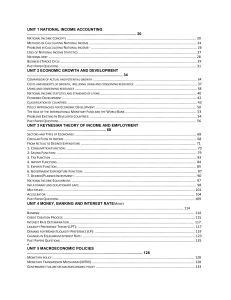

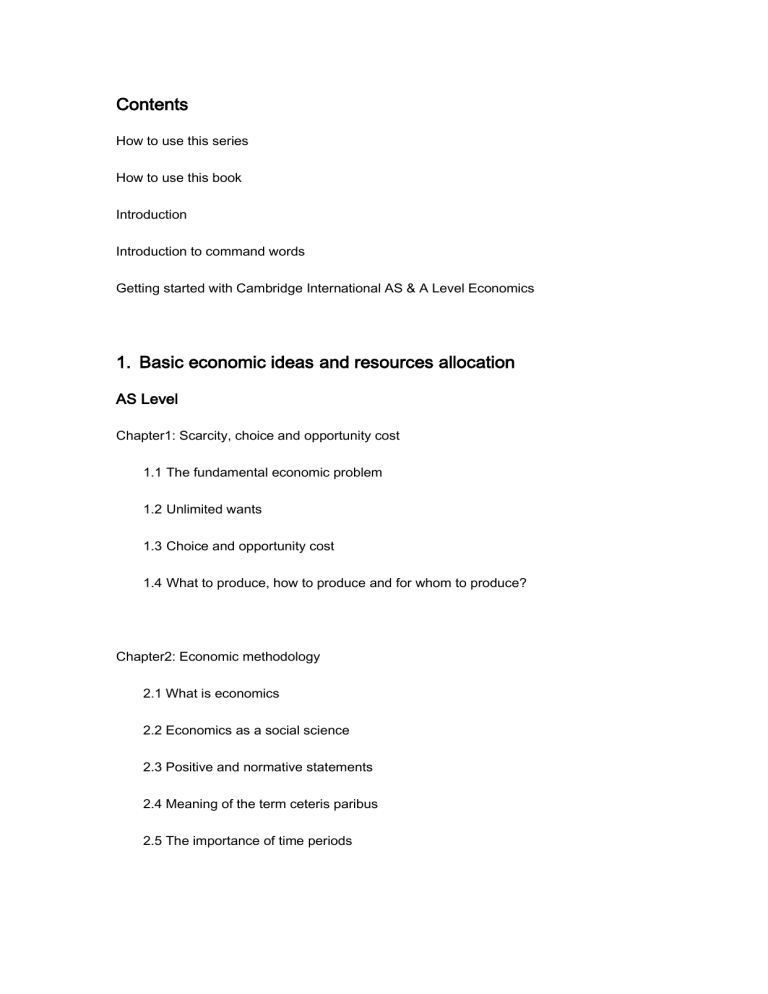

Contents How to use this series How to use this book Introduction Introduction to command words Getting started with Cambridge International AS & A Level Economics 1. Basic economic ideas and resources allocation AS Level Chapter1: Scarcity, choice and opportunity cost 1.1 The fundamental economic problem 1.2 Unlimited wants 1.3 Choice and opportunity cost 1.4 What to produce, how to produce and for whom to produce? Chapter2: Economic methodology 2.1 What is economics 2.2 Economics as a social science 2.3 Positive and normative statements 2.4 Meaning of the term ceteris paribus 2.5 The importance of time periods Chapter3: Factors of production 3.1 The factors of production 3.2 The difference between human capital and physical capital 3.3 Specialisation and the division of labour 3.4 The role of the entrepreneur Chapter4: Resource allocation in different economic systems 4.1 What are economic systems? 4.2 The market economy 4.3 The planned economy 4.4 The mixed economy Chapter5: Production possibility curves 5.1 The production possibility curve 5.2 The production possibility curve and opportunity cost 5.3 The shape of the production possibility curve 5.4 Shifts in the production possibility curve Chapter6: Classification of goods and services End-of-unit exam-style questions 6.1 Excludability and rivalry 6.2 Private goods 6.3 Public goods 6.4 Merit goods, demerit goods and information failure 2. The price system and the microeconomy AS Level: Chapter7: Demand and supply curves 7.1 The price mechanism and markets 7.2 Demand 7.3 The demand curve/ The factors that affect demand 7.4 Supply 7.5 The supply curve 7.6 The factors affecting supply 7.7 Cause of a shift in the demand curve 7.8 Causes of a shift in the supply curve 7.9 How to distinguish between a shift in the demand or supply curve and a moment along the curves. Chapter8: Price elasticity, income elasticity and cross elasticity of demand 8.1 What do economists mean by elasticity? 8.2 Price elasticity of demand 8.3 Income elasticity of demand 8.4 Cross elasticity of demand 8.5 How price, income and cross elasticities of demand can affect decision-making Chapter9: Price elasticity of supply 9.1 Price elasticity of supply 9.2 Factors influencing price elasticity of supply 9.3 Implications of PES for the ways in which businesses react to changing market conditions Chapter10: The interaction of demand and supply 10.1 Market equilibrium and disequilibrium 10.2 The effects of shifts in demand and supply curves on equilibrium price and quantity 10.3 Relationships between markets 10.4 The functions of price in resource allocation Chapter11: Consumer and producer surplus 11.1 The significance of consumer surplus 11.2 The significance of producer surplus A Level: Chapter30: Utility 30.1 Utility and diminishing marginal utility 30.2 The equi-marginal principle 30.3 Derivation of an individual demand curve 30.4 Limitations of marginal utility theory and assumptions of rational behaviour Chapter31: Indifference curves and budget lines 31.1 Indifference curves 31.2 Budget lines 31.3 The income and substitution effects of a price change 31.4 Limitations of the model of indifference curves Chapter32: Efficiency and market failure 32.1 Introduction to efficiency 32.2 Conditions needed for productive efficiency 32.3 Conditions needed for allocative efficiency 32.4 Pareto optimality 32.5 Dynamic efficiency 32.6 Market failure Chapter33: Private costs and benefits, externalities