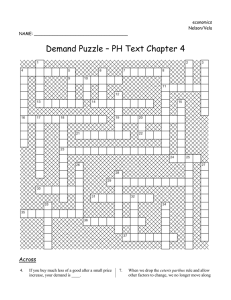

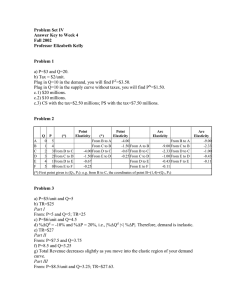

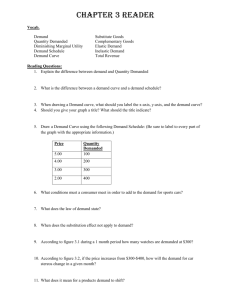

1 | The economic problem Scarcity Problem Infinite Wants but a finite quantity of resources <- Basic economic problem The Economic problem The demand for resources is greater than their supply - Decisions have to be made on how scarce resources are allocated ● ● ● What to produce? How to produce? For whom to produce? Opportunity cost All decision-makers are faced with choices, and upon making such choices there is a cost The opportunity cost is the cost of the next best alternative given up Production possibility curve (PPC) A production possibility curve illustrates the different combinations of two goods that can be produced if all resources in the country are fully used and the maximum quantity of goods that can be produced, Assuming that the country can produce Capital and Consumer goods. Capital goods - purchased by firms to produce other goods, machinery, tools, equipment etc. Consumer goods - purchased by households such as food, cars, furniture, etc. ● When a point is on the PPC curve, resources are fully employed ● When a point is below the PPC curve, resources are inefficiently allocated, and not all resources are used ● Points above the PPC curve are not possible are the country has insufficient resources Causes of Positive and negative economic growth Possible causes for positive economic growth - PPC shift outwards (can produce more) - New Technology: Advancements made in technology - Education and training: educating and training the population. - Improved efficiency: Resources can be used and allocated more efficiently - New resources: resources that enable them to produce more Possible causes for negative economic growth - PPC shift inwards (productive potential falls) - Resource depletion: The country runs out of a natural resource, such as coal. - Emigration: Highly skilled workers move overseas for better opportunities - Wars, conflict, and natural disasters: Damage costs - Natural events: Bad weather and disasters can affect production(e.g. agriculture) 2 | Economic Assumptions Underlying Assumptions in Economics 1) Consumers aim to maximize benefits 2) Businesses aim to maximize profits Rational Decision Making: Based on clear thought or reason Irrational Decision making: Going against logic, counters logic Why Consumers may not maximize benefit: - Difficulty calculating benefits: The consumer has difficulty calculating the benefits gained from consuming a product. - Influenced by others: The consumer may be under the influence of others, such as someone who was influenced by another on social media and follows a trend/hype - Habits: The consumer has a habit of purchasing from a particular brand Why Producers may not maximize profit: - Social enterprises: Social enterprises aim to maximize improvements in human or environmental well-being, not maximizing their profit. - Influenced by others: Influenced by the behavior of others in an organization - Non-profit organizations: Commercial enterprises that operate as charities and complete charitable work (e.g UNICEF) - Alternative business objectives: For example, prioritize care for customers 3 | The Demand Curve Effective demand Demand is the amount of a good that will be bought at given prices over a period of time Effective demand is the amount that would be bought (how much people can afford) The Demand curve The demand curve shows that relationship between the price and quantity demanded - The demand curve slopes down from left to right The law of demand: price and quantity demanded have an inverse relationship Movement along the demand curve When there is a change in price, there is a movement along the demand curve. For example, if the prices fall, there is a movement from point A to B, leading to an increase in the quantity demanded Shifts in the demand curve A change in any other factors, such as income, for example, there will be a shift (movement to the left or right of the entire demand curve) in the demand curve 4 | Factors that shift the demand curve Non-Price Determinants of Demand - Habits, fashion, and tastes: Habits and fashion/tastes can cause consumers to become irrational when making decisions which can affect demand for goods. - Income: Income that can be spared and used on luxury goods, e.g. consumers may decide to spend more money on going out to nice restaurants; Disposable income. - Substitutes and complements: Many goods and services have substitutes (e.g. coke and Pepsi) - if the substitute decreases in price, the demand for the substitute would increase and the demand for the other good would decrease. If a complementary good’s price increases, it reduces the demand for both complementary goods (e.g cars and petrol) - Advertising: Advertising can increase demand for a product. - Government policies: Government policies such as taxation can impact demand. - Demographic changes: Changes in demographic can affect the demand in 4 main ways: age distribution, women-to-men ratio, geographical distribution, and the distribution of ethnicities. 