of a chattel mortgage constituted on personal property which is sold at a price payable in installments. Any agreement to the contrary shall be VOID NOTE: mortgagor defaults in payment – creditor has no right to appropriate to himself the personal property (only permitted to recover credit from proceeds of sale) PLEDGE Constituted on movables Thing delivered to creditor/third person CONVENTIONAL: deficiency cannot be recovered even if stipulated CONVENTIONAL: excess of proceeds of sale is retained by the pledgee UNLESS otherwise stipulated Pledgee may appropriate thing pledge if it is not sold in two public auctions REAL MORTGAGE Constituted on immovables Delivery not necessary PLEDGE Thing delivered to creditor/third person Pledge in public instrument showing description and date of pledge to bind persons CONVENTIONAL: deficiency cannot be recovered even if stipulated CHATTEL MORTGAGE Delivery not necessary CONVENTIONAL: excess of proceeds of sale is retained by the pledgee Deficiency can be recovered Excess of proceeds of sale belongs to the mortgagor even if there is no stipulation Mortgagee cannot appropriate thing mortgaged. Chattel mortgage registered and accompanied by an affidavit of good faith to bind third persons Deficiency can be recovered EXCEPT on personal property sold in installments Excess of proceeds of sale belongs to the mortgagor even if there is no stipulation REAL MORTGAGE Constituted on movables Must be registered to bind third persons May secure future obligations CHATTEL MORTGAGE Constituted on immovables Must be accompanied by an affidavit of good faith to bind third persons Cannot secure future obligations LAWS GOVERNING CHATTEL MORTGAGES 1. Chattel Mortgage Law (Act No. 1508) 2. Civil code 3. Revised Administrative Code 4. Revised Penal Code 5. Ship Mortgage Decree (Pres. Decree No. 1521) CRIMINAL LIABILITY IN PLEDGE OR MORTGAGE 1. Any person who, pretending to be the owner of any real property, shall convey, sell, encumber, or mortgage, the same shall be guilty of estafa. 2. Any person who, knowing that real property is encumbered, shall dispose of the same as unencumbered, is also guilty of estafa 3. Any person who shall knowingly remove any personal property mortgaged under the Chattel Mortgage Law to any province or city other than that which it was located at the time of the execution of the mortgage, without the written consent of the mortgagee or his executors, administrators, or assignees (punishable under Revised Penal Code) 4. Any mortgagor who shall sell or pledge personal property already pledged, or any part thereof, under the terms of the Chattel Mortgage Law, without the written consent of the mortgagee written on the back of the mortgage and noted on the record thereof in the office of the Register of Deeds of the province where such property is located (punishable under Revised Penal Code) NOTE: mortgagor not relived of criminal liability even if o o the mortgage indebtedness is thereafter paid in full or the mortgagor-seller informed the purchaser that the thing sold had been mortgaged RIGHT OF REDEMPTION 1. When condition of chattel mortgage is BROKEN, the following may redeem: a) Mortgagor; b) Person holding a subsequent mortgage; or c) A subsequent attaching creditor 2. An attaching creditor who so redeems – shall be subrogated to the rights of the mortgagee and entitled to foreclosure same s mortgagee 3. Redemption made – by paying/delivering to mortgagee the amount due, cost and expenses incurred by sch breach of condition before the sale ANTICHRESIS ANTICHRESIS - contract whereby the creditor acquires the right to receive the fruits of an immovable of his debtor, with the obligation to apply them to the payment of the interest, if owing, and thereafter to the principal of his credit o Anti – against o Chresis – use o Antichresis – action of giving a credit against the use of property o It involves an express agreement between the parties such that the creditor will have possession of the debtor's fruits of the property to the interest owed by the debtor, if any, real property given as security, and such creditor will apply the then to the principal amount CHARACTERISTICS OF ANTICHRESIS 1. Accessory contract - dependent upon another for its existence; because it secures the performance of a principal obligation 2. Formal contract - It must be in writing; must be in specific form to be valid The amount of the principal and of the interest shall be in writing; otherwise, the contract of antichresis is void. 3. Nominate contract - It has a special name under the law. 4. Real right - It creates a lien on immovable property. 5. Real property - It is a real property by itself. 6. Indivisible - It subsists as long as the principal obligation remains unpaid. REQUISITES OF ANTICHRESIS 1. That it be constituted to principal obligation may secure all kinds of obligations, be they pure or subject to a resolutory or suspensive condition. 2. That the debtor be the absolute owner of the immovable property. 3. That the debtor must have the free disposal of such immovable property, and in the absence thereof, that he be duly authorized for the purpose. 4. That the amount of the principal and the interest must be in writing; otherwise, the antichresis is void (the principal obligation, however, may still be valid) MEASURE OF APPLICATION OF FRUITS TO INTEREST AND PRINCIPAL The actual market value of the fruits at the time of application thereof to the interest and principal shall be the measure of such application. (Contract does not cover the immovable BUT ONLY its fruits) OBLIGATIONS OF ANTICHRETIC CREDITOR 1. To pay the taxes and charges upon the immovable, unless there is a stipulation to the contrary required to pay indemnity for damages to the debtor if creditor does not pay taxes 2. To bear the expenses necessary for its preservation and repair APPLICATION OF THE FRUITS OF THE IMMOVABLE Another obligation of creditor is to apply the fruits after receiving them to the: 1. The taxes and charges upon the immovable. 