and social costs and benefits 33.1 Externalities 33.2 Types of cost and benefits 33.3 Negative and positive externalities of production and consumption 33.4 Asymmetric information and moral hazard 33.5 Use of costs and benefits in analysing decisions Chapter34: Types of cost, revenue and profit, short-run and long-run production 34.1 Introduction to production 34.2 Short-run production function 34.3 Short-run cost function 34.4 Long-run production function 34.5 Long-run cost function 34.6 Internal and external economies and diseconomies of scale 34.7 Total, average and marginal revenue 34.8 Normal, subnormal and supernormal profit Chapter35: Different market structures 35.1 Market structures and their characteristics 35.2 Barriers to entry and exit 35.3 Performance of firms in different market structures 35.4 Comparison of monopoly with perfect competition 35.5 Contestable markets Chapter36: Growth and survival of firms 36.1 Reasons for different sizes of firms 36.2 Internal and external growth of firms 36.3 Integration 36.4 Cartels 36.5 The principal-agent problem Chapter37: Differing objectives and policies of firms 37.1 The traditional profit maximizing objective 37.2 Other objectives of firms 37.3 Price discrimination 37.4 Other pricing policies 37.5 Relationship between price elasticity of demand and a firm’s revenue 3. Government microeconomic intervention AS Level: Chapter12: Reasons for government intervention 12.1 What is market failure? 12.2 How governments intervene in markets 12.3 Controlling prices in markets Chapter13: Methods and effects of government 13.1 The impact and incidence of specific indirect taxes 13.2 The impact and incidence of subsidies 13.3 The direct provision of goods and services 13.4 Maximum and minimum prices 13.5 Buffer stock schemes 13.6 Provision of information Chapter14: Addressing income and wealth inequality 14.1 Income and wealth 14.2 Measuring income and wealth inequality 14.3 Economic reasons for inequality of income and wealth 14.4 Policies to redistribute income and wealth A Level: Chapter38: Government policies to achieve efficient resource allocation and correct market failure 38.1 Government policies to correct negative and positive externalities 38.2 Other tools to correct market failure 38.3 Government failure in microeconomic intervention Chapter39: Equity and redistribution of income and wealth 39.1 Equity, equality and efficiency 39.2 Absolute and relative poverty 39.3 Policies towards equity Chapter40: Labour market forces and government intervention 40.1 The demand for labour 40.2 The supply of labour 40.3 Wage determination in perfect markets 40.4 Wage determination in imperfect markets 40.5 Wage differentials 40.6 Transfer earnings and economic rent 4. The macroeconomy AS Level: Chapter15: National income statistics 15.1 National income statistics 15.2 Gross domestic product and gross national income 15.3 Methods of measuring GDP 15.4 Market prices and basic prices 15.5 Gross values and net values Chapter16: Introduction to the circular flow of income 16.1 The circular flow of income 16.2 The difference between an open and a closed economy 16.3 The impact of injections and leakages on the circular flow 16.4 Equilibrium and disequilibrium income 16.5 Links between injections and leakages Chapter17: Aggregate demand and aggregate supply analysis 17.1 Aggregate demand 17.2 Determinants of the components of aggregate demand 17.3 The aggregate demand curve 17.4 Aggregate supply 17.5 Macro equilibrium and disequilibrium