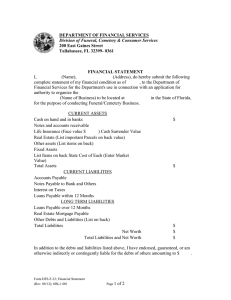

Jeshaun Charles Balance Sheet Notes The Balance Sheet has many uses some of which may include: 1. Liquidity- this would refer to how easy assets can be converted to cash. 2. Solvency- this indicates the ability to pay debts when they are due. 3. Financial Flexibility- the ability to alter amounts and timings of cash. The Balance Sheet Limitations are: It does not reflect the fair value for some accounts, a lot of judgement and estimates are used, it fails to include some items of financial value that would not be able to be valued objectively. Asset Classifications 1. Current Assets are assets that a company can convert easily into cash, sell or consume within a year. This would include Receivables, Inventories, Prepaid Expense, Cash and Cash Equivalents and Market Securities. 2. Long-term Investments have four types which are Investments in Securities, Investment in Tangible Assets, Investments set aside in special funds, and Investment in non-consolidated subsidiaries. 3. Property, Plant and Equipment (PPE) 4. Intangible Assets 5. Other Assets would include of a wide variety of items that do not appear to fall clearly into one of the other classifications. a) Noncurrent Receivables b) Prepaid Pension Costs c) Deferred Income Taxes d) Advances to Subsidiaries Liabilities Classification There are two types of Liabilities which are: 1. Current Liabilities are debts that are due within one year or the operating cycle. This would include Accounts Payable, Wages Payable, Salary Payable, Note Payable and Income Tax Payable. 2. Long-term Liabilities are debts that due more than one year or the operating cycle. This would include Bonds Payable, Mortgage Payable, Notes Payable and Pension Obligations. Equity Classifications 1. Capital Stocks 3. Accumulated or other Comprehensive Income 5. Non-Controlling Interest 2. Retained Earnings 4. Less: Treasury Shares