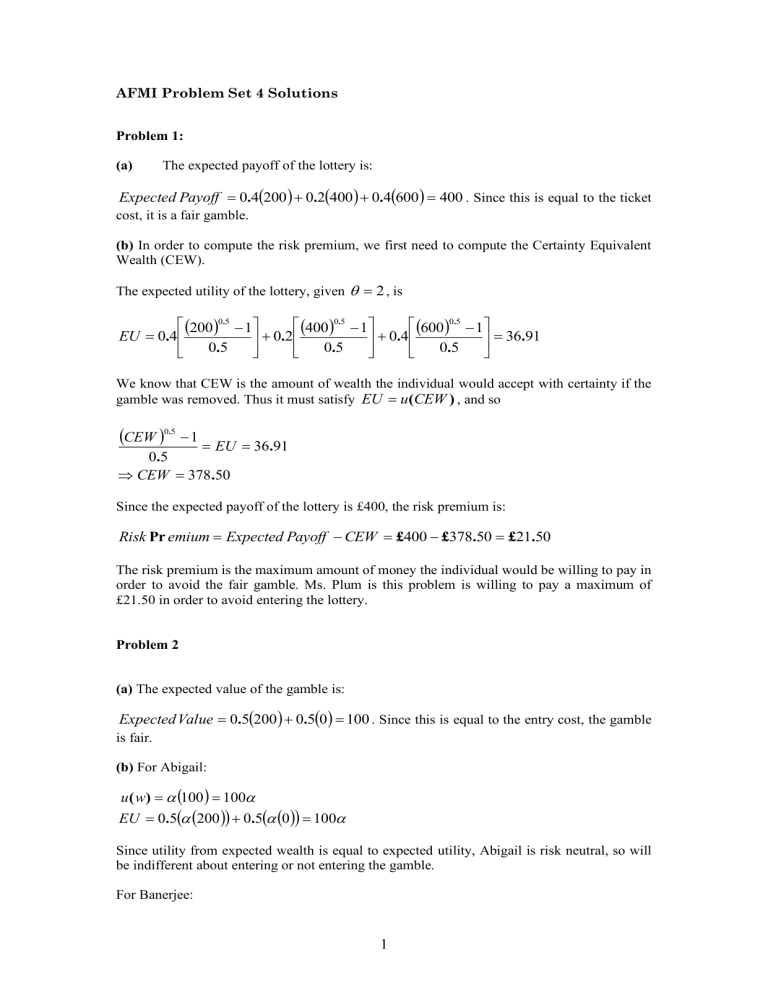

AFMI Problem Set 4 Solutions Problem 1: (a) The expected payoff of the lottery is: Expected Payoff = 0.4(200 ) + 0.2(400 ) + 0.4(600 ) = 400 . Since this is equal to the ticket cost, it is a fair gamble. (b) In order to compute the risk premium, we first need to compute the Certainty Equivalent Wealth (CEW). The expected utility of the lottery, given = 2 , is (200 )0.5 − 1 (400 )0.5 − 1 (600 )0.5 − 1 EU = 0.4 + 0.2 + 0.4 = 36.91 0.5 0.5 0.5 We know that CEW is the amount of wealth the individual would accept with certainty if the gamble was removed. Thus it must satisfy EU = u(CEW ) , and so (CEW )0.5 − 1 = EU = 36.91 0.5 CEW = 378.50 Since the expected payoff of the lottery is £400, the risk premium is: Risk Pr emium = Expected Payoff − CEW = £400 − £378.50 = £21.50 The risk premium is the maximum amount of money the individual would be willing to pay in order to avoid the fair gamble. Ms. Plum is this problem is willing to pay a maximum of £21.50 in order to avoid entering the lottery. Problem 2 (a) The expected value of the gamble is: Expected Value = 0.5(200 ) + 0.5(0) = 100 . Since this is equal to the entry cost, the gamble is fair. (b) For Abigail: u ( w) = (100 ) = 100 EU = 0.5( (200 )) + 0.5( (0 )) = 100 Since utility from expected wealth is equal to expected utility, Abigail is risk neutral, so will be indifferent about entering or not entering the gamble. For Banerjee: 1 u (w) = ln(100 ) = 4.6051 EU = 0.5 ln(200 ) + 0.5 ln(0 ) = 2.6491 + undefined = 2.6491 Notice that we have ignored ln(0 ) as this does not exist. Since utility from expected wealth is higher than expected utility, Banerjee is risk averse, so will not enter the gamble. For Chris: u (w) = (100) = 10000 2 EU = 0.5(200 ) + 0.5(0) = 20000 2 2 Since utility from expected wealth is less than expected utility, Chris is risk lover, so will enter the gamble. Problem 3: (a) A fair price premium is one that earns the company zero expected profits. Say p is the per unit price of insurance, i.e. the insurance company charges p amount for each £ insured. Since insurance is available at actuarially fair price, p must satisfy: ( p − 1) + (1 − ) p = 0 p = So the fair premium is simply equal to the probability of accident. (b) Let insurance amount be x . If there is an accident, the individual ends up with wealth equal to w0 − px − D + x . If there is no accident, the individual ends up with wealth equal to w0 − px . Since p = , the expected utility of the individual is: EU = u (w0 − x − D + x ) + (1 − )u (w0 − x ) The individual’s problem is to choose the amount of insurance x in order to maximize the expected utility from buying the insurance, i.e. max ( x) u( w0 − x − D + x ) + (1 − ) u( w0 − x ) (c) The FOC to this maximization problem is: (1 − ) u / ( w0 − x − D + x ) − (1 − ) u / ( w0 − x ) = 0 u / ( w0 − x − D + x ) = u / ( w0 − x ) w0 − x − D + x = w0 − x D=x Hence with actuarially fair insurance, optimal insurance amount is equal to the total damage from accident, D = x , i.e. the utility maximizing amount of insurance purchased is equal to the total amount of loss in damages, meaning that the agent fully insures against all risks. 2