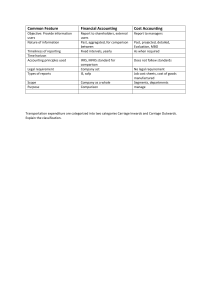

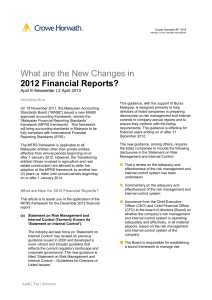

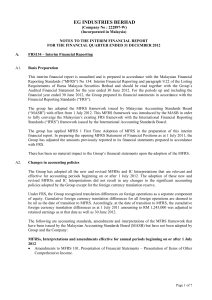

BKAR3033 FINANCIAL ACCOUNTING & REPORTING III A221 PROJECT GUIDELINE (20%) AND PRESENTATION (5%) APPLICATION OF MFRS BY MALAYSIAN COMPANIES DUE DATE: 18 JANUARY 2023 _________________________________________________________________________ OBJECTIVE The objectives of this project are three-fold. Firstly, to a) enhance students’ understanding of the application and disclosure of MFRS 108 Changes in Accounting policy, Estimates and Errors, MFRS 110 Events After Reporting period, MFRS 116 Property Plant Equipment, and MFRS 136 Impairment by Malaysian listed companies. Secondly, b) to analyse other related disclosure – Key Audit Matters, c) to assess companies’ performance before and during Covid-19. The project requires students to analyse listed companies’ annual reports for the financial year ending 2020 and 2021. REQUIRED 1. This group project comprises at most 5 members. Each student is to find 1 company. Thus, a group of five members will have a total of 5 different companies. 2. Retrieve the company’s annual report for the years 2020 and 2021 at http://www.bursamalaysia.com/market/ ✅ Allocation of companies for each lecture group is as follows: Group Same company as CC1 with an alphabet: A A-B B C-D C E-F D G-H E I-J F K-L G M-N H O-P I Q-R J S-T 1 K L M N 3. U-V W-X Y, U &V K-L, V-X Identify items qualified under i) MFRS 108 Changes in Accounting policy Estimates and Errors, none ii) MFRS 110 Events After Reporting period governance, and ( 202096- expected credit losses of financial assets, fair value measurements of financial instruments, impairment assessments of assets (property, plant and equipment and goodwill, 2021- ✅ iii) Key Audit Matters that have been reported in the financial statements. ✅ Please be informed that companies might use different terms for this information. Prepare a report explaining all these findings using your own words. Capture the evidence for the list of events qualified as i) MFRS 108, MFRS 110, and Key Audit Matters No evidence is required if there is no information on MFRS 108, MFRS 110✅, and critical audit matters ✅ in the annual report. ii) i) ii) Examine the disclosures of MFRS 116 and MFRS 136 on the company’s annual report. Download both standards from www.masb.org.my. For MFRS 116, go to the Disclosure section on page 1110. Refer to para 73. You are required to examine the disclosure of all items under para 73 by selected companies. For MFRS 136, go to the Disclosure section on page 1410. Refer to para 130. You are required to examine the disclosure of all items under para 130 by selected companies. For this task, prepare a checklist for both paragraphs and check whether the companies disclose the required item together with the evidence (screenshot/print screen). Format for report writing: Line spacing: 2; Font: Times New Roman (size 12) and should not exceed 50 pages, excluding references and appendices. iii) Softcopy of your project should include the following: 2 (a) (b) the write-up of your project in a word file. Slide/Video presentation (15 to 20 minutes). 8. Group video presentation should be brief and concise, covering significant project findings. It should be at most 20 minutes long. 9. Content of the project report should be organised as follows: i. Introduction - briefly explain the project. ii. Background of companies - briefly explain the companies and the business activities of the companies. (Not more than four pages in total). iii. Disclosure of MFRS 108. Discuss the availability of the information in the company’s annual report, the frequently reported policy changes, the accounting treatment, and/or the possible impact of the events on the company’s financial position, if available. iv. Disclosure of MFRS110. Discuss the availability of the information in the company’s annual report. Discuss the type of accounting treatment and/or the possible impact of the events on the company’s financial position if available. v. Disclosure of MFRS116 and MFRS 136. Examine the disclosure of both standards and provide a checklist. vi. Discuss the information related to critical audit matters. What are the common key audit matters disclosed in the sample companies? ✅ Common key audit matters include: - Recoverability of the trade receivables vii. Prepare a financial statement analysis on the impact of COVID19 on the firm’s financial performance. Use at least 3 (THREE) financial performance matrices (profitability, liquidity, solvency, market) to assess the firm’s performance during Covid-19 (the years 2020 and 2021). viii. Conclusion - briefly summarise your project findings on MFRS 108 disclosures, MFRS 110 disclosures, MFRS 116, MFRS 136, and critical audit matters. Provide a brief discussion on what you have learned from the project, including any problems and issues encountered. 3 4