2. The expenses for preservation and repair. 3. Interest on the principal obligation. 4. Principal obligation NOTE: the sums spent by creditor in fulfillment of the obligations shall be charged against the fruits of the property WHEN DEBTOR CAN REACQUIRE ENJOYMENT OF PROPERTY 1. Upon full payment of his obligation to the creditor. 2. When he is compelled by the creditor to enter into the enjoyment of the property, unless there is stipulation to the contrary (it is when creditor does not want to pay taxes and expenses incurred for the preservation and repair) EFFECT OF NON-PAYMENT OF THE DEBT WITHIN THE PERIOD AGREED UPON The creditor does not acquire ownership of the immovable for non-payment of the debt within the period agreed upon. Any stipulation to the contrary is void. In case of non-payment, the creditor shall have the following remedies: 1. To petition the court for the payment of the debt. 2. To sell the immovable. The provisions of the Rules of Court on foreclosure of mortgages shall apply. In case of any deficiency in the foreclosure sale, the creditor can recover the deficiency. Article 2085. The following requisites are essential to the contracts of pledge and mortgage: pledge, that the thing pledged be placed in the possession of the creditor, or of a third person by common agreement. (1) That they be constituted to secure the fulfillment of a principal obligation; (2) That the pledgor or mortgagor be the absolute owner of the thing pledged or mortgaged; (3) That the persons constituting the pledge or mortgage have the free disposal of their property, and in the absence thereof, that they be legally authorized for the purpose. Third persons who are not parties to the principal obligation may secure the latter by pledging or mortgaging their own property. Article 2094. All movables which are within commerce may be pledged, provided they are susceptible of possession. Article 2086. The provisions of article 2952 are applicable to a pledge or mortgage. Article 2087. It is also of the essence of these contracts that when the principal obligation becomes due, the things in which the pledge or mortgage consists may be alienated for the payment to the creditor. Article 2088. The creditor cannot appropriate the things given by way of pledge or mortgage, or dispose of them. Any stipulation to the contrary is null and void. Article 2089. A pledge or mortgage is indivisible, even though the debt may be divided among the successors in interest of the debtor or of the creditor. Therefore, the debtor's heir who has paid a part of the debt cannot ask for the proportionate extinguishment of the pledge or mortgage as long as the debt is not completely satisfied. Neither can the creditor's heir who received his share of the debt return the pledge or cancel the mortgage, to the prejudice of the other heirs who have not been paid. From these provisions is excepted the case in which, there being several things given in mortgage or pledge, each one of them guarantees only a determinate portion of the credit. The debtor, in this case, shall have a right to the extinguishment of the pledge or mortgage as the portion of the debt for which each thing is especially answerable is satisfied. Article 2090. The indivisibility of a pledge or mortgage is not affected by the fact that the debtors are not solidarily liable. Article 2091. The contract of pledge or mortgage may secure all kinds of obligations, be they pure or subject to a suspensive or resolutory condition. Article 2092. A promise to constitute a pledge or mortgage gives rise only to a personal action between the contracting parties, without prejudice to the criminal responsibility incurred by him who defrauds another, by offering in pledge or mortgage as unencumbered, things which he knew were subject to some burden, or by misrepresenting himself to be the owner of the same. Article 2093. In addition to the requisites prescribed in article 2085, it is necessary, in order to constitute the contract of Article 2095. Incorporeal rights, evidenced by negotiable instruments, bills of lading, shares of stock, bonds, warehouse receipts and similar documents may also be pledged. The instrument proving the right pledged shall be delivered to the creditor, and if negotiable, must be indorsed. Article 2096. A pledge shall not take effect against third persons if a description of the thing pledged and the date of the pledge do not appear in a public instrument. Article 2097. With the consent of the pledgee, the thing pledged may be alienated by the pledgor or owner, subject to the pledge. The ownership of the thing pledged is transmitted to the vendee or transferee as soon as the pledgee consents to the alienation, but the latter shall continue in possession. Article 2098. The contract of pledge gives a right to the creditor to retain the thing in his possession or in that of a third person to whom it has been delivered, until the debt is paid. Article 2099. The creditor shall take care of the thing pledged with the diligence of a good father of a family; he has a right to the reimbursement of the expenses made for its preservation, and is liable for its loss or deterioration, in conformity with the provisions of this Code. Article 2100. The pledgee cannot deposit the thing pledged with a third person, unless there is a stipulation authorizing him to do so. The pledgee is responsible for the acts of his agents or employees with respect to the thing pledged. Article 2101. The pledgor has the same responsibility as a bailor in commodatum in the case under article 1951. Article 2102. If the pledge earns or produces fruits, income, dividends, or