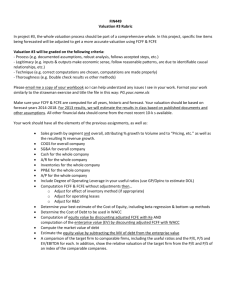

Free Cash Flow to Firm (FCFF) and Free Cash Flow to Equity (FCFE) Dr. Manish Dadhich Definition of Cash Flow • The incoming and outgoing of cash in a particular financial year results in the increase or decrease in the cash position of the company is known as cash flow. • It arises due to the activities of the business, i.e. operating, investing and financing activities. In a nutshell, the difference between cash at the beginning and the end of the financial year is regarded as cash flow for the respective year. Definition of Free Cash Flow • The actual cash available with the company, for distribution it to its security holders, is known as free cash flow. A positive free cash flow reveals that the company is generating enough cash to run the enterprise efficiently. • However, the Negative free cash flow shows that the company is not able to generate sufficient cash, or it has invested money somewhere else which will generate high returns in the future. BASIS FOR COMPARISON CASH FLOW FREE CASH FLOW Meaning Movement of cash of an organization, resulting in either increase or decrease of its cash is known as cash flow. Cash available with the organization to be distributed among security holders is known as free cash flow. Calculation The sum total of Operating, Operating Cash flows less Investing and Financing cash flows. Capital Expenditure. Advantage Helpful in determining the liquidity Helpful in determining a of the company. company's financial health. Scope It is formalistic and common phenomenon. It is more comprehensive and realistic to the firm Benefits of Free Cash Flow (FCF) • Because FCF accounts for changes in working capital, it can provide important insights into the value of a company and the health of its fundamental trends. For example, a decrease in accounts payable (outflow) could mean that vendors are requiring faster payment. • A decrease in accounts receivable (inflow) could mean the company is collecting cash from its customers quicker. An increase in inventory (outflow) could indicate a building stockpile of unsold products. Including working capital in a measure of profitability provides an insight that is missing from the income statement. Importance of the free cash flow • Knowing the company’s free cash flow enables management to decide on future ventures that would improve the shareholder value. Additionally, having an abundant FCF indicates that a company is capable of paying their monthly dues. • Companies can also use their FCF to expand business operations or pursue other short-term investments. Compared to earnings per share, free cash flow is more transparent in showing the company’s potential to produce cash and profits. Importance of the free cash flow • Meanwhile, other entities looking to invest may likely consider companies that have a healthy free cash flow because of a promising future. • Couple this with a low-valued share price, investors can generally make good investments with companies that have high FCF. Other investors greatly consider FCF compared to other measures because it also serves as an important basis for stock pricing. Limitations associated with the free cash flow • The company’s net income greatly affects a company’s free cash flow because it also influences a company’s ability to generate cash from operations. As such, other activities (i.e. those not within the core business operations of a company) from which the company generates income must be scrutinized deeply in order to reflect a more appropriate FCF value. Limitations associated with the free cash flow • On the investors’ side, they must be wary of a company’s policies that affect their declaration of FCF. • For example, some companies lengthen the time to settle their debts to maintain cash or, the opposite; shortening the time they collect debts due to them. Companies also have different guidelines on which assets they declare as capital expenditures, thus affecting the computation of FCF. Types of Free Cash Flow 1. Free Cash Flow to the Firm (FCFF) also referred to as “unlevered” 2. Free Cash Flow to Equity also knows as “levered” 1. Free Cash Flow to the Firm (FCFF) • Free cash flow to the firm (FCFF) represents the amount of cash flow from operations available for distribution after depreciation expenses, taxes, working capital, and investments are accounted for and paid. • FCFF is essentially a measurement of a company's profitability after all expenses and reinvestments. It is one of the many benchmarks used to compare and analyze a firm's financial health. Characteristics of FCFE 1. Free cash flow to the firm (FCFF) represents the cash flows from operations available for distribution after depreciation expenses, taxes, working capital, and investments are accounted for. 2. Free cash flow is arguably the most important financial indicator of a company's stock value. 