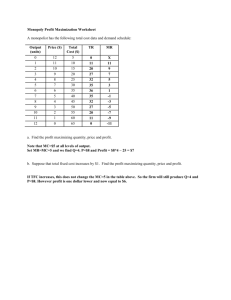

Managerial Economics (MBA 525) Case Study #4 Spring 2023 Q1. The demand and cost function for a company are estimated are estimated to be as follows: P=100-8Q TC= 50+80Q-10Q^2+0.6Q^3 a. What price should the company charge if it wants to maximize its profit in the short run? b. What price should it charge if it wants to maximize its revenue in the short run? Q2. Assume the demand function and total cost function are as given below: P=170-5Q TC=40+50Q+5Q^2 a. Find the profit maximizing output and price level? b. Assume the above firm is a perfect competitive one, find the profit maximizing output and price? c. From your answers to parts a and b above, what can you say about the price and output? d. Without finding the final answer, what is the equation for the long run profit maximizing output (P=AC)? Q3. You are a theater owner fortunate to book a summer box office hit into your single theater. You are now planning the length of its run. Your share of the film’s projected box office is R = 10 W -0.25 (W)^2, where R is in thousands of dollars and W is the number of weeks that the movie runs. The average operating cost of your theater is AC =MC = $5 thousand per week. a. To maximize your profit, how many weeks should the movie run? What is your profit? b. You realize that your typical movie makes an average operating profit of $1.5 thousand per week. How does this fact affect your decision in part a above if at all?