5 | The supply curve Supply and the Supply Curve Supply is the amount of food that sellers are prepared to offer for sale at a price over time The supply curve represents the relationship between the price and quantity supplied - Slopes upwards from left to right The law of supply: A proportional relationship between the price and quantity supplied Movement along the supply curve As with the demand curve, when there is a change in price, there is a movement along the supply curve, for example, the price increasing from P1 to P2 leads to an increase in supply. Shifts in the supply curve A change in any other factors, such as production costs, will be shown by a shift (movement to the left or right of the entire supply curve) in the supply curve Fixed Supply In some cases the supply of a product/service may be fixed. The supply curve will be vertical 6 | Factors that may shift the supply curve Non-price determinants of supply: - CoP/Cost of Production(Inward shift): The quantity supplied of any product is influenced by the Cost of Production(CoP). Costs include wages, raw materials, energy, rent, and machinery. - Advancements/changes in technology(Outward Shift): Advancements made in technology, benefits businesses as new technology can be more efficient and convenient, reducing the CoP and increasing supplying speed. - Subsidies(Outward shift): Subsidies are grants from the government, which may be given to encourage them to produce a particular product. - Indirect taxes(Inward shift): Indirect taxes are taxes on spending. VAT (Value-Added-Tax) and duties are examples of indirect taxation. - Natural factors(Inward shift): Production of some goods and services (e.g. agriculture) is influenced by natural factors, such as a drought or severe storm. 7 | Market Equilibrium Equilibrium Price The price at which supply and demand are equal, the equilibrium price is also known as the market clearing price, this is because the amount supplied is completely bought. Total revenue The total revenue is the amount of money generated from the sale of output Total revenue = Price x Quantity Shifts in Demand The equilibrium price will change if there are shifts in the demand curve, for example, a shift outwards (D1 to D2) will lead to a price increase from P1 to P2 and a rise in quantity sold from Q1 to Q2. The opposite can also happen where the demand curve shifts inward. Shifts in Supply A change in supply like a shift in the curve will also affect the equilibrium price, for example, a shift outwards from S1 to S2 will lower the equilibrium price from P1 to P2 and increase the quantity sold from Q1 to Q2. Again, the opposite can also happen with supply shifting right. Shifts in Supply and Demand It is also possible for both the supply and demand to change at the same time in a market. When there is a change in both supply and demand, it isn’t possible to show exactly what will happen to the price and quantity unless it's known precisely how much D & S shift. Excess Demand If the price charged in a market is below the equilibrium price, there is excess demand meaning there is a shortage of goods in the market that are able to be supplied Excess Supply If the price charged in a market is above the equilibrium price, there is excess supply meaning there is a surplus of goods in the market that are unable to be sold 8 | PED What is price elasticity of demand? Price elasticity of demand is the responsiveness of quantity demanded to a change in price, for some goods, a price change will result in a large change in demand, and for others a smaller change. Price inelastic demand When a price change results in a small change in demand, the good is price inelastic Price elastic demand When a price change results in a significant change in demand, the good is price elastic Calculating price elasticity of demand PED = % change in quantity demanded / % change in price Interpreting the numeral value of elasticity PED < 1: inelastic PED > 1: elastic PED = 0: Perfectly inelastic PED = 1: Perfectly elastic PED = -1: Unitary elastic Factors affecting PED Income: If consumers spend a large proportion of their income on a product, demand will be more elastic. For example, most consumers purchasing expensive TVs will be using up a large proportion of their income, so they may react when prices rise. Necessity: Goods considered ‘essential’ by consumers will have inelastic demand. This is because even if the prices of essentials(e.g food and fuel) rise, consumers cannot reduce the amount they purchase significantly; these goods are necessities. Time: In the short term, goods have inelastic demand because often it takes time for consumers to find substitutes when the price rises. Substitutes: Goods that have lots of close substitutes tend to have elastic demand(e.g. coke and pepsi). This is because consumers can switch easily from one product to another. 9 | PES What is price elasticity of supply? Price elasticity of supply is the responsiveness of quantity supplied to a change in price, for some goods, a price change will result in a large change in supply, and for others a smaller change. Price inelastic supply When a price change results in a small change in supply, the good is price inelastic Price elastic supply When a price change results in a significant change in supply, the good is price elastic Calculating price elasticity of supply PES = % change in quantity supplied / % change in price Interpreting the numerical value of price elasticity of supply PES < 1: inelastic PES > 1: elastic PES = 0: Perfectly inelastic PES = Infintie: Perfectly elastic PES = 1: Unitary elastic Factors that affect PES: Factors of production: If producers have easy access to the Factors of Production, they will be able to boost production if necessary. This means that supply will be elastic. Availability of stocks: Producers that hold stocks of goods can respond quickly to price changes so supply will be elastic. However, where it is impossible or expensive to do, supply will be inelastic. Spare capacity: Supply will be more elastic if producers have spare capacity. With spare capacity, producers can produce more with their resources. Time: The speed at which producers can react to price changes in the market can affect PES. Generally, all producers can adjust to output if they are given time. As a result, the more time producers have to react to price changes, the more elastic supply will be. PES for manufactured and primary products Several factors can influence the speed at which producers can react. Goods that can be produced quickly are likely to have an elastic supply. For example, the supply of a chocolate bar is likely to be supply elastic because it is easy to react to, whereas the supply of diamonds would be inelastic as it is hard to react to changes in the market. 