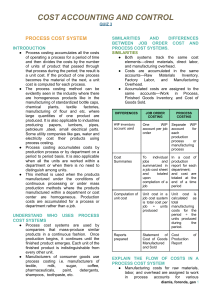

Presenter: Rex Jhon A. Suello Master in Business Administration BA504 – Management Accounting Dr. Christopher Plamenco Process Costing System • • • • Oftentimes, the production of manufactured products is easily divisible into specific jobs, and job order costing system is appropriate. However, job order costing system does not work well when the production cycle involves a continuous flow of raw materials through various processing departments, and the finished output is characterized as homogenous units, each displaying the same basic characteristics. Wood pulp is processed into giant rolls of paper, refineries process crude oil into gasoline, iron ore is processed into steel, sand is processed into glass, and so forth. The physical nature of these processes makes it hard to identify and associate specific units of direct labor and direct material with the final output. Process Costing System • Process Costing System is a methodology used in cost accounting to allocate the total cost of production to homogenous units produced via a continuous process that usually involves multiple steps or departments. https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.euroglaces.eu%2Fice-creamtechnology&psig=AOvVaw0OvZfs6v_RPrfaT8P3A0O&ust=1683830563177000&source=images&cd=vfe&ved=0CBEQjRxqFwoTCKiaguaz6_4CFQAAAAAdAAA AABAZ Process Costing System Materials Assembly Dept. Work-in-process Department Process 1 xxx Labor xxx xxx Overhead Cost of completed units in Dept. 1 transfer to Dept 2 Paints Dept. Work-in-process Department Process 2 x Plus additional applicable M, L, OH Cost of completed units in Dept. 2 transfer to Dept 3 Packaging Dept. Work-in-process Department Process 3 x Plus additional applicable M, L, OH Cost of completed units in Dept. 3 transfer to FGI Finished goods inventory x When sold, debit to COGS Step 1 Analyze the cost-flow model by determining the inventory levels on: 1. Beginning balance of work-in-process inventory for a specific department (which were not completed in the previous period). 2. Units started during the period in the department. 3. How much of the beginning WIP units and units started during the period were completed in the same period. 4. Units not yet finished (WIP, ending which will be brought to the next period as WIP, beginning). Step 2 Determine the number of equivalent units produced in the process called EQUIVALENT UNITS OF PRODUCTION (EUP). For example, if the ending work-in-process inventory in a specific department is 1,000 units and all materials were added at the beginning of the process and labor and overhead applied to units is 60% complete as to conversion, the EUP will be: Materials Labor and Overhead 1,000 units x 100% = 1,000 units 1,000 units x 60% = 600 units Step 3 Calculate all of the applicable direct costs and indirect costs that was incurred in the production process so that these cost will be assigned later to the equivalent units as to completed units and in-process units. Relevant costs in this scenario includes all costs associated with beginning inventories and current period costs added to continue the production process. Step 4 Calculate the cost per equivalent unit of production (Cost per EUP). Cost per EUP = Applicable costs in the production process / EUP Step 5 When cost per EUP is available, allocate all relevant costs to all products completed and all products still in process. KEY TAKEAWAY The cost flows in a process costing system are similar to the cost flows in a job costing system. The primary difference between the two costing methods is that a process costing system assigns product costs—direct materials, direct labor, and manufacturing overhead—to each production department (or process) rather than to each job. Each production department has its own work-in-process inventory account when using process costing. References • • • https://saylordotorg.github.io/text_managerial-accounting/s08-02-product-costflows-in-a-proces.html https://www.youtube.com/watch?v=Gf_ou5bqsGE https://www.youtube.com/watch?v=pjG1yZBFazY