Uploaded by

Dimple Sharma

2023 Supply Chain Outlook: Expert Advice on Thriving in Change

advertisement

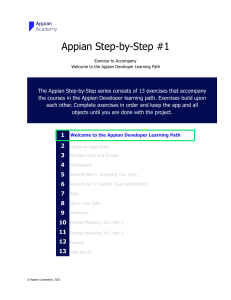

2023 Supply Chain Outlook: Expert Advice on Thriving in Times of Change Four experts weigh in on the future of supply chain management. Contents 3 10 Applying the lessons of the supply chain crisis. Developing agility in times of change. 4 13 Building resilience means bouncing back fast. Q&A with Deepak Mavatoor, Shifting from output to outcomes. Q&A with Vlad Filippov, Spark Equation 7 16 Adapting to continued supply chain disruptions. Q&A with Peter Liddell, KPMG The role of technology and Tata Consultancy Services Q&A with Joaquim Duarte Oliveira, Deloitte Portugal automation in supply chains. appian.com | 2 Applying the lessons of the supply chain crisis. The past two years have brought repeated, outsized To answer these questions, Appian interviewed four supply disruptions to the world’s supply chains. Prior to 2020, chain thought leaders for their expert insights on the state supply chains were largely invisible to the general public. of supply chains. These experts from Tata Consultancy COVID-19 and other disruptions brought massive upheavals Services, KPMG, Deloitte, and Spark Equation bring decades that shined a spotlight on a precariously balanced system. of supply chain management and technology experience to Supply chain professionals are curious about a number of questions: What lessons can we learn from the past two years? Are we out of the woods or will disruptions continue eating into company profits? And how can companies evolve bear on answering several key questions. We discuss the state of supply chains, how companies can successfully adapt going forward, the role of environmental, social, and governance (ESG) initiatives, and much more. their supply chain management to survive or even thrive in the future, no matter what comes next? appian.com | 3 Building resilience means bouncing back fast: Deepak Mavatoor, Managing Partner, Tata Consultancy Services. A Managing Partner in Growth and Transformation within TCS Manufacturing, Energy and Resources business unit, Deepak heads the Supply Chain and Plant Operations business advisory practice. He has more than 20 years of proven thought leadership in the manufacturing sector across supply chain, manufacturing, and operations functions. His passion is helping his customers shift their businesses to be driven by digital, IOT, and cognitive. Mavatoor earned his MBA from the Ross School of Business at the University of Michigan, and has a bachelor’s degree in Mechanical Engineering from the University of Mysore, India. appian.com | 4 Q&A with Deepak Mavatoor. Q: What have the last two years shown about the world’s supply chains? Well, for starters, two years ago, my family didn’t know what I did for a living. Now they do and think I’m the cause! “The concept of resilience shouldn’t assume that you won’t fail, but rather that you should be able to get back up fast.” In all seriousness, the past two years have shown that the way we think about our current supply chains as resilient or Some of the best companies have run more “what if” robust is a myth. The supply chain has grown so global and scenarios so they don’t fall into the trap of thinking “this complex that it has become brittle. worked for the last eight years, so I’ll continue to do this.” The concepts of lean manufacturing, just-in-time, or justin-sequence were great when the disruptions weren’t to this extent. We’ve become extremely efficient in our supply chain, making the tension so palpable that a single tap could break it. Traditionally, companies kept lean inventory for ideal conditions, but if something doesn’t follow the ideal path, their inventory buffer goes away in 24 hours. You have to keep enough fat in the system to withstand disruptions. They have the tools, processes, systems, and culture to handle these what-ifs. Some companies do sales and operations (S&OP) planning far more frequently—sometimes two or three times a week—which shifts the culture to be more scenario-planning-oriented. Q: What role should automation play for companies in the supply chain? There’s a lot we do that doesn’t require a lot of discretion like basic planning or forecasting. You can use automation to “We’ve become extremely efficient in our supply chain, making the tension so palpable that a single tap could break it.” collect the data, refine the data, and come up with intelligence so a human can make the final decision. At TCS, we have a concept called the “Machine-first Delivery Model.” Only if a machine cannot do the work do we send the work to a human. When people talk one on one, they always recognize what Q: What makes the difference between those who successfully adapt and those who don’t? Well, almost no companies have been left untouched [by the previous two years]. But the concept of resilience shouldn’t assume that you won’t fail, but rather that you should be able to get back up fast. When you think from that angle, you notice the best companies have focused on scenario planning. In our personal lives, we think about