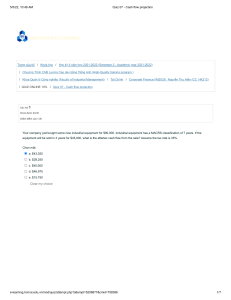

Anh 31191026414 - Từ Lê Minh Nhà của tôi Các khoá học của tôi KTQT 2-116- Từ 24-3 đến 19-5- S5 Ôn tập và KIỂM TRA GIỮA KỲ (Week 9) Ôn tập TNTA Bắt đầu vào lúc Trạng thái Kết thúc lúc Thời gian thực hiện Điểm Câu Hỏi 1 Thứ hai, 30 Tháng 5 2022, 8:37 PM Đã xong Thứ hai, 30 Tháng 5 2022, 8:41 PM 4 phút 5 giây 9,00 trên 10,00 (90%) Hoàn thành Đạt điểm 1,00 trên 1,00 A company's profit after tax for the year to 31 December 2015 was £150,000. The comparative figure for 2014 was £135,000. The company's issued share capital at 1 January 2014 consisted of 240,000 ordinary shares. A 1 for 4 bonus issue was made on 1 July 2015. There were no other share issues in either year. Basic EPS for 2015 and restated basic EPS for 2014 are: a. 55.6p and 50p b. 55.6p and 56.25p c. 50p and 45p d. 50p and 56.25p Câu Hỏi 2 Hoàn thành Đạt điểm 1,00 trên 1,00 Given the definition adopted in IAS 32 – Financial instruments: presentation, which one of the following would not be a financial instrument? a. forward exchange contract b. prepaid insurance c. Cash at bank d. Bill of exchange Câu Hỏi 3 Hoàn thành Đạt điểm 1,00 trên 1,00 Which of the following should be deducted from accounting profit when computing current income tax expense? a. Deductible and recognised expense b. Non-deductible but recognised c. Non-deductible expense but not recognised d. Deductible expense but not recognised Câu Hỏi 4 Hoàn thành Đạt điểm 1,00 trên 1,00 A tax base of an asset or a liability is: a. Difference between the temporary difference of that asset or liability and its fair value. b. The amount that can be deductible in the future tax return with respect to that asset or liability c. The amount attributed to that asset or liability for tax purposes. d. Difference between the temporary difference of that asset of liability and the present value of future cash flows derived from that asset or liability. Câu Hỏi 5 Hoàn thành Đạt điểm 1,00 trên 1,00 When should the financial instrument be recognized in the financial statements? a. When it is probable that future economic benefits associated with the instrument will flow to the entity and the cost of the instrument can be measured reliably. b. On the trade date or the settlement date, based on the accounting model applied by the entity. c. When the entity becomes a party to the contractual provisions of the instrument. d. On the date when the financial instrument is delivered to the entity and the entity formally accepts and confirms delivery. Câu Hỏi 6 Hoàn thành Đạt điểm 1,00 trên 1,00 For a share-based payment transaction in which the terms of the arrangement provide an entity with the choice of whether to settle in cash or by issuing equity instruments, the entity shall determine whether it has ------------ to settle in cash and account for the share-based payment transaction accordingly. a. A deferred liability b. A present obligation c. future obligation d. A contingent liability Câu Hỏi 7 Hoàn thành Đạt điểm 1,00 trên 1,00 A company's profit after tax for the year to 31 December 20X1 was $300,000. The comparative figure for 20X0 was $180,000. The company's issued share capital at 1 January 20X0 consisted of 1.000.000 ordinary shares. A 1 for 2 bonus issue was made on 1 October 20X1. There were no other share issues in either year. Basic EPS for 20X1 and restated basic EPS for 20X0 are: a. $ 0.3 & $0.18 b. $ 0.3 & $ 0.12 c. $ 0.2 & $ 0.12 d. $ 0.2 & $0.18 Câu Hỏi 8 Hoàn thành Đạt điểm 1,00 trên 1,00 Deferred tax should be accounted for in relation to certain differences between taxable profit and accounting profit. The differences which require an entity to account for deferred tax are: a. Both temporary differences and permanent differences b. Permanent differences c. Neither temporary differences nor permanent differences d. Temporary differences Câu Hỏi 9 Hoàn thành Đạt điểm 0,00 trên 1,00 Basic earnings per share shall be calculated by dividing the numerator by the number of ordinary shares outstanding (the denominator): a. At the start of the period b. At the end of the period c. At the date of the capitalisation issue d. The weighted-average during the period Câu Hỏi 10 Hoàn thành Đạt điểm 1,00 trên 1,00 Deferred tax asset shall be recognized: a. For all deductible temporary differences, to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised b. For all taxable temporary differences, to the extent that it is probable that taxable profit will be available against which the taxable temporary difference can be utilised. c. For all deductible temporary differences including the goodwill arising on business combination. d. For all taxable temporary differences including the goodwill arising on business combination. ◄ ôn tập TNTV Chuyển tới... Kiểm tra giữa kỳ ►