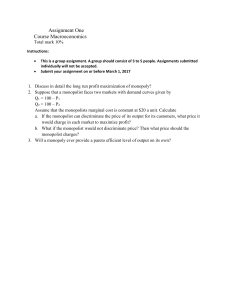

1. skip

2. Ocean and Natasha are two friends who live in Delhi and New York

respectively. Ocean and Natasha only care about consuming bread

and wine, and have identical preferences. Ocean spends his entire

income on 9 glasses of wine and 4 loaves of bread, paying 300

rupees per glass and 500 rupees per loaf in Delhi. Natasha has an

income of $15 and faces prices of $2 per glass of wine and $0.5 (i.e.

50 cents) per loaf of bread in New York.

a. Draw their budget constraints on the same graph.

b. Can we conclude from the information above that Natasha

must be worse off than Ocean, (and would therefore prefer

his budget set than her own) ?

3. A consumer with strictly convex preferences consumes two goods

𝑥! and 𝑥" . Suppose 𝑥! is a Normal Good and an Ordinary Good. Show

using indifference curves the Slutsky income and substitution

effects of a price increase for 𝑥! from 𝑝! to 𝑝!# . Denote the price of

good 2 by 𝑝" , and income by 𝑚.

Note: make sure to draw a large graph, where intersections vs. tangencies, and

parallel vs. not parallel lines can be identified. Indifference curves should not

intersect. Label slopes and intercepts.

4. A firm that uses inputs 𝑥! and 𝑥" , has a production function that is

given by 𝑓(𝑥! , 𝑥" ) = +min {𝑥! , 𝑥" }

a. What kind of returns to scale does this firm experience?

Explain.

b. If the two inputs 𝑥! and 𝑥" cost $3 and $4 per unit

respectively, what is the total cost function 𝑐(𝑦) of this firm?

Hint: do not use the Lagrangean to solve this problem as the

production function is not differentiable. Ask yourself, if the

firm had to produce, say, 8 units, what input combination will

do so in the cheapest way? What would the answer be if it

wanted to produce 𝑦 units?

c. If the firm is in a perfectly competitive market and the current

market price for its output is $100 per unit, how many units

will the firm supply at this price? Explain.

5. There is a single motel (a monopolist) in the town of Elyria, OH.

Demand for rooms is given by 𝑞 = 200 − 2𝑝. The marginal cost of a

room is $10/night.

a. What will be the price of a room in this market?

b. What is the price elasticity of demand at the equilibrium output

level?

c. What is the deadweight loss of this monopoly? Show your work.

6. A monopolist sells bottles of mineral water to two customers: the

high demand customer’s demand is described by

𝑞$ = 50 − 𝑝$

and the low demand customer’s demand is described by

𝑞% = 30 − 𝑝%

The total willingness to pay of a consumer for 𝑞 units is the area

under their inverse demand curve till 𝑞 units. The costs of

production are 0. Suppose the monopolist cannot distinguish

between the two consumers and is thinking about offering each of

the customers two options:

Option A: buy 50 bottles for a total payment of $𝑦

Option B: buy 25 bottles for a total payment of $𝑥.

Consumers buy the option that gives them a higher net consumer

surplus. They can only buy a single option, and a single unit of it.

a. Suppose 𝑥 is set equal to the total willingness to pay of the

low demand customer for 25 bottles. Compute 𝑥.

b. Given your answer for 𝑥, what 𝑦 should the monopolist set

to maximize profits? Explain.

7. Jia and Megha are two Christmas tree sellers on W 95th St, where

the demand curve for trees is described by 𝑝 = 500 − 𝑄, where 𝑄 =

𝑞& + 𝑞' , and 𝑞( is the output of seller 𝑖 = 𝐽, 𝑀. Each seller’s total cost

function for producing trees is 𝑐(𝑞( ) = 10 + 𝑞(" .

a. Suppose Jia believes that Megha will bring 𝑞B' trees to the

market. How many trees should Jia bring to the market in

response to this belief? Explain.

b. What is the Cournot-Nash equilibrium level of outputs (such

that neither seller wants to change their output, given the

output of the other seller). Explain.

c. If this was a perfectly competitive industry, with a large

number of sellers like Jia and Megha, what would be the longrun equilibrium price and quantity sold per seller? Assume

that 𝑐(𝑞( ) above is the long run cost function of the firms, for

𝑞( > 0, and for 𝑞( = 0, 𝑐(0) = 0. [Note: you can do this part

even if you were unable to do the first two.]

8. There are two consumers, A and B, in an economy, who consume

two goods, 𝑥 and 𝑦. A is endowed with 3 units of 𝑥 and 2 units of 𝑦.

B’s endowment is 4 units of 𝑥 and 5 units of 𝑦. A and B’s utility

functions are 𝑈) (𝑥, 𝑦) = 2𝑥 + 𝑦 and 𝑈* (𝑥, 𝑦) = 𝑥 + 𝑦.

a. Define a Pareto Optimal allocation. Is the initial endowment

allocation Pareto Optimal? Explain.

b. Draw an Edgeworth box for this economy, and show the initial

endowment, and the indifference curves passing through the

initial endowment (label their slopes and intercepts).

c. Show on the graph the allocations that are Pareto-superior to

the endowment, if any. Show the contract curve (the set of all

the Pareto Optimal allocations) in this economy. Explain.

9. An airport is located next to a housing developer’s project. Let 𝑥 be

the number of noisy planes that fly at the airport every day and let 𝑦

be the number of houses the developer builds. The airport’s total

profits are

𝜋) (𝑥) = 32𝑥 − 2𝑥 "

and the developer’s total profits are

𝜋+ (𝑥, 𝑦) = 70𝑦 − 4𝑦 " − 𝑥𝑦.

The airport says to the developer: “you decide how many flights I

should fly but then you must compensate me for any loss in my

profits as a result.”

a. How many flights will the developer ask the airport to fly?

b. How much compensation, if any, will the developer pay the

airport?

Show your work.