contingencies—what happens they could have done better, but they’re often so pressed for time putting out fires that they can’t focus on the insights. We should be focusing on the top 10 percent of disruptions, but we can’t because the other 90 percent takes up our time. Q: What is the industry missing? What problems are particularly thorny to solve? Everywhere you go, people talk about increasing collaboration. We all know the importance of connecting with tier-1 and tier-2 suppliers. when the kids aren’t on time or your alarm clock doesn’t go Everyone’s trying to solve this with only technology, but it’s off? In the professional world, we always plan for an ideal not going to entirely happen that way due to a lack of trust scenario. It’s hard to fathom when wars break out, but we between “different players in the ecosystem.” Technology must consider them. appian.com | 5 is key but the basic human values and relationship is more important. I won’t trust you because you build a blockchain; I’ll trust you because I trust you. Unfortunately, each player in the external value chain often worries that providing information such as capacity, inventory, or internal operational efficiency metrics could lead to someone else taking advantage of them. It’s a business strategy, and there’s nothing wrong with that, but relationships can’t be that transactional. We will all be as strong as the weakest link, so there has to be a feeling of “we’re all one big family.” This way, if something breaks, you can support them immediately. Q: Any parting thoughts? I’ve been doing this for a while, and the problems haven’t changed—we’ve developed new words to describe the same problems like poor forecasts or bad transportation. I’ve yet to find a new problem, but I’ve found new words to describe them. But what makes me hopeful is that technology has evolved so much. When I started 20 years back, we didn’t have access to many technologies that enable prediction, scenario planning, simulation, and visibility. We are seeing this technology drive business changes more and more. The world is more complex and current technology positions us to better handle this complexity. We’re in a much better position. appian.com | 6 Adapting to continued supply chain disruptions: Peter Liddell, Partner, KPMG. Peter leads the Global Operations Centre of Excellence (incorporating supply chain, procurement & advanced manufacturing) for KPMG. He has worked with clients across the Asia-Pacific region for the past 33 years, where he has helped them to enhance their operational and financial performance. Peter has designed and run large scale transformation programs that have driven value throughout the clients’ portfolios by accelerating opportunities to mitigate excessive business complexity and unnecessary operational costs, whilst helping them to position for growth and in accessing new markets. His key areas of expertise include operational strategy; supply chain and logistics advisory; business process analysis, improvement, and redesign; and project, change, and risk management. Since joining KPMG, Peter worked in the consumer and industrial manufacturing sectors but has also supported a broad range of clients across many other industries including automotive, life sciences, retail, transport and logistics, telecommunications, energy, mining, and natural resources. Peter is also currently leading the life sciences industry sector for KPMG in Asia Pacific. appian.com | 7 Q&A with Peter Liddell. Q: Can you walk us through your view of the big supply chain disruptors of the past 24 months? Obviously, the biggest disruption was the pandemic. When combined with other factors like the Russia-Ukraine conflict, they contributed to a near-total reduction in passenger freight and significant reductions in ocean freight, too. The freight supply and demand equation was a common issue throughout the pandemic and during the recovery period. Plus, geopolitical challenges like the Russia-Ukraine conflict also reshaped global supply chain flows, often adding significant lead time for most products shipped via ocean freight. Post-pandemic, we’ve seen the US and EU invest heavily in infrastructure projects to help rebuild their respective economies. This has led to a run on manufacturing goods from China, causing shipping prices to rise at astronomical rates and leading to containers getting backed up in major global ports. Finally, in-country domestic supply chains were also disrupted [for nations across the globe]. Ongoing COVID-19 outbreaks often reduced the availability of local workforces needed to move goods within countries. Ultimately we’ve experienced a period of unbelievable growth in the demand for goods, yet limited supply of logistics, both globally and locally. This was a We also don’t know how long the Russia-Ukraine conflict will last or what simmering geopolitical issues could erupt in ways that cause more disruptions. You just need one more issue to flare up and another major shipping lane might close down. We’re definitely in for a bumpy 12 – 18 months at least. The good news is that the global supply chain pressure index, which measures supply