interests, the creditor shall compensate what he receives with those which are owing him; but if none are owing him, or insofar as the amount may exceed that which is due, he shall apply it to the principal. Unless there is a stipulation to the contrary, the pledge shall extend to the interest and earnings of the right pledged. In case of a pledge of animals, their offspring shall pertain to the pledgor or owner of animals pledged, but shall be subject to the pledge, if there is no stipulation to the contrary. Article 2103. Unless the thing pledged is expropriated, the debtor continues to be the owner thereof. Nevertheless, the creditor may bring the actions which pertain to the owner of the thing pledged in order to recover it from, or defend it against a third person. Article 2104. The creditor cannot use the thing pledged, without the authority of the owner, and if he should do so, or should misuse the thing in any other way, the owner may ask that it be judicially or extrajudicially deposited. When the preservation of the thing pledged requires its use, it must be used by the creditor but only for that purpose. Article 2105. The debtor cannot ask for the return of the thing pledged against the will of the creditor, unless and until he has paid the debt and its interest, with expenses in a proper case. Article 2106. If through the negligence or willful act of the pledgee, the thing pledged is in danger of being lost or impaired, the pledgor may require that it be deposited with a third person. Article 2113. At the public auction, the pledgor or owner may bid. He shall, moreover, have a better right if he should offer the same terms as the highest bidder. The pledgee may also bid, but his offer shall not be valid if he is the only bidder. Article 2114. All bids at the public auction shall offer to pay the purchase price at once. If any other bid is accepted, the pledgee is deemed to have been received the purchase price, as far as the pledgor or owner is concerned. Article 2107. If there are reasonable grounds to fear the destruction or impairment of the thing pledged, without the fault of the pledgee, the pledgor may demand the return of the thing, upon offering another thing in pledge, provided the latter is of the same kind as the former and not of inferior quality, and without prejudice to the right of the pledgee under the provisions of the following article. Article 2115. The sale of the thing pledged shall extinguish the principal obligation, whether or not the proceeds of the sale are equal to the amount of the principal obligation, interest and expenses in a proper case. If the price of the sale is more than said amount, the debtor shall not be entitled to the excess, unless it is otherwise agreed. If the price of the sale is less, neither shall the creditor be entitled to recover the deficiency, notwithstanding any stipulation to the contrary. The pledgee is bound to advise the pledgor, without delay, of any danger to the thing pledged. Article 2116. After the public auction, the pledgee shall promptly advise the pledgor or owner of the result thereof. Article 2108. If, without the fault of the pledgee, there is danger of destruction, impairment, or diminution in value of the thing pledged, he may cause the same to be sold at a public sale. The proceeds of the auction shall be a security for the principal obligation in the same manner as the thing originally pledged. Article 2117. Any third person who has any right in or to the thing pledged may satisfy the principal obligation as soon as the latter becomes due and demandable. Article 2109. If the creditor is deceived on the substance or quality of the thing pledged, he may either claim another thing in its stead, or demand immediate payment of the principal obligation. Article 2110. If the thing pledged is returned by the pledgee to the pledgor or owner, the pledge is extinguished. Any stipulation to the contrary shall be void. If subsequent to the perfection of the pledge, the thing is in the possession of the pledgor or owner, there is a prima facie presumption that the same has been returned by the pledgee. This same presumption exists if the thing pledged is in the possession of a third person who has received it from the pledgor or owner after the constitution of the pledge. Article 2111. A statement in writing by the pledgee that he renounces or abandons the pledge is sufficient to extinguish the pledge. For this purpose, neither the acceptance by the pledgor or owner, nor the return of the thing pledged is necessary, the pledgee becoming a depositary. Article 2112. The creditor to whom the credit has not been satisfied in due time, may proceed before a Notary Public to the sale of the thing pledged. This sale shall be made at a public auction, and with notification to the debtor and the owner of the thing pledged in a proper case, stating the amount for which the public sale is to be held. If at the first auction the thing is not sold, a second one with the same formalities shall be held; and if at the second auction there is no sale either, the creditor may appropriate the thing pledged. In this case he shall be obliged to give an acquittance for his entire claim. Article 2118. If a credit which has been pledged becomes due before it is redeemed, the pledgee may collect and receive the amount due. He shall apply the same to the payment of his claim, and deliver the surplus, should there be any, to the pledgor. Article 2119. If two or more things are pledged, the pledgee may choose which he will cause to be sold, unless there is a stipulation to the contrary. He may demand the sale of only as many of the things as are necessary for the payment of the debt. Article 2120. If a third party secures an obligation by pledging his own movable property under the provisions of article 2085 