3. A positive FCFF value indicates that the firm has cash remaining after expenses. 4. A negative value indicates that the firm has not generated enough revenue to cover its costs and investment activities. The Formula for FCFF: • Free Cash Flow to Equity (FCFE) is another cash flow measure that focuses on cash flows to equity holders alone. • FCFE = Net Income + Depreciation – (Change in noncash Working Capital) – Capital Expenditures – Net Debt Paid. • FCFE can also be computed (as an historical quantity) from the statement of cash flows as – FCFE = Cash flow from Operations – Capital Expenditures – Net Debt paid (short-term and long-term) • If there are other non-common stock securities, cash flows associated with them, such as preferred dividends are also subtracted. • The value of common equity is the discounted present value of free cash flows to equity. Another formula • • • • • FCFF=CFO+ (IE×(1−TR))−CAPEX where: CFO=Cash flow from operations IE=Interest Expense CAPEX=Capital expenditures 2. Free Cash Flow to Equity • In corporate finance, free cash flow to equity (FCFE) is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacks—after all expenses, reinvestments, and debt repayments are taken care of. Whereas dividends are the cash flows actually paid to shareholders, the FCFE is the cash flow simply available to shareholders. 2. Free Cash Flow to Equity • Free cash flow to equity is the cash flow available to the company ’ s holders of common equity after all operating expenses, interest, and principal payments have been paid and necessary investments in working and fixed capital have been made. FCFE is the cash flow from operations minus capital expenditures minus payments to (and plus receipts from) debt holders. 2. Free Cash Flow to Equity • The way in which free cash flow is related to a company ’ s net income, cash flow from operations, and measures such as EBITDA (earnings before interest, taxes, depreciation, and amortization) is important: • The analyst must understand the relationship between a company ’ s reported accounting data and free cash flow in order to forecast free cash flow and its expected growth. Although a company reports cash flow from operations (CFO) on the statement of cash flows, CFO is not free cash flow. Net income and CFO data can be used, however, in determining a company ’ s free cash flow. FCFE Formula Additional Comments Net Income (+) Depreciation & Amortization (+/-) Changes in Working Capital (-) Capex (+/-) Net Borrowings Net Income is after the payment of Interest expense. Net Income can be taken directly from the Income Statement. You can also find this in the Cash Flow from Operations if the CFO is prepared using the In-direct method Add back all the non-cash charges Generally, this number is found in the Income Statements. In some companies, Deprecation & Amortization head is not given separately as these expense gets included in Cost of Goods Sold, SG&A You can find Depreciation & Amortization figures from the Cash Flow statements (CFO) Please note that this cash is either an outflow or an inflow. Working capital primarily includes Inventory, Receivables, Payables. You may also include accrued liabilities in this formula. Short term debt is not included here in the changes in Working Capital Critical to determining CapEx levels required to support sales and margins in the forecast This number can be most easily located from Cash Flow from Investments. Please note that not only the Capital Expenditure is taken, we must also include “addition to intangibles”. Intangibles become important for software/knowledge-based businesses. Like working capital, this number can also be an outflow or an inflow This includes both the short term debt as well as the long term debt. Formula • Free Cash Flow to Equity Formula Starting from EBIT • FCFE Formula = EBIT – Interest – Taxes + Depreciation & Amortization + Changes in WC + Capex + Net Borrowings • Free Cash Flow to Equity Formula Starting from FCFF • FCFE Formula = FCFF – [ Interest x (1-tax)] + Net Borrowings Illustration • Operating profit = 168 NCA = 1345 Income tax expense = 15 Interest on loan = 74 • Depreciation is charged at 10% per annum on the year end non-current asset balance and is included in other operating costs in the income statement. • The investment in net working capital in Y0 was 220 and in Y1 increased to 240. Projected cash flows Year 1 Operating profit 168 Add depreciation (1340 x 10%) 134 Less incremental working capital (240 -220) Less taxation (20) Less interest (74) (15) –––––– Free cash flow to equity 193 Difference between FCFF and FCFE Factors FCFF FCFE Cash Flows Pre Debt Cash Flows post Debt Cash Flows Expected Growth Growth in Operating Income = Reinvestment rate * ROC Growth in Net Income = Retention ratio * ROE Discount Rate WACC Cost of Equity Beta Bottom- up Bottom-up • Thx