Chapter18: Economic growth 18.1 Economic growth 18.2 Measurement of economic growth 18.3 Nominal GDP and real GDP 18.4 Causes and consequences of economic growth Chapter19: Unemployment 19.1 Unemployment 19.2 The labour force 19.3 Level of unemployment 19.4 The stock and flow of unemployment 19.5 Measure of unemployment 19.6 The causes of unemployment 19,7 The consequences of unemployment 19.8 How significant is unemployment? Chapter20: Price stability 20.1 What is price stability 20.2 Inflation, deflation and disinflation 20.3 Calculating the inflation rate 20.4 Measurement of inflation and deflation 20.5 The difficulties of measuring changes in the price level 20.6 The difference between money values and real data 20.7 The causes of inflation 20.8 The consequences of inflation 20.9 Extension: The causes and consequences of deflation Chapter41: The circular flow of income 41.1 The multiplier 41.2 Components of aggregate demand and their determinants 41.3 Full employment level of national income and equilibrium level of national income Chapter42: Economic growth and sustainability 42.1 Actual and potential economic growth 42.2 Positive and negative output gaps 42.3 The business cycle 42.4 Policies to promote economic growth 42.5 Inclusive economic growth 42.6 Sustainable economic growth A Level: Chapter43: Employment and unemployment 43.1 Full employment 43.2 Equilibrium and disequilibrium unemployment 43.3 Voluntary and involuntary unemployment 43.3 The natural rate of unemployment 43.4 The natural rate of unemployment 43.5 Patterns and trends in unemployment 43.6 Patterns and trends in employment 43.7 The forms of labour mobility 43.8 Policies to reduce unemployment Chapter44: Money and banking 44.1 Introduction to money 44.2 The money supply 44.3 The quantity theory of money 44.4 Functions of commercial banks 44.5 Causes of changes in the money supply 44.6 The effectiveness of policies to reduce inflation 44.7 The liquidity preference theory 44.8 Interest rate determination 5. Government macroeconomic intervention AS Level: Chapter21: Government macroeconomic policy objectives 21.1 Price stability 21.2 Low unemployment 21.3 Economic growth Chaapter22: Fiscal policy 22.1 Fiscal policy and the budget 22.2 The national debt 22.3 Taxation 22.4 Government spending 22.5 Expansionary and contractionary fiscal policy Chapter23: Monetary policy 23.1 What is monetary policy 23.2 The tools of monetary policy 23.3 The difference between expansionary and contractionary monetary policy 23.4 The impact of expansionary and contractionary monetary policy Chapter24: Supply-side policy 24.1 Supply-side policy objectives 24.2 Supply-side policy tools/ The impact pf Supply-side policy tools on the macroeconomy 24.3 The effectiveness of supply-side policies A Level: Chapter45: Government macroeconomic policy 45.1 Inflation 45.2 Balance of payments stability 45.3 Unemployment 45.4 Economic growth 45.5 Economic development 45.6 Sustainability 45.7 Redistribution of income and wealth Chapter46: Links between macroeconomic problems and their interrelatedness 46.1 The relationship between the internal and external value of money 46.2 The relationship between the balance of payments and inflation 46.3 The relationship between growth and inflation 46.4 The relationship between growth and the balance of payments 46.5 The relationship between inflation and unemployment Chapter47: Effectiveness of policy options to meet all macroeconomic objectives 47.1 The effectiveness of fiscal policy in relation to different