chain stressors, indicates that the problem has already peaked. How fast supply chain pressures come down is an open question—new or current geopolitical conflicts not being resolved could make for a lengthier return to normal. There are a number of global challenges contributing to the second wave of disruptions—for example, everyone is trying to get their hands on construction materials and equipment, which may slow down repairs and maintenance of critical assets or stall new capital projects (retail stores, distribution centers, manufacturing sites, etc.). Additionally, many industries producing critical components such as semiconductors, packaging, raw materials, etc., haven’t fully caught up. And with consumption so high, we could face shortages or run out of critical production inputs. This could lead to more supply imbalances for critical industries. perfect storm that I hadn’t seen in more than 30 years. Q: Has the pain stopped? Or are we still facing a rough road? Unfortunately, no, it hasn’t stopped yet. One trend that we will definitely see in 2023 is continuous disruption. And I also think that we’ll see a second wave of supply chain risk. “One trend that we will definitely see in 2023 is continuous disruption. And I also think that we’ll see a second wave of supply chain risk.” Continuous disruption will be evident in a number of ways. Organizations will continue to have trouble with transport logistics as many of the global ocean freight providers haven't yet caught up to the demand. Even if we can get all the container ships we need into the ocean, we don’t always have the crews available, so you’ll continue to have an imbalance of supply and demand. appian.com | 8 Q: What was the critical factor for companies that adapted well? If you peel the onion down a layer, you see that the companies that did well likely had a lot of safety stock or inventory stockpiles. Many also turned to premium freight for faster deliveries, however these strategies are not sustainable. There was a lot of luck for many of them, to be frank. Today, companies have started to adapt by right-sizing their supply chains. Many are looking at different sourcing methods and revisiting where they do their manufacturing. For example, they may look at suppliers with really long, in-transit times that they’ve always done business with and try to find a closer supplier in order to reduce lead time. It allows them to be much more agile, often waiting only 3 – 4 weeks instead of 12 for critical supplies. “Customers expect major companies they buy from to have responsible sourcing.” Companies were initially urged by regulators, consumers, and financial institutions to focus on scope 1 and scope 2 emissions, but now, scope 3 will become a focus in 2023. Companies need to find where carbon, waste, and highenergy use occurs throughout their extended supply chain and devise strategies to mitigate their exposures. One area where companies are investing is full supply chain digitization. Achieving end-to-end supply chain visibility provides real-time transparency into how products really flow through the global supply chain, giving companies real data on carbon, energy, and waste. A lot of companies think they know how their products are flowing, but until they get the real data, they don’t actually know. Digitizing the wider supply chain and generating real time supply chain analytics can help. Q: What topics deserve more thought and attention than they’re currently getting? Two come to mind. First, manufacturing footprint considerations deserve some attention. With the combination of inflationary pressures, high shipping costs, Q: What role has environmental, social, and governance (ESG) played in supply chain thinking? Well, pre-pandemic, board members and executive teams spoke about ESG, but at best, it was more about understanding and setting standards and then signing off on end-of-year reports. But ESG has become a larger focus due to consumer behavior. You can read the studies: customers expect major companies they buy from to have responsible sourcing. Also, the global investment community is starting to take action by calling companies out who greenwash, while refusing to allocate funds for those not proactively addressing ESG. They’ll also start to walk away from companies that lack and geopolitics putting pressure on energy and labor expenditures, we’re starting to see more investments into southeast Asian countries like Vietnam, Indonesia, and Thailand. This signals a shift away from Chinese manufacturing for many global corporations. Second, we need to talk seriously about the workforce. Two years ago, we were expecting enterprise-wide digital transformation journeys. As companies continue this—by shifting their enterprise resource planning (ERP) or other functional technologies to the cloud or putting more digital power behind procurement, operations, and broader enterprise activities—they need to focus on how they will actively train the workforce or find people with the technical know-how to handle these shifts. good ESG governance. appian.com | 9 Developing agility in times of change: Joaquim Duarte