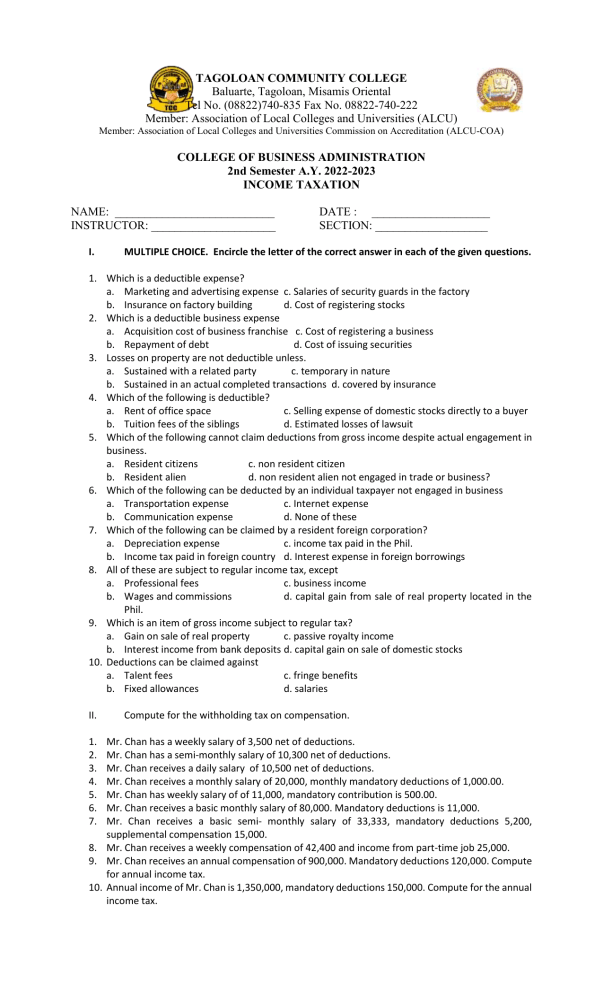

TAGOLOAN COMMUNITY COLLEGE Baluarte, Tagoloan, Misamis Oriental Tel No. (08822)740-835 Fax No. 08822-740-222 Member: Association of Local Colleges and Universities (ALCU) Member: Association of Local Colleges and Universities Commission on Accreditation (ALCU-COA) COLLEGE OF BUSINESS ADMINISTRATION 2nd Semester A.Y. 2022-2023 INCOME TAXATION NAME: ___________________________ INSTRUCTOR: _____________________ I. DATE : ____________________ SECTION: ___________________ MULTIPLE CHOICE. Encircle the letter of the correct answer in each of the given questions. 1. Which is a deductible expense? a. Marketing and advertising expense c. Salaries of security guards in the factory b. Insurance on factory building d. Cost of registering stocks 2. Which is a deductible business expense a. Acquisition cost of business franchise c. Cost of registering a business b. Repayment of debt d. Cost of issuing securities 3. Losses on property are not deductible unless. a. Sustained with a related party c. temporary in nature b. Sustained in an actual completed transactions d. covered by insurance 4. Which of the following is deductible? a. Rent of office space c. Selling expense of domestic stocks directly to a buyer b. Tuition fees of the siblings d. Estimated losses of lawsuit 5. Which of the following cannot claim deductions from gross income despite actual engagement in business. a. Resident citizens c. non resident citizen b. Resident alien d. non resident alien not engaged in trade or business? 6. Which of the following can be deducted by an individual taxpayer not engaged in business a. Transportation expense c. Internet expense b. Communication expense d. None of these 7. Which of the following can be claimed by a resident foreign corporation? a. Depreciation expense c. income tax paid in the Phil. b. Income tax paid in foreign country d. Interest expense in foreign borrowings 8. All of these are subject to regular income tax, except a. Professional fees c. business income b. Wages and commissions d. capital gain from sale of real property located in the Phil. 9. Which is an item of gross income subject to regular tax? a. Gain on sale of real property c. passive royalty income b. Interest income from bank deposits d. capital gain on sale of domestic stocks 10. Deductions can be claimed against a. Talent fees c. fringe benefits b. Fixed allowances d. salaries II. 1. 2. 3. 4. 5. 6. 7. Compute for the withholding tax on compensation. Mr. Chan has a weekly salary of 3,500 net of deductions. Mr. Chan has a semi-monthly salary of 10,300 net of deductions. Mr. Chan receives a daily salary of 10,500 net of deductions. Mr. Chan receives a monthly salary of 20,000, monthly mandatory deductions of 1,000.00. Mr. Chan has weekly salary of of 11,000, mandatory contribution is 500.00. Mr. Chan receives a basic monthly salary of 80,000. Mandatory deductions is 11,000. Mr. Chan receives a basic semi- monthly salary of 33,333, mandatory deductions 5,200, supplemental compensation 15,000. 8. Mr. Chan receives a weekly compensation of 42,400 and income from part-time job 25,000. 9. Mr. Chan receives an annual compensation of 900,000. Mandatory deductions 120,000. Compute for annual income tax. 10. Annual income of Mr. Chan is 1,350,000, mandatory deductions 150,000. Compute for the annual income tax.