macroeconomic objectives 47.2 The effectiveness of monetary policy in relation to different macroeconomic objectives 47.3 The effectiveness of supply-side policy in relation to different macroeconomic objectives 47.4 The effectiveness of exchange rate policy in relation to different macroeconomic objectives 47.5 The effectiveness of international trade policy in relation to different macroeconomic objectives 47.6 The problems arising from conflicts between policy objectives 47.7 Government failure in macroeconomic policies 6. International economic issues AS Level: Chapter25: The reasons for international trade 25.1 Absolute and comparative advantage 25.2 The benefits of specialization and free trade (trade liberalization) 25.3 Exports, imports and the term of trade 25.4 Limitations of the theory of absolute and comparative advantage Chapter26: Protectionism 26.1 Protectionism 26.2 Tools of protection and their impact 26.3 The arguments for protectionism 26.4 The arguments against protectionism Chapter27: Current account of the balance of payments 27.1 What is a country’s balance of payments? 27.2 Components of the current account of balance of payments 27.3 Balance and imbalances (deficit and surplus) in the current account of the balance of payments 27.4 Current account balance calculations 27.5 Causes of imbalances in the current account of balance of payments 27.6 Consequences of imbalances in the current account on the economy Chapter28: Exchange rates 28.1 The exchange rate 28.2 How a floating exchange rate is determined 28.3 Depreciation and appreciation of a floating exchange rate 28.4 The causes of changes in a floating exchange rate 28.5 The impact of exchange rate changes on the domestic economy Chapter29: Policies to correct imbalances in the current account of the balance of payments 29.1 Government policy objective of stability of the current account 29.2 The effect of fiscal policy on the current account 29.3 The effect of monetary policy on the current account 29.4 The effect of supply-side policy on the current account A Level: Chapter48: Policies to correct disequilibrium in the balance of payments 48.1 The components of the balance of payments 48.2 Effect of fiscal, monetary, supply-side, protectionist and the exchange rate policies on the balance of payments 48.3 Expenditure-switching and expenditure-reducing policies Chapter49: Exchange rates 49.1 Measurement of exchange rates 49.2 Determination of exchange rates 49.3 Revaluation and devaluation of a fixed exchange rate 49.4 Changes in the exchange rate under different exchange rate systems 49.5 The effects of changing exchange rate on the external economy Chapter50: Economic development 50.1 How economies are classified in terms of development and national income 50.2 Other indicators of living standards and economic development 50.3 Comparison of economic growth rates and living standards Chapter51: Characteristics of countries at different levels of development 51.1 Population growth and structure 51.2 Income distribution 51.3 Economic structure Chapter52: Relationship between countries at different levels of development 52.1 International aid 52.2 Trade and investment 52.3 The role of multinational companies 52.4 The causes and consequences of external debt 52.5 The role of International Monetary Fund and the World Bank Chapter53: Globalization 53.1 What is globalization 53.2 Trade blocs 53.3 Trade creation 53.4 Trade diversion Chapter54 Preparing for assessment Appendix : Key formulae Glossary Index Acknowledgements