Oliveira, Supply Chain & Network Operations Leader, Deloitte Portugal. Joaquim is currently the Supply Chain & Network Operations Leader at Deloitte Portugal, bringing 17 years of consulting experience and has worked with clients across industries (life sciences, FMCG, retail, manufacturing, automotive, construction, and utilities) and geographies in Europe (Portugal, Netherlands, Belgium, Hungary, Czech Republic, and Slovakia) and Africa (Angola, Mozambique, and Cape Verde). Joaquim has worked on multiple digital transformations programs and his core competencies include supply chain planning (demand planning, supply planning, S&OP, S&OE, and IBP), logistics transformation (3PL), smart factory (data & performance monitoring), digital customer transformation, market entry and go-to-market strategy, and agile-driven transformations. In addition to his client work, he has published some market studies related to direct-to-consumer—online experience and last mile operations, smart factory, digitalization in automotive, and digital health (prescription and reimbursement digital apps in Europe). He has earned a Global Executive MBA from the IE Business School with a focus on entrepreneurship and managing global businesses. Additionally, he has a business management degree from the Nova School of Business and Economics and completed the Advanced Negotiation Programme “The Game Negotiation Dynamics” from the NOVA School of Business and Economics. appian.com | 10 Q&A with Joaquim Duarte Oliveira. Q: Reflecting on the past year, what have been the biggest challenges in supply chain management? Q: What technology has been instrumental in terms of managing supply chain challenges? The COVID-19 pandemic exposed serious vulnerabilities in Current technology is better able to support agile and today’s highly efficient global supply chains. As COVID-19 resilient supply chain processes. Many technologies, transitions to an endemic state, the world braces for still more including AI, machine learning, IoT, cloud computing, and shocks and inflationary pressures driven by sanctions on data availability, are maturing and offer more capabilities at Russia and uncertainty throughout Eastern Europe. a lower cost than before. Clogged ports and empty store shelves around the world For instance, scenario planning, which requires handling speak to the additional work companies must do to make an enormous amount of data, used to be an issue. The their supply chains more resilient, even as they face pressure expansion of computing power and flexible visualization now to hold down costs. These measures are important and enables both exception management and near real-time necessary, but they miss another crucial element in supply scenario planning. chain management: agility. The breakthrough of exception-based planning is due to Agility offers three important benefits: better and more the growing computational power that can handle big data timely data for improved visibility, the ability to execute combined with increased machine learning capabilities, faster than the competition, and more integrated, planning functionalities, and integrated data modeling collaborative relationships with key supply chain partners. possibilities. Plus, today’s technology allows companies to These benefits ultimately enable faster and better responses integrate planning layers and models to allow for end-to-end to new opportunities. visibility and synchronized planning. Q: When it comes to managing supply chain issues, how have you seen teams adapt? In the near future, the vast majority of activities in supply The capabilities, key performance metrics, and performance expectations related to agility are not as standardized or welldefined as they are for supply chain efficiency. The focus on chain planning will be handled by digital solutions, where predictability, scenario planning, visibility, and agility are the key elements, leveraged through decision intelligence and automation. agility will vary based on a company’s overall strategy and the design of the supply chain to support that strategy. However, in our experience, agility can be built in four areas: demand sensing, collaborative relationships, process integration, and information integration. Each area involves building new capabilities—but, more importantly, they require an understanding of the role of “Many technologies, including AI, machine learning, IoT, cloud computing, and data availability, are maturing and offer more capabilities at a lower cost than before.” agility in creating competitive advantage. Supply chain managers must strike the right balance between agility, resilience, and efficiency. appian.com | 11 Q: Which topics around supply chain management aren’t getting enough focus among the press? Among organizations? Talent is already hard to find and attract. While technology has advanced, supply chain teams need talented people with skills fundamentally different from those expected of planners in the past. New hires must be able to think on a strategic and Also, the talent needed to implement new technologies is just as rare and usually already [in high demand with low