10 | YED What is price elasticity of demand? Income elasticity of demand measures the responsiveness of demand to a change in income Calculating YED YED = % change quantity demanded / % change in income Interpreting the value of YED -1 < YED < 1: Income inelastic demand (Necessities) YED > 1 or YED < -1: Income elastic demand (Luxury goods) YED > 0: Normal goods YED < 0: Inferior goods Income rise: Quantity demanded of inferior goods fall Income fall: Quantity demanded of inferior goods rise Price elasticity and the government Governments often raise revenue by imposing indirect taxes such as value-added tax (VAT) and excise duty on products. Government chooses inelastic goods as consumers will avoid heavily taxed items if the demand for them is elastic. Governments also consider giving subsidies to producers, the purpose of this is to increase supply. If the subsidy is designed to make goods cheaper for the poor, the demand must be inelastic, if it's not, the price will only reduce slightly. 11| The Mixed Economy The Public and Private Sectors A mixed economy is an economic system that combines the public and private sectors. Public sectors are owned by the government. Private Sectors are owned by Individuals (Businesses + firms). Private Sector Organizations Consumer goods eg. groceries, consumer durables(SPC) - Sole trader - Partnerships - Companies Aims: Survival, Growth, Social Responsibility, Profit Maximisation Public Sector Organizations - Central government departments - Local authority services - Public corporations/state-owned enterprises - Other public organizations Aim: Improve the quality of services, Minimise costs, Allow social cost, Money Types of Economies Free Economy - Vast majority of goods and services provided by the private sector Planned Economy - Relies entirely on the public sector to choose, produce, distribute goods Mixed Economy - Relies on both the public sector and the private sector Market Failure A free market economic system fails to allocate resources efficiently when there are two activities that lead to external costs and too few activities that lead to external benefits Causes for market failure: - Missing market: goods and services not provided by private sector - Externalities: Firms do not take into account all the CoP. - Lack of competition: No competition, the market becomes dominated by a small number of firms, and consumers are exploited. - Lack Info: Efficient if there is a free flow of information - Factor immobility: Factors of production need to be mobile 12 | Privatization What is privatization? Privatization involves transferring public sector goods to the private sector ● Sale of nationalized industries ● Contracting out ● The sale of land and property Why privatization takes place: - To generate income: The sale of state assets generates income for the government. - Public sector organizations were inefficient: Some nationalized industries lacked the incentive to make a profit and often made losses. It was argued that in the private sector, they would have to cut costs, improve services and return profits for shareholders. - To reduce political interference: In the private sector, the government could not use these organizations for political aims. They would be free to choose their own investment levels, prices, product ranges, and growth rates. Effects of privatization: - Consumers: It is hoped that consumers will benefit from privatization. Once in the private sector, businesses are under pressure to meet customer needs and return a profit for the owners. - Workers: Quite often in the run-up to privatization, and after an organization has moved into the private sector, quite large numbers of people are made redundant. - Businesses: Once in the private sector, firms are left without government interference and have to face competition. They have been affected in many ways in the UK. - Government: One way in which governments have benefited from privatization is the huge amount of revenue that has been generated. However, privatization has been expensive. 13 | Externalities External costs (Negative externalities) Some economic activity results in costs that are incurred by third parties - Resource depletion - Noise, air, and water pollution - Traffic congestion/ overcrowding External benefits (Positive externalities) Some economic activity results in benefits that are incurred by third parties - Education - Healthcare - Vaccinations Social Cost The cost to society as a whole of an economic activity Social cost = Private costs + External costs Social Benefit The benefit to society as a whole of an economic activity Social benefit = Private benefits + External benefits Government policies to deal with externalities - Taxation: Reduces external costs of production and external costs of consumption - Subsidies: The government offers money through subsidies or financial rewards - Fines: The government can reduce external costs through a series of fines - Government regulation: The government can reduce the external costs of production by implementing laws to protect the environment - Pollution Permit: Governments can issue a pollution permit to a company which gives the company a limit on how much polluting material can be produced.