he shall have the same rights as a guarantor under articles 2066 to 2070, and articles 2077 to 2081. He is not prejudiced by any waiver of defense by the principal obligor. Article 2121. Pledges created by operation of law, such as those referred to in articles 546, 1731, and 1994, are governed by the foregoing articles on the possession, care and sale of the thing as well as on the termination of the pledge. However, after payment of the debt and expenses, the remainder of the price of the sale shall be delivered to the obligor. Article 2122. A thing under a pledge by operation of law may be sold only after demand of the amount for which the thing is retained. The public auction shall take place within one month after such demand. If, without just grounds, the creditor does not cause the public sale to be held within such period, the debtor may require the return of the thing. Article 2123. With regard to pawnshops and other establishments, which are engaged in making loans secured by pledges, the special laws and regulations concerning them shall be observed, and subsidiarily, the provisions of this Title. Article 2124. Only the following property may be the object of a contract of mortgage: (1) Immovables; (2) Alienable real rights in accordance with the laws, imposed upon immovables. Nevertheless, movables may be the object of a chattel mortgage. Article 2134. The amount of the principal and of the interest shall be specified in writing; otherwise, the contract of antichresis shall be void. Article 2135. The creditor, unless there is a stipulation to the contrary, is obliged to pay the taxes and charges upon the estate. He is also bound to bear the expenses necessary for its preservation and repair. Article 2125. In addition to the requisites stated in article 2085, it is indispensable, in order that a mortgage may be validly constituted, that the document in which it appears be recorded in the Registry of Property. If the instrument is not recorded, the mortgage is nevertheless binding between the parties. The sums spent for the purposes stated in this article shall be deducted from the fruits. (1882) The persons in whose favor the law establishes a mortgage have no other right than to demand the execution and the recording of the document in which the mortgage is formalized. But the latter, in order to exempt himself from the obligations imposed upon him by the preceding article, may always compel the debtor to enter again upon the enjoyment of the property, except when there is a stipulation to the contrary. Article 2126. The mortgage directly and immediately subjects the property upon which it is imposed, whoever the possessor may be, to the fulfillment of the obligation for whose security it was constituted. Article 2127. The mortgage extends to the natural accessions, to the improvements, growing fruits, and the rents or income not yet received when the obligation becomes due, and to the amount of the indemnity granted or owing to the proprietor from the insurers of the property mortgaged, or in virtue of expropriation for public use, with the declarations, amplifications and limitations established by law, whether the estate remains in the possession of the mortgagor, or it passes into the hands of a third person. Article 2128. The mortgage credit may be alienated or assigned to a third person, in whole or in part, with the formalities required by law. Article 2129. The creditor may claim from a third person in possession of the mortgaged property, the payment of the part of the credit secured by the property which said third person possesses, in the terms and with the formalities which the law establishes. Article 2130. A stipulation forbidding the owner from alienating the immovable mortgaged shall be void. Article 2131. The form, extent and consequences of a mortgage, both as to its constitution, modification and extinguishment, and as to other matters not included in this Chapter, shall be governed by the provisions of the Mortgage Law and of the Land Registration Law. Article 2132. By the contract of antichresis the creditor acquires the right to receive the fruits of an immovable of his debtor, with the obligation to apply them to the payment of the interest, if owing, and thereafter to the principal of his credit. Article 2133. The actual market value of the fruits at the time of the application thereof to the interest and principal shall be the measure of such application. Article 2136. The debtor cannot reacquire the enjoyment of the immovable without first having totally paid what he owes the creditor. Article 2137. The creditor does not acquire the ownership of the real estate for non-payment of the debt within the period agreed upon. Every stipulation to the contrary shall be void. But the creditor may petition the court for the payment of the debt or the sale of the real property. In this case, the Rules of Court on the foreclosure of mortgages shall apply. Article 2138. The contracting parties may stipulate that the interest upon the debt be compensated with the fruits of the property which is the object of the antichresis, provided that if the value of the fruits should exceed the amount of interest allowed by the laws against usury, the excess shall be applied to the principal. Article 2139. The last paragraph of article 2085, and articles 2089 to 2091 are applicable to this contract. Article 2140. By a chattel mortgage, personal property is recorded in the Chattel Mortgage Register as a security for the performance of an obligation. If the movable, instead of being recorded, is delivered to the creditor or a third person, the contract is a pledge and not a chattel mortgage. Article 2141. The provisions of this Code on pledge, insofar as they are not in conflict with the Chattel Mortgage Law shall be applicable to chattel mortgages.