supply]. How can you attract and retain these gems? At the very least, make sure to offer them attractive career paths. Present a perspective on the next steps they could take in a few years’ time, either in management or in commercial or analytical functions. tactical level about scenarios and risks, must have analytical as well as communication skills, and be heavily marketoriented. With skills like these, they might just as well work in marketing or R&D. appian.com | 12 Shifting from output to outcomes: Vlad Filippov, Founder and CEO, Spark Equation. A seasoned technology industry professional with over 15 years of experience, Vlad Filippov is the founder and CEO of Spark Equation, a product development and engineering company based in Chicago that specializes in building intelligent products. Additionally, as the CTO of Progress Retail, Vlad brings his expertise in data and decision intelligence to his role as a guest lecturer at Depaul University. Vlad began his career as a self-taught engineer in logistics and quickly rose to become one of the top logistics consultants for a leading transportation and supply chain management provider. This experience sparked his passion for bridging the gap between business and technology, leading him to establish Spark Equation. In his spare time, Vlad enjoys spending time with his family, reading business and technology books, riding his motorcycle, and being creative. He is passionate about helping others achieve their product goals and is always looking for new opportunities to innovate and lead. appian.com | 13 Q&A with Vlad Filippov. Q: What have the past few years revealed about our supply chains? The pandemic was a once-in-a-lifetime black swan event that showed you can’t always rely on what worked in the past five or ten years. Events demonstrated that businesses need to be dynamic in their decision-making and resource allocation to not only succeed but often to survive. Businessas-usual with five-year plans or long-term roadmaps just won't work anymore. You’re either adapting, or you’re dying. As we look to the future, I think complexities will only increase, and supply chain issues will have a more amplified effect. Back in the day, businesses were more isolated. Now, every business is connected, and a change or event affects Second, employ technology to help with faster decisionmaking. To do this, you must ensure that data is available and your processes are optimized. This means getting real-time data so you can know what inputs lead to which outcomes. Often, this means combining many different paths together. Companies need to shift focus from outputs to outcomes. They need to start tracking how they invest and direct resources and inputs, which requires real-time visibility and data into results. For example, if you plan to improve customer satisfaction, how fast can you find that what you’re doing is working? Is it six months? If you only get that result later and don’t track leading indicators, then you’re operating blind. shown that being proactive can’t just be something you talk Q: You’ve talked a little about interconnections. How do businesses go about being more connected with their suppliers? about in the boardroom: you have to live it. In other words, Start with compatibility. Before you embark on any project, you must walk the talk or become obsolete. the first thing to ask yourself is “will you be compatible?” If you everything else. Businesses will need to keep track of more moving parts in the supply chain. The last two years have choose a software solution that can't connect to other players in the market, you’ll fly solo. “Business as usual with 5-year plans or long-term roadmaps won’t work anymore. You’re either adapting or you’re dying.” If you deploy a new product, you need to have API enablement built in from the get-go. A public API cannot be an afterthought—you must have the connectivity upfront as part of the architecture of your systems or process. This gives you adaptability. If your process is too rigid and you’re not able to connect the Q: With that in mind, how should companies look to adapt to supply chain issues? First, there needs to be a mindset shift from backward- to forward-looking. You need to be more proactive than reactive. Companies must invest on three fronts: people, processes, and technology between your company and third parties, the core of your business will be closed off and you won’t be able to connect with the rest of the world. As soon as things start changing, your system might not be effective and you won’t be able to adapt. technology. You need to invest in governance to move from yearly planning to monthly planning. And train your people to be more dynamic, and put that training and proactivity into reskilling the workforce as needed. “Before you embark on any project, the first thing to ask yourself is ‘Will you be compatible?’” appian.com | 14 Q: What topics deserve more focus from companies and the press than they currently get? Three things come to mind. First, we need to talk about how complex this industry is. Logistics is one of the most complex disciplines. I wish the general public