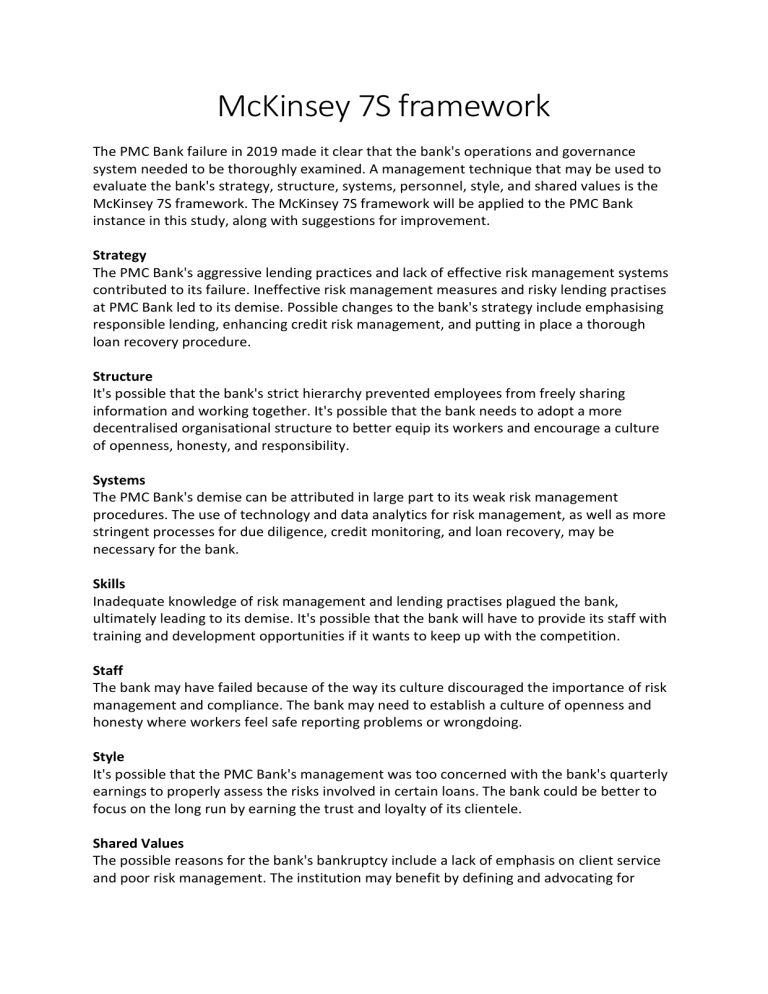

McKinsey 7S framework The PMC Bank failure in 2019 made it clear that the bank's operations and governance system needed to be thoroughly examined. A management technique that may be used to evaluate the bank's strategy, structure, systems, personnel, style, and shared values is the McKinsey 7S framework. The McKinsey 7S framework will be applied to the PMC Bank instance in this study, along with suggestions for improvement. Strategy The PMC Bank's aggressive lending practices and lack of effective risk management systems contributed to its failure. Ineffective risk management measures and risky lending practises at PMC Bank led to its demise. Possible changes to the bank's strategy include emphasising responsible lending, enhancing credit risk management, and putting in place a thorough loan recovery procedure. Structure It's possible that the bank's strict hierarchy prevented employees from freely sharing information and working together. It's possible that the bank needs to adopt a more decentralised organisational structure to better equip its workers and encourage a culture of openness, honesty, and responsibility. Systems The PMC Bank's demise can be attributed in large part to its weak risk management procedures. The use of technology and data analytics for risk management, as well as more stringent processes for due diligence, credit monitoring, and loan recovery, may be necessary for the bank. Skills Inadequate knowledge of risk management and lending practises plagued the bank, ultimately leading to its demise. It's possible that the bank will have to provide its staff with training and development opportunities if it wants to keep up with the competition. Staff The bank may have failed because of the way its culture discouraged the importance of risk management and compliance. The bank may need to establish a culture of openness and honesty where workers feel safe reporting problems or wrongdoing. Style It's possible that the PMC Bank's management was too concerned with the bank's quarterly earnings to properly assess the risks involved in certain loans. The bank could be better to focus on the long run by earning the trust and loyalty of its clientele. Shared Values The possible reasons for the bank's bankruptcy include a lack of emphasis on client service and poor risk management. The institution may benefit by defining and advocating for fundamental values that place an emphasis on serving customers with integrity, openness, and responsibility. Recommendations Make changes to the bank's lending policies that will improve lending and credit risk management. Increase the security of your business's financial operations by leveraging data analytics and cutting-edge technology to improve your due diligence, credit monitoring, and loan recovery procedures. Educate your staff on effective risk management and lending practises by investing in training and development programmes. Create an environment where employees feel safe reporting concerns and where ethics and responsibility are highly valued. Focus on fostering trust and loyalty among your bank's clientele for the bank's longterm success. Identify and support principles that centre on the satisfaction of your customers, including openness and responsibility. By using the McKinsey 7S framework to analyse the PMC Bank case, the bank will be able to pinpoint problem areas and create a thorough plan to fix them. If the bank follows my advice, it will be able to win back the trust of its customers and thrive for the long haul.