knew how many pieces were involved, so they knew that if something happens in one given part of the supply chain, it’ll affect everything else. The public, for example, may want to move to electric vehicles, but it’s a complex move—you can’t just switch them on overnight. Second, we need to talk about how we’ll solve the shortage of truck drivers. How do you solve that problem? Autonomous vehicles? Training and incentives? If I’m not mistaken, many truckers today are above 40 or 50. The industry is not getting younger, and they’ll be exiting the workforce. Finally, when looking for vendors, ask how they invest in technology. Instead of choosing the cheapest vendor, look for those who are investing in technology to be more sustainable and efficient. Their products will be superior to the products of a competitor in the long run. appian.com | 15 The role of technology and automation in supply chains. Across these conversations, some common threads emerged: often have a mix of structured, semi-structured, and predicted continued disruptions, the need for agility, the unstructured data scattered across a disjointed IT importance of automation, the growing focus on ESG, and the environment. Sharing data with other companies who benefits of greater data connections. are facing similar data challenges just intensifies your The emphasis each expert placed on the importance of technology own challenges. and automation is particularly noteworthy. The right technology— A process automation platform with a data fabric puts such as a process automation platform—is critical to helping you this issue to rest. Data fabrics let developers work with meet challenges and become more agile and adaptable. data in a virtual environment rather than performing Solve the connection problem. As Filippov put it, “Start with compatibility.” Connecting suppliers and sharing data is non-negotiable. Companies extensive database programming. This lets them create usable, performant applications faster than with traditional development, letting you connect systems and share data internally or across companies easily. appian.com | 16 Automate critical tasks. Automation itself plays a big role in supply chain management. As Mavatoor put it, “Give machines the first right of refusal.” Process automation platforms offer multiple tools—including robotic process automation, intelligent document processing, AI, and more—to transfer repeatable processes to machines. This helps boost efficiency, increase margins, and sharpen your competitive advantage. Plus, you get more from your current workforce, alleviating labor shortage pains. Boost visibility. Connecting your own systems and integrating with your suppliers’ IT environments gives you greater transparency and enables you to make adaptive choices faster. As Liddell predicted, “Digitizing the wider supply chain and generating real-time supply chain analytics can help.” A process automation platform can help you collect data from across the supply chain, then combine information and analytics in a centralized location. With this capability at your fingertips, you’ll notice problems in your supply chain sooner and be empowered to take informed action. Increase adaptability. As Oliveira put it, “In the near future, the vast majority of activities in supply chain planning will be handled by digital With automation tools like business logic and AI, you can enable software applications to make quick decisions on your behalf. For instance, if supplies run low in a given region, you can set up rules to either choose a different supplier or approve premium freight costs to reduce lead times. Next steps. In the face of so much ambiguity, the right tools in your corner can help you not only withstand times of change, but turn them into opportunities for competitive advantage. And it doesn’t take an army of developers—it only takes a few. An enterprise-grade process automation platform can help. Appian offers four key capabilities: • A data fabric to help unify data from multiple sources quickly, easily, and securely. • Process automation tools to help connect people, AI, bots, and business logic for end-to-end process automation. • A seamless total experience for users across web and mobile devices. • Process mining tools to identify bottlenecks, nonconformances, and root cause issues using real-world data. With Appian, you can get your first supply chain application built for your organization in just eight weeks. Guaranteed. Learn more by visiting appian.com/supplychain. solutions, where predictability, scenario planning, visibility, and agility are the key elements, leveraged through decision intelligence and automation.” appian.com | 17 About Appian Appian is the unified platform for change. We accelerate customers’ businesses by discovering, designing, and automating their most important processes. The Appian Low-Code Platform combines the key capabilities needed to get work done faster, Process Mining + Workflow + Automation, in a unified low-code platform. Appian is open, enterprisegrade, and trusted by industry leaders. For more information, visit www.appian